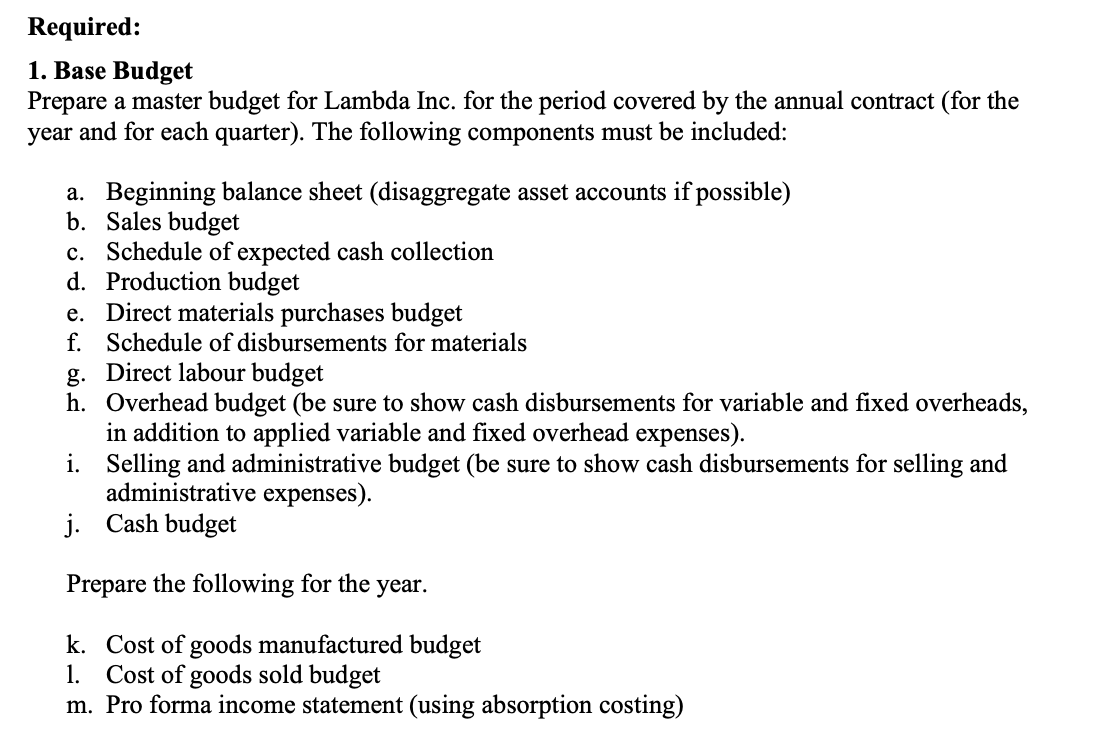

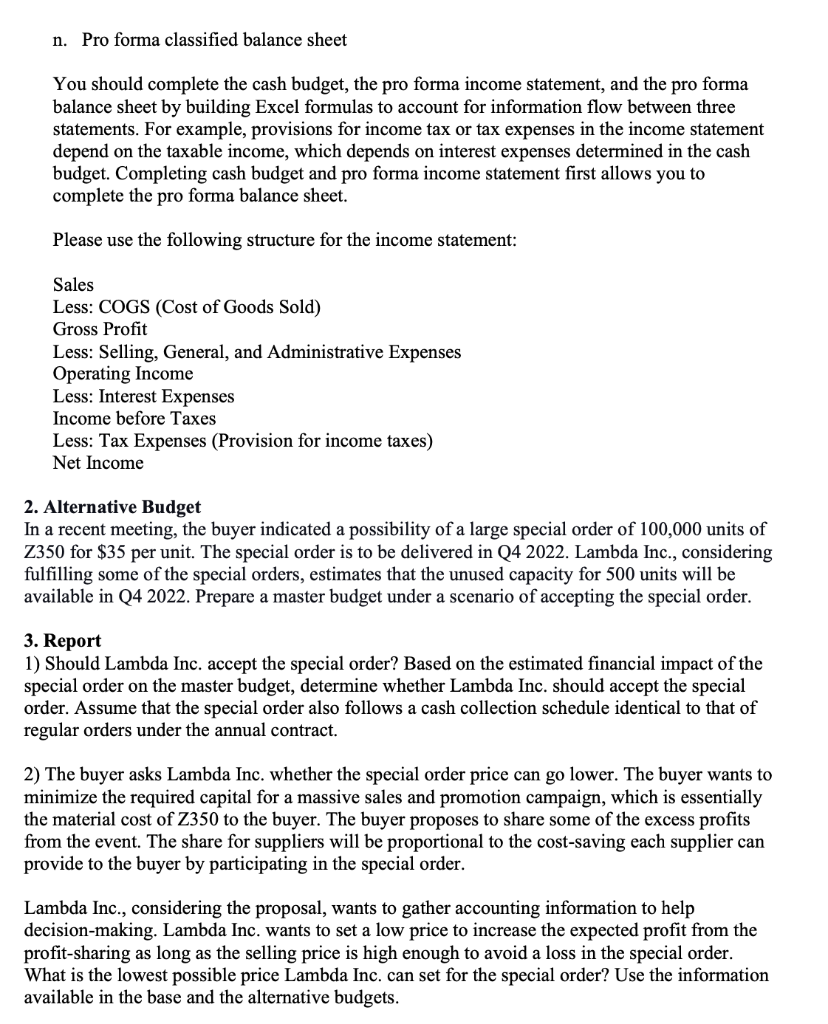

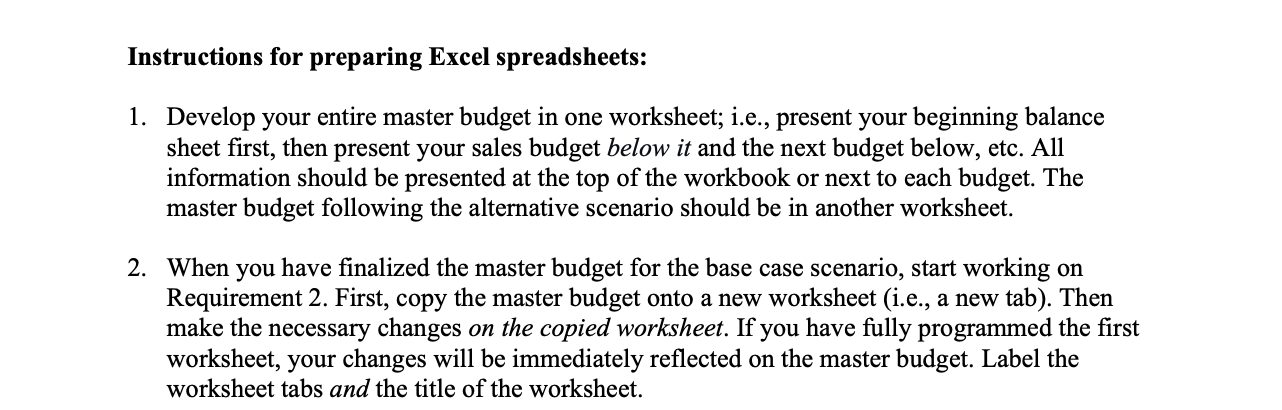

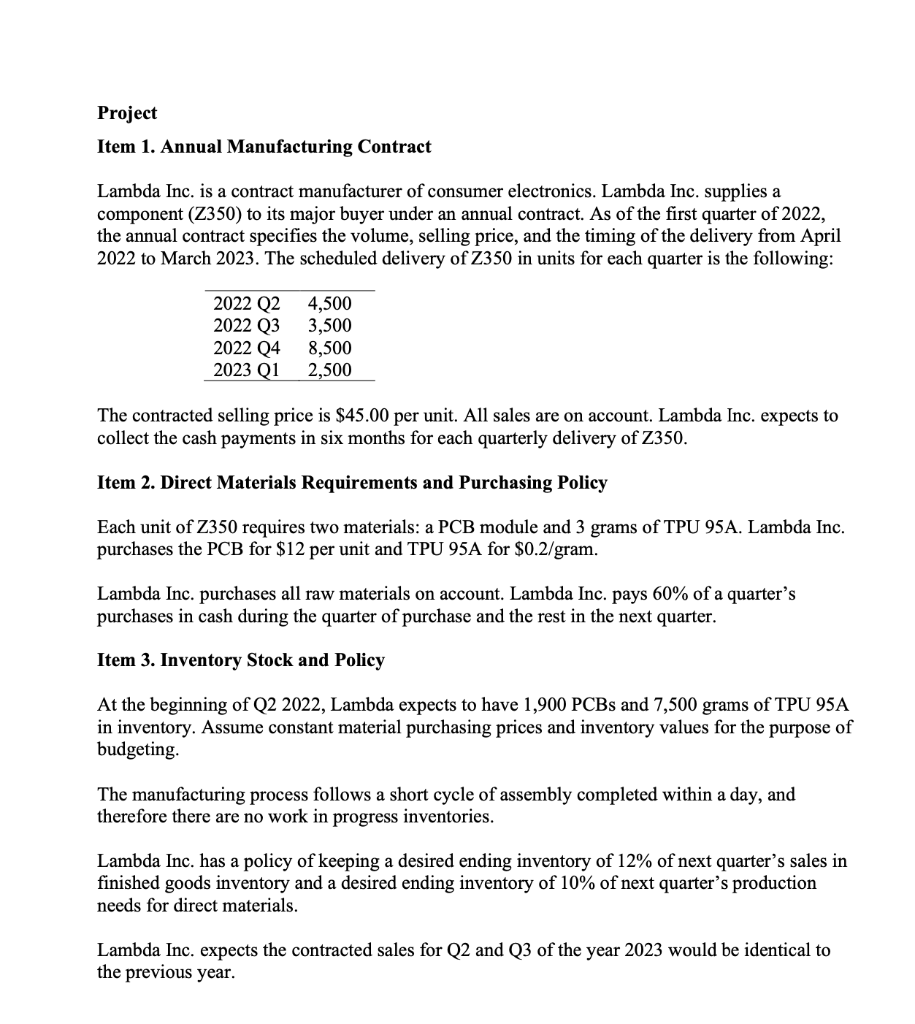

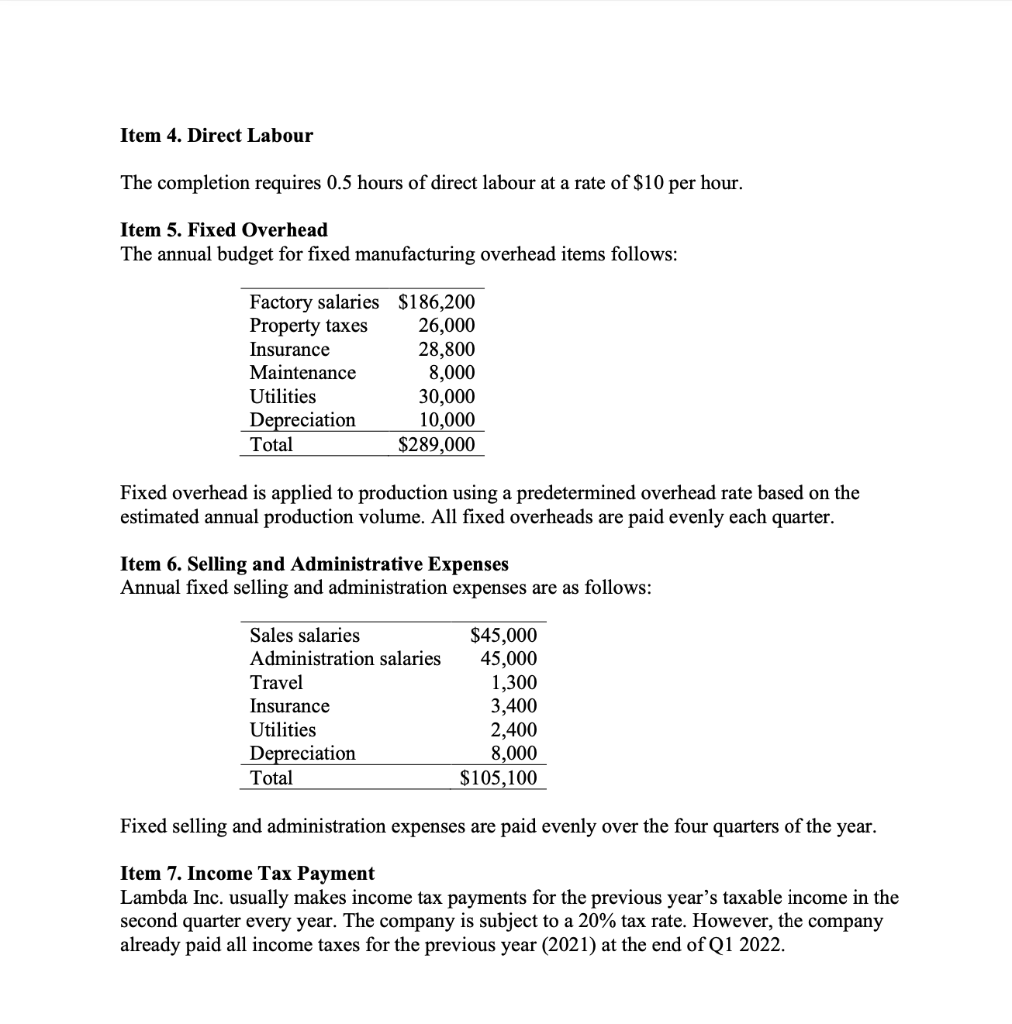

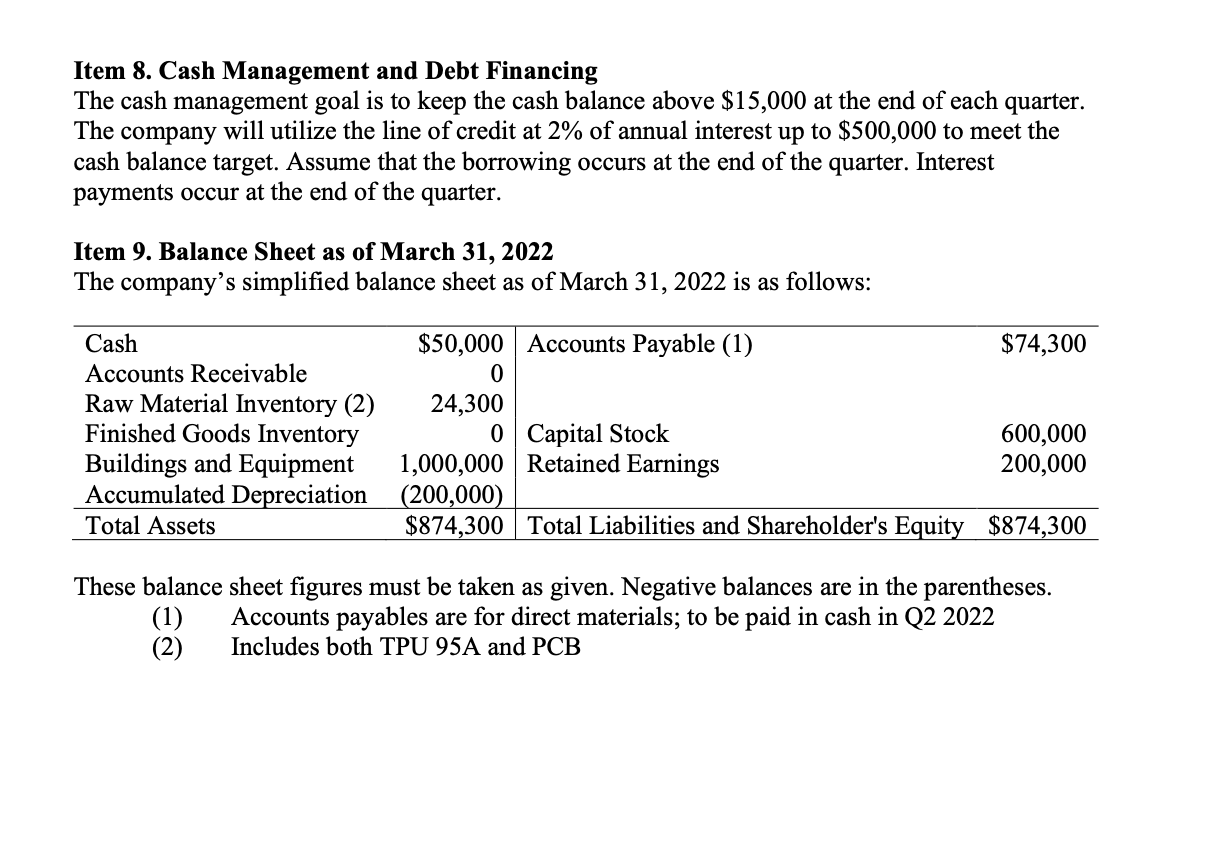

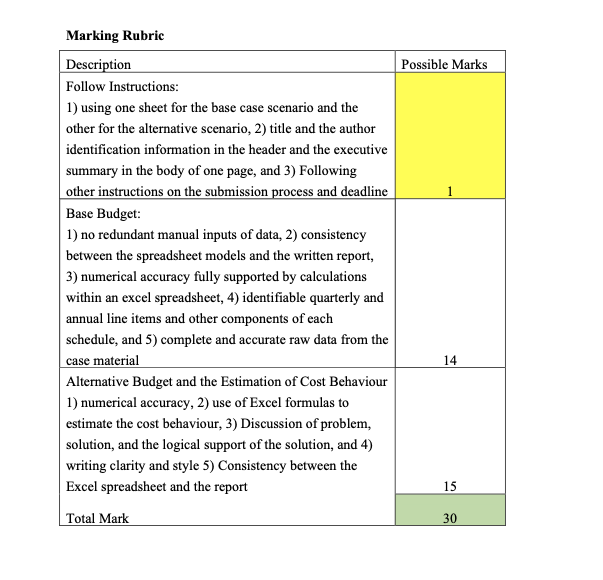

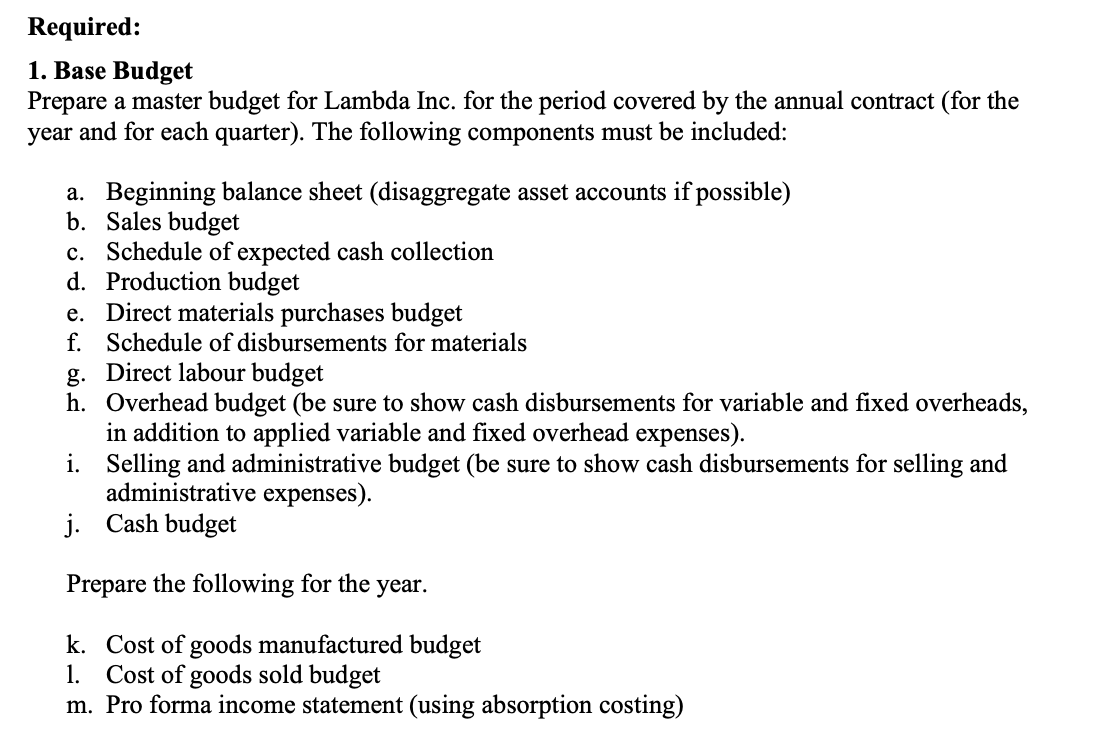

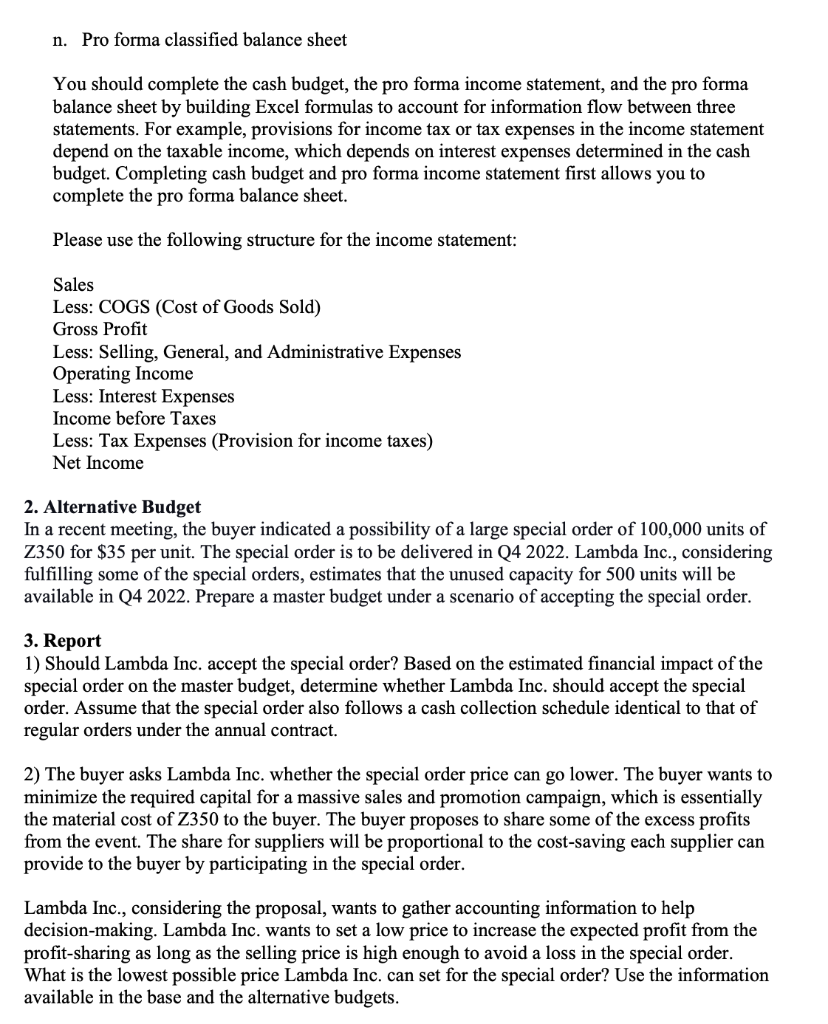

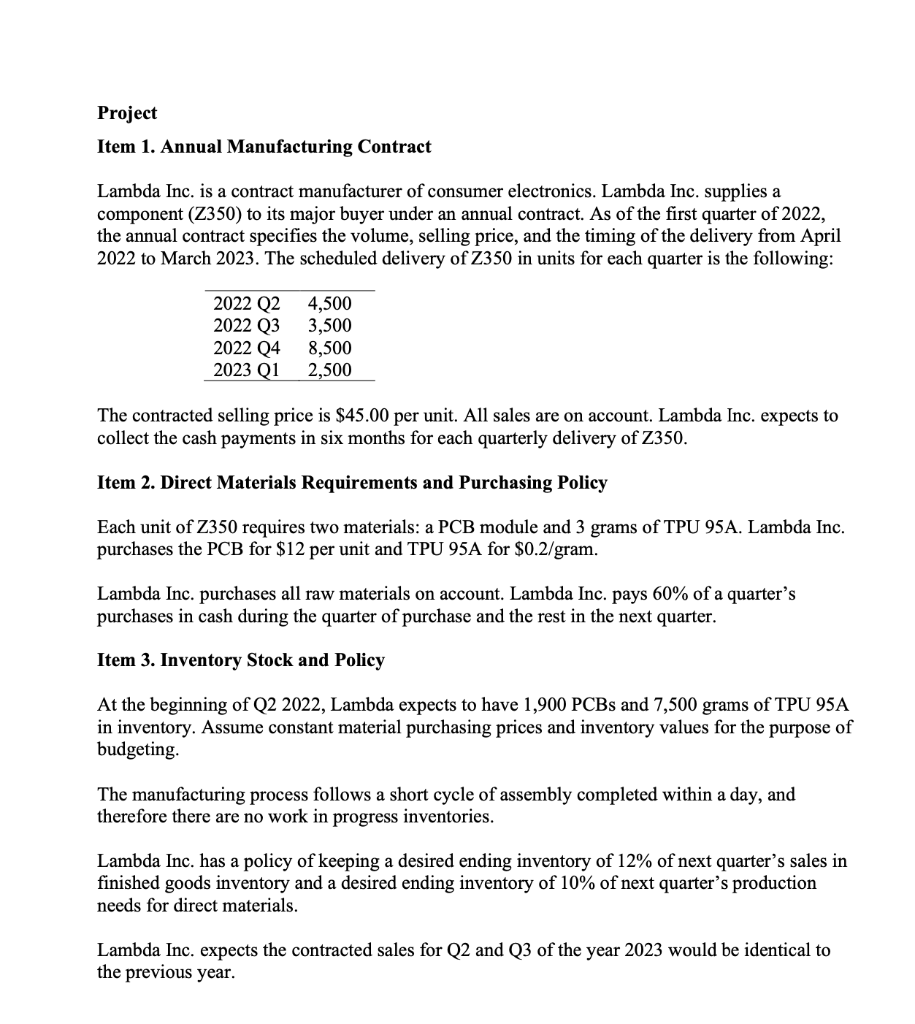

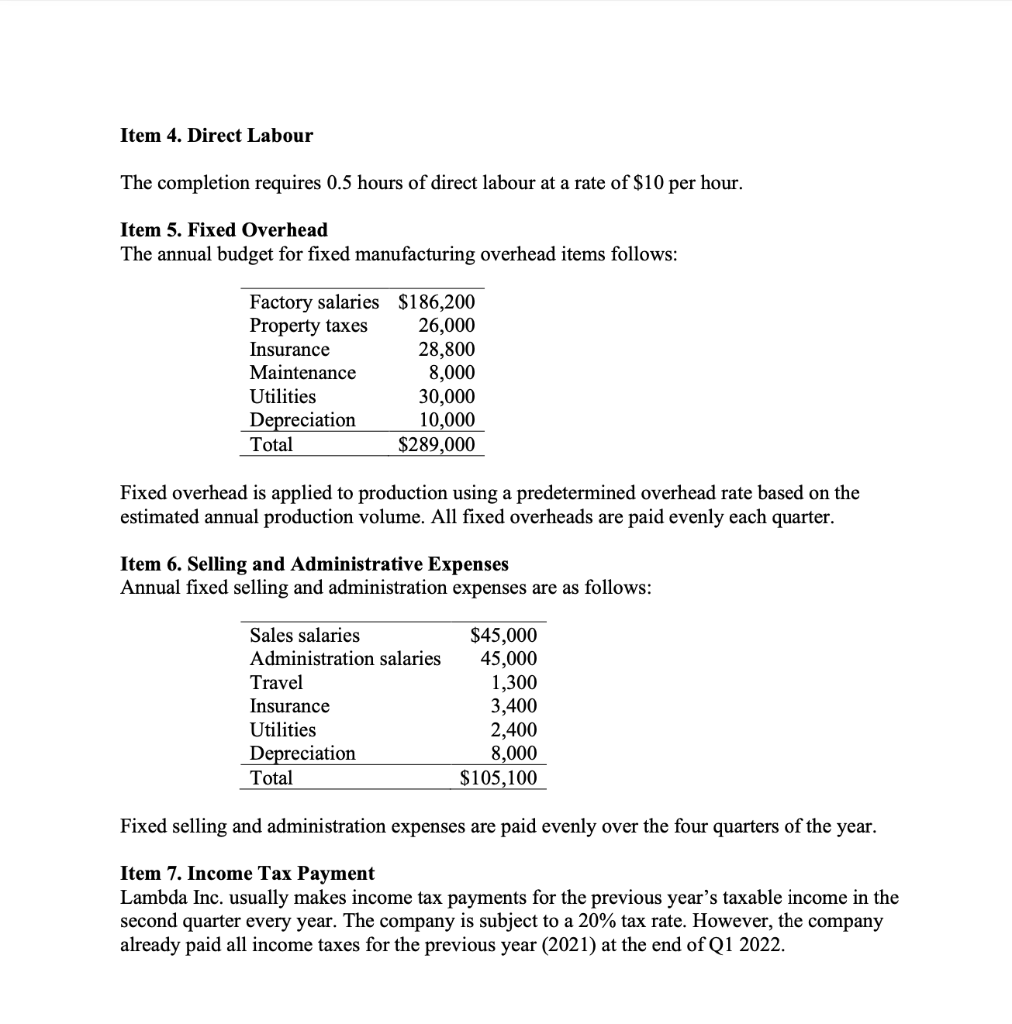

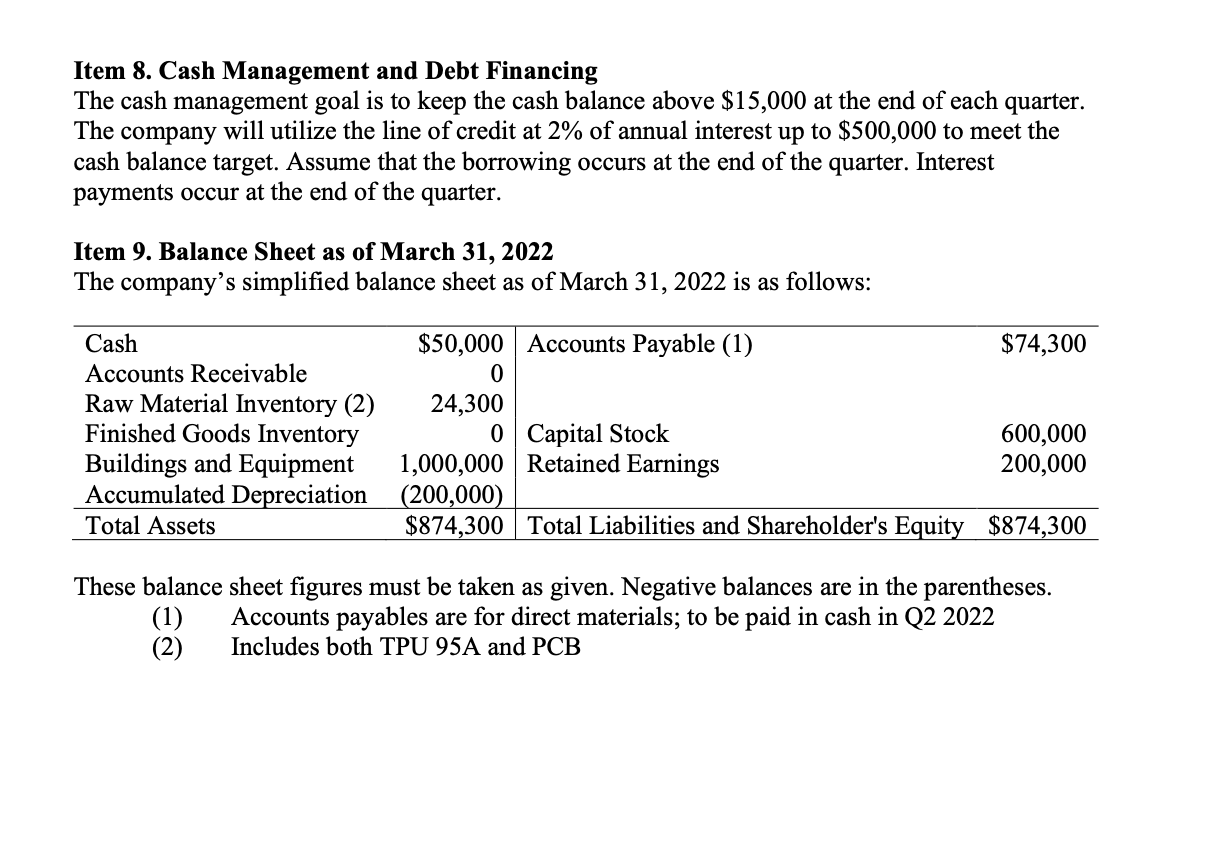

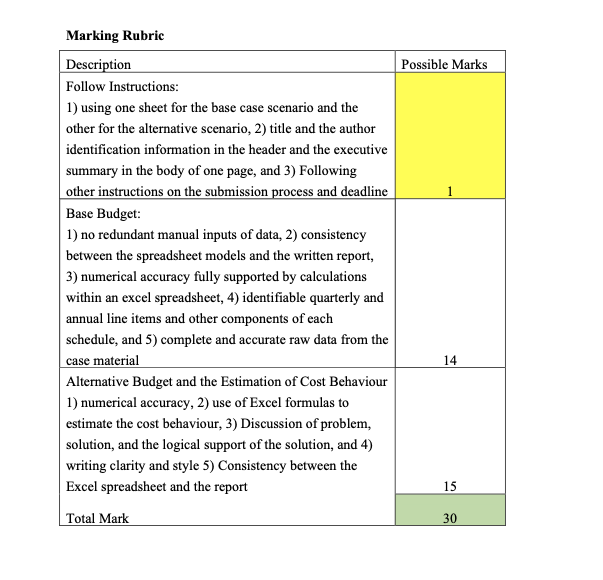

Required: 1. Base Budget Prepare a master budget for Lambda Inc. for the period covered by the annual contract (for the year and for each quarter). The following components must be included: a. Beginning balance sheet (disaggregate asset accounts if possible) b. Sales budget c. Schedule of expected cash collection d. Production budget e. Direct materials purchases budget f. Schedule of disbursements for materials g. Direct labour budget h. Overhead budget (be sure to show cash disbursements for variable and fixed overheads, in addition to applied variable and fixed overhead expenses). i. Selling and administrative budget (be sure to show cas disbursements for selling