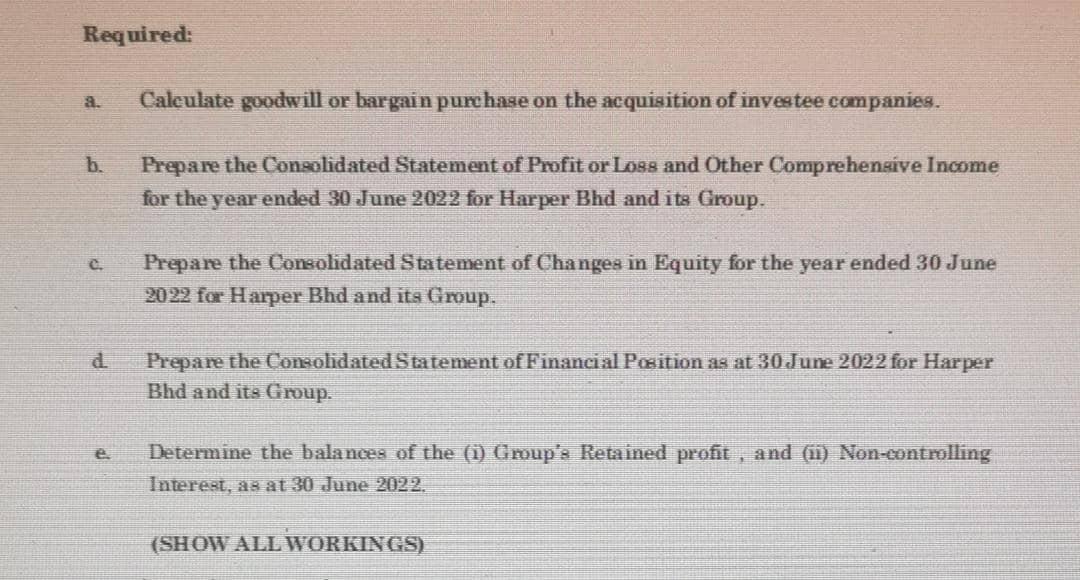

Require to answer question a and c only.

Require to answer question a and c only.

