Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required: 1. Calculate 2024 earnings per share for IGF. 2. Calculate IGF's 2024 price-earnings ratio. 3. Calculate IGF's 2024 dividend payout ratio. Analysis Case 19-6

required:

required:

1. Calculate 2024 earnings per share for IGF.

2. Calculate IGF's 2024 price-earnings ratio.

3. Calculate IGF's 2024 dividend payout ratio.

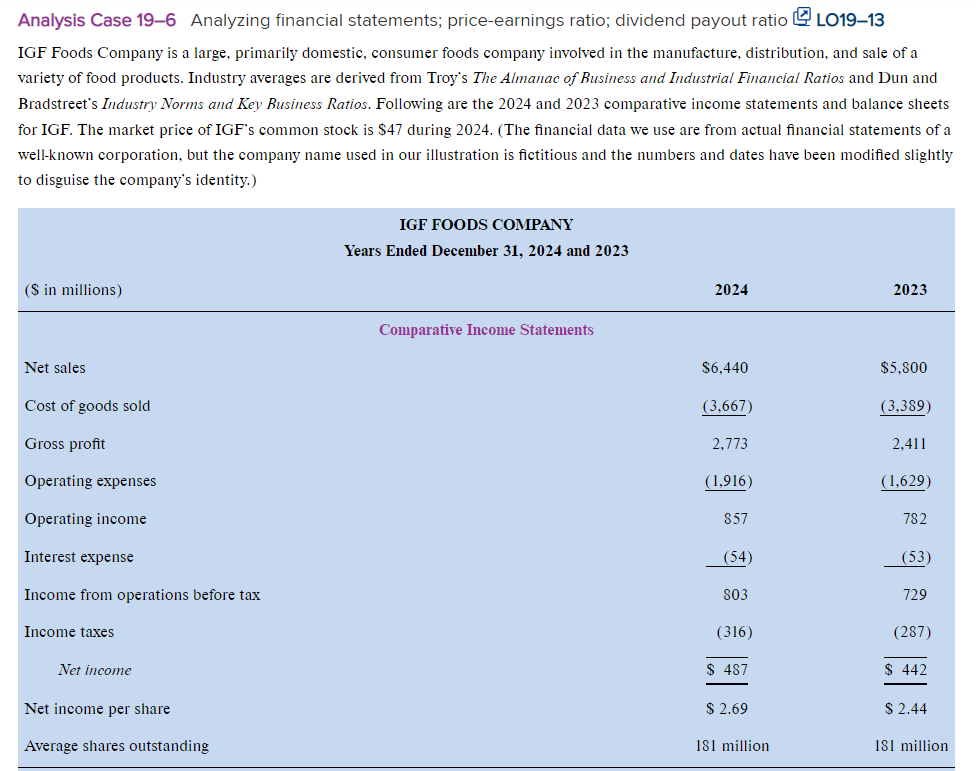

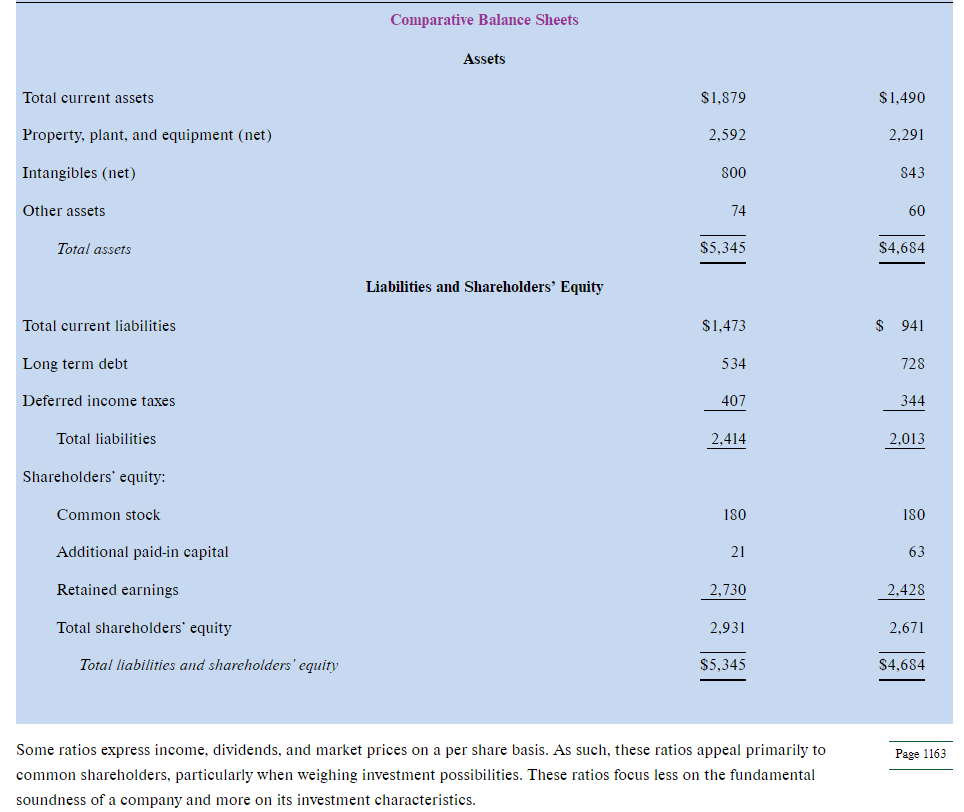

Analysis Case 19-6 Analyzing financial statements; price-earnings ratio; dividend payout ratio LO19-13 IGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy's The Almanac of Business and Industrial Financial Ratios and Dun and Bradstreet's Industry Norms and Key Business Ratios. Following are the 2024 and 2023 comparative income statements and balance sheets for IGF. The market price of IGF's common stock is $47 during 2024. (The financial data we use are from actual financial statements of a well-known corporation, but the company name used in our illustration is fictitious and the numbers and dates have been modified slightly to disguise the company's identity.) Some ratios express income, dividends, and market prices on a per share basis. As such, these ratios appeal primarily to common shareholders, particularly when weighing investment possibilities. These ratios focus less on the fundamental soundness of a company and more on its investment characteristicsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started