Answered step by step

Verified Expert Solution

Question

1 Approved Answer

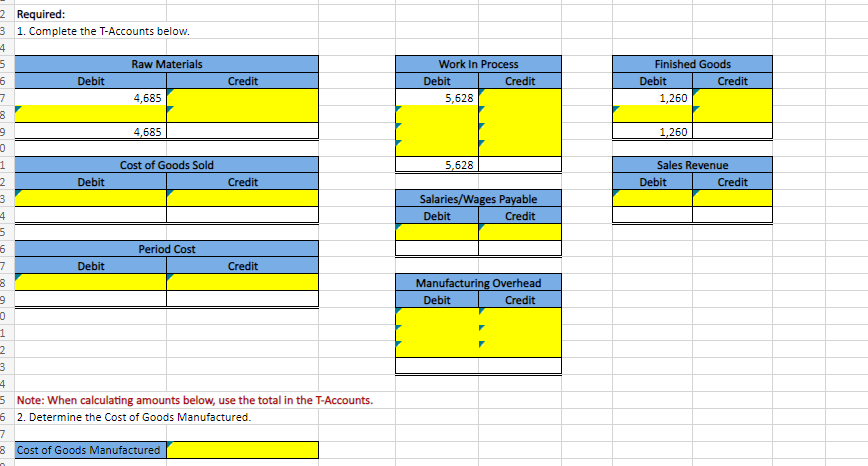

Required: 1. Complete the T-Accounts below. begin{tabular}{|c|c|} hline multicolumn{2}{|c|}{ Raw Materials } hline Debit & Credit hline 4,685 & hline 4,685 &