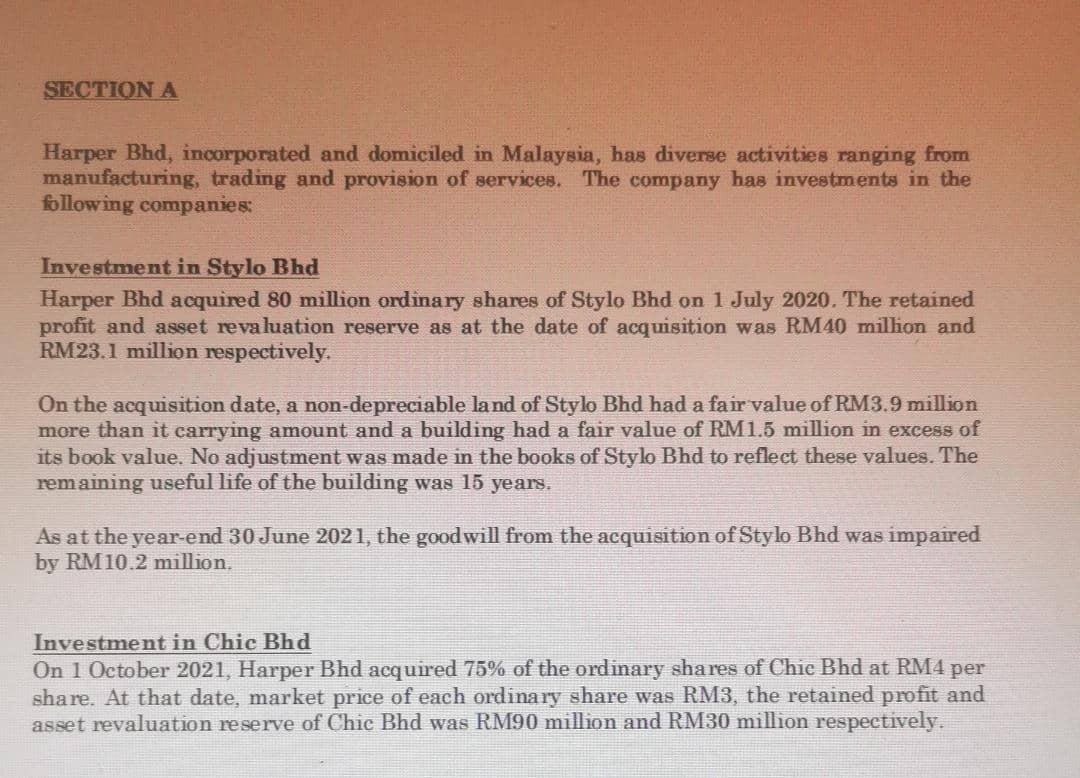

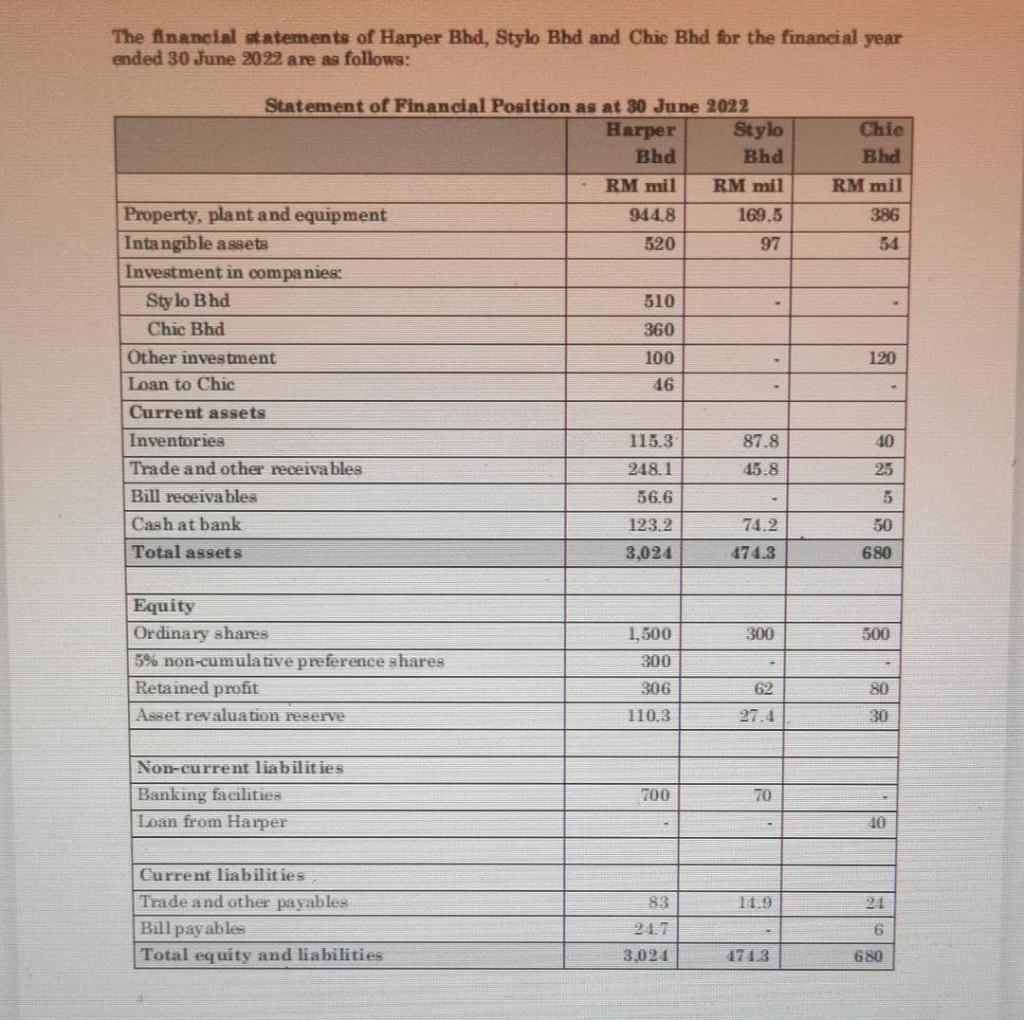

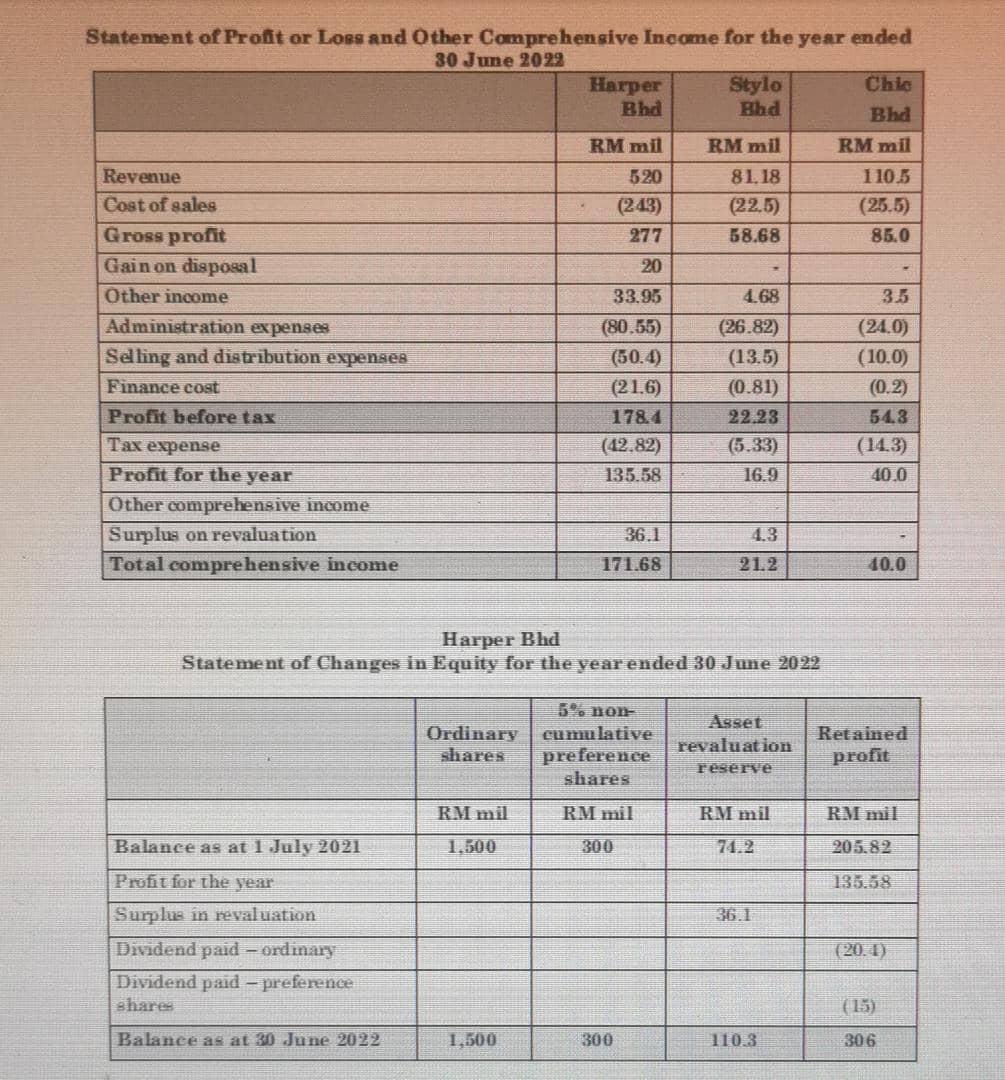

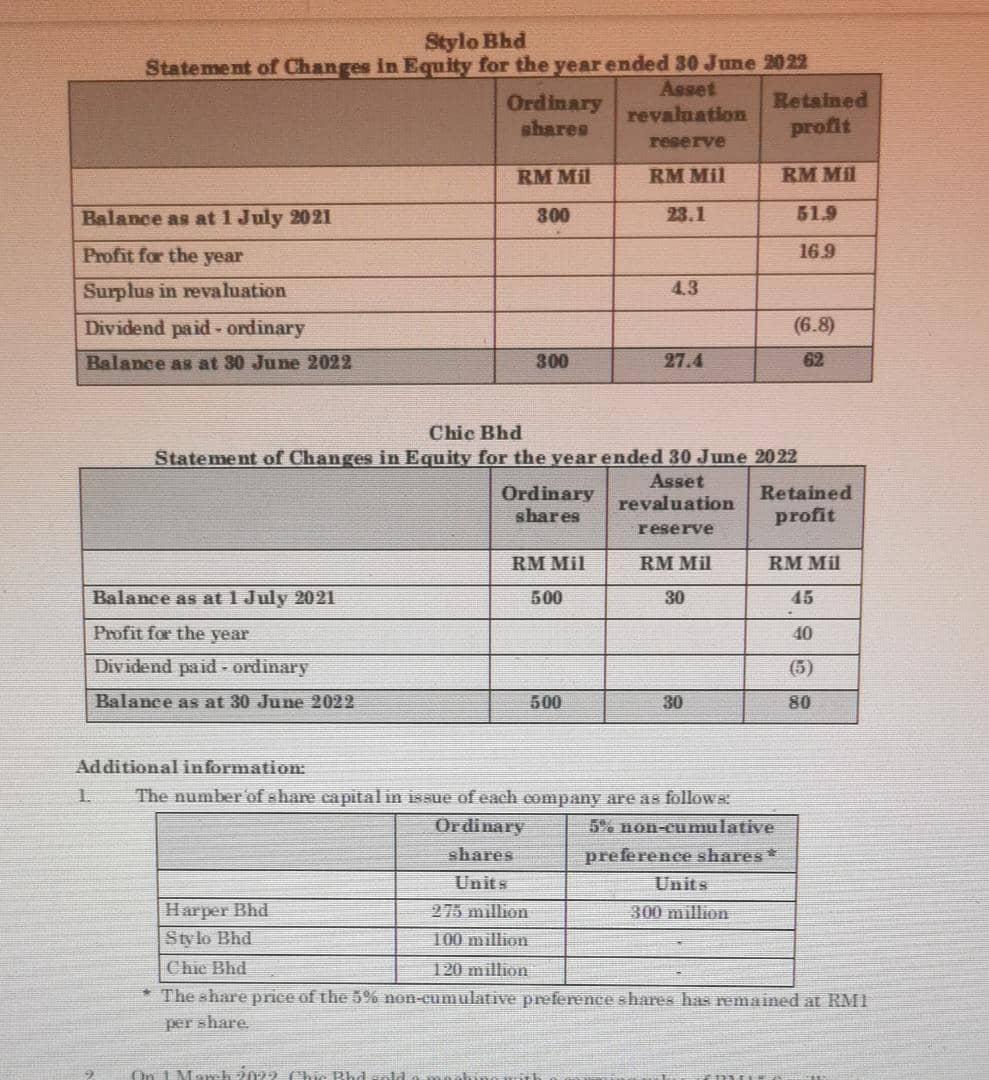

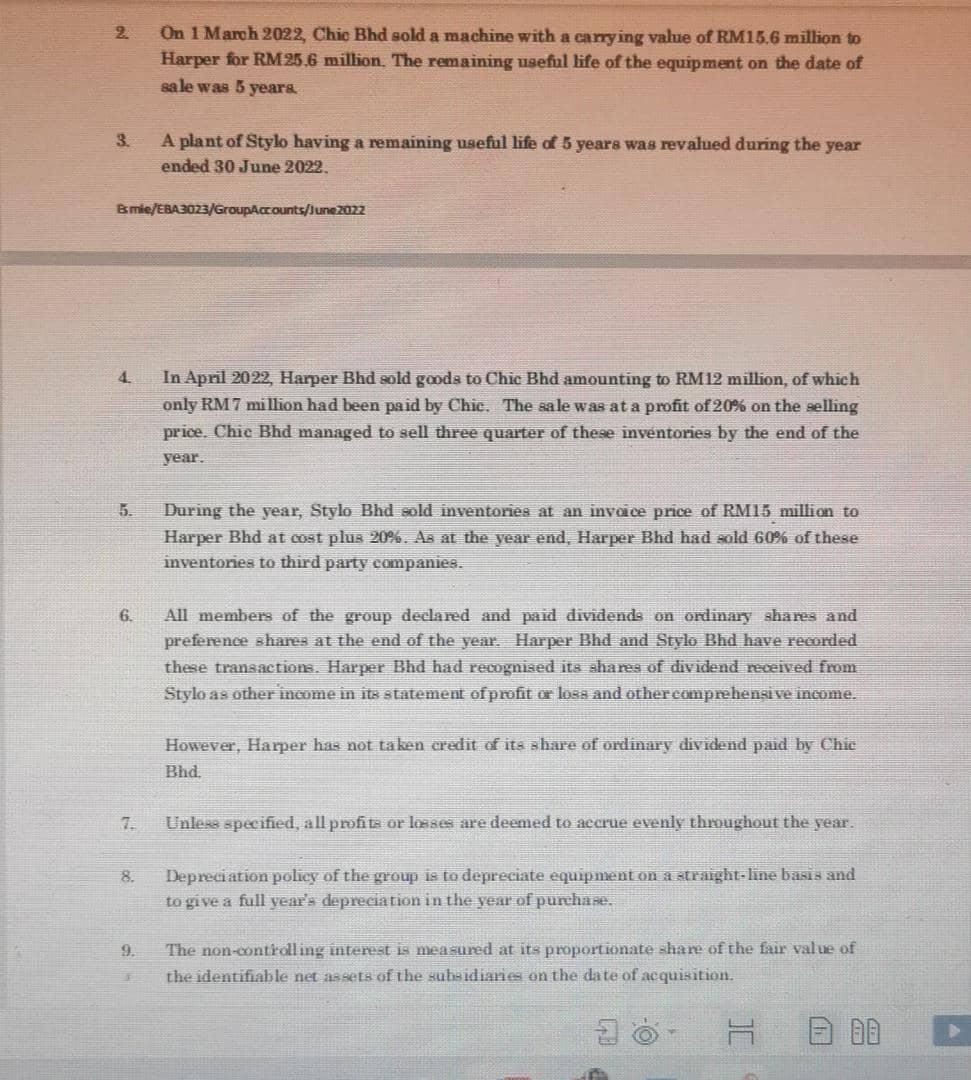

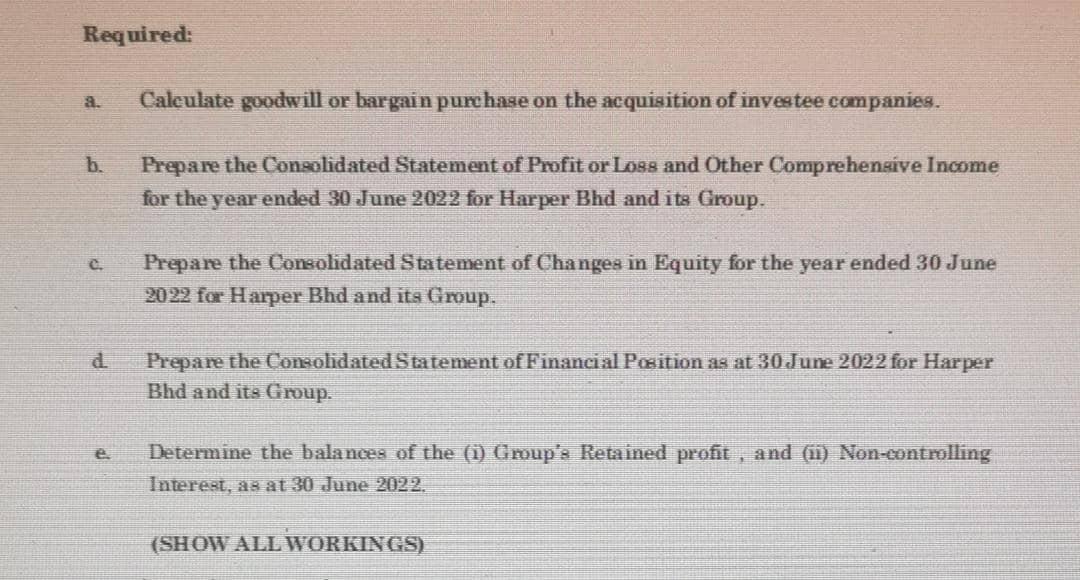

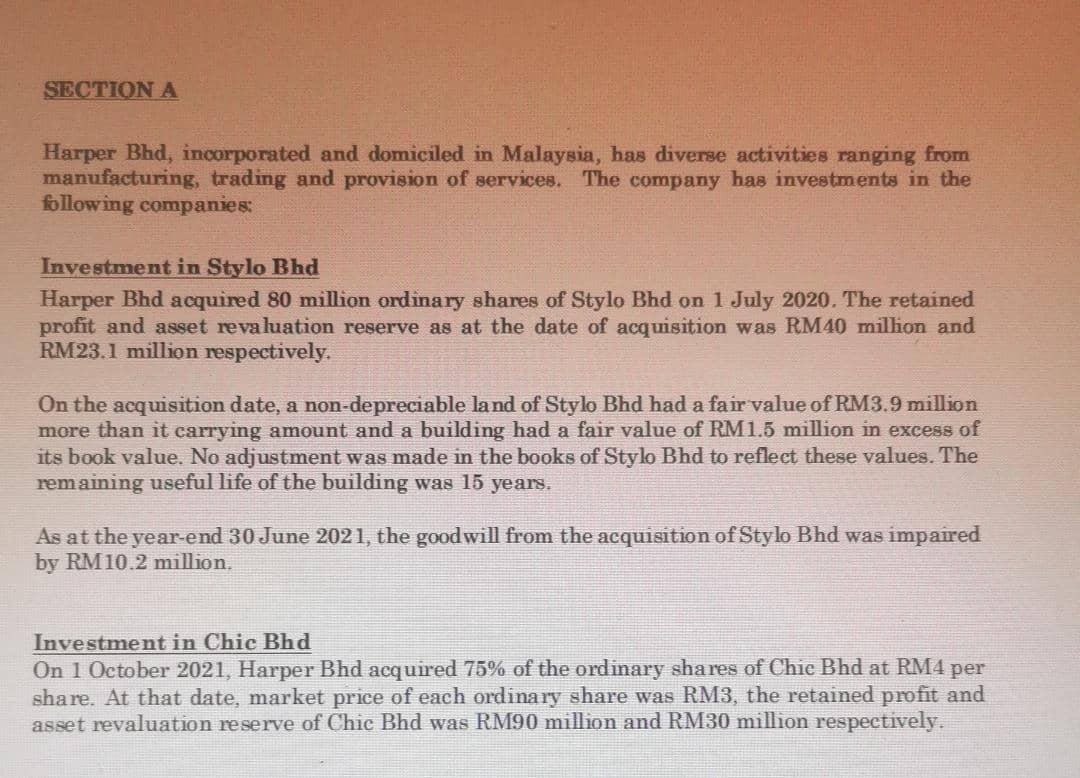

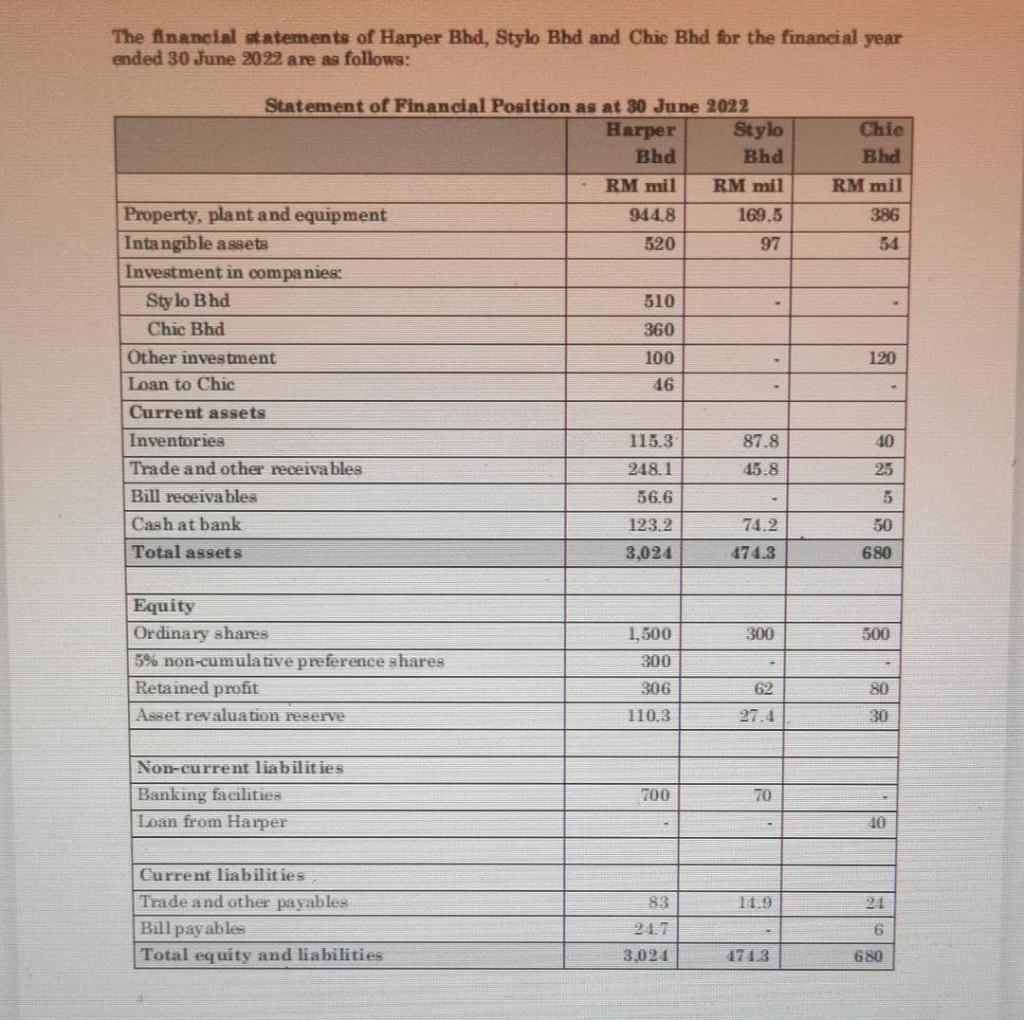

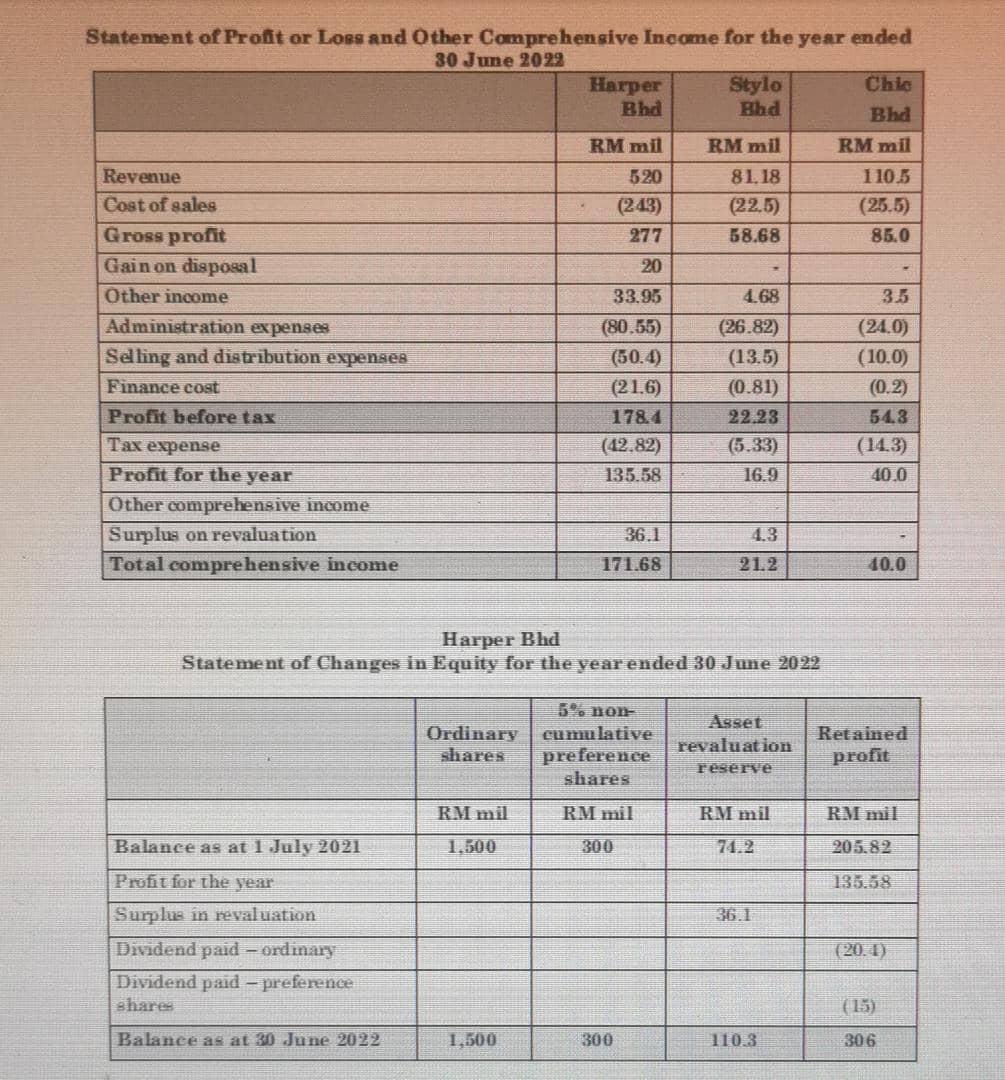

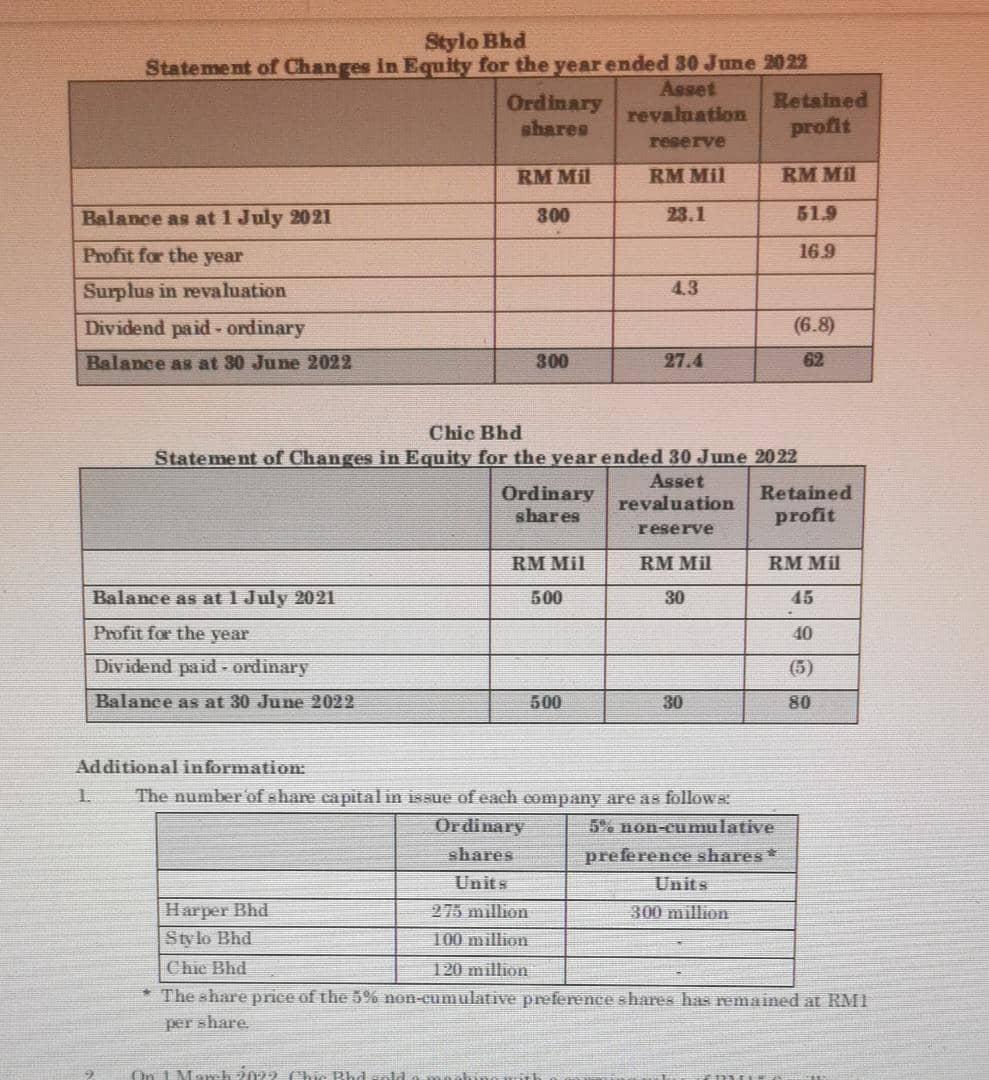

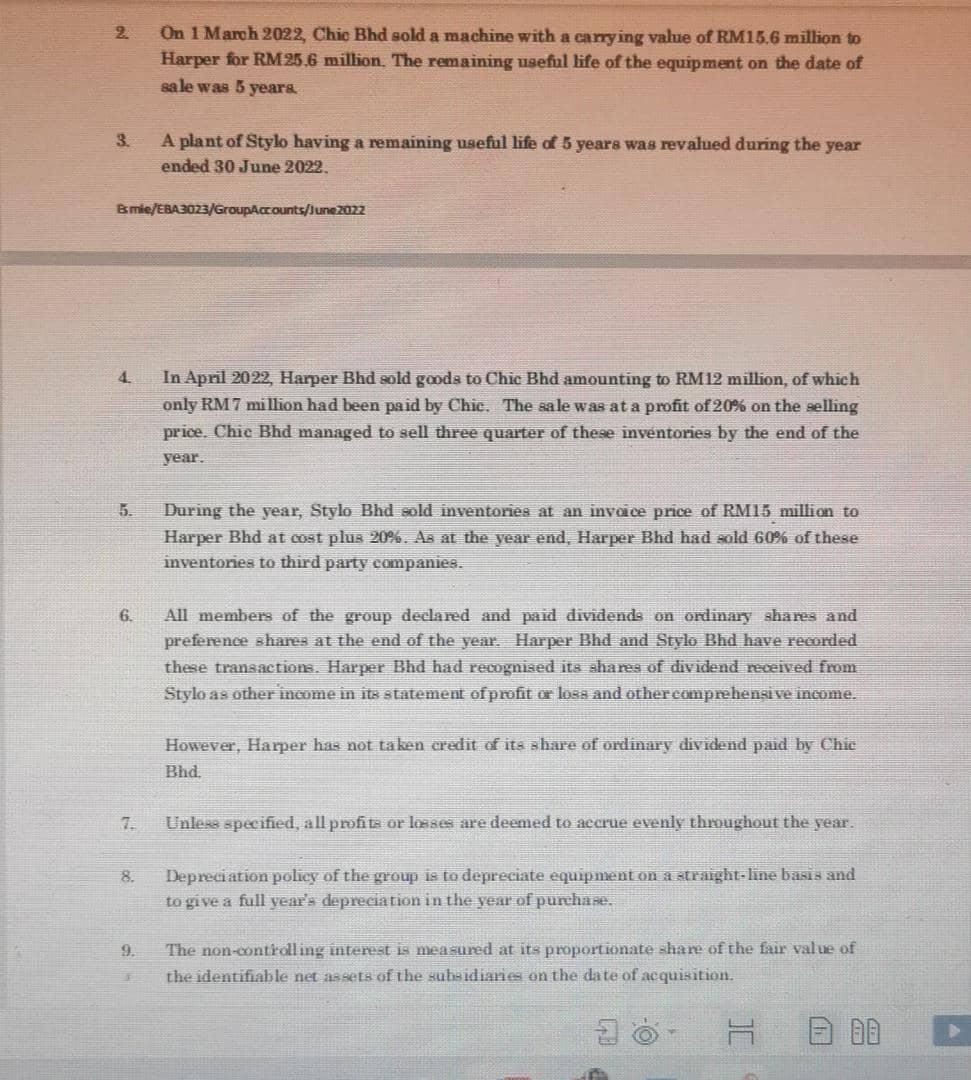

SECTION A Harper Bhd, incorporated and domiciled in Malaysia, has diverse activities ranging from manufacturing, trading and provision of services. The company has investments in the following companies: Investment in Stylo Bhd Harper Bhd acquired 80 million ordinary shares of Stylo Bhd on 1 July 2020. The retained profit and asset revaluation reserve as at the date of acquisition was RM40 million and RM23.1 million respectively. On the acquisition date, a non-depreciable land of Stylo Bhd had a fair value of RM3.9 million more than it carrying amount and a building had a fair value of RM1.5 million in excess of its book value. No adjustment was made in the books of Stylo Bhd to reflect these values. The remaining useful life of the building was 15 years. As at the year-end 30 June 2021, the goodwill from the acquisition of Stylo Bhd was impaired by RM10.2 million. Investment in Chic Bhd On 1 October 2021, Harper Bhd acquired 75% of the ordinary shares of Chic Bhd at RM4 per share. At that date, market price of each ordinary share was RM3, the retained profit and asset revaluation reserve of Chic Bhd was RM90 million and RM30 million respectively. The financial statements of Harper Bhd, Stylo Bhd and Chic Bhd for the financial year ended 30 June 2022 are as follows: Statement of Financial Position as at 30 June 2022 Harper Stylo Chic Bhd Bhd Bhd RM mil RM mil RM