Answered step by step

Verified Expert Solution

Question

1 Approved Answer

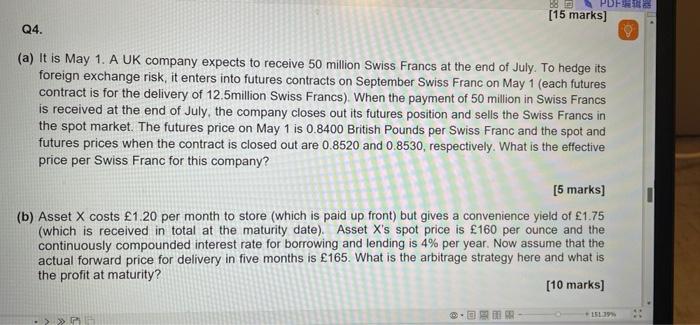

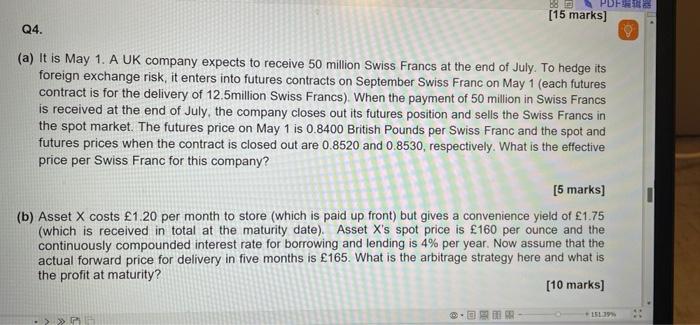

require detailed steps, thanks 68.3 PDF [15 marks) 19 Q4. (a) It is May 1. A UK company expects to receive 50 million Swiss Francs

require detailed steps, thanks

68.3 PDF [15 marks) 19 Q4. (a) It is May 1. A UK company expects to receive 50 million Swiss Francs at the end of July. To hedge its foreign exchange risk, it enters into futures contracts on September Swiss Franc on May 1 (each futures contract is for the delivery of 12.5million Swiss Francs). When the payment of 50 million in Swiss Francs is received at the end of July, the company closes out its futures position and sells the Swiss Francs in the spot market. The futures price on May 1 is 0.8400 British Pounds per Swiss Franc and the spot and futures prices when the contract is closed out are 0.8520 and 0.8530, respectively. What is the effective price per Swiss Franc for this company? [5 marks) a (b) Asset X costs 1.20 per month to store (which is paid up front) but gives a convenience yield of 1.75 (which is received in total at the maturity date). Asset X's spot price is 160 per ounce and the continuously compounded interest rate for borrowing and lending is 4% per year. Now assume that the actual forward price for delivery in five months is 165. What is the arbitrage strategy here and what is the profit at maturity? [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started