Question

( REPOST: This case has two different patter, Fact Patter 1 and Fact Patter 2. Posted below are questions for Fact Patter 1 that I

( REPOST: This case has two different patter, Fact Patter 1 and Fact Patter 2. Posted below are questions for Fact Patter 1 that I needed some help. I would appreciate if anyone could help in answering those 3 questions below. Please don't put the answer for FACT Pattern 2, I only need help for fact patter 1))

( REPOST: This case has two different patter, Fact Patter 1 and Fact Patter 2. Posted below are questions for Fact Patter 1 that I needed some help. I would appreciate if anyone could help in answering those 3 questions below. Please don't put the answer for FACT Pattern 2, I only need help for fact patter 1))

Fact Pattern 1

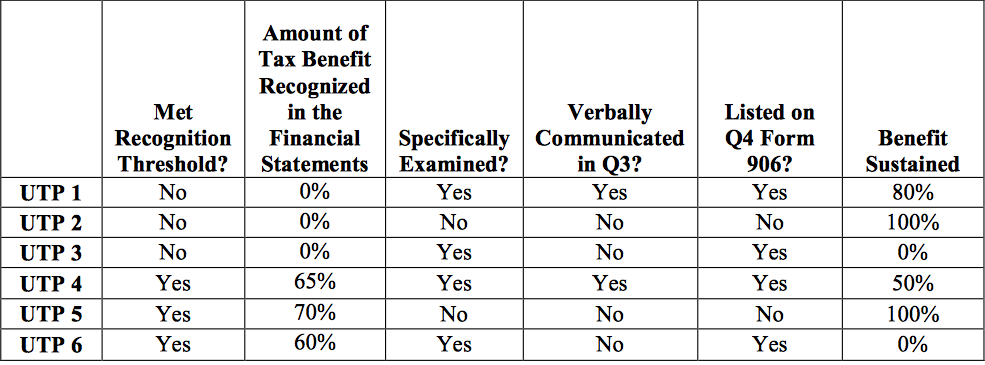

3D Printing Inc. (3D Printing), a calendar-year-end company, has multiple uncertain tax positions (UTPs) related to its 2010 federal tax return. Some UTPs met the more-likely-than-not recognition threshold on the basis of 3D Printings initial assessment while others did not. During 2012, the IRS audited the 2010 tax return. During Q3 2012, the examining agents verbally indicated the preliminary conclusion on certain UTPs, and the IRS and 3D Printing formalized their agreement on these UTPs by signing IRS Form 906, Closing Agreement on Final Determination Covering Specific Matters, in Q4 2012. Subsequently, in Q1 2013, the IRS completed its examination of the 2010 tax return whereby the IRS and 3D Printing agreed to the final closing agreement. 3D Printing does not intend to appeal or litigate any aspects of the examined UTPs, and it is remote that the IRS would examine or reexamine any aspects of the 2010 federal tax return. Refer to the table below for further facts on each of the UTPs.

Required:

1. For each tax position taken on its 2010 federal tax return:

a. When can 3D Printing assert an "effective settlement"?

b. When should 3D Printing adjust previously recognized amounts in the financial statements, if any?

2. Does 3D Printing have a basis to change its assessment of similar tax positions taken in other periods if it concludes it meets the effective settlement conditions related to the UTPs included in its 2010 tax return?

3. If 3D Printing were to report under IFRSs, what are the main differences in accounting for uncertainty in income taxes it would encounter?

UTP 1 UTP 2 UTP 4 UTP 5 UTP 6 Amount of Tax Benefit Recognized Verbally Listed on Met in the Recognition Financial Specifically Communicated Q4 Form. Benefit 906? Sustained Threshold? Statements Examined? in Q3? 0% Yes 80% Yes Yes 0% 100% No 0% Yes 0% No Yes 65% Yes Yes 50% Yes Yes No No 70% 100% Yes No 60% 0% Yes Yes Yes UTP 1 UTP 2 UTP 4 UTP 5 UTP 6 Amount of Tax Benefit Recognized Verbally Listed on Met in the Recognition Financial Specifically Communicated Q4 Form. Benefit 906? Sustained Threshold? Statements Examined? in Q3? 0% Yes 80% Yes Yes 0% 100% No 0% Yes 0% No Yes 65% Yes Yes 50% Yes Yes No No 70% 100% Yes No 60% 0% Yes Yes YesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started