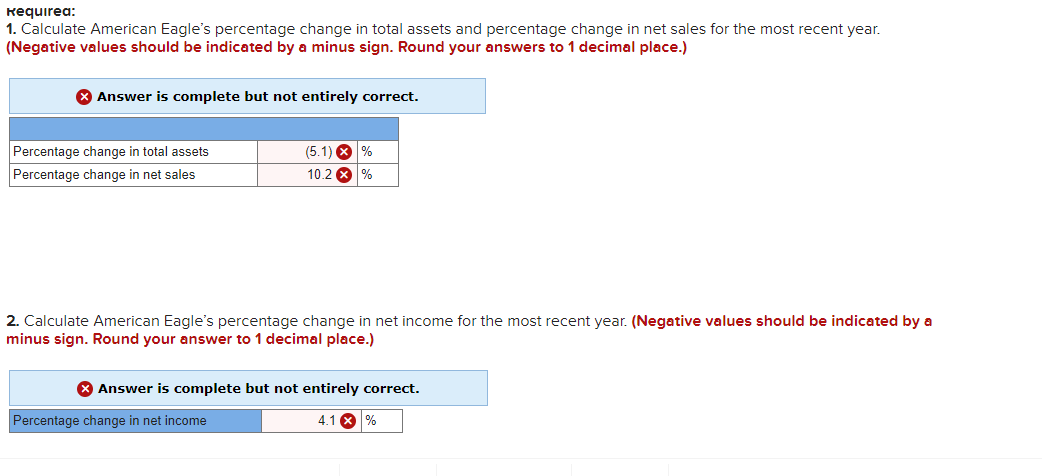

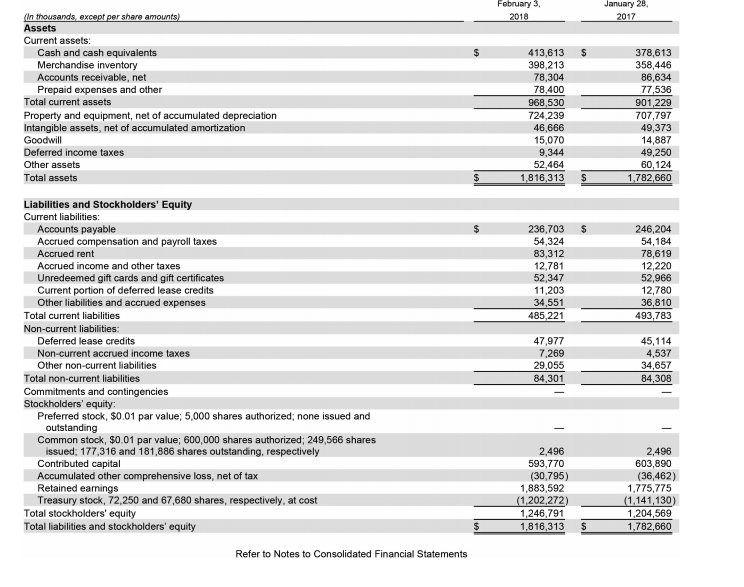

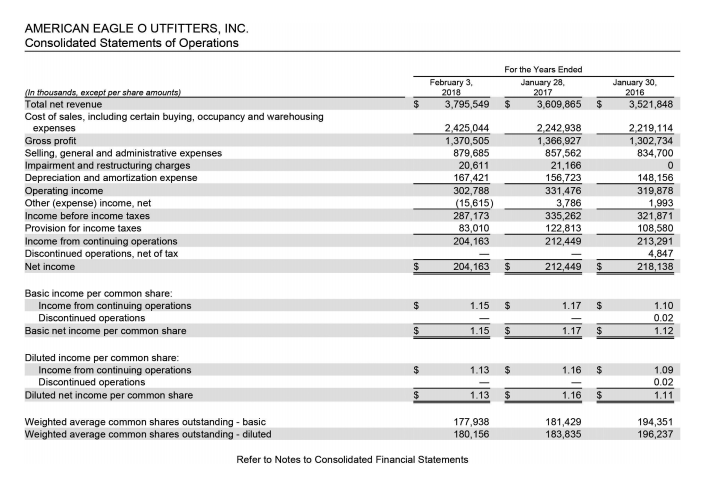

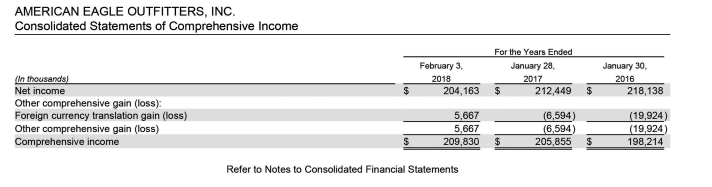

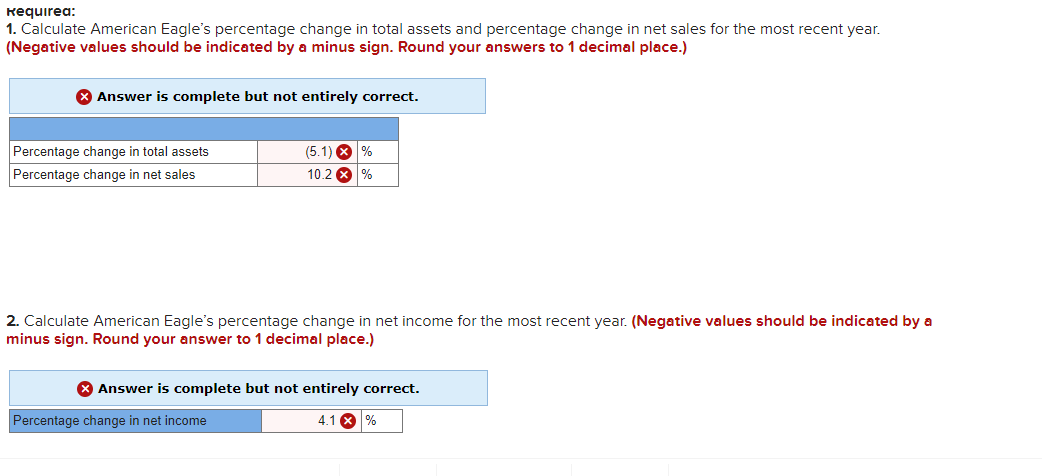

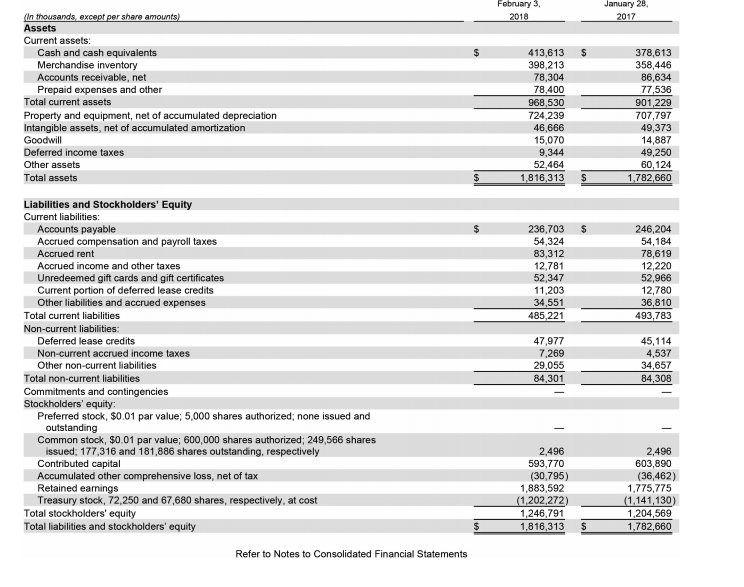

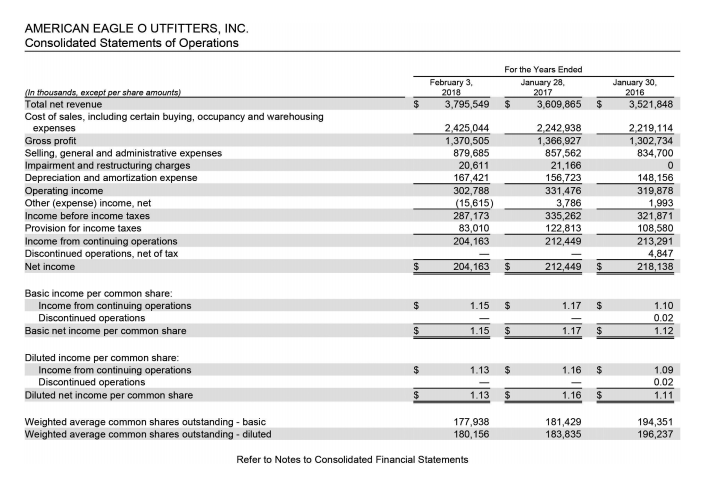

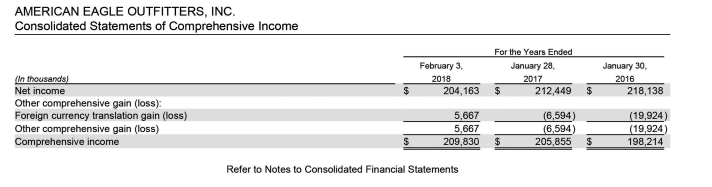

Requirea: 1. Calculate American Eagle's percentage change in total assets and percentage change in net sales for the most recent year. (Negative values should be indicated by a minus sign. Round your answers to 1 decimal place.) Answer is complete but not entirely correct. Percentage change in total assets Percentage change in net sales (5.1) % 10.2 X % 2. Calculate American Eagle's percentage change in net income for the most recent year. (Negative values should be indicated by a minus sign. Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Percentage change in net income 4.1 x % AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Operations February 3. 