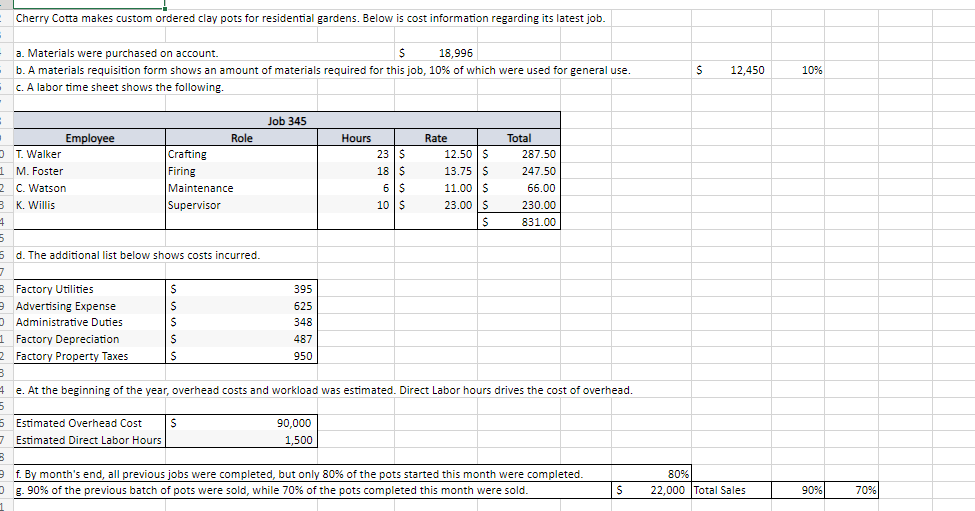

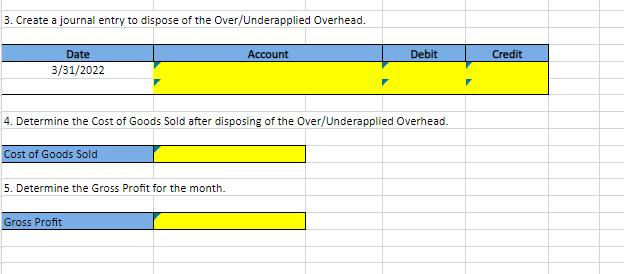

Required: 1. Complete the T-Accounts below. \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Raw Materials } \\ \hline Debit & Credit \\ \hline 4,685 & \\ \hline 4,685 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ Work In Process } \\ \hline Debit & Credit \\ \hline 5,628 & \\ & \\ & \\ \hline 5,628 & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Finished Goods } \\ \hline Debit & Credit \\ \hline 1,260 & \\ & \\ \hline 1,260 & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Cost of Goods Sold } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Salaries/Wages Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline \hline & \\ \hline Manufacturing Overhead \\ \hline Debit & Credit \\ \hline & \\ & r \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Sales Revenue } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Period Cost } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} 1 2 3 4 5 Note: When calculating amounts below, use the total in the T-Accounts. 6 2. Determine the Cost of Goods Manufactured. 8 Cost of Goods Manufactured Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job. a. Materials were purchased on account. $18,996 b. A materials requisition form shows an amount of materials required for this job, 10% of which were used for general use. c. A labor time sheet shows the following. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Job 345} \\ \hline Employee & \multicolumn{2}{|l|}{ Role } \\ \hline T. Walker & Crafting & \\ \hline M. Foster & Firing & \\ \hline C. Watson & Maintenance & \\ \hline K. Willis & Supervisor & \\ \hline \multicolumn{3}{|c|}{ d. The additional list below shows costs incurred. } \\ \hline Factory Utilities & s & 395 \\ \hline Advertising Expense & s & 625 \\ \hline Administrative Duties & s & 348 \\ \hline Factory Depreciation & s & 487 \\ \hline Factory Property Taxes & s & 950 \\ \hline \end{tabular} e. At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of overhead. \begin{tabular}{|c|c|c|} \hline Estimated Overhead Cost & s & 90,000 \\ \hline Estimated Direct Labor Hours & & 0 \\ \hline \end{tabular} f. By month's end, all previous jobs were completed, but only 80% of the pots started this month were completed. g. 90% of the previous batch of pots were sold, while 70% of the pots completed this month were sold. Total Sales 90% 70% 3. Create a journal entry to dispose of the Over/Underapplied Overhead. \begin{tabular}{|c|c|c|c|} \hline Date & Account & Debit & Credit \\ \hline 3/31/2022 & & \multicolumn{2}{|c|}{} \\ \hline & & & \end{tabular} 4. Determine the Cost of Goods Sold after disposing of the Over/Underapplied Overhead. \begin{tabular}{|l|l|} \hline Cost of Goods Sold & \\ \hline \end{tabular} 5. Determine the Gross Profit for the month. Gross Profit

Required: 1. Complete the T-Accounts below. \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Raw Materials } \\ \hline Debit & Credit \\ \hline 4,685 & \\ \hline 4,685 & \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ Work In Process } \\ \hline Debit & Credit \\ \hline 5,628 & \\ & \\ & \\ \hline 5,628 & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Finished Goods } \\ \hline Debit & Credit \\ \hline 1,260 & \\ & \\ \hline 1,260 & \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Cost of Goods Sold } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Salaries/Wages Payable } \\ \hline Debit & Credit \\ \hline & \\ \hline \hline & \\ \hline Manufacturing Overhead \\ \hline Debit & Credit \\ \hline & \\ & r \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Sales Revenue } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Period Cost } \\ \hline Debit & Credit \\ \hline & \\ \hline & \\ \hline \hline \end{tabular} 1 2 3 4 5 Note: When calculating amounts below, use the total in the T-Accounts. 6 2. Determine the Cost of Goods Manufactured. 8 Cost of Goods Manufactured Cherry Cotta makes custom ordered clay pots for residential gardens. Below is cost information regarding its latest job. a. Materials were purchased on account. $18,996 b. A materials requisition form shows an amount of materials required for this job, 10% of which were used for general use. c. A labor time sheet shows the following. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Job 345} \\ \hline Employee & \multicolumn{2}{|l|}{ Role } \\ \hline T. Walker & Crafting & \\ \hline M. Foster & Firing & \\ \hline C. Watson & Maintenance & \\ \hline K. Willis & Supervisor & \\ \hline \multicolumn{3}{|c|}{ d. The additional list below shows costs incurred. } \\ \hline Factory Utilities & s & 395 \\ \hline Advertising Expense & s & 625 \\ \hline Administrative Duties & s & 348 \\ \hline Factory Depreciation & s & 487 \\ \hline Factory Property Taxes & s & 950 \\ \hline \end{tabular} e. At the beginning of the year, overhead costs and workload was estimated. Direct Labor hours drives the cost of overhead. \begin{tabular}{|c|c|c|} \hline Estimated Overhead Cost & s & 90,000 \\ \hline Estimated Direct Labor Hours & & 0 \\ \hline \end{tabular} f. By month's end, all previous jobs were completed, but only 80% of the pots started this month were completed. g. 90% of the previous batch of pots were sold, while 70% of the pots completed this month were sold. Total Sales 90% 70% 3. Create a journal entry to dispose of the Over/Underapplied Overhead. \begin{tabular}{|c|c|c|c|} \hline Date & Account & Debit & Credit \\ \hline 3/31/2022 & & \multicolumn{2}{|c|}{} \\ \hline & & & \end{tabular} 4. Determine the Cost of Goods Sold after disposing of the Over/Underapplied Overhead. \begin{tabular}{|l|l|} \hline Cost of Goods Sold & \\ \hline \end{tabular} 5. Determine the Gross Profit for the month. Gross Profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started