req 1-4b

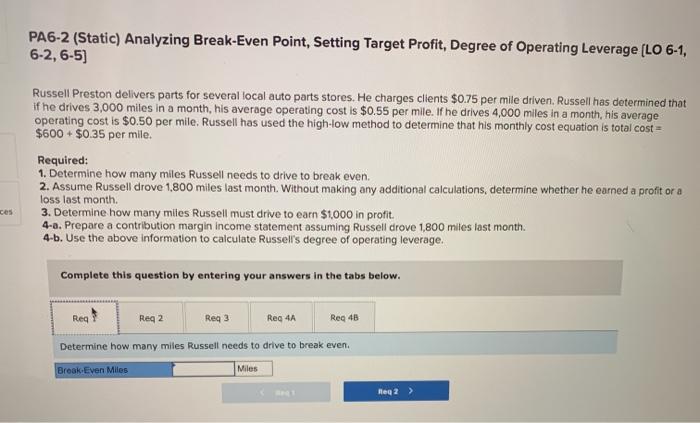

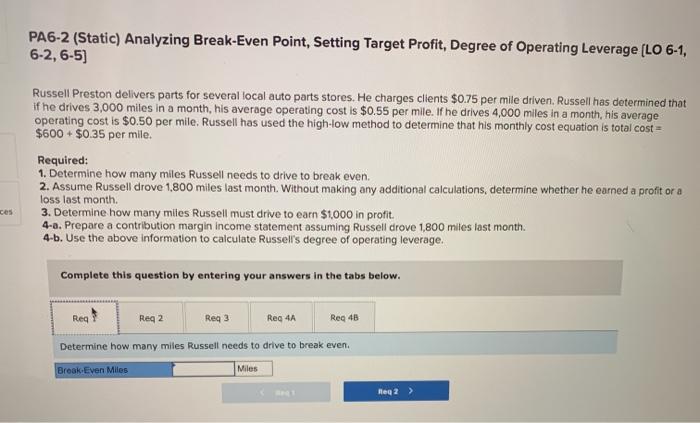

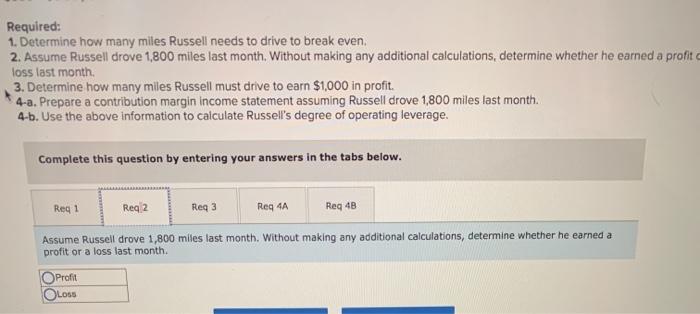

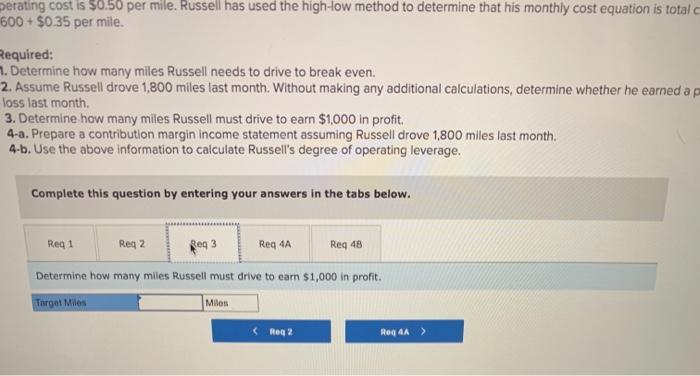

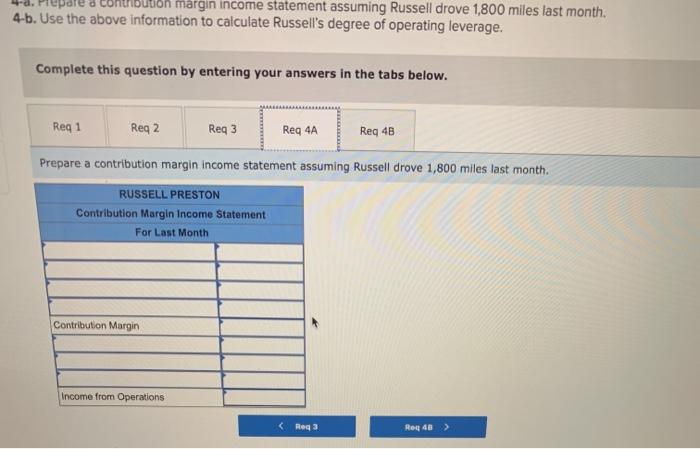

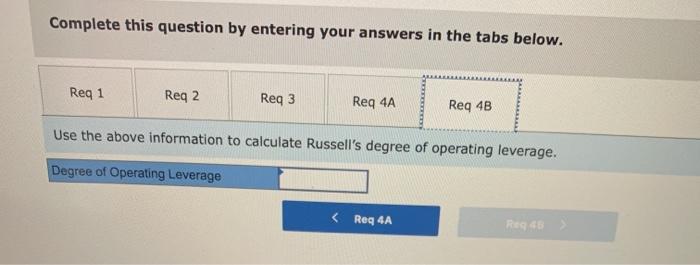

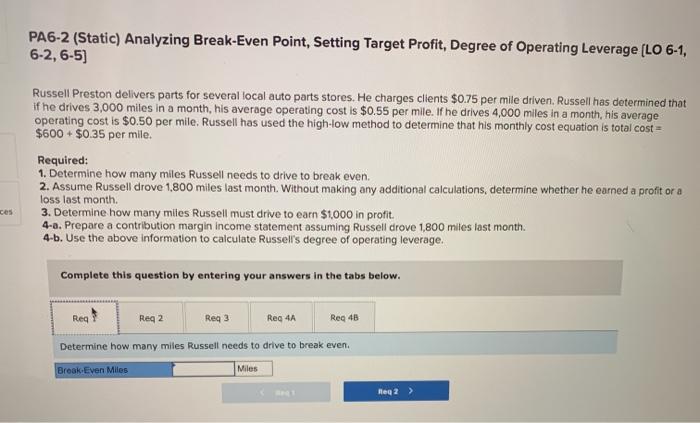

PA6-2 (Static) Analyzing Break-Even Point, Setting Target Profit, Degree of Operating Leverage (LO 6-1, 6-2, 6-5) Russell Preston delivers parts for several local auto parts stores. He charges clients $0.75 per mile driven, Russell has determined that if he drives 3,000 miles in a month, his average operating cost is $0.55 per mile. If he drives 4,000 miles in a month, his average operating cost is $0.50 per mile. Russell has used the high-low method to determine that his monthly cost equation is total cost = $600 + $0.35 per mile. Required: 1. Determine how many miles Russell needs to drive to break even 2. Assume Russell drove 1.800 miles last month. Without making any additional calculations, determine whether he earned a profit or a loss last month. 3. Determine how many miles Russell must drive to earn $1000 in profit. 4-a. Prepare a contribution margin income statement assuming Russell drove 1,800 miles last month. 4-6. Use the above information to calculate Russell's degree of operating leverage. ces Complete this question by entering your answers in the tabs below. Reg Reg 2 Req3 Reg 4 Req 48 Determine how many miles Russell needs to drive to break even. Break Even Miles Miles Reg 2 > Required: 1. Determine how many miles Russell needs to drive to break even 2. Assume Russell drove 1,800 miles last month. Without making any additional calculations, determine whether he earned a profit loss last month. 3. Determine how many miles Russell must drive to earn $1,000 in profit. 