Answered step by step

Verified Expert Solution

Question

1 Approved Answer

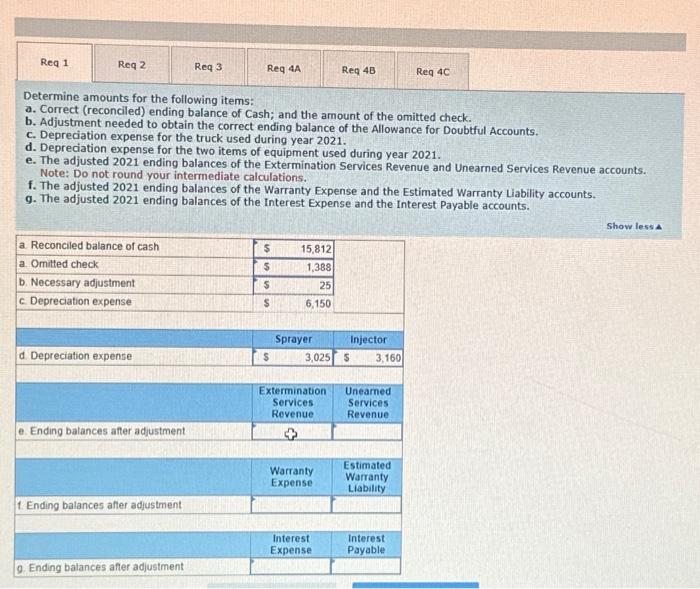

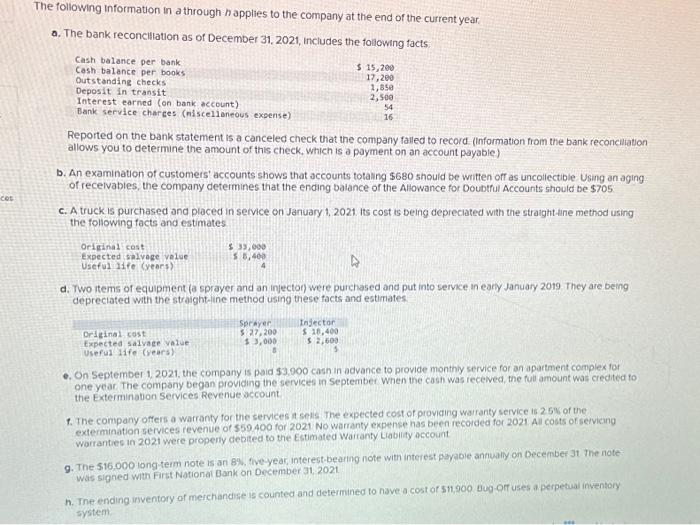

Req 1 Req 2 Determine amounts for the following items: a. Correct (reconciled) ending balance of Cash; and the amount of the omitted check. b.

Req 1 Req 2 Determine amounts for the following items: a. Correct (reconciled) ending balance of Cash; and the amount of the omitted check. b. Adjustment needed to obtain the correct ending balance of the Allowance for Doubtful Accounts. a. Reconciled balance of cash a. Omitted check b. Necessary adjustment c. Depreciation expense Req 3 c. Depreciation expense for the truck used during year 2021. d. Depreciation expense for the two items of equipment used during year 2021. d. Depreciation expense Req 4A e. The adjusted 2021 ending balances of the Extermination Services Revenue and Unearned Services Revenue accounts. Note: Do not round your intermediate calculations. e. Ending balances after adjustment f. The adjusted 2021 ending balances of the Warranty Expense and the Estimated Warranty Liability accounts. g. The adjusted 2021 ending balances of the Interest Expense and the Interest Payable accounts. 1. Ending balances after adjustment g Ending balances after adjustment $ $ $ $ $ Req 4B 15,812 1,388 25 6,150 Sprayer 3,025 $ Warranty Expense Interest Expense Injector Extermination Uneamed Services Services Revenue Revenue Req 4C 3,160 Estimated Warranty Liability Interest Payable Show less A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started