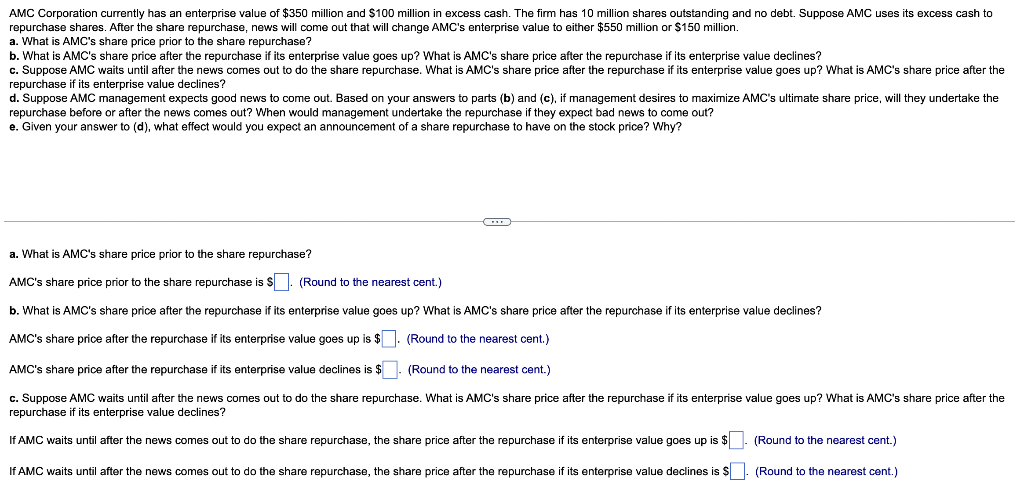

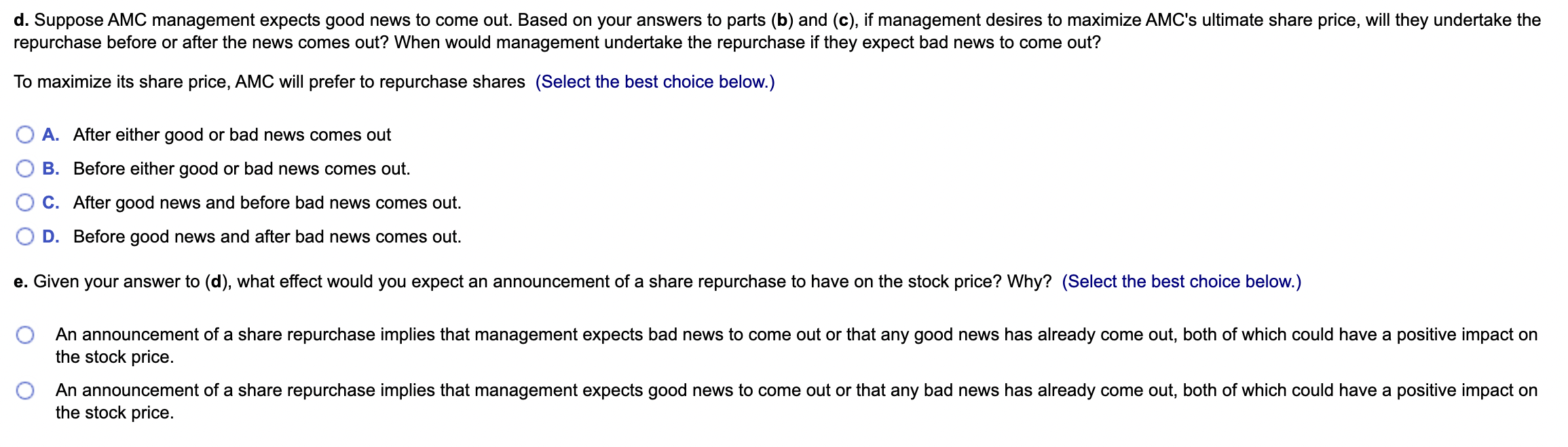

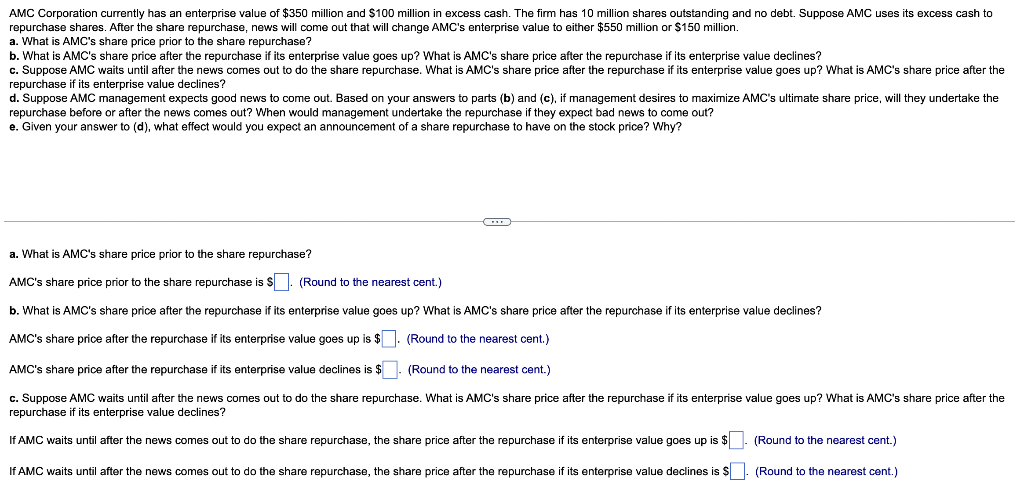

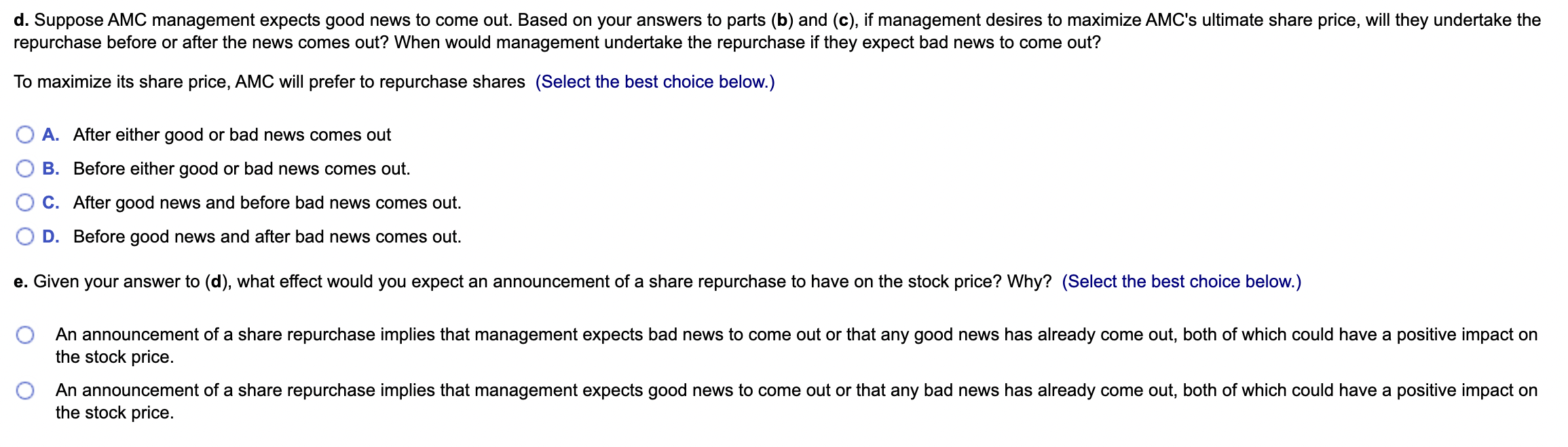

repurchase shares. After the share repurchase, news will come out that will change AMC's enterprise value to either $550 million or $150 million. a. What is AMC's share price prior to the share repurchase? b. What is AMC's share price after the repurchase if its enterprise value goes up? What is AMC's share price after the repurchase if its enterprise value declines? repurchase if its enterprise value declines? repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? e. Given your answer to (d), what effect would you expect an announcement of a share repurchase to have on the stock price? Why? a. What is AMC's share price prior to the share repurchase? AMC's share price prior to the share repurchase is S (Round to the nearest cent.) b. What is AMC's share price after the repurchase if its enterprise value goes up? What is AMC's share price after the repurchase if its enterprise value declines? AMC's share price after the repurchase if its enterprise value goes up is $ (Round to the nearest cent.) AMC's share price after the repurchase if its enterprise value declines is $. (Round to the nearest cent.) repurchase if its enterprise value declines? d. Suppose AMC management expects good news to come out. Based on your answers to parts (b) and (c), if management desires to maximize AMC's ultimate share price, will they undertake the repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? To maximize its share price, AMC will prefer to repurchase shares (Select the best choice below.) A. After either good or bad news comes out B. Before either good or bad news comes out. C. After good news and before bad news comes out. D. Before good news and after bad news comes out. e. Given your answer to (d), what effect would you expect an announcement of a share repurchase to have on the stock price? Why? (Select the best choice below.) An announcement of a share repurchase implies that management expects bad news to come out or that any good news has already come out, both of which could have a positive impact on the stock price. An announcement of a share repurchase implies that management expects good news to come out or that any bad news has already come out, both of which