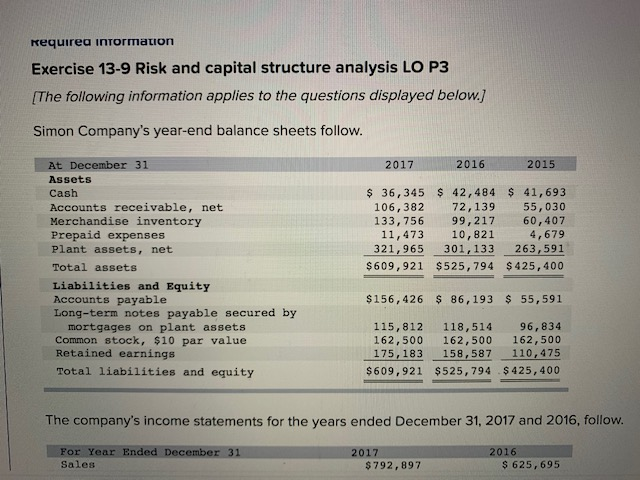

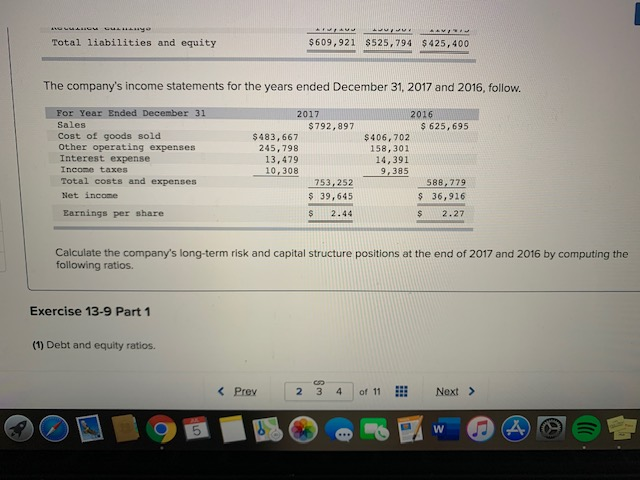

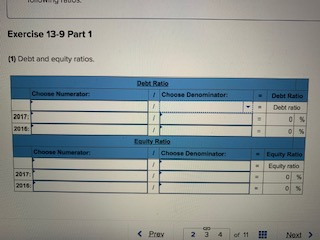

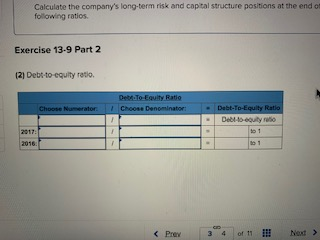

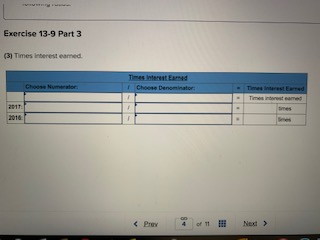

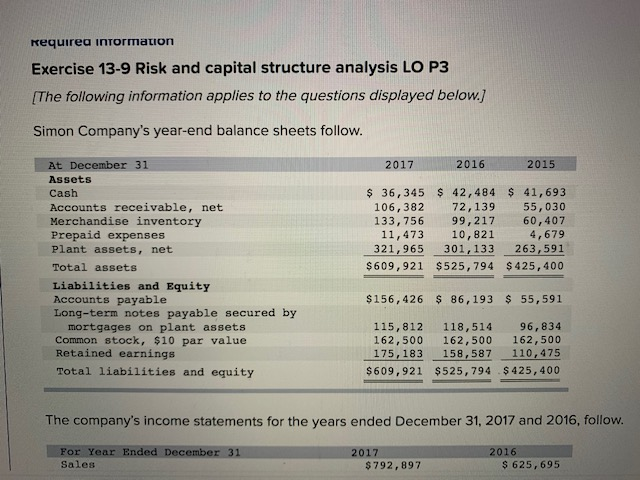

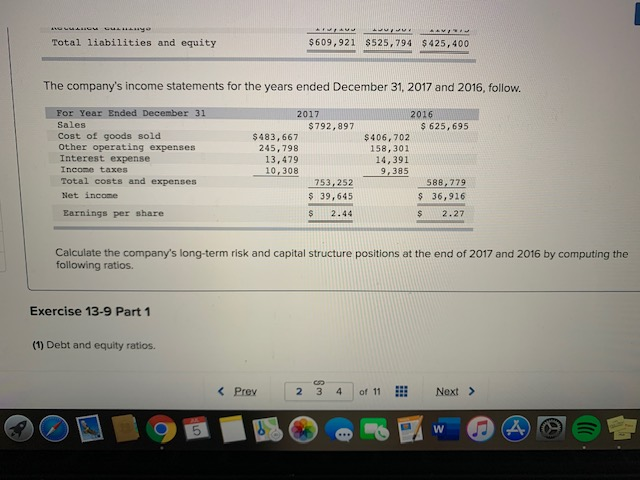

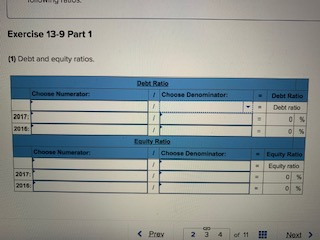

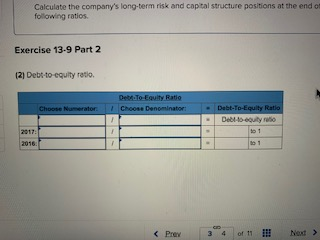

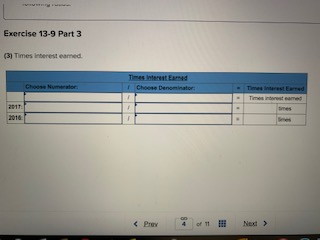

requirea information Exercise 13-9 Risk and capital structure analysis LO P3 [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 36, 345 $ 42,484 $ 41,693 106, 382 72,139 55,030 133, 756 99,217 60,407 11,473 10,821 4,679 321,965 301, 133 263,591 $609,921 $525, 794 $ 425,400 $156,426 $ 86,193 $ 55,591 115,812 118,514 96,834 162,500 162,500 162,500 175,183 158,587 110,475 $609,921 $525, 794 $425,400 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 Sales 2017 $ 792,897 2016 $ 625,695 AULA FA JUJU AAV Total liabilities and equity $609,921 $525,794 $425,400 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income 2017 $ 792,897 $483,667 245,798 13,479 10,308 753, 252 $ 39,645 $ 2.44 2016 $ 625,695 $ 406, 702 158, 301 14,391 9,385 588,779 $ 36,916 $ 2.27 Earnings per share Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 1 (1) Debt and equity ratios. W A Exercise 13-9 Part 1 (1) Debt and equity ratios. Debt Ratio Choose Denominator Cose Numerator Debt Italie - 2017 Debt ratio 0 0 % Choose Numerator Eowity Ratio ! Choose Denominator Equy Ratio Equity ratio 0 % 2011 1 CO Calculate the company's long-term risk and capital structure positions at the end of following ratios. Exercise 13.9 Part 2 (2) Debt-to-equity