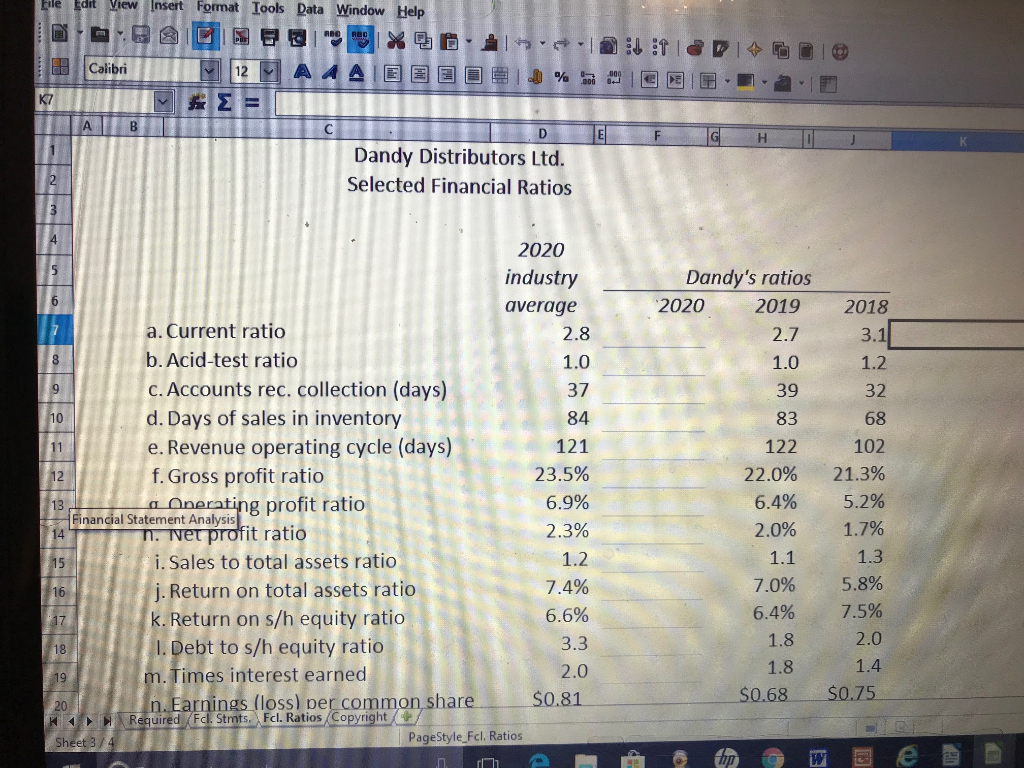

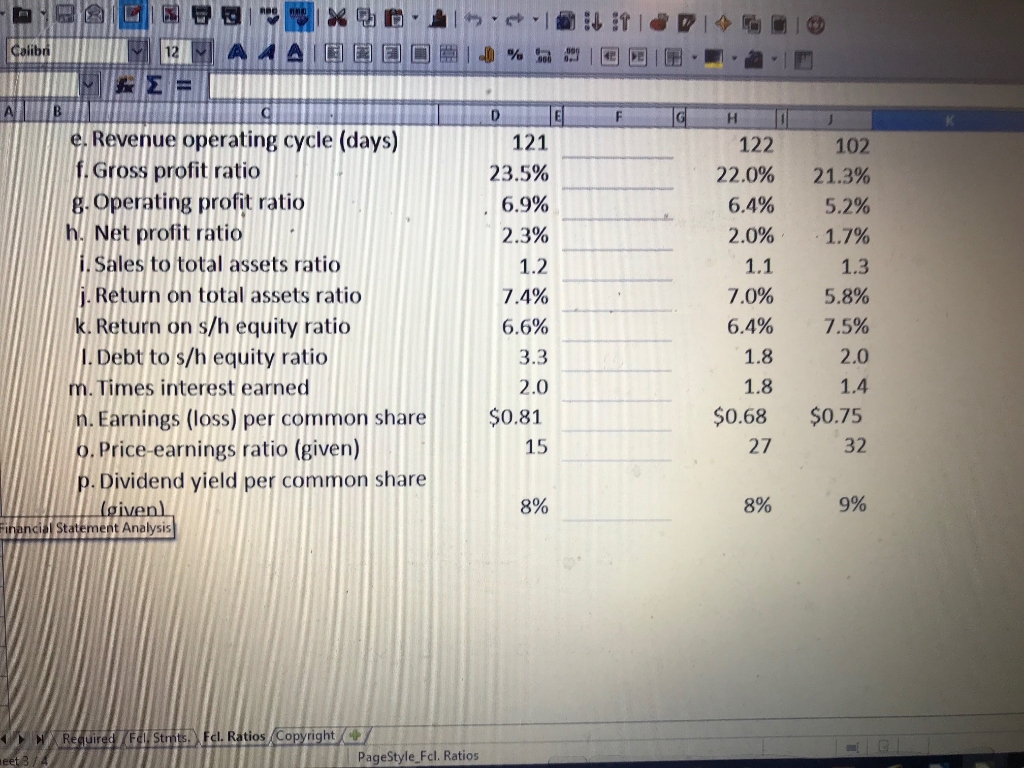

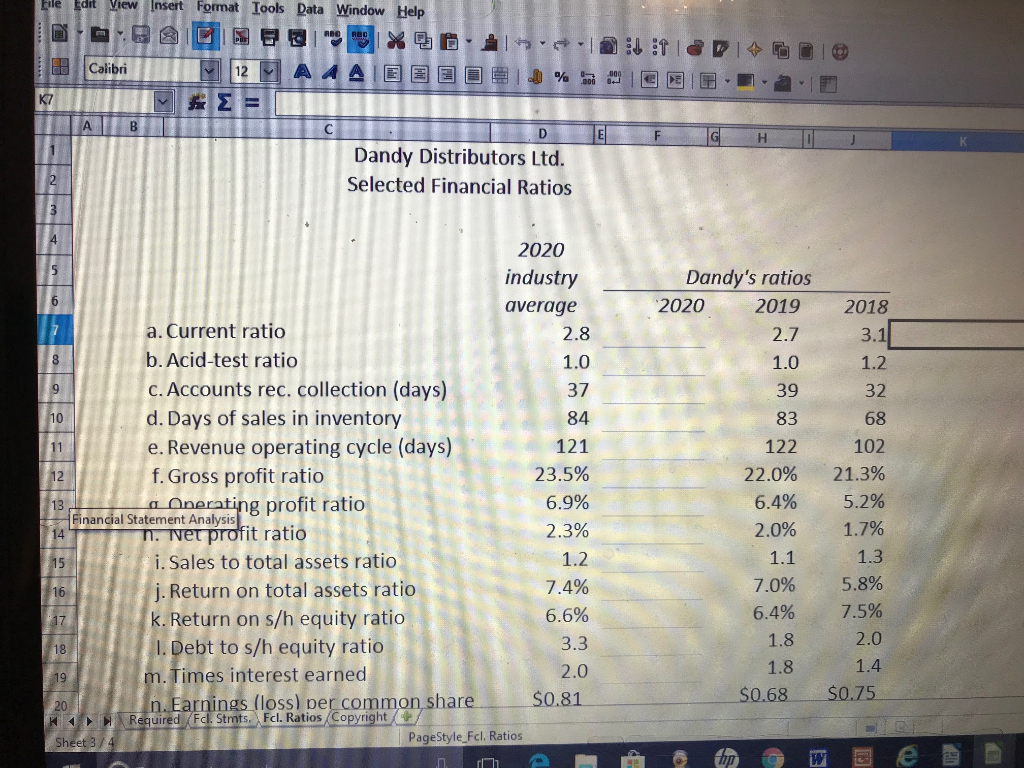

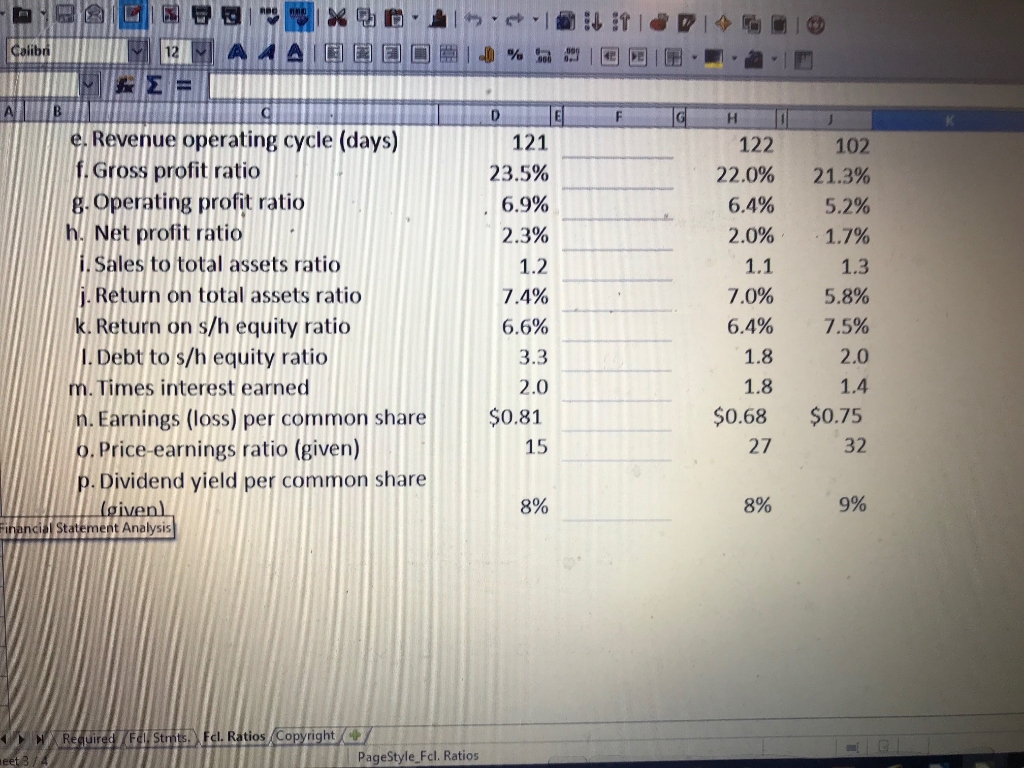

Required. 1. Based on Dandy's financial statements, calculate ratios for the year ended December 31,2020. Assume all sales are on credit. Show your work.

