Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight

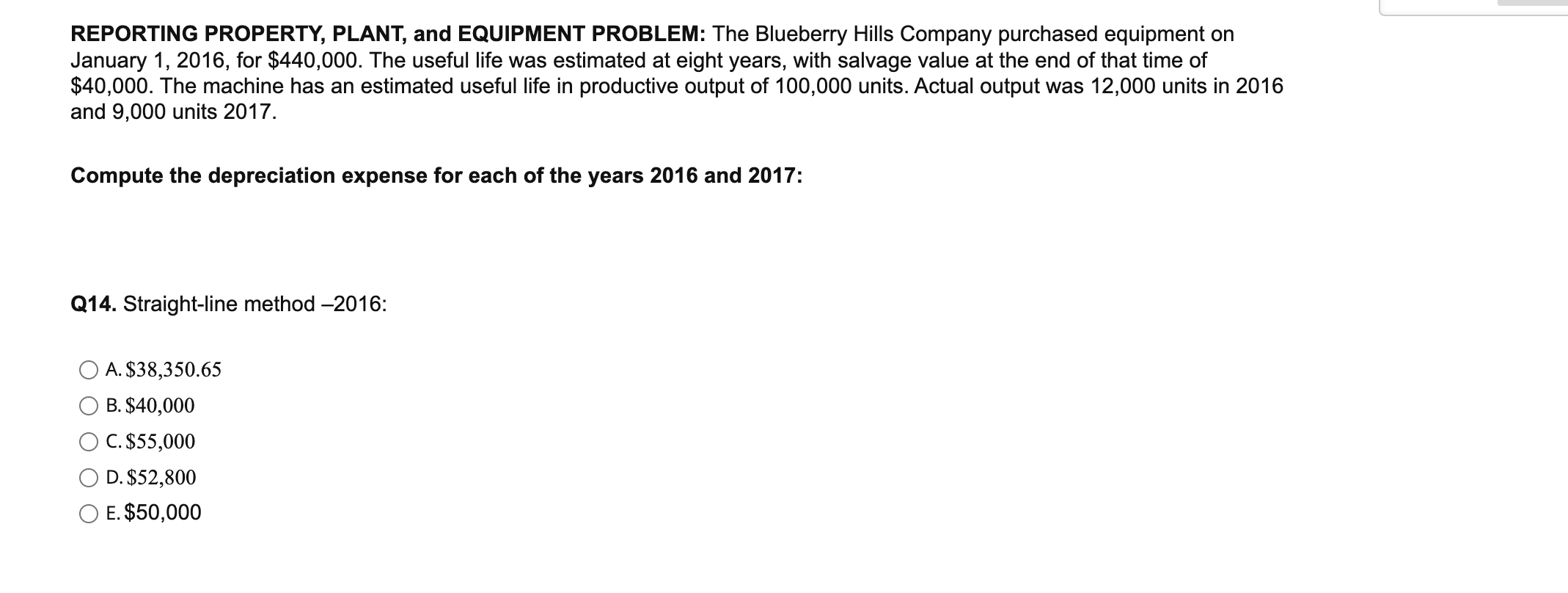

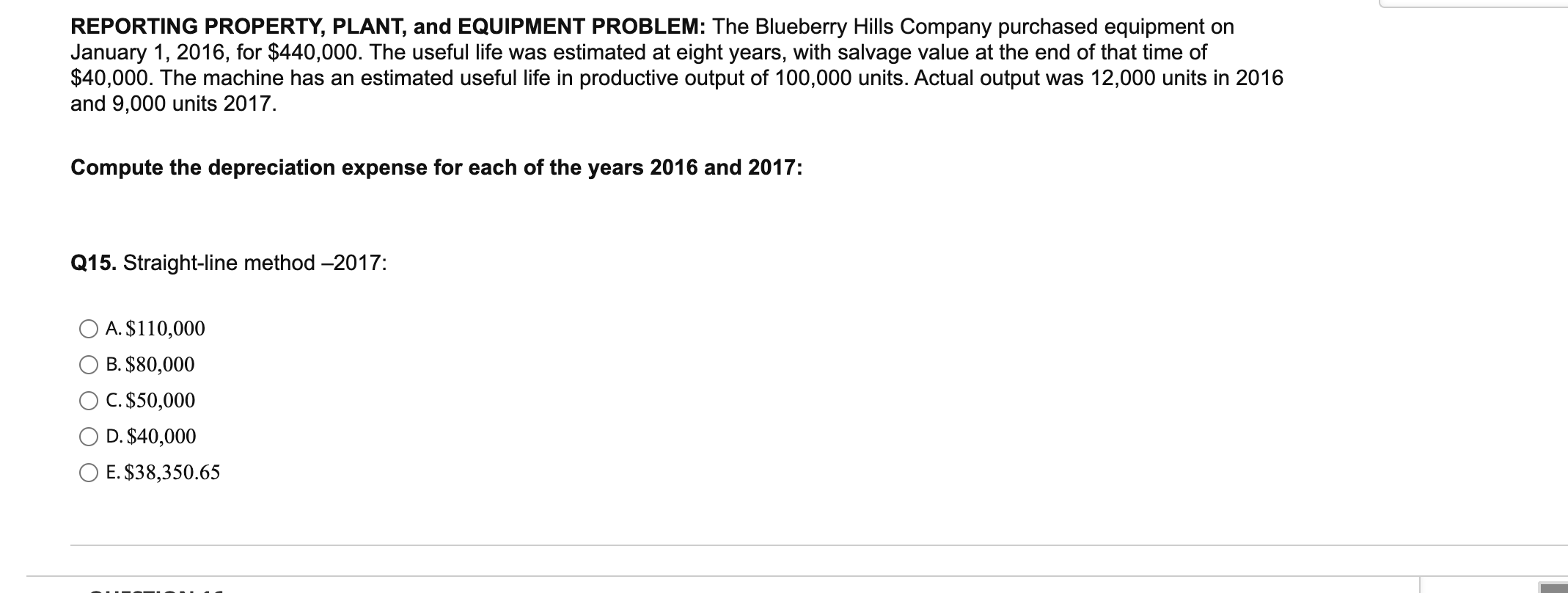

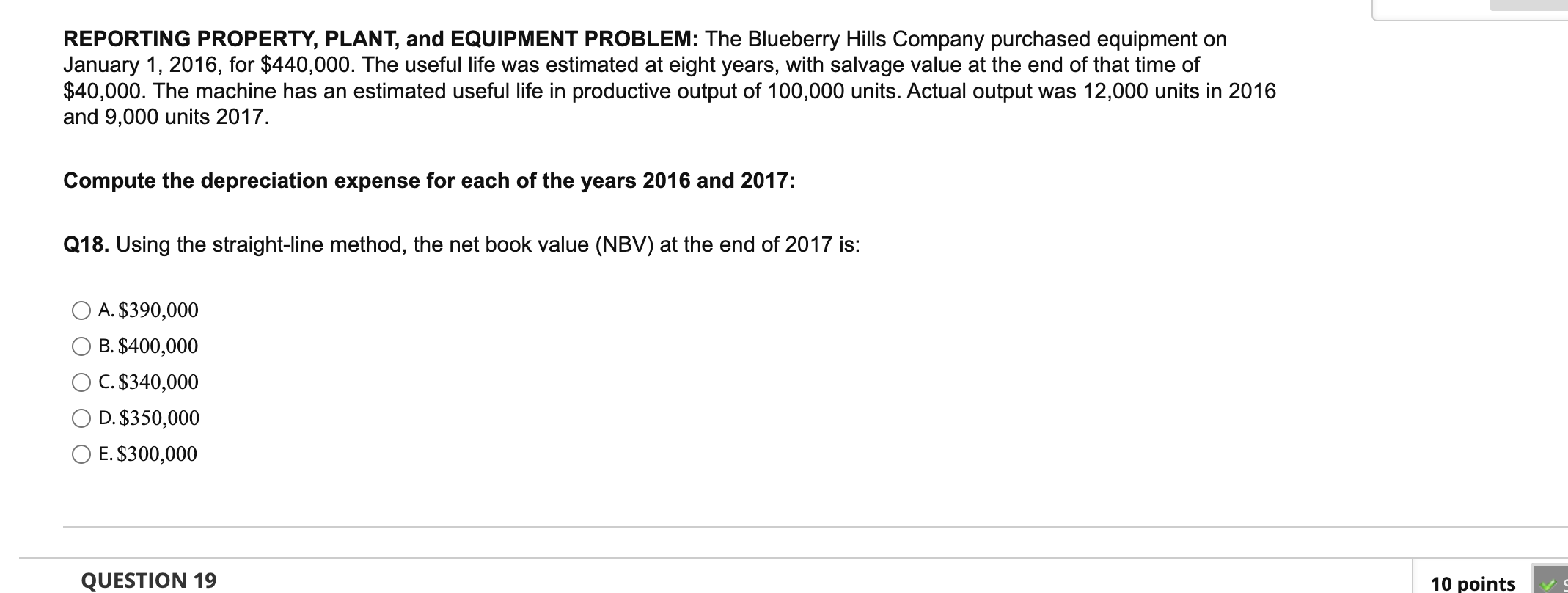

REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q14. Straight-line method -2016: A. $38,350.65 B. $40,000 C. $55,000 D. $52,800 E. $50,000 REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q15. Straight-line method -2017: A. $110,000 B. $80,000 C. $50,000 D. $40,000 E. $38,350.65 REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q18. Using the straight-line method, the net book value (NBV) at the end of 2017 is: A. $390,000 B. $400,000 C. $340,000 D. $350,000 E. $300,000

REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q14. Straight-line method -2016: A. $38,350.65 B. $40,000 C. $55,000 D. $52,800 E. $50,000 REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q15. Straight-line method -2017: A. $110,000 B. $80,000 C. $50,000 D. $40,000 E. $38,350.65 REPORTING PROPERTY, PLANT, and EQUIPMENT PROBLEM: The Blueberry Hills Company purchased equipment on January 1,2016 , for $440,000. The useful life was estimated at eight years, with salvage value at the end of that time of $40,000. The machine has an estimated useful life in productive output of 100,000 units. Actual output was 12,000 units in 2016 and 9,000 units 2017. Compute the depreciation expense for each of the years 2016 and 2017: Q18. Using the straight-line method, the net book value (NBV) at the end of 2017 is: A. $390,000 B. $400,000 C. $340,000 D. $350,000 E. $300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started