Question

Required- 1. BBC has an average accounts payable balance of $5000000. Its average daily cost of goods sold is $15000 and it receives terms of

Required- 1. BBC has an average accounts payable balance of $5000000. Its average daily cost of goods sold is $15000 and it receives terms of 2/15, net 35, from its suppliers. BBC chooses to forgot the discount. Is the firm managing its accounts payable well?

2. Max Corp. has an average accounts payable balance of $225000. Its average daily cost of goods sold is $10000, and it receives terms of 1/15, net 40, from its suppliers. Max chooses to forgot the discount. Is the firm managing its accounts payable well?

Please solve these questions correctly. Thank you!

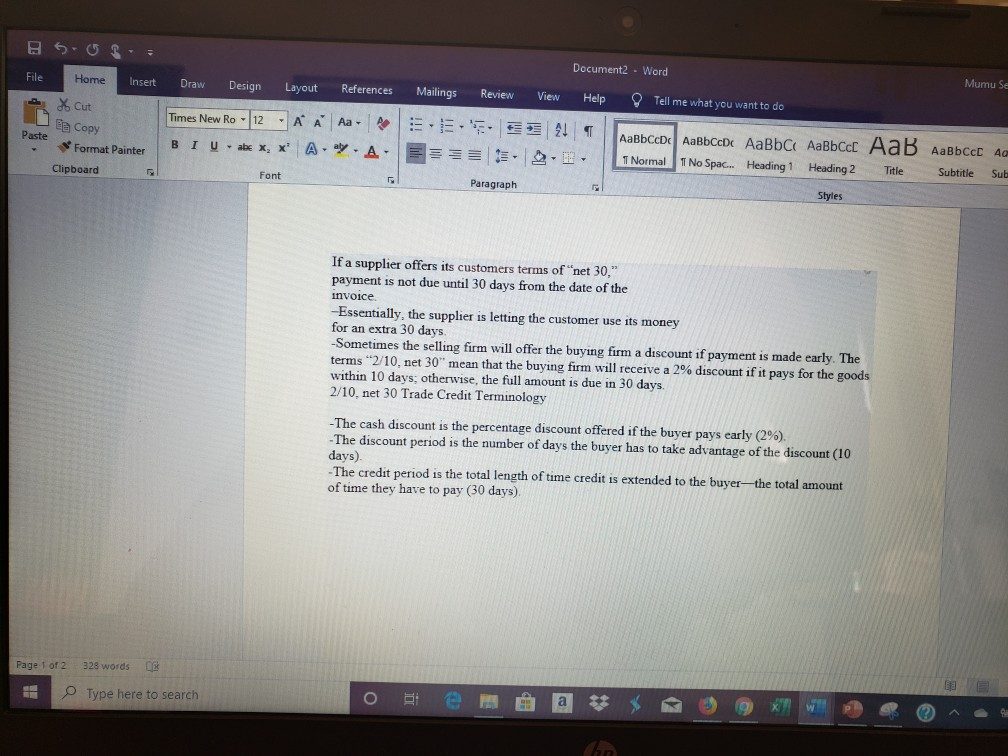

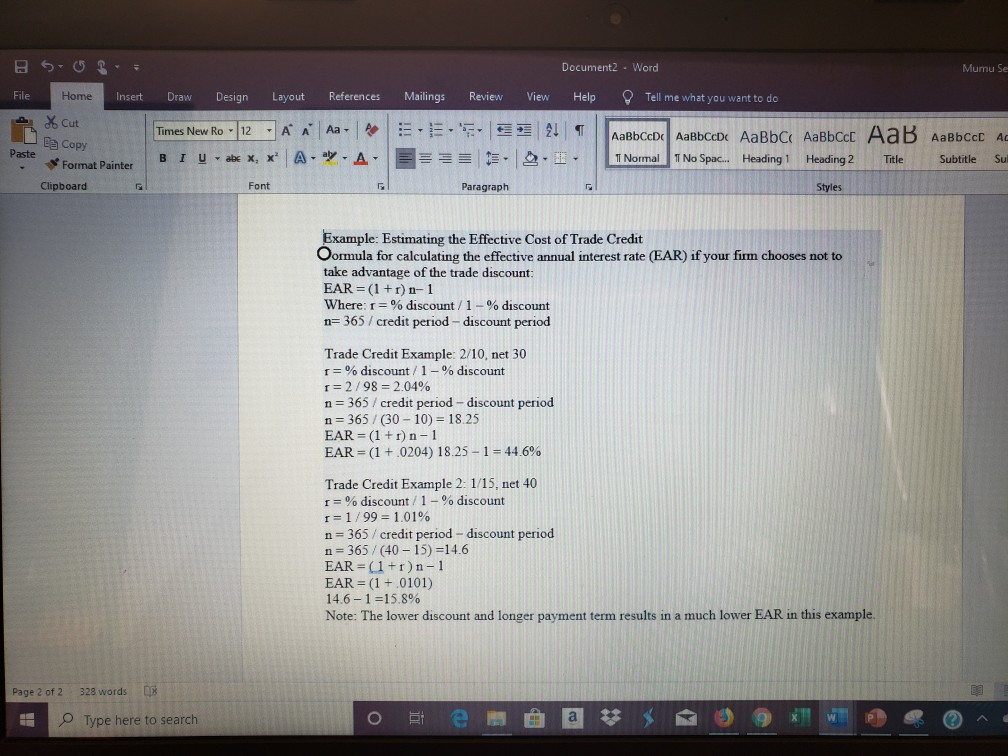

Document2 - Word References Mumu se Mailings Review View BSURE File Home Insert Draw Design Layout - X. Cut Times New Ro - 12 - A A Paste Format Painter BIU.abe x, x' A Clipboard Font Help Tell me what you want to do Be Copy A aty A A- | 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Sub Paragraph Styles If a supplier offers its customers terms of net 30," payment is not due until 30 days from the date of the invoice -Essentially, the supplier is letting the customer use its money for an extra 30 days -Sometimes the selling firm will offer the buying firm a discount if payment is made early. The terms "2/10, net 30" mean that the buying firm will receive a 2% discount if it pays for the goods within 10 days; otherwise, the full amount is due