2. From these ratios, analyze the financial performance of Dandy.

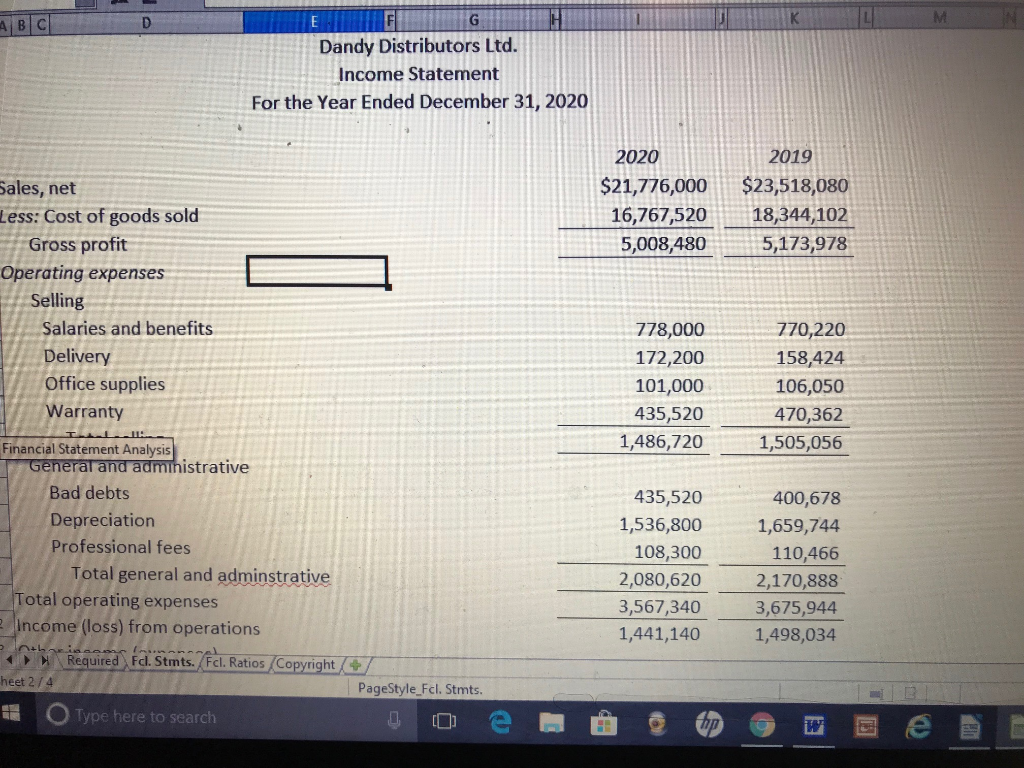

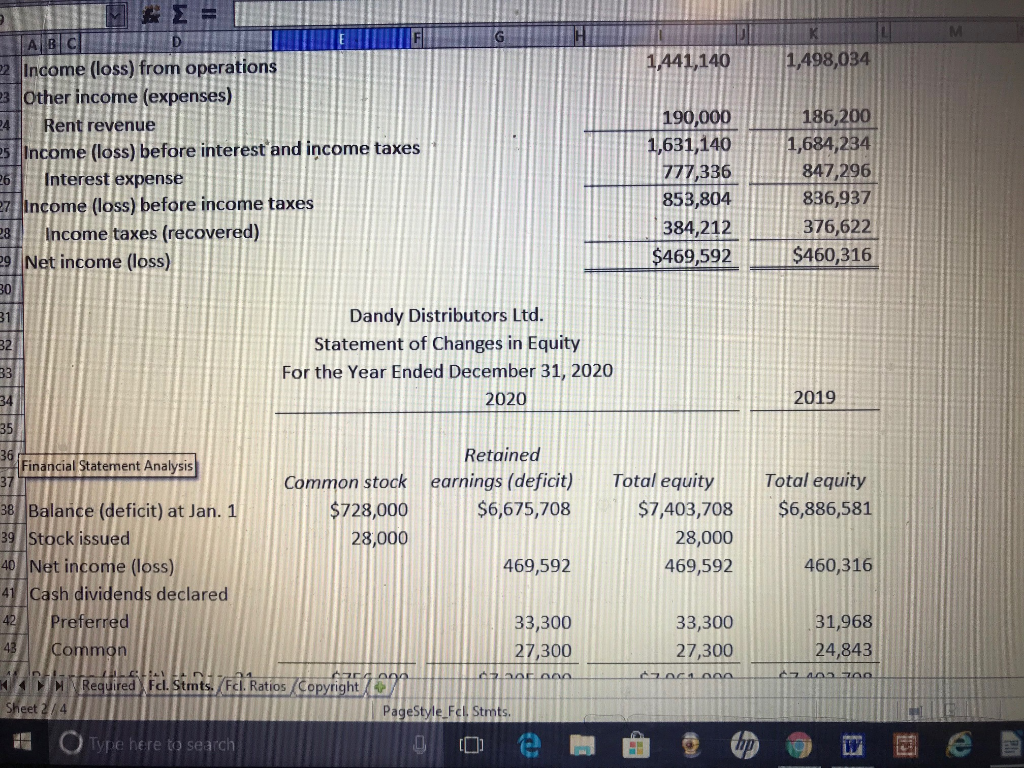

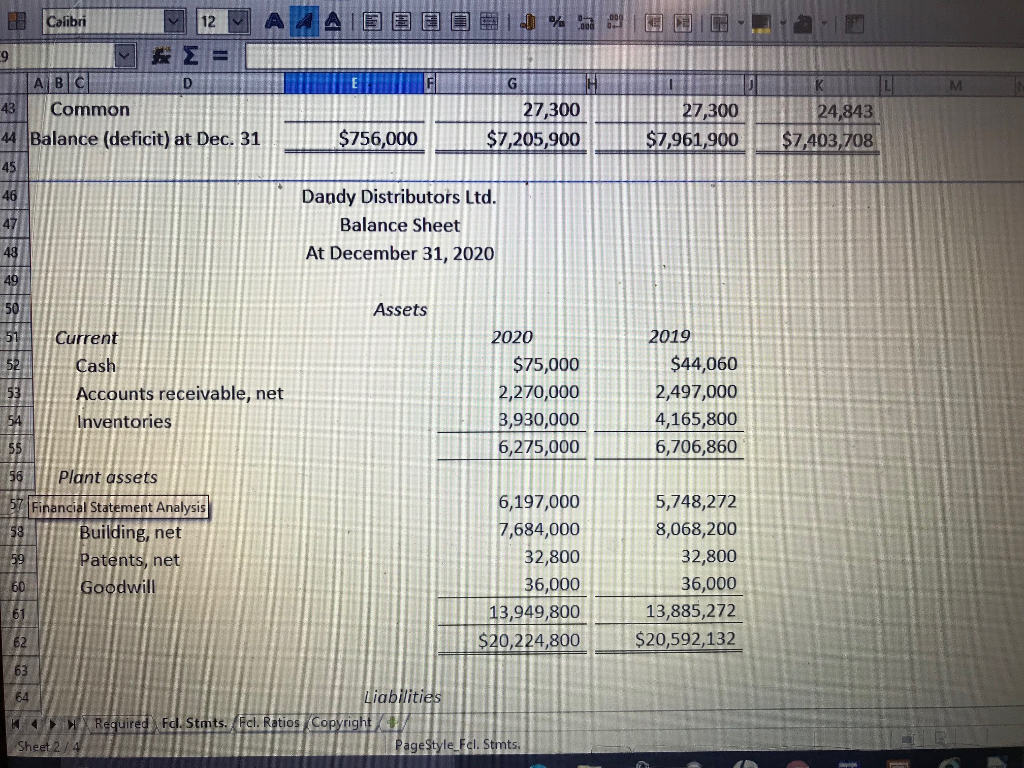

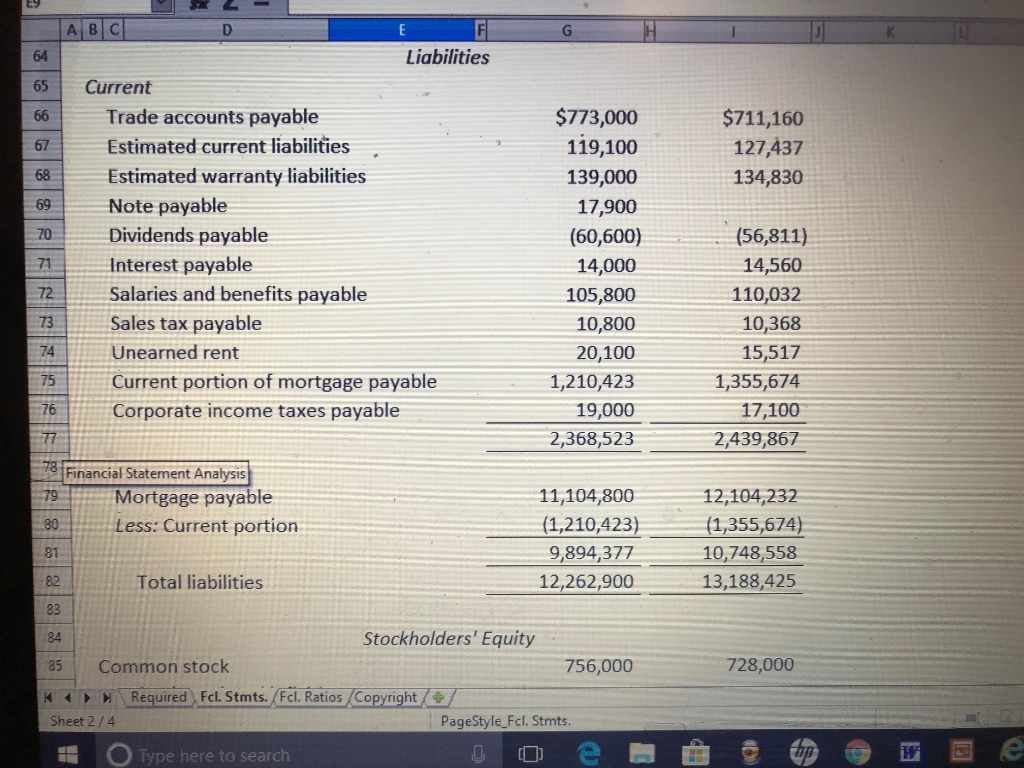

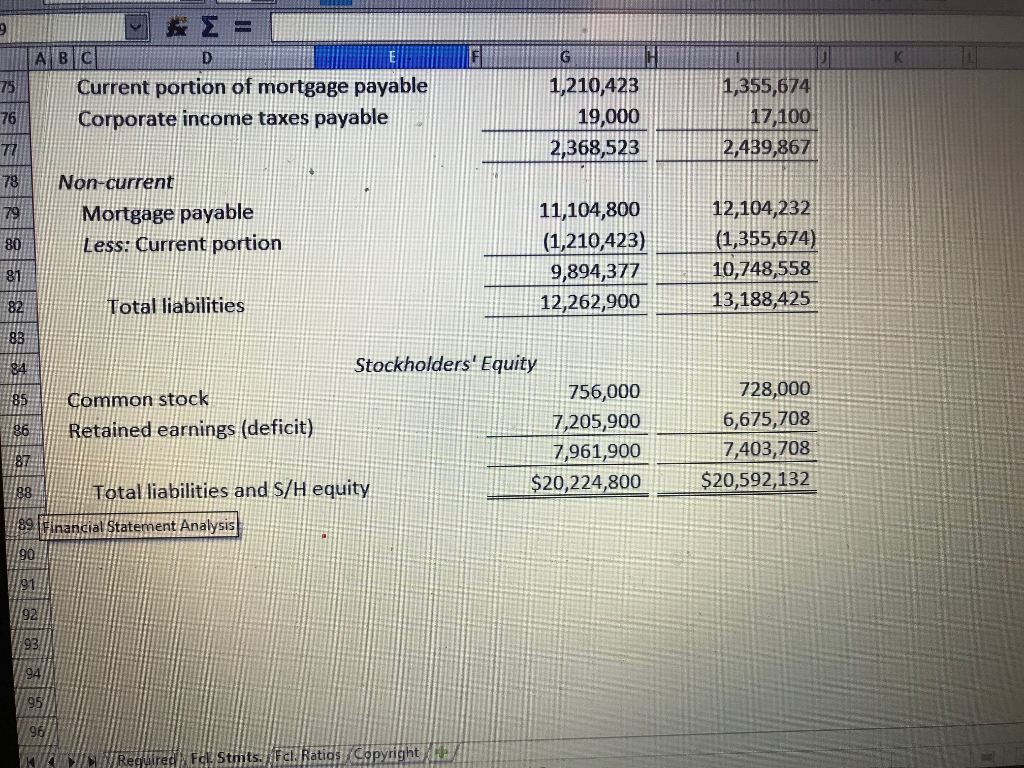

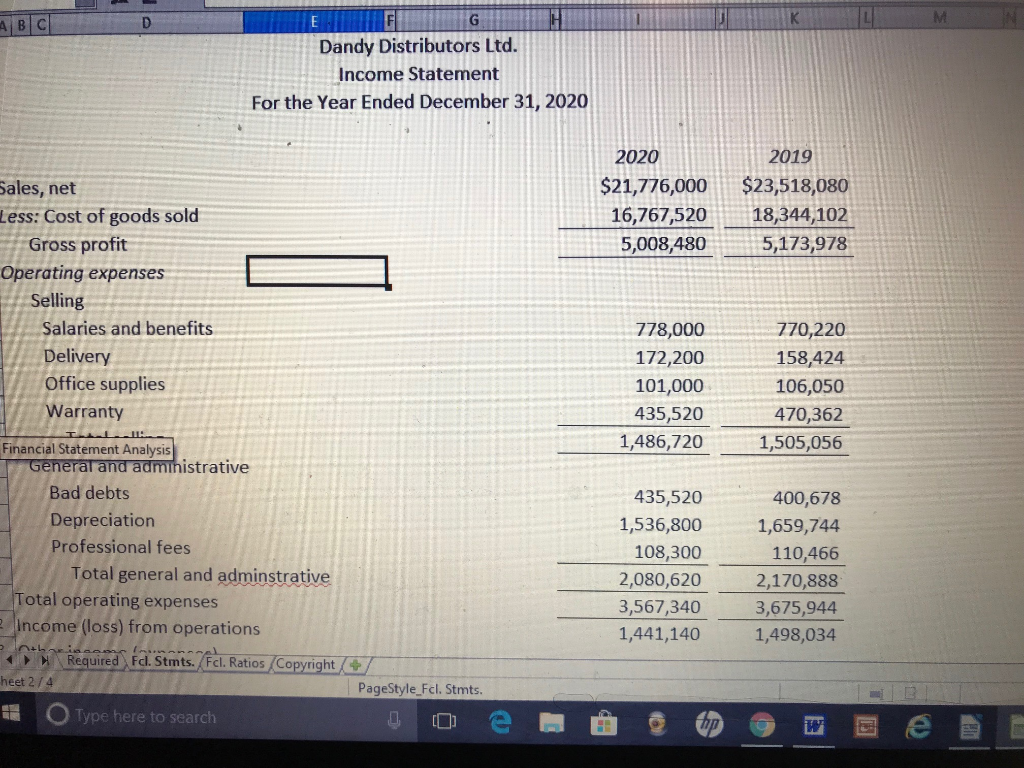

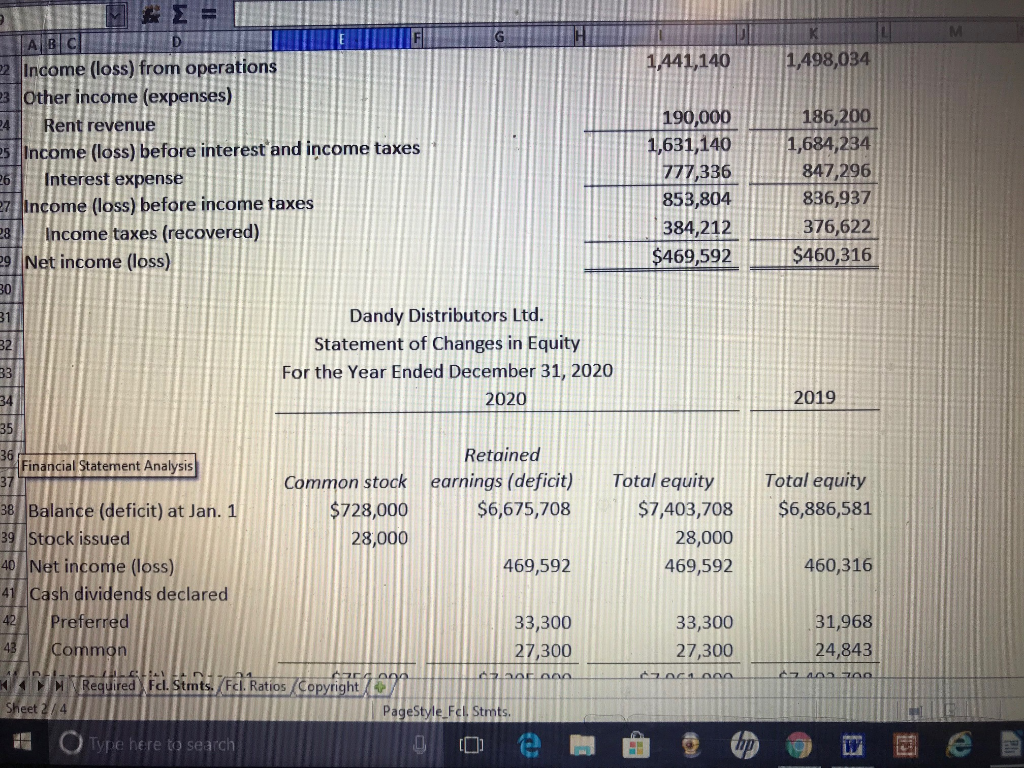

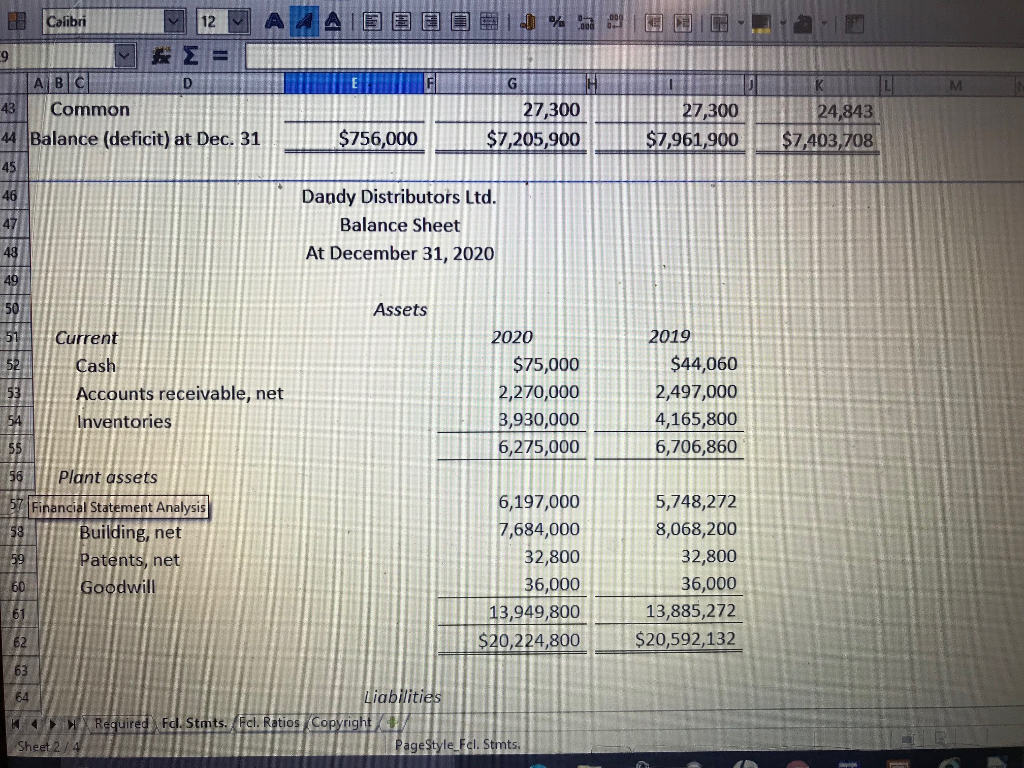

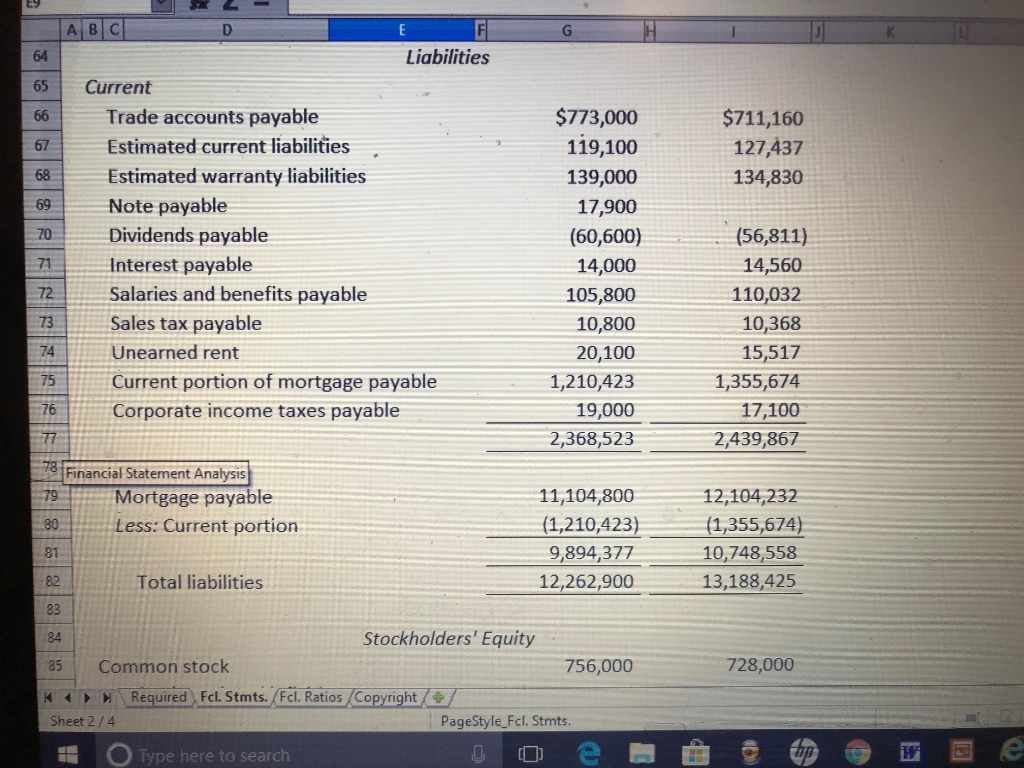

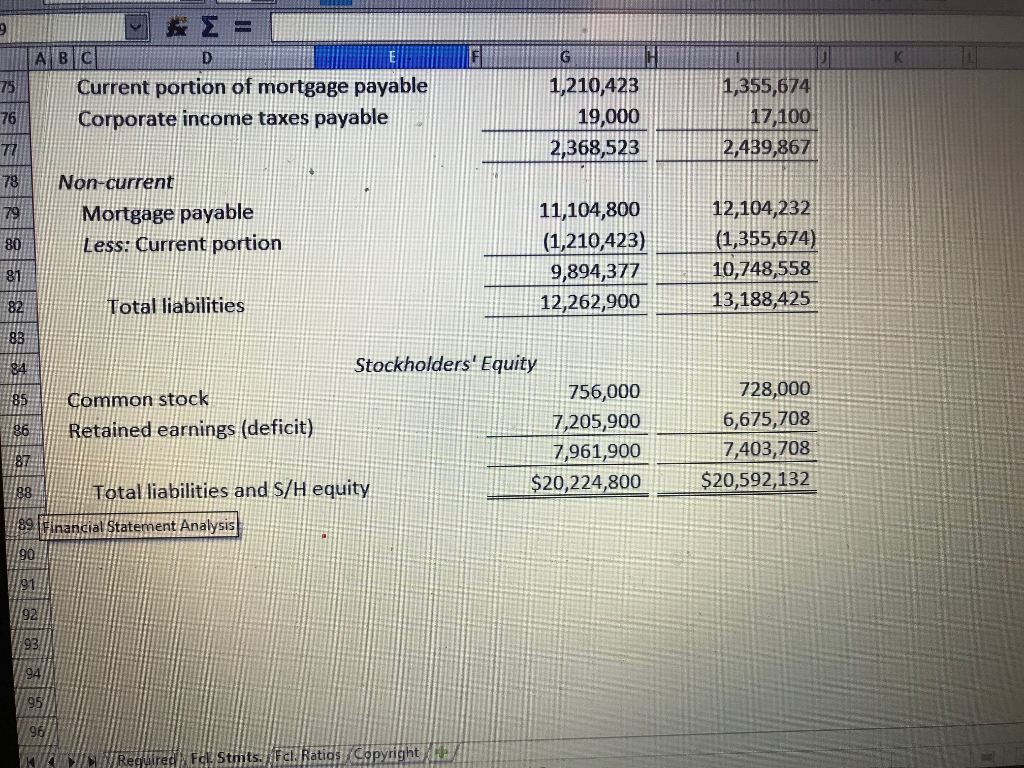