ratio Debt To Equity Ratio Choose Denominator: Choose Numerator Debt-To-Equity Ratio Deblocuity 1 2017: 2016: Exercise 13-9 Part 3 (3) Times interest earned Choose to Times Herstad Choose Denominator 2011 requirea information Exercise 13-9 Risk and capital structure analysis LO P3 [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 36, 345 $ 42,484 $ 41,693 106, 382 72,139 55,030 133, 756 99,217 60,407 11,473 10,821 4,679 321,965 301, 133 263,591 $609,921 $525, 794 $ 425,400 $156,426 $ 86,193 $ 55,591 115,812 118,514 96,834 162,500 162,500 162,500 175,183 158,587 110,475 $609,921 $525, 794 $425,400 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 Sales 2017 $ 792,897 2016 $ 625,695 AULA FA JUJU AAV Total liabilities and equity $609,921 $525,794 $425,400 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income 2017 $ 792,897 $483,667 245,798 13,479 10,308 753, 252 $ 39,645 $ 2.44 2016 $ 625,695 $ 406, 702 158, 301 14,391 9,385 588,779 $ 36,916 $ 2.27 Earnings per share Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 1 (1) Debt and equity ratios. W A Exercise 13-9 Part 1 (1) Debt and equity ratios. Debt Ratio Choose Denominator Cose Numerator Debt Italie - 2017 Debt ratio 0 0 % Choose Numerator Eowity Ratio ! Choose Denominator Equy Ratio Equity ratio 0 % 2011 1 CO Calculate the company's long-term risk and capital structure positions at the end of following ratios. Exercise 13.9 Part 2 (2) Debt-to-equity ratio Debt To Equity Ratio Choose Denominator: Choose Numerator Debt-To-Equity Ratio Deblocuity 1 2017: 2016: Exercise 13-9 Part 3 (3) Times interest earned Choose to Times Herstad Choose Denominator 2011