Answered step by step

Verified Expert Solution

Question

1 Approved Answer

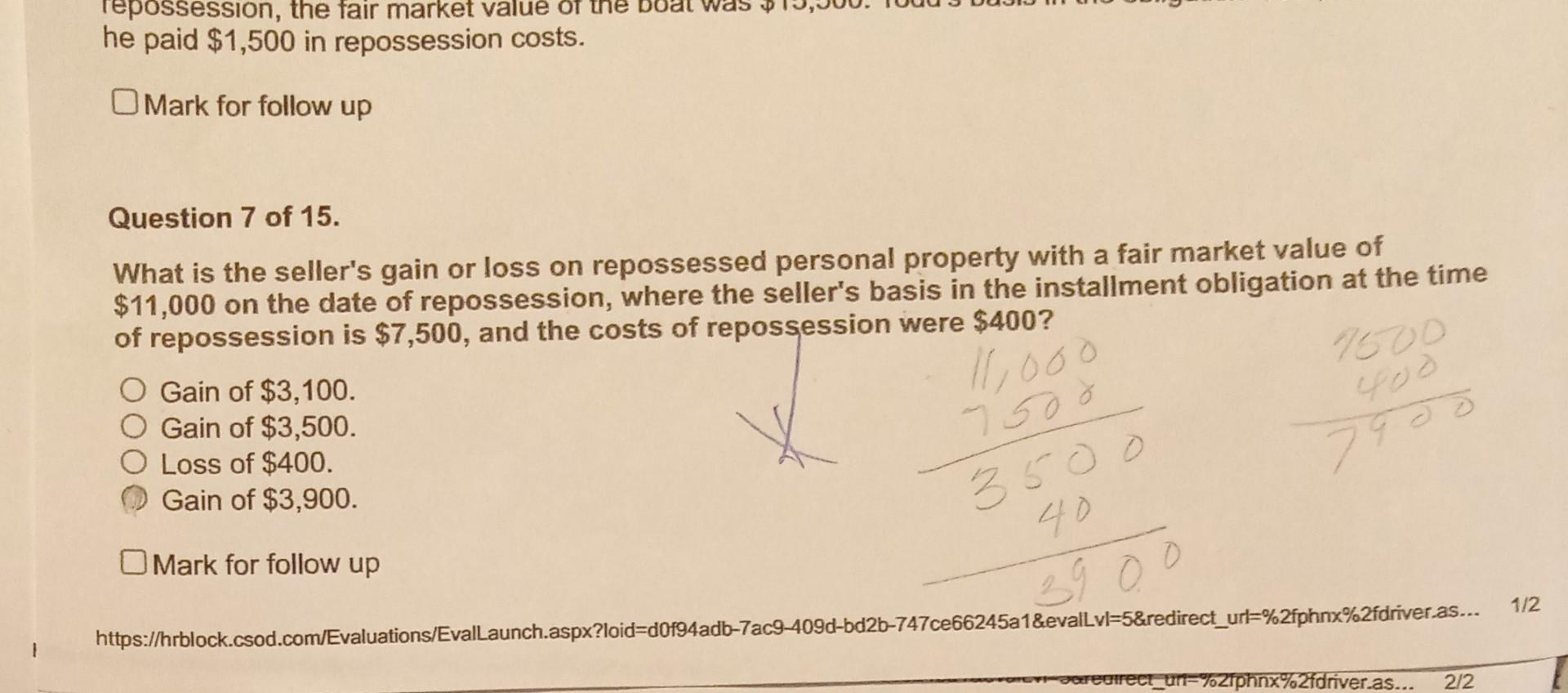

repossession, the fair market value of the he paid $1,500 in repossession costs. OMark for follow up Question 7 of 15. What is the seller's

