Answered step by step

Verified Expert Solution

Question

1 Approved Answer

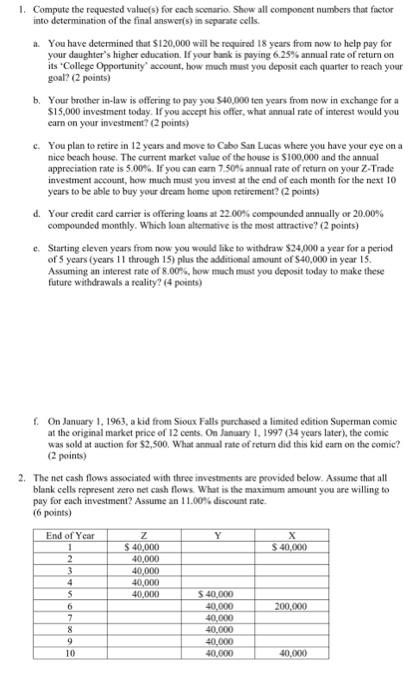

*REQUEST* can this problem be shown/done through excel along with formulas. 1. Compute the requested value(s) for each secnario. Show all component numbers that foctor

*REQUEST* can this problem be shown/done through excel along with formulas.

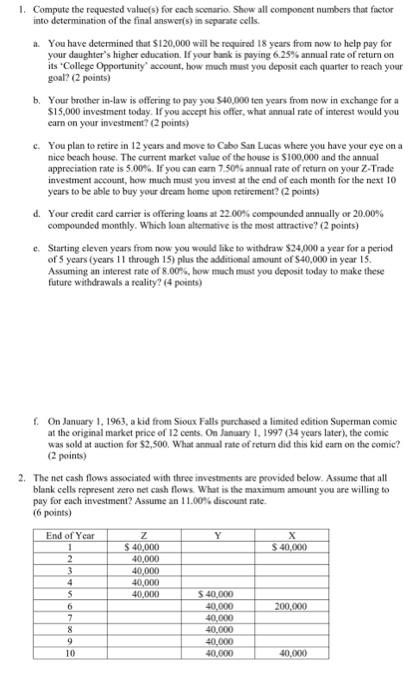

1. Compute the requested value(s) for each secnario. Show all component numbers that foctor into determination of the final answer(s) in separate cells. a. You have determined that $120,000 will be required 18 years from now to help pay for your daughter's higher education. If your hank is poying 6.25% annual rate of return on its 'College Opportunity' account, bow much must you deposit tach quarter to reach your goal? ( 2 ponts) b. Your brother in-law is offering to pay you $40,000 ten years from now in exchange for a $15,000 investment today. If you accept his offer, what annual mate of interest would you earn on your investment? (2 points) c. You plan to retire in 12 years and move to Cabo San Lucas where you have your cye on a nice beach house. The curreat market value of the house is $100.000 and the annual appreciation rate is 5.00%. If you can earn 7.50% annual rate of return on your Z-Trade investment account, how much must you inved at the end of each month for the next 10 years to be able to buy your dream home upoe retirement? (2 points) d. Your credit card carrier is offering loans at 22.00 f coupounded annually or 20.00% compounded monthly. Which loan altemative is the most attractive? ( 2 points) c. Starting cleven years from now you woald hike to withdraw $24,000 a year for a period of 5 years (years 11 through 15 ) plus the additional amount of 540,000 in year 15 . Assuming an interest rate of 8.007 , bow much must you dcposit today to make these future withdrawals a reality? (4 points) f. On January 1, 1963, a kid from Sioux Falls purchased a limited edition Superman comic at the origimal market price of 12 cents. On Janaary 1, 1997 (34 years later), the comic was sold at auction for $2,500. What annul rate of return did this kid earn on the comic? ( 2 points) 2. The net eash flows associated with three investments are provided below. Assume that all blank cells represent zero net cash flows. What is the maximum amount you are willing to pay for each investment? Assume an 11.00 s. discount rate. (6 points) 1. Compute the requested value(s) for each secnario. Show all component numbers that foctor into determination of the final answer(s) in separate cells. a. You have determined that $120,000 will be required 18 years from now to help pay for your daughter's higher education. If your hank is poying 6.25% annual rate of return on its 'College Opportunity' account, bow much must you deposit tach quarter to reach your goal? ( 2 ponts) b. Your brother in-law is offering to pay you $40,000 ten years from now in exchange for a $15,000 investment today. If you accept his offer, what annual mate of interest would you earn on your investment? (2 points) c. You plan to retire in 12 years and move to Cabo San Lucas where you have your cye on a nice beach house. The curreat market value of the house is $100.000 and the annual appreciation rate is 5.00%. If you can earn 7.50% annual rate of return on your Z-Trade investment account, how much must you inved at the end of each month for the next 10 years to be able to buy your dream home upoe retirement? (2 points) d. Your credit card carrier is offering loans at 22.00 f coupounded annually or 20.00% compounded monthly. Which loan altemative is the most attractive? ( 2 points) c. Starting cleven years from now you woald hike to withdraw $24,000 a year for a period of 5 years (years 11 through 15 ) plus the additional amount of 540,000 in year 15 . Assuming an interest rate of 8.007 , bow much must you dcposit today to make these future withdrawals a reality? (4 points) f. On January 1, 1963, a kid from Sioux Falls purchased a limited edition Superman comic at the origimal market price of 12 cents. On Janaary 1, 1997 (34 years later), the comic was sold at auction for $2,500. What annul rate of return did this kid earn on the comic? ( 2 points) 2. The net eash flows associated with three investments are provided below. Assume that all blank cells represent zero net cash flows. What is the maximum amount you are willing to pay for each investment? Assume an 11.00 s. discount rate. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started