Answered step by step

Verified Expert Solution

Question

1 Approved Answer

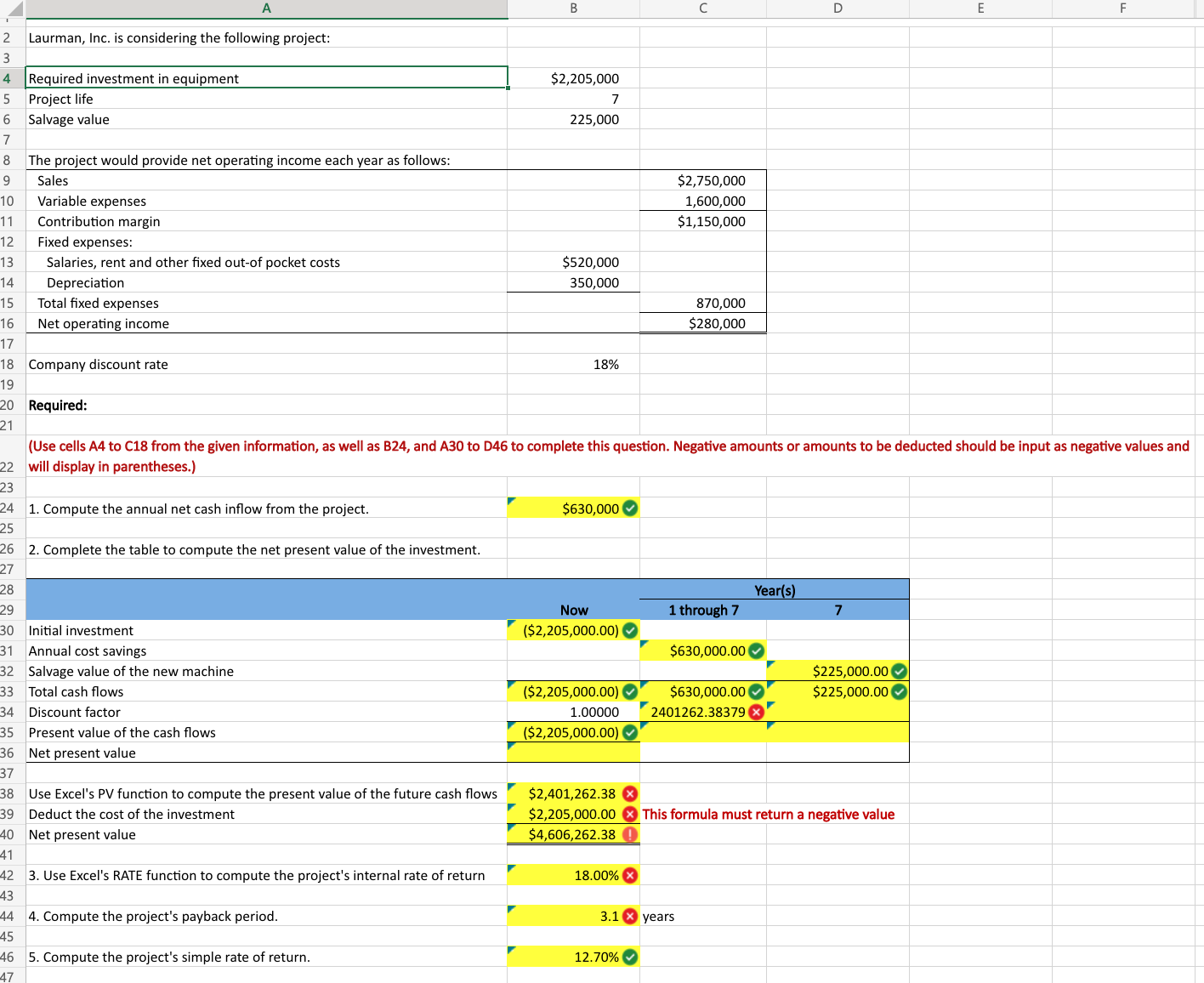

Reposting because it was answered incorrectly, please show the formulas!! Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value

Reposting because it was answered incorrectly, please show the formulas!!

Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value The project would provide net operating income each year as follows: Sales Variable expenses Contribution margin Fixed expenses: Salaries, rent and other fixed out-of pocket costs Depreciation Total fixed expenses Net operating income \begin{tabular}{|r|} \hline 2,750,000 \\ 1,600,000 \\ \hline$1,150,000 \\ \hline 870,000 \\ \hline$280,000 \\ \hline \hline \end{tabular} Company discount rate Required: will display in parentheses.) 1. Compute the annual net cash inflow from the project. $630,000 2. Complete the table to compute the net present value of the investment. Use Excel's PV function to compute the present value of the future cash flows $2,401,262.38 $4,606,262.38 3. Use Excel's RATE function to compute the project's internal rate of return 18.00% 4. Compute the project's payback period. 3.1 years 5. Compute the project's simple rate of return. 12.70%

Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value The project would provide net operating income each year as follows: Sales Variable expenses Contribution margin Fixed expenses: Salaries, rent and other fixed out-of pocket costs Depreciation Total fixed expenses Net operating income \begin{tabular}{|r|} \hline 2,750,000 \\ 1,600,000 \\ \hline$1,150,000 \\ \hline 870,000 \\ \hline$280,000 \\ \hline \hline \end{tabular} Company discount rate Required: will display in parentheses.) 1. Compute the annual net cash inflow from the project. $630,000 2. Complete the table to compute the net present value of the investment. Use Excel's PV function to compute the present value of the future cash flows $2,401,262.38 $4,606,262.38 3. Use Excel's RATE function to compute the project's internal rate of return 18.00% 4. Compute the project's payback period. 3.1 years 5. Compute the project's simple rate of return. 12.70% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started