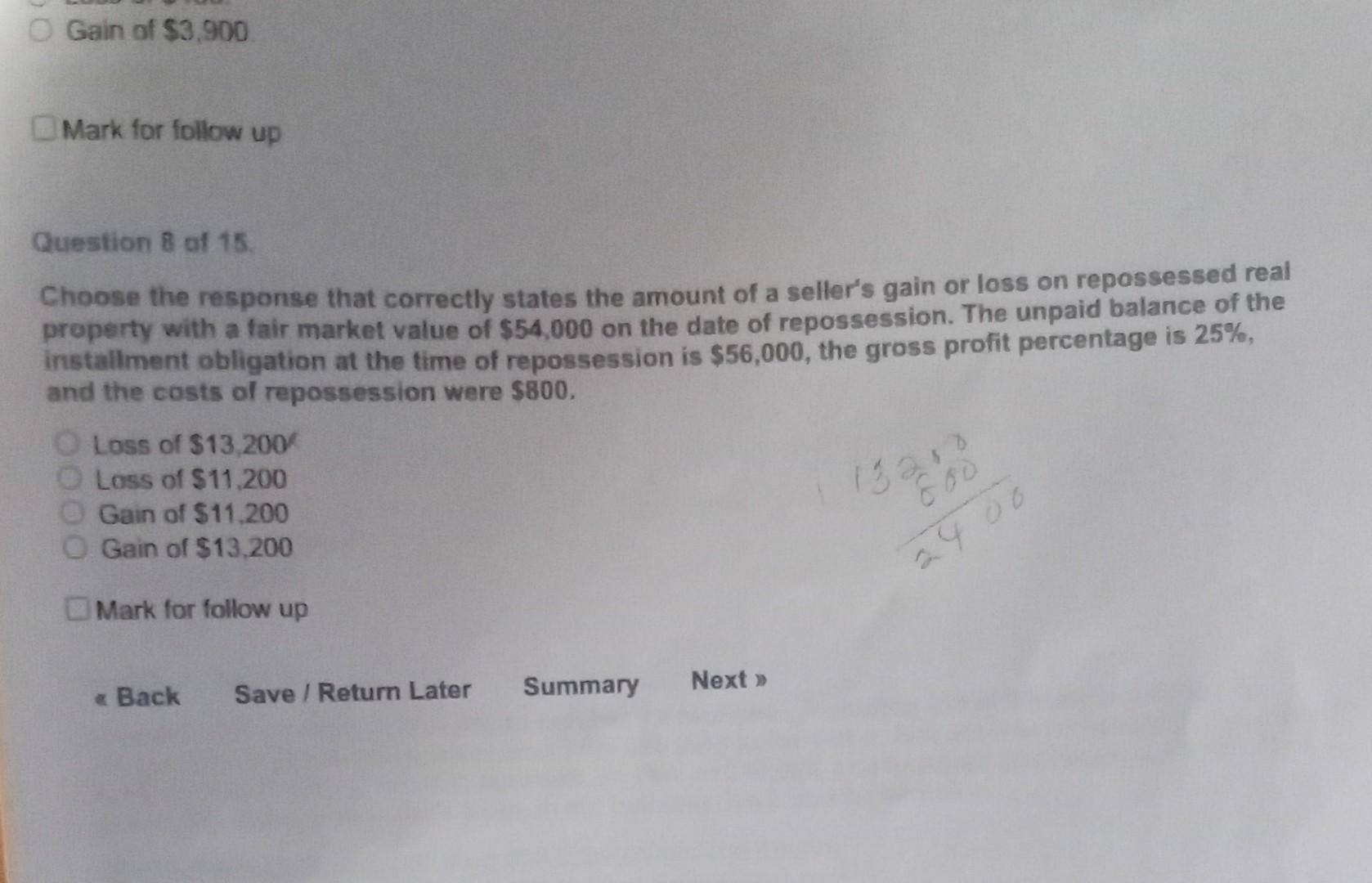

repossession, the fair market value of the he paid $1,500 in repossession costs. OMark for follow up Question 7 of 15. What is the seller's gain or loss on repossessed personal property with a fair market value of $11,000 on the date of repossession, where the seller's basis in the installment obligation at the time of repossession is $7,500, and the costs of repossession were $400? 11,000 1500 7900 Gain of $3,100. Gain of $3,500. Loss of $400. Gain of $3,900. OMark for follow up 3500 40 3900 https://hrblock.csod.com/Evaluations/EvalLaunch.aspx?loid=d0f94adb-7ac9-409d-bd2b-747ce66245a1&evalLvl=5&redirect_url=%2fphnx%2fdriver.as... acredirect_ur-%2iphnx%2fdriver.as... 2/2 1/2 O Gain of $3,900. Mark for follow up Question 8 of 15. Choose the response that correctly states the amount of a seller's gain or loss on repossessed real property with a fair market value of $54,000 on the date of repossession. The unpaid balance of the installment obligation at the time of repossession is $56,000, the gross profit percentage is 25%, and the costs of repossession were $800. 0000 Loss of $13,200 O Loss of $11,200 Gain of $11,200 Gain of $13,200 Mark for follow up Back Save / Return Later Summary Next >>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started