Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Req 1 Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. Note: Loss amounts should

Req

Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years.

Note: Loss amounts should be indicated with a minus sign. Leave no cells blank.

Red text indicates no response was expected in a cell or a formulabased calculation is incorrect; no points deducted. Prepare journal entries for to record the transactions described credit "Cash, Materials, etc." for construction costs incurred

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

tableNoYear,General Journal,Debit,CreditConstruction in progress,Cash, Materials, etc.,Accounts receivable,Billings on construction contract,Cash,Accounts receivable,No journal entry required,xoxxx

Req A Prepare a partial balance sheet to show the presentation of the project as of December

Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount.Prepare a partial balance sheet to show the presentation of the project as of December Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount.

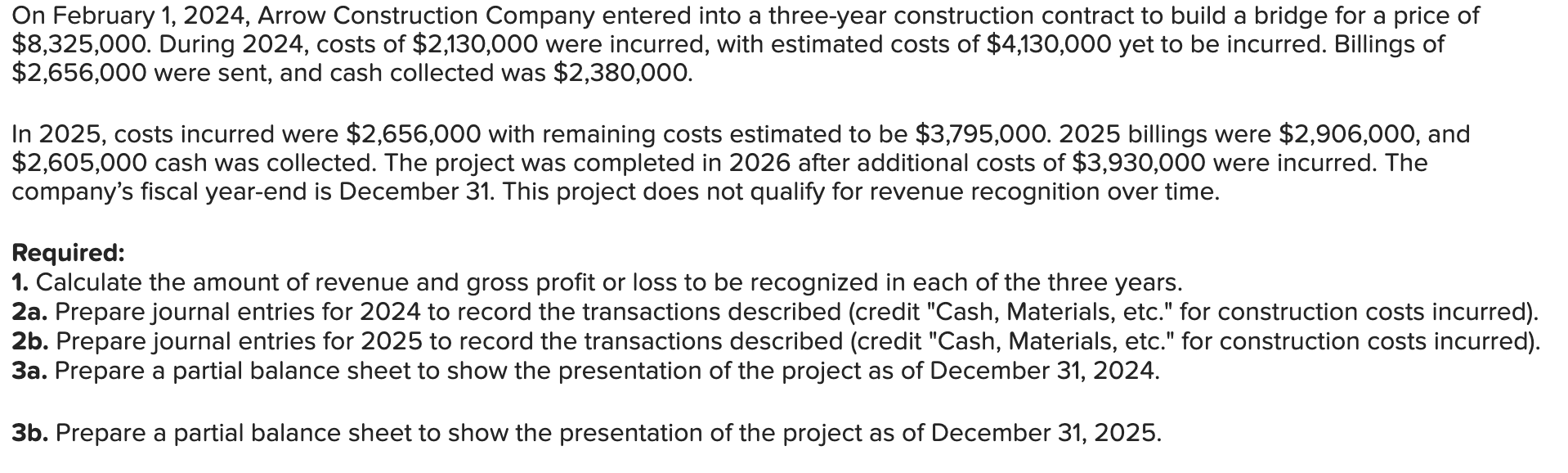

tableBalance SheetAt December Current assets:,$Accounts receivable,Current liabilities:,Billings in excess of CIP, On February Arrow Construction Company entered into a threeyear construction contract to build a bridge for a price of

$ During costs of $ were incurred, with estimated costs of $ yet to be incurred. Billings of

$ were sent, and cash collected was $

In costs incurred were $ with remaining costs estimated to be $ billings were $ and

$ cash was collected. The project was completed in after additional costs of $ were incurred. The

company's fiscal yearend is December This project does not qualify for revenue recognition over time.

Required:

Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years.

a Prepare journal entries for to record the transactions described credit "Cash, Materials, etc." for construction costs incurred

b Prepare journal entries for to record the transactions described credit "Cash, Materials, etc." for construction costs incurred

a Prepare a partial balance sheet to show the presentation of the project as of December

b Prepare a partial balance sheet to show the presentation of the project as of December On February Arrow Construction Company entered into a threeyear construction contract to build a bridge for a price of $ During costs of $ were incurred, with estimated costs of $ yet to be incurred. Billings of $ were sent, and cash collected was $

In costs incurred were $ with remaining costs estimated to be $ billings were $ and $ cash was collected. The project was completed in after additional costs of $ were incurred. The companys fiscal yearend is December This project does not qualify for revenue recognition over time.

Required:

Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years.

a Prepare journal entries for to record the transactions described credit "Cash, Materials, etc." for construction costs incurred

b Prepare journal entries for to record the transactions described credit "Cash, Materials, etc." for construction costs incurred

a Prepare a partial balance sheet to show the presentation of the project as of December

b Prepare a partial balance sheet to show the presentation of the project as of December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started