Question

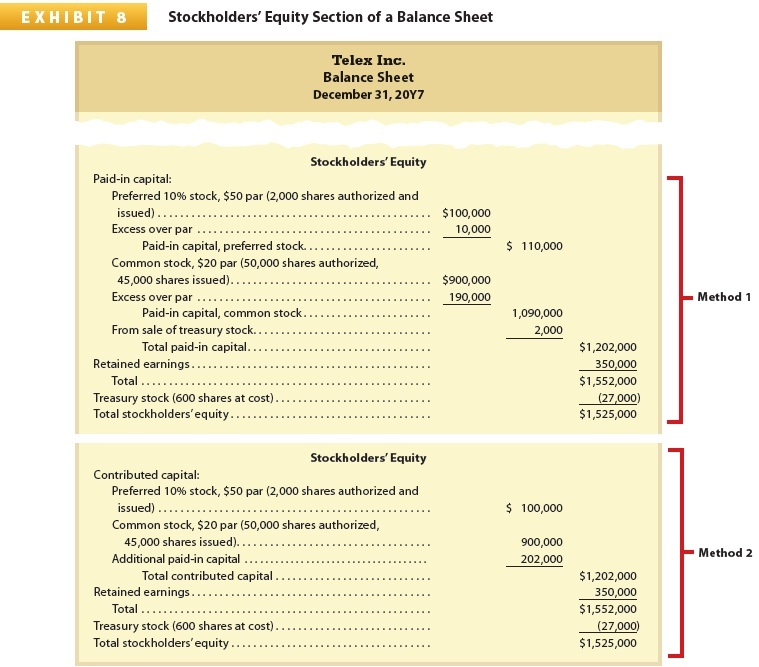

Reporting Stockholders' Equity Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 100,000

Reporting Stockholders' Equity

Reporting Stockholders' Equity

Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 100,000 shares of common stock authorized, and 1,000 shares have been reacquired.

| Common Stock, $40 par | $3,200,000 | |

| Paid-In Capital from Sale of Treasury Stock | 64,000 | |

| Paid-In Capital in Excess of ParCommon Stock | 720,000 | |

| Retained Earnings | 1,568,000 | |

| Treasury Stock | 29,000 | |

| Stockholders' Equity | ||

| Paid-In Capital: | ||

| Common Stock, $40 Par | $ | |

| Excess over par | ||

| Paid-in capital, common stock | $ | |

| Treasury Stock | ||

| Total Paid-in Capital | $ | |

| Total | $ | |

| Total Stockholders' Equity | $ | |

On October 31, Legacy Rocks Inc., a marble contractor, issued for cash 77,000 shares of $10 par common stock at $11, and on November 19, it issued for cash 17,040 shares of preferred stock, $50 par at $53.

Required:

| A. | Journalize the entries for October 31 and November 19. Refer to the Chart of Accounts for exact wording of account titles. |

| B. | What is the total amount invested (total paid-in capital) by all stockholders as of November 19? |

| CHART OF ACCOUNTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legacy Rocks Inc. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The declaration, record, and payment dates in connection with a cash dividend of $108,000 on a corporations common stock are January 12, March 13, and April 12.

Journalize the entries required on each date. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.

EXHIBIT 8 Stockholders' Equity Section of a Balance Sheet Telex Inc. Balance Sheet December 31, 20Y7 Stockholders' Equity Paid-in capital Preferred 10% stock, $50 par (2,000 shares authorized and 110,000 Common stock, $20 par (50,000 shares authorized, Method 1 1,090,000 2,000 1,202,000 350,000 1,552,000 (27,000) $1,525,000 Total . .. Stockholders' Equity Contributed capital Preferred 10% stock, $50 par (2,000 shares authorized and 5 100,000 Common stock, $20 par (50,000 shares authorized 900,000 202,000 Method 2 1,202,000 350,000 1,552,000 (27000 1,525,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started