and administrative expenses). j. Cash budget Prepare the following for the year. k. Cost of goods manufactured budget 1. Cost of goods sold budget m. Pro forma income statement (using absorption costing) n. Pro forma classified balance sheet You should complete the cash budget, the pro forma income statement, and the pro forma balance sheet by building Excel formulas to account for information flow between three statements. For example, provisions for income tax or tax expenses in the income statement depend on the taxable income, which depends on interest expenses determined in the cash budget. Completing cash budget and pro forma income statement first allows you to complete the pro forma balance sheet. Please use the following structure for the income statement: Sales Less: COGS (Cost of Goods Sold) Gross Profit Less: Selling, General, and Administrative Expenses Operating Income Less: Interest Expenses Income before Taxes Less: Tax Expenses (Provision for income taxes) Net Incon 2. Alternative Budget In a recent meeting, the buyer indicated a possibility of a large special order of 100,000 units of Z350 for $35 per unit. The special order is to be delivered in Q4 2022. Lambda Inc., considering fulfilling some of the special orders, estimates that the unused capacity for 500 units will be available in Q4 2022. Prepare a master budget under a scenario of accepting the special order. 3. Report 1) Should Lambda Inc. accept the special order? Based on the estimated financial impact of the special order on the master budget, determine whether Lambda Inc. should accept the special order. Assume that the special order also follows a cash collection schedule identical to that of regular orders under the annual contract. 2) The buyer asks Lambda Inc. whether the special order price can go lower. The buyer wants to minimize the required capital for a massive sales and promotion campaign, which is essentially the material cost of Z350 to the buyer. The buyer proposes to share some of the excess profits from the event. The share for suppliers will be proportional to the cost-saving each supplier can provide to the buyer by participating in the special order. Lambda Inc., considering the proposal, wants to gather accounting information to help decision-making. Lambda Inc. wants to set a low price to increase the expected profit from the profit-sharing as long as the selling price is high enough to avoid