mil Property, plant and equipment 944.8 169.5 386 Intangible assets 520 97 54 Investment in companies: Stylo Bhd 510 Chic Bhd 360 Other investment 100 Loan to Chic 46 . Current assets Inventories 115.3 87.8 Trade and other receivables 248.1 45.8 Bill receivables 56.6 Cash at bank 123.2 74.2 Total assets 3,024 474.3 Equity Ordinary shares 1,500 300 5% non-cumulative preference shares 300 Retained profit 306 Asset revaluation reserve 110.3 Non-current liabilities Banking facilities 700 Loan from Harper Current liabilities Trade and other payables 83 24.7 Bill payables Total equity and liabilities 3,024 T 62 27.4 70 474.3 120 - 40 25 5 50 680 500 80 30 10 24 6 680 Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022 Harper Stylo Chic Bhd Bhd Bhd RM mil RM mil RM mil 520 81.18 110.5 Revenue Cost of sales (243) (22.5) (25.5) Gross profit 277 58.68 85.0 Gain on disposal 20 Other income 33.95 4.68 35 Administration expenses (80.55) (26.82) (24.0) Selling and distribution expenses (50.4) (13.5) (10.0) Finance cost (21.6) (0.81) (0.2) Profit before tax 178.4 22.23 54.3 Tax expense (42.82) (5.33) (14.3) Profit for the year 135.58 16.9 40.0 Other comprehensive income Surplus on revaluation 36.1 4.3 Total comprehensive income 171.68 21.2 40.0 Harper Bhd Statement of Changes in Equity for the year ended 30 June 2022 Ordinary shares 5% non- cumulative preference shares Asset revaluation Retained profit reserve RM mil RM mil RM mil RM mil 1,500 300 74.2 205.82 135.58 36.1 (20.4) (15) 1,500 300 110.3 306 Balance as at 1 July 2021 Profit for the year Surplus in revaluation Dividend paid - ordinary Dividend paid - preference shares Balance as at 30 June 2022 Stylo Bhd Statement of Changes in Equity for the year ended 30 June 2022 Asset Ordinary shares revaluation Retained profit reserve RM Mil RM Mil RM MI Balance as at 1 July 2021 