2018 3,795,549 For the Years Ended January 28, 2017 $ 3,609,865 January 30, 2016 3,521,848 $ $ (In thousands, except per share amounts) Total net revenue Cost of sales, including certain buying, occupancy and warehousing expenses Gross profit Selling, general and administrative expenses Impairment and restructuring charges Depreciation and amortization expense Operating income Other (expense) income, net Income before income taxes Provision for income taxes Income from continuing operations Discontinued operations, net of tax Net income 2.425,044 1,370,505 879,685 20,611 167,421 302,788 (15,615) 287,173 83,010 204,163 2.242938 1,366,927 857,562 21,166 156,723 331,476 3,786 335,262 122,813 212,449 2,219,114 1,302,734 834,700 0 148, 156 319,878 1,993 321,871 108,580 213,291 4,847 218,138 $ 204,163 $ 212,449 $ $ 1.15 $ 1.17 $ Basic income per common share: Income from continuing operations Discontinued operations Basic net income per common share 1.10 0.02 1.12 $ 1.15 $ 1.17 $ $ 1.13 $ 1.16 $ Diluted income per common share: Income from continuing operations Discontinued operations Diluted net income per common share Weighted average common shares outstanding - basic Weighted average common shares outstanding - diluted 1.09 0.02 1.11 $ 1.13 $ 1.16 $ 177,938 180, 156 181,429 183,835 194,351 196,237 Refer to Notes to Consolidated Financial Statements AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Comprehensive Income February 3, 2018 204,163 For the Years Ended January 28, 2017 $ 212,449 January 30, 2016 218,138 $ $ In thousands) Net income Other comprehensive gain (loss): Foreign currency translation gain (loss) Other comprehensive gain (loss) Comprehensive income 5,667 5,667 209,830 (6,594) (6,594) 205,855 (19,924) (19,924 198,214 $ $ $ Refer to Notes to Consolidated Financial Statements