Answered step by step

Verified Expert Solution

Question

1 Approved Answer

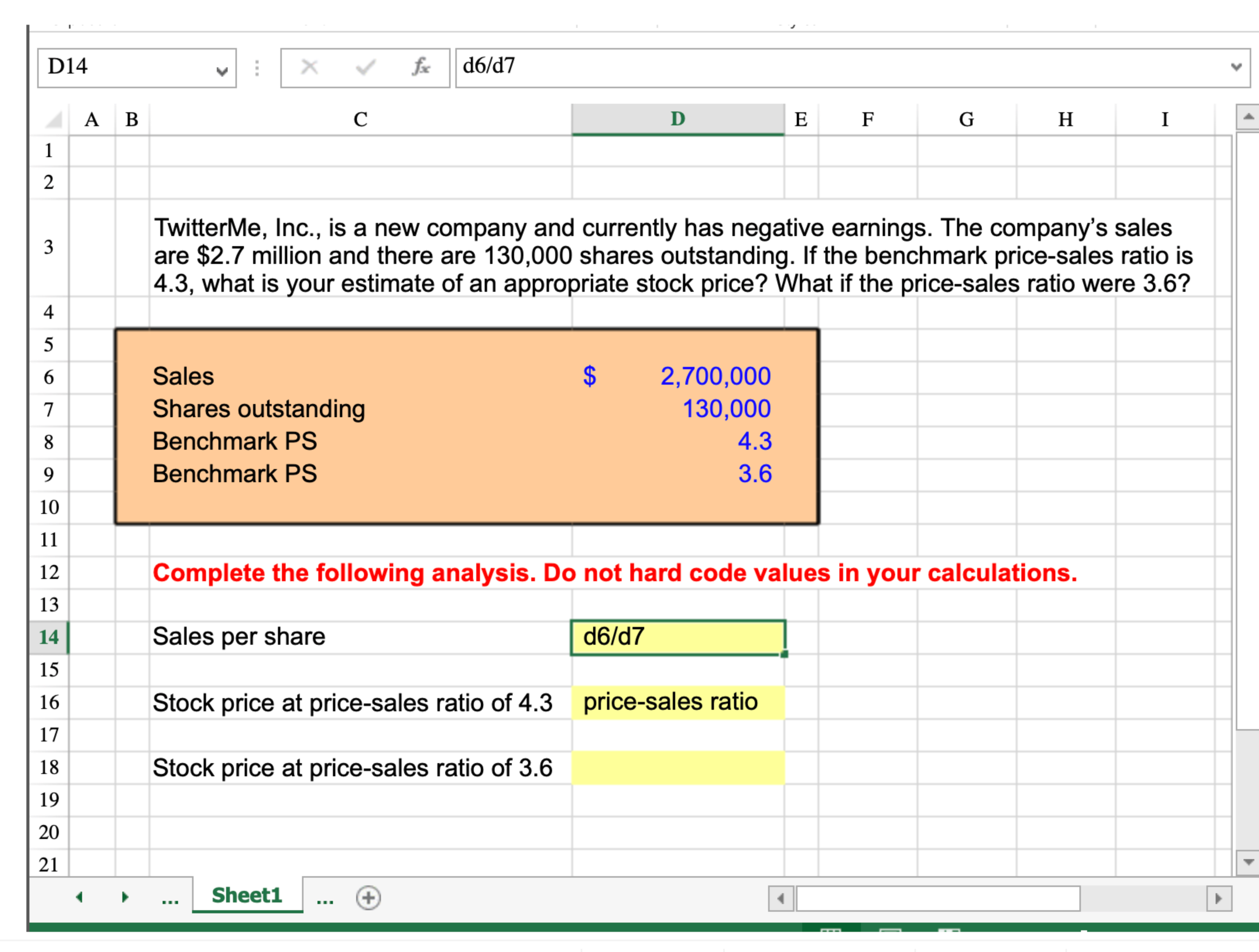

TwitterMe, Inc., is a new company and currently has negative earnings. The company's sales are $ 2 . 7 million and there are 1 3

TwitterMe, Inc., is a new company and currently has negative earnings. The company's sales

are $ million and there are shares outstanding. If the benchmark pricesales ratio is

what is your estimate of an appropriate stock price? What if the pricesales ratio were

Complete the following analysis. Do not hard code values in your calculations.

Sales per share

Stock price at pricesales ratio of pricesales ratio

Stock price at pricesales ratio of TwitterMe, Inc., is a new company and currently has negative earnings. The companys sales are $ million and there are shares outstanding. If the benchmark pricesales ratio is what is your estimate of an appropriate stock price? What if the pricesales ratio were

I just need to know how to enter each question into Connect because no matter what Im entering it is telling me I am incorrect.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started