300 23.1 51.9 Profit for the year 16.9 Surplus in revaluation 4.3 Dividend paid-ordinary (6.8) Balance as at 30 June 2022 300 27.4 62 Chic Bhd Statement of Changes in Equity for the year ended 30 June 2022 Ordinary shares Asset revaluation Retained profit reserve RM Mil RM Mil RM Mil Balance as at 1 July 2021 500 30 45 Profit for the year 40 Dividend paid-ordinary Balance as at 30 June 2022 500 30 80 Additional information: 1. The number of share capital in issue of each company are as follows: 5% non-cumulative Ordinary shares Units preference shares * Units Harper Bhd 275 million 300 million Stylo Bhd 100 million Chic Bhd 120 million The share price of the 5% non-cumulative preference shares has remained at RM1 per share On 1 March 2022 Chic Bhd gold 2 2 On 1 March 2022, Chic Bhd sold a machine with a carrying value of RM15.6 million to Harper for RM 25.6 million. The remaining useful life of the equipment on the date of sale was 5 years 3. A plant of Stylo having a remaining useful life of 5 years was revalued during the year ended 30 June 2022. Esmie/EBA3023/GroupAccounts/June202z 4. In April 2022, Harper Bhd sold goods to Chic Bhd amounting to RM12 million, of which only RM 7 million had been paid by Chic. The sale was at a profit of 20% on the selling price. Chic Bhd managed to sell three quarter of these inventories by the end of the year. 5. During the year, Stylo Bhd sold inventories at an invoice price of RM15 million to Harper Bhd at cost plus 20%. As at the year end, Harper Bhd had sold 60% of these inventories to third party companies. 