could have a positive impact on the stock price. repurchase shares. After the share repurchase, news will come out that will change AMC's enterprise value to either $550 million or $150 million. a. What is AMC's share price prior to the share repurchase? b. What is AMC's share price after the repurchase if its enterprise value goes up? What is AMC's share price after the repurchase if its enterprise value declines? repurchase if its enterprise value declines? repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? e. Given your answer to (d), what effect would you expect an announcement of a share repurchase to have on the stock price? Why? a. What is AMC's share price prior to the share repurchase? AMC's share price prior to the share repurchase is S (Round to the nearest cent.) b. What is AMC's share price after the repurchase if its enterprise value goes up? What is AMC's share price after the repurchase if its enterprise value declines? AMC's share price after the repurchase if its enterprise value goes up is $ (Round to the nearest cent.) AMC's share price after the repurchase if its enterprise value declines is $. (Round to the nearest cent.) repurchase if its enterprise value declines? d. Suppose AMC management expects good news to come out. Based on your answers to parts (b) and (c), if management desires to maximize AMC's ultimate share price, will they undertake the repurchase before or after the news comes out? When would management undertake the repurchase if they expect bad news to come out? To maximize its share price, AMC will prefer to repurchase shares (Select the best choice below.) A. After either good or bad news comes out B. Before either good or bad news comes out. C. After good news and before bad news comes out. D. Before good news and after bad news comes out. e. Given your answer to (d), what effect would you expect an announcement of a share repurchase to have on the stock price? Why? (Select the best choice below.) An announcement of a share repurchase implies that management expects bad news to come out or that any good news has already come out, both of which could have a positive impact on the stock price. An announcement of a share repurchase implies that management expects good news to come out or that any bad news has already come out, both of which could have a positive impact on the stock price