ABC Dandy Distributors Ltd. Income Statement For the Year Ended December 31, 2020 2020 2019 Sales, net Less: Cost of goods sold $21,776,000 $23,518,080 16,767,52018,344,102 5,173,978 Gross profit 5,008,480 Operating expenses Selling Salaries and benefits Delivery Office supplies Warranty 778,000 172,200 101,000 435,520 1,486,720 770,220 158,424 106,050 470,362 1,505,056 Financial Statement Analysis General and administrative Bad debts Depreciation Professional fees 435,520 1,536,800 108,300 2,080,620 3,567,340 1,441,140 400,678 1,659,744 110,466 2,170,888 3,675,944 1,498,034 Total general and adminstrative 2.1 Total operating expenses ncome (loss) from operations Required fd Stmts fcl. Ratios Copyight heet 2/ PageStyle_Fcl. Stmts Type here to search A1301814980 2 Income (loss)from operatioris Other income (expenses) 4Rent revenue 5 Income (loss) before interest and income taxes 26 190,000 1 186200 1,631,140 1,684,234 777,336 847 296 836,937 | 384,212 | 376,622 $469,592$460,316 nteres Income (loss) before income taxes 853,804 Income taxes (recovered) income (loss) 30 Dandy Distributors Ltd. Statement of Changes in Equity For the Year Ended December 31, 2020 2020 2019 Retained Financial Statement Analysi Common stock earnings (deficit) Total equityTotal equity 728,000$6,675,708$7,403,708 s6,886,581 Balance (deficit) at Jan. 1 Stock issued Net income (loss Cash dividends declared 28,000 28,000 469,592 469,592 460,316 33,300 27,300 33,300 27,300 31,968 24,843 Required Fcl. Stmts. Fcl. Ratios C 4 opyright PageStyle Fel St OType here to seardh Colibri 