6. All members of the group declared and paid dividends on ordinary shares and preference shares at the end of the year. Harper Bhd and Stylo Bhd have recorded these transactions. Harper Bhd had recognised its shares of dividend received from Stylo as other income in its statement of profit or loss and other comprehensive income. However, Harper has not taken credit of its share of ordinary dividend paid by Chic Bhd. 7. Unless specified, all profits or losses are deemed to accrue evenly throughout the year. 8. and Depreciation policy of the group is to depreciate equipment on a straight-line to give a full year's depreciation in the year of purchase. 9. The non-controlling interest is measured at its proportionate share of the fair value of the identifiable net assets of the subsidiaries on the date of acquisition. S H 00 Required: a. Calculate goodwill or bargain purchase on the acquisition of investee companies. b. Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022 for Harper Bhd and its Group. C. Prepare the Consolidated Statement of Changes in Equity for the year ended 30 June 2022 for Harper Bhd and its Group. d Prepare the Consolidated Statement of Financial Position as at 30 June 2022 for Harper Bhd and its Group. e. Determine the balances of the (1) Group's Retained profit, and (ii) Non-controlling Interest, as at 30 June 2022. (SHOW ALL WORKINGS) SECTION A Harper Bhd, incorporated and domiciled in Malaysia, has diverse activities ranging from manufacturing, trading and provision of services. The company has investments in the following companies: Investment in Stylo Bhd Harper Bhd acquired 80 million ordinary shares of Stylo Bhd on 1 July 2020. The retained profit and asset revaluation reserve as at the date of acquisition was RM40 million and RM23.1 million respectively. On the acquisition date, a non-depreciable land of Stylo Bhd had a fair value of RM3.9 million more than it carrying amount and a building had a fair value of RM1.5 million in excess of its book value. No adjustment was made in the books of Stylo Bhd to reflect these values. The remaining useful life