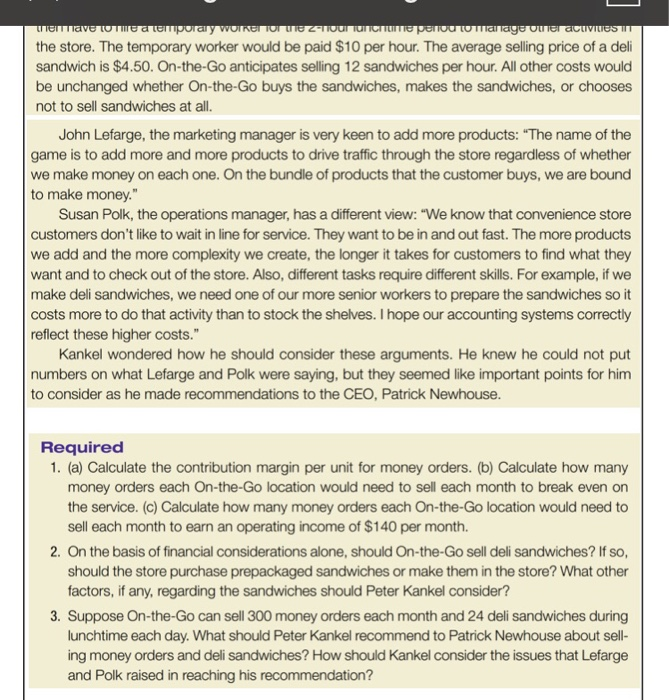

Required 1. (a) Calculate the contribution margin per unit for money orders. (b) Calculate how many money orders each On-the-Go location would need to sell each month to break even on the service. (c) Calculate how many money orders each On-the-Go location would need to sell each month to earn an operating income of $140 per month.

2. On the basis of financial considerations alone, should On-the-Go sell deli sandwiches? If so, should the store purchase prepackaged sandwiches or make them in the store? What other factors, if any, regarding the sandwiches should Peter Kankel consider?

3. Suppose On-the-Go can sell 300 money orders each month and 24 deli sandwiches during lunchtime each day. What should Peter Kankel recommend to Patrick Newhouse about sell- ing money orders and deli sandwiches? How should Kankel consider the issues that Lefarge and Polk raised in reaching his recommendation?

i need tha answer of 2nd and 3rd questions

acuVILIOS IT Woman we atemporary WOIREI TOIVEZ-NOUI TUNCIe panouwwanaye ou the store. The temporary worker would be paid $10 per hour. The average selling price of a deli sandwich is $4.50. On-the-Go anticipates selling 12 sandwiches per hour. All other costs would be unchanged whether On-the-Go buys the sandwiches, makes the sandwiches, or chooses not to sell sandwiches at all. John Lefarge, the marketing manager is very keen to add more products: The name of the game is to add more and more products to drive traffic through the store regardless of whether we make money on each one. On the bundle of products that the customer buys, we are bound to make money." Susan Polk, the operations manager, has a different view: We know that convenience store customers don't like to wait in line for service. They want to be in and out fast. The more products we add and the more complexity we create, the longer it takes for customers to find what they want and to check out of the store. Also, different tasks require different skills. For example, if we make deli sandwiches, we need one of our more senior workers to prepare the sandwiches so it costs more to do that activity than to stock the shelves. I hope our accounting systems correctly reflect these higher costs." Kankel wondered how he should consider these arguments. He knew he could not put numbers on what Lefarge and Polk were saying, but they seemed like important points for him to consider as he made recommendations to the CEO, Patrick Newhouse. Required 1. (a) Calculate the contribution margin per unit for money orders. (b) Calculate how many money orders each On-the-Go location would need to sell each month to break even on the service. (c) Calculate how many money orders each On-the-Go location would need to sell each month to earn an operating income of $140 per month. 2. On the basis of financial considerations alone, should on-the-Go sell deli sandwiches? If so, should the store purchase prepackaged sandwiches or make them in the store? What other factors, if any, regarding the sandwiches should Peter Kankel consider? 3. Suppose On-the-Go can sell 300 money orders each month and 24 deli sandwiches during lunchtime each day. What should Peter Kankel recommend to Patrick Newhouse about sell- ing money orders and deli sandwiches? How should Kankel consider the issues that Lefarge and Polk raised in reaching his recommendation? acuVILIOS IT Woman we atemporary WOIREI TOIVEZ-NOUI TUNCIe panouwwanaye ou the store. The temporary worker would be paid $10 per hour. The average selling price of a deli sandwich is $4.50. On-the-Go anticipates selling 12 sandwiches per hour. All other costs would be unchanged whether On-the-Go buys the sandwiches, makes the sandwiches, or chooses not to sell sandwiches at all. John Lefarge, the marketing manager is very keen to add more products: The name of the game is to add more and more products to drive traffic through the store regardless of whether we make money on each one. On the bundle of products that the customer buys, we are bound to make money." Susan Polk, the operations manager, has a different view: We know that convenience store customers don't like to wait in line for service. They want to be in and out fast. The more products we add and the more complexity we create, the longer it takes for customers to find what they want and to check out of the store. Also, different tasks require different skills. For example, if we make deli sandwiches, we need one of our more senior workers to prepare the sandwiches so it costs more to do that activity than to stock the shelves. I hope our accounting systems correctly reflect these higher costs." Kankel wondered how he should consider these arguments. He knew he could not put numbers on what Lefarge and Polk were saying, but they seemed like important points for him to consider as he made recommendations to the CEO, Patrick Newhouse. Required 1. (a) Calculate the contribution margin per unit for money orders. (b) Calculate how many money orders each On-the-Go location would need to sell each month to break even on the service. (c) Calculate how many money orders each On-the-Go location would need to sell each month to earn an operating income of $140 per month. 2. On the basis of financial considerations alone, should on-the-Go sell deli sandwiches? If so, should the store purchase prepackaged sandwiches or make them in the store? What other factors, if any, regarding the sandwiches should Peter Kankel consider? 3. Suppose On-the-Go can sell 300 money orders each month and 24 deli sandwiches during lunchtime each day. What should Peter Kankel recommend to Patrick Newhouse about sell- ing money orders and deli sandwiches? How should Kankel consider the issues that Lefarge and Polk raised in reaching his recommendation