a loss in the special order. What is the lowest possible price Lambda Inc. can set for the special order? Use the information available in the base and the alternative budgets. Instructions for preparing Excel spreadsheets: 1. Develop your entire master budget in one worksheet; i.e., present your beginning balance sheet first, then present your sales budget below it and the next budget below, etc. All information should be presented at the top of the workbook or next to each budget. The master budget following the alternative scenario should be in another worksheet. 2. When you have finalized the master budget for the base case scenario, start working on Requirement 2. First, copy the master budget onto a new worksheet (i.e., a new tab). Then make the necessary changes on the copied worksheet. If you have fully programmed the first worksheet, your changes will be immediately reflected on the master budget. Label the worksheet tabs and the title of the worksheet. 5. Do not round any numerical values; Instead, use appropriate display formats via Format Cells" or shortcuts for display formats to indicate unit of each quantity or to determine the number of decimal places displayed. Project Item 1. Annual Manufacturing Contract Lambda Inc. is a contract manufacturer of consumer electronics. Lambda Inc. supplies a component (Z350) to its major buyer under an annual contract. As of the first quarter of 2022, the annual contract specifies the volume, selling price, and the timing of the delivery from April 2022 to March 2023. The scheduled delivery of Z350 in units for each quarter is the following: 2022 Q2 2022 Q3 2022 Q4 2023 Q1 4,500 3,500 8,500 2,500 The contracted selling price is $45.00 per unit. All sales are on account. Lambda Inc. expects to collect the cash payments in six months for each quarterly delivery of Z350. Item 2. Direct Materials Requirements and Purchasing Policy Each unit of Z350 requires two materials: a PCB module and 3 grams of TPU 95A. Lambda Inc. purchases the PCB for $12 per unit and TPU 95A for $0.2/gram. Lambda Inc. purchases all raw materials on account. Lambda Inc. pays 60% of a quarter's purchases in cash during the quarter of purchase and the rest in the next quarter. Item 3. Inventory Stock and Policy At the beginning of Q2 2022, Lambda expects to have 1,900 PCBs and 7,500 grams of TPU 95A in inventory. Assume constant material purchasing prices and inventory values