Answered step by step

Verified Expert Solution

Question

1 Approved Answer

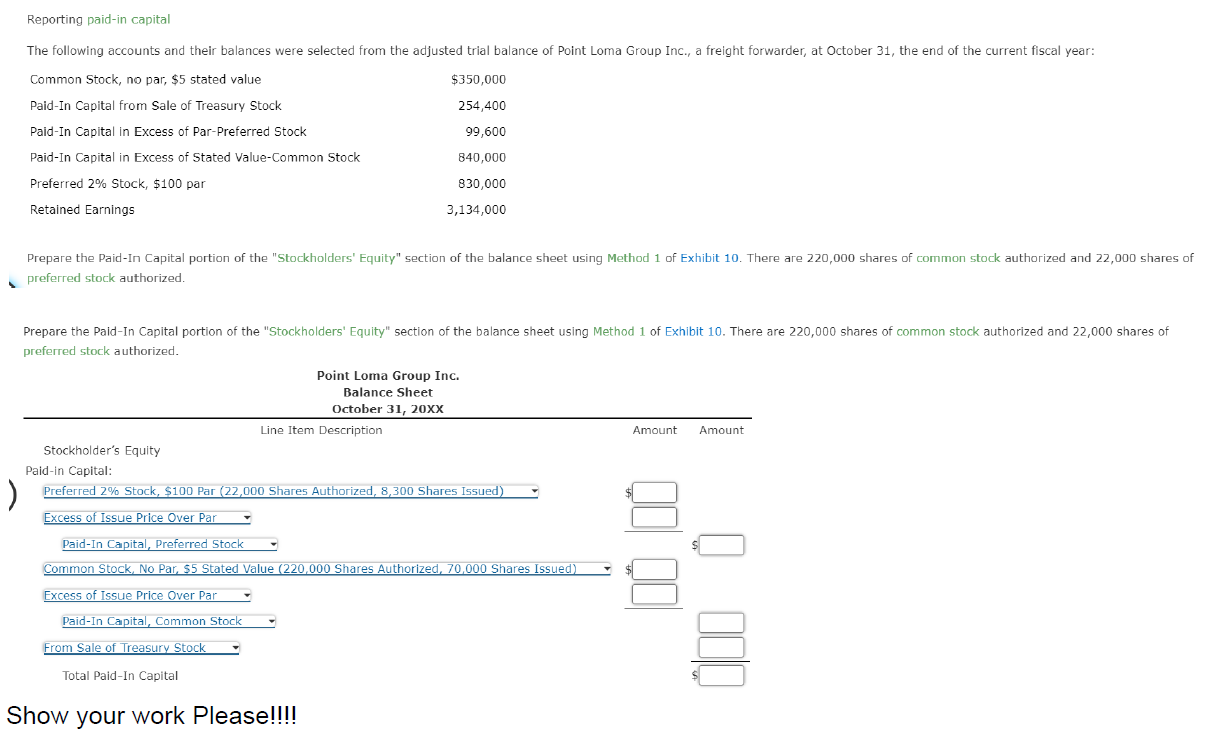

Reporting paid-in capital The following accounts and their balances were selected from the adjusted trial balance of Point Loma Group Inc., a freight forwarder,

Reporting paid-in capital The following accounts and their balances were selected from the adjusted trial balance of Point Loma Group Inc., a freight forwarder, at October 31, the end of the current fiscal year: Common Stock, no par, $5 stated value Paid-In Capital from Sale of Treasury Stock Paid-In Capital in Excess of Par-Preferred Stock $350,000 254,400 99,600 Paid-In Capital in Excess of Stated Value-Common Stock 840,000 830,000 3,134,000 Preferred 2% Stock, $100 par Retained Earnings Prepare the Paid-In Capital portion of the "Stockholders' Equity" section of the balance sheet using Method 1 of Exhibit 10. There are 220,000 shares of common stock authorized and 22,000 shares of preferred stock authorized. Stockholder's Equity Prepare the Paid-In Capital portion of the "Stockholders' Equity" section of the balance sheet using Method 1 of Exhibit 10. There are 220,000 shares of common stock authorized and 22,000 shares of preferred stock authorized. Point Loma Group Inc. Balance Sheet October 31, 20xx Line Item Description Amount Amount Paid-In Capital: ) Preferred 2% Stock, $100 Par (22,000 Shares Authorized, 8,300 Shares Issued) Excess of Issue Price Over Par Paid-In Capital, Preferred Stock Common Stock, No Par, $5 Stated Value (220,000 Shares Authorized, 70,000 Shares Issued) Excess of Issue Price Over Par Paid-In Capital, Common Stock From Sale of Treasury Stock Total Paid-In Capital Show your work Please!!!! 00 00 000 0

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the PaidIn Capital portion of the Stockholders Equity section of the balance sheet we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started