9 27,300 $7,205,900 Common 27,300 24.843 Balance (deficit) at Dec. 31$756,000S7205900SZ961900 S7,403 708 Dandy Distributors Ltd Balance Sheet At December 31, 2020 50 Assets urren 2020 2019 $75,000 270,000 ,930,000 6,275,000 $44,060 2,497,000 4,165,800 6,706,860 Cash cc ounts receivable, net Inventories Plant ossets 5,748,272 7,684,0008,068,200 32,800 36,000 13,885,272 $20,224,800$20,592,132 197,000 Statement Analysis Building, net Patents, net 32,800 36,000 13,949,800 1820224.800 S20,5932 132 Liab tmts A| B | C 355,674 17100 2.368,5232,439867 1,210,423 19,000 75 Current portion of mortgage payable 76Corporate income taxes payable Ti 78Non-current 7Mortgage payable 11,10480012,104 232 (1,355,674) 80Less: Current portion (1210423) 10,748,558 9,8943710748,558 13,188,425 82 otal liabilities 12,262,900 Stockholders Equity 756,000 7,205,900 7,961,900 $20,224,800 728,000 6,675,708 7,403,708 $20,592,132 -BI' common stock Retained earnings (deficit) Total liabilities and s/H equity nancialStatement Analysis ty 91 93 95