in 30 days. 2/10.net 30 Trade Credit Terminology - The cash discount is the percentage discount offered if the buyer pays early (2%). - The discount period is the number of days the buyer has to take advantage of the discount (10 days) - The credit period is the total length of time credit is extended to the buyer--the total amount of time they have to pay (30 days) Page 1 of 2 328 words Type here to search han Document2 - Word Mumu se File Draw Design Layout References Mailings Review View Help Tell me what you want to do Home Insert * Cut Da Copy Format Painter Clipboard Times New Ro - 12-AA BIU - abe X, X A-ay BE2! == == . . cD| 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Sul Paste A Font Paragraph Styles Example: Estimating the Effective Cost of Trade Credit Oormula for calculating the effective annual interest rate (EAR) if your firm chooses not to take advantage of the trade discount: EAR = (1 + r) 1-1 Where: 1 =% discount/1-% discount n=365 / credit period - discount period Trade Credit Example: 2/10, net 30 1=% discount/1-% discount r= 2/98 = 2.04% n = 365 / credit period - discount period n=365 / (30 - 10) = 18.25 EAR = (1 + r)n-1 EAR = (1 +.0204) 18.25 - 1 = 44.6% Trade Credit Example 2: 1/15, net 40 r=% discount/1-% discount r=1/99 = 1.01% n=365/ credit period - discount period n= 365/(40 - 15) =14.6 EAR=(1+r)n-1 EAR = (1 + 0101) 14.6 -1 =15.8% Note: The lower discount and longer payment term results in a much lower EAR in this example. Page 2 of 2 328 words % Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started