4-a. Prepare a contribution margin income statement assuming Russell drove 1,800 miles last month. 4-6. Use the above information to calculate Russell's degree of operating leverage. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Reg 3 Reg 4A Req 4B Assume Russell drove 1,800 miles last month. Without making any additional calculations, determine whether he earned a profit or a loss last month. O Profit Loss Derating cost is $0.50 per mile. Russell has used the high-low method to determine that his monthly cost equation is total 600 + $0.35 per mile. Required: 1. Determine how many miles Russell needs to drive to break even. 2. Assume Russell drove 1,800 miles last month. Without making any additional calculations, determine whether he earned a p loss last month. 3. Determine how many miles Russell must drive to earn $1,000 in profit. 4-a. Prepare a contribution margin income statement assuming Russell drove 1.800 miles last month. 4-6. Use the above Information to calculate Russell's degree of operating leverage. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3 Reg 4A Reg 48 Determine how many miles Russell must drive to earn $1,000 in profit. Target Miles Miles margin income statement assuming Russell drove 1,800 miles last month. 4-b. Use the above information to calculate Russell's degree of operating leverage. Complete this question by entering your answers in the tabs below. Reg 1 Req2 Reg 3 Reg 4A Req 48 Prepare a contribution margin income statement assuming Russell drove 1,800 miles last month. RUSSELL PRESTON Contribution Margin Income Statement For Last Month Contribution Margin Income from Operations Rega Reg 40 > Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Req3 Req 4A Req 4B Use the above information to calculate Russell's degree of operating leverage. Degree of Operating Leverage