Answered step by step

Verified Expert Solution

Question

1 Approved Answer

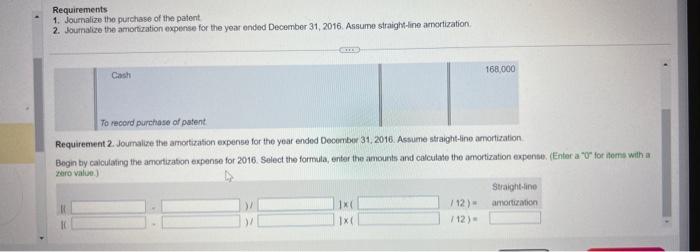

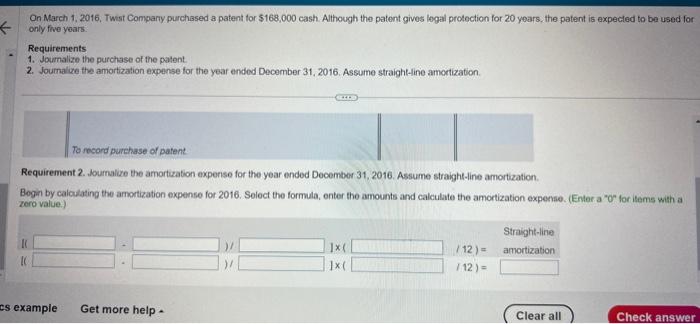

req 2 Requirements 1. Journalize the purchase of the patent. 2. Journalize ine purchase of the palent Joume the amortization expense for the year ended

req 2

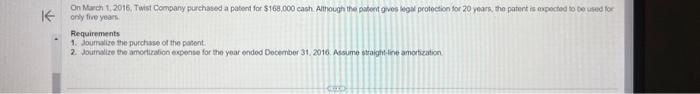

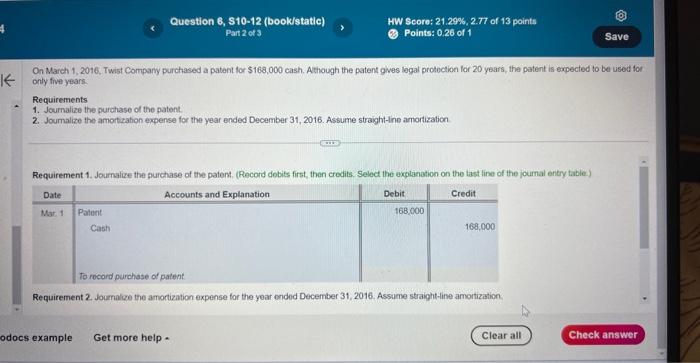

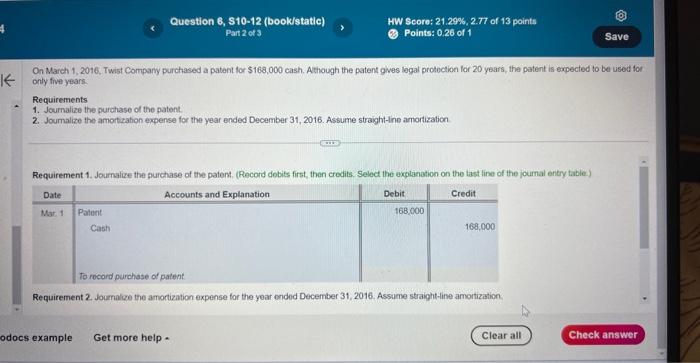

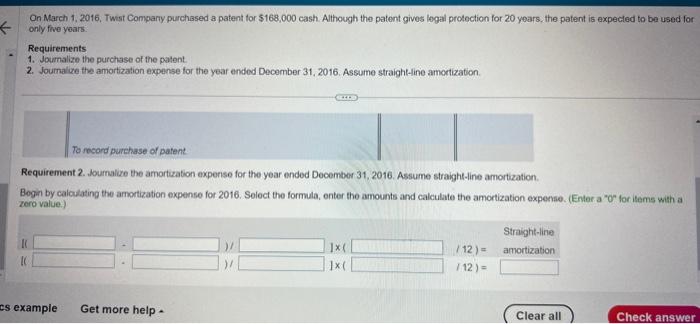

Requirements 1. Journalize the purchase of the patent. 2. Journalize ine purchase of the palent Joume the amortization expense for the year ended December 31, 2016. Assume straightrine amortization Requirement 2. Joumalize the amotization expense for the year ended Deconbor 31, 2016. Acsume straight-ino amorization. Bogin by calculating the amortiration expense for 2016 . Select the formula, enter the amcunts and calculate the amortization expense, (Enter a "or for itoms with a toro value. only fine year Requirements 1. Journilio the purchase of the parent 2. Joundite the amoriralion expense for the year ended Dockember 31. 2016. Assime srolghtitine amortzation On March 1, 2016, Twist Company purchased a patent for $168,000 cash. Athough the patent gives legal protection for 20 years, the patent is expected to be used fo onty five years Requirements 1. Journalize the purchase of the patent. 2. Joumalize the amortiration expense for the year ended December 31, 2016. Assume straight-line amortization Requirement 1. Journalize the gurchase of the patent. (Record dobits first, then credits. Select the exglaiation on the tast line of the journal entry table.) Requirement 2. Joumalize the amorization expense for the year ended December 31, 2016. Assume straight-line amontization. On March 1, 2016, Twist Company purchased a patent for $168,000 cash. Although the patent gives legal protoction for 20 years, the patent is expected to be used for only five yoars. Requirements 1. Joumalize the purchase of the patent. 2. Joumalize the amortization expense for the year ended December 31, 2016. Assume straight-line amorization. Requirement 2. Journalize the amortuzation experise for the year ended December 31, 2016. Assume straight-line amortization. Begin by calculating the amortization expense for 2016. Solect the formula, enter the amounts and calculate the amortization expecha. (Enter a "o" for items with a zero value.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started