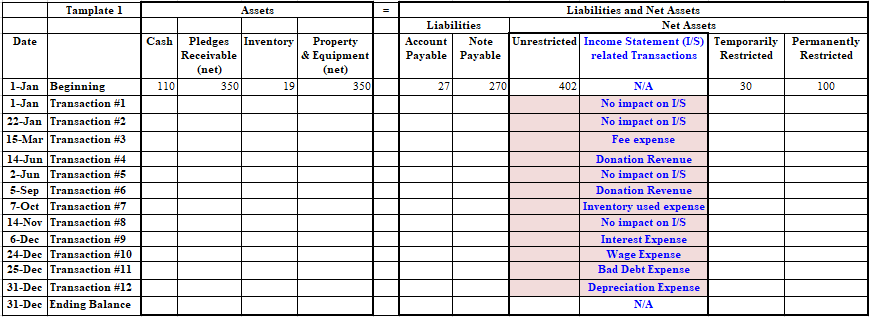

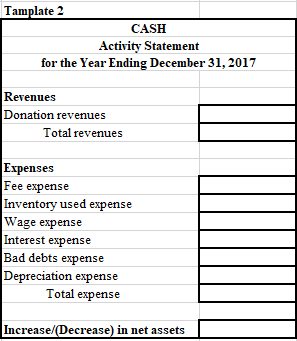

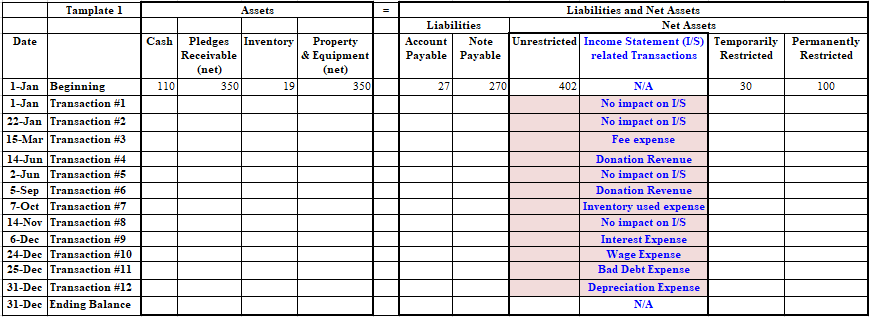

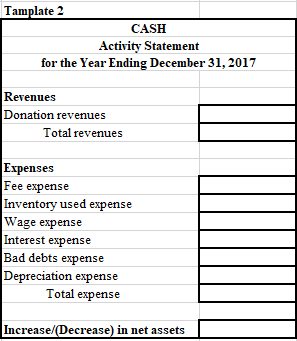

Reporting the Results of Operations: The Activity and Cash Flow Statements Situation: Suppose you are a financial manager in a nonprofit organization named Concern for Animal Shelter and Habitats (CASH). The organization places homeless animals in permanent homes You need to record financial transactions on Transaction Work Sheet during the fiscal year, and then need to prepare (or generate) an Activity Statement (i.e. Income Statement or Operating Statement) based on Transaction Work Sheet at the end of the fiscal year. To generate Activity Statement, you need to select transaction records that have effects on Activity Statement and then using these selected records you need to generate Activity Statement. (Note: Read the entire Chapter 10, especially the "Recording and Reporting Financial Information" section, pages 381 384, carefully. Also, take a look at Exhibit 10-7 and Exhibit 10-8 in pages 384-385. These examples are helpful for you to generate Activity Statement using Transaction Worksheet) Transactions during this fiscal year (January 1 to December 31, 2017) of operations were as follows Transaction 1. January 1: CASH bought a car. The car cost was a $100 and CASH paid for it when car was received. Transaction 2. January 22: CASH received a S300 payment from a pledge made last year Transaction 3. March 15: CASH paid out a S50 annual fee to the American Association of Animal Shelter and Habitats Transaction 4. June 14: CASH collected $80 in new donations. CASH can use this $80 for amy purpose because donors did not impose any restriction on the donations. Transaction 5. July 2: CASH received a letter from a donor. The letter said that the donor promises to make a gift of S120, which can be used for any purposes Transaction 6. September 5: CASH bought drugs, 60 pills (S1 per pill), for dog and cat. They paid half now, and still owe the other half, to be paid at the end of the year Reporting the Results of Operations: The Activity and Cash Flow Statements Situation: Suppose you are a financial manager in a nonprofit organization named Concern for Animal Shelter and Habitats (CASH). The organization places homeless animals in permanent homes You need to record financial transactions on Transaction Work Sheet during the fiscal year, and then need to prepare (or generate) an Activity Statement (i.e. Income Statement or Operating Statement) based on Transaction Work Sheet at the end of the fiscal year. To generate Activity Statement, you need to select transaction records that have effects on Activity Statement and then using these selected records you need to generate Activity Statement. (Note: Read the entire Chapter 10, especially the "Recording and Reporting Financial Information" section, pages 381 384, carefully. Also, take a look at Exhibit 10-7 and Exhibit 10-8 in pages 384-385. These examples are helpful for you to generate Activity Statement using Transaction Worksheet) Transactions during this fiscal year (January 1 to December 31, 2017) of operations were as follows Transaction 1. January 1: CASH bought a car. The car cost was a $100 and CASH paid for it when car was received. Transaction 2. January 22: CASH received a S300 payment from a pledge made last year Transaction 3. March 15: CASH paid out a S50 annual fee to the American Association of Animal Shelter and Habitats Transaction 4. June 14: CASH collected $80 in new donations. CASH can use this $80 for amy purpose because donors did not impose any restriction on the donations. Transaction 5. July 2: CASH received a letter from a donor. The letter said that the donor promises to make a gift of S120, which can be used for any purposes Transaction 6. September 5: CASH bought drugs, 60 pills (S1 per pill), for dog and cat. They paid half now, and still owe the other half, to be paid at the end of the year