of the building was 15 years. As at the year-end 30 June 2021, the goodwill from the acquisition of Stylo Bhd was impaired by RM10.2 million. Investment in Chic Bhd On 1 October 2021, Harper Bhd acquired 75% of the ordinary shares of Chic Bhd at RM4 per share. At that date, market price of each ordinary share was RM3, the retained profit and asset revaluation reserve of Chic Bhd was RM90 million and RM30 million respectively. The financial statements of Harper Bhd, Stylo Bhd and Chic Bhd for the financial year ended 30 June 2022 are as follows: Statement of Financial Position as at 30 June 2022 Harper Stylo Chic Bhd Bhd Bhd RM mil RM mil RM mil Property, plant and equipment 944.8 169.5 386 Intangible assets 520 97 54 Investment in companies: Stylo Bhd 510 Chic Bhd 360 Other investment 100 Loan to Chic 46 . Current assets Inventories 115.3 87.8 Trade and other receivables 248.1 45.8 Bill receivables 56.6 Cash at bank 123.2 74.2 Total assets 3,024 474.3 Equity Ordinary shares 1,500 300 5% non-cumulative preference shares 300 Retained profit 306 Asset revaluation reserve 110.3 Non-current liabilities Banking facilities 700 Loan from Harper Current liabilities Trade and other payables 83 24.7 Bill payables Total equity and liabilities 3,024 T 62 27.4 70 474.3 120 - 40 25 5 50 680 500 80 30 10 24 6 680 Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022 Harper Stylo Chic Bhd Bhd Bhd RM mil RM mil RM mil 520 81.18 110.5 Revenue Cost of sales (243) (22.5) (25.5) Gross profit 277 58.68 85.0 Gain on disposal 20 Other income 33.95 4.68 35 Administration expenses (80.55) (26.82) (24.0) Selling and distribution expenses (50.4) (13.5) (10.0) Finance cost (21.6) (0.81) (0.2) Profit before tax 178.4 22.23 54.3 Tax expense (42.82) (5.33) (14.3) Profit for the year 135.58 16.9 40.0 Other comprehensive income Surplus on revaluation 