for the purpose of budgeting The manufacturing process follows a short cycle of assembly completed within a day, and a therefore there are no work in progress inventories. Lambda Inc. has a policy of keeping a desired ending inventory of 12% of next quarter's sales in finished goods inventory and a desired ending inventory of 10% of next quarter's production needs for direct materials. Lambda Inc. expects the contracted sales for Q2 and Q3 of the year 2023 would be identical to the previous year. Item 4. Direct Labour The completion requires 0.5 hours of direct labour at a rate of $10 per hour. Item 5. Fixed Overhead The annual budget for fixed manufacturing overhead items follows: Factory salaries $186,200 Property taxes 26,000 Insurance 28,800 Maintenance 8,000 Utilities 30,000 Depreciation 10,000 Total $289,000 Fixed overhead is applied to production using a predetermined overhead rate based on the estimated annual production volume. All fixed overheads are paid evenly each quarter. Item 6. Selling and Administrative Expenses Annual fixed selling and administration expenses are as follows: Sales salaries Administration salaries Travel Insurance Utilities Depreciation Total $45,000 45,000 1,300 3,400 2,400 8,000 $105,100 Fixed selling and administration expenses are paid evenly over the four quarters of the year. Item 7. Income Tax Payment Lambda Inc. usually makes income tax payments for the previous year's taxable income in the second quarter every year. The company is subject to a 20% tax rate. However, the company already paid all income taxes for the previous year (2021) at the end of Q1 2022. Item 8. Cash Management and Debt Financing The cash management goal is to keep the cash balance above $15,000 at the end of each quarter. The company will utilize the line of credit at 2% of annual interest up to $500,000 to meet the cash balance target. Assume that the borrowing occurs at the end of the quarter. Interest payments occur at the end of the quarter. Item 9. Balance Sheet as of March 31, 2022 The company's simplified balance sheet as of March 31, 2022 is as follows: Cash $50,000 Accounts Payable (1) $74,300 Accounts Receivable 0 Raw Material Inventory (2) 24,300 Finished Goods Inventory 0 Capital Stock 600,000 Buildings and Equipment 1,000,000 tained Earnings 200,000 Accumulated Depreciation (200,000) Total Assets $874,300 Total Liabilities and Shareholder's Equity $874,300 These balance sheet figures must be taken as given. Negative balances are in the parentheses. (1) Accounts payables are for direct materials; to be paid in cash in Q2 2022 (2) Includes both TPU 95A and PCB Possible Marks Marking Rubric Description Follow Instructions: 1) using one sheet for the base case scenario and the other for the alternative scenario, 2) title and the author identification information in the header and the executive summary in the body of one page, and 3) Following other instructions on the submission process and deadline Base Budget: 1) no redundant manual inputs of data, 2) consistency between the spreadsheet models and the written report, 3) numerical accuracy fully supported by calculations within an excel spreadsheet, 4) identifiable quarterly and annual line items and other components of each schedule, and 5) complete and accurate raw data from the case material Alternative Budget and the Estimation of Cost Behaviour 1) numerical accuracy, 2) use of Excel formulas to estimate the cost behaviour, 3) Discussion of problem, solution, and the logical support of the solution, and 4) writing clarity and style 5) Consistency between the Excel spreadsheet and the report 14 15 Total Mark 30