36.1 4.3 Total comprehensive income 171.68 21.2 40.0 Harper Bhd Statement of Changes in Equity for the year ended 30 June 2022 Ordinary shares 5% non- cumulative preference shares Asset revaluation Retained profit reserve RM mil RM mil RM mil RM mil 1,500 300 74.2 205.82 135.58 36.1 (20.4) (15) 1,500 300 110.3 306 Balance as at 1 July 2021 Profit for the year Surplus in revaluation Dividend paid - ordinary Dividend paid - preference shares Balance as at 30 June 2022 Stylo Bhd Statement of Changes in Equity for the year ended 30 June 2022 Asset Ordinary shares revaluation Retained profit reserve RM Mil RM Mil RM MI Balance as at 1 July 2021 300 23.1 51.9 Profit for the year 16.9 Surplus in revaluation 4.3 Dividend paid-ordinary (6.8) Balance as at 30 June 2022 300 27.4 62 Chic Bhd Statement of Changes in Equity for the year ended 30 June 2022 Ordinary shares Asset revaluation Retained profit reserve RM Mil RM Mil RM Mil Balance as at 1 July 2021 500 30 45 Profit for the year 40 Dividend paid-ordinary Balance as at 30 June 2022 500 30 80 Additional information: 1. The number of share capital in issue of each company are as follows: 5% non-cumulative Ordinary shares Units preference shares * Units Harper Bhd 275 million 300 million Stylo Bhd 100 million Chic Bhd 120 million The share price of the 5% non-cumulative preference shares has remained at RM1 per share On 1 March 2022 Chic Bhd gold 2 2 On 1 March 2022, Chic Bhd sold a machine with a carrying value of RM15.6 million to Harper for RM 25.6 million. The remaining useful life of the equipment on the date of sale was 5 years 3. A plant of Stylo having a remaining useful life of 5 years was revalued during the year ended 30 June 2022. Esmie/EBA3023/GroupAccounts/June202z 4. In April 2022, Harper Bhd sold goods to Chic Bhd amounting to RM12 million, of which only RM 7 million had been paid by Chic. The sale was at a profit of 20% on the selling price. Chic Bhd managed to sell three quarter of these inventories by the end of the year. 5. During the year, Stylo Bhd sold inventories at an invoice price of RM15 million to Harper Bhd at cost plus 20%. As at the year end, Harper Bhd had sold 60% of these inventories to third party companies. 6. All members of the group declared and paid dividends on ordinary shares and preference shares at the end of the year. Harper Bhd and Stylo Bhd have recorded these transactions. Harper Bhd had recognised its shares of dividend received from Stylo as other income in its statement of profit or loss and other comprehensive income. However, Harper has not taken credit of its share of ordinary dividend paid by Chic Bhd. 7. Unless specified, all profits or losses are deemed to accrue evenly throughout the year. 8. and Depreciation policy of the group is to depreciate equipment on a straight-line to give a full year's depreciation in the year of purchase. 9. The non-controlling interest is measured at its proportionate share of the fair value of the identifiable net assets of the subsidiaries on the date of acquisition. S H 00 Required: a. Calculate goodwill or bargain purchase on the acquisition of investee companies. b. Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2022 for Harper Bhd and its Group. C. Prepare the Consolidated Statement of Changes in Equity for the year ended 30 June 2022 for Harper Bhd and its Group. d Prepare the Consolidated Statement of Financial Position as at 30 June 2022 for Harper Bhd and its Group. e. Determine the balances of the (1) Group's Retained profit, and (ii) Non-controlling Interest, as at 30 June 2022. (SHOW ALL WORKINGS)

Require to answer question a and c only.

Require to answer question a and c only.