Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Compute Pittman Company's break-even point in dollar sales for next year assuming: a. The agents' commission rate remains unchanged at 15%. b.

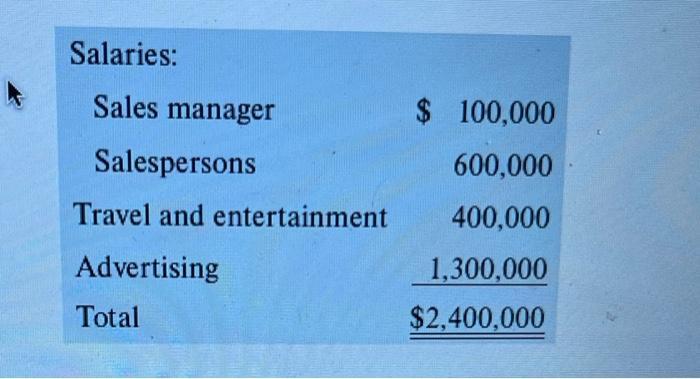

Required: 1. Compute Pittman Company's break-even point in dollar sales for next year assuming: a. The agents' commission rate remains unchanged at 15%. b. The agents' commission rate is increased to 20%. c. The company employs its own sales force. 2. Assume that Pittman Company decides to continue selling through agents and pays the 20% commission rate. Determine the dollar sales that would be required to generate the same net income as contained in the budgeted income statement for next year. 3. Determine the dollar sales at which net income would be equal regardless of whether Pittman Company sells through agents (at a 20% commission rate) or employs its own sales force. 4. Compute the degree of operating leverage that the company would expect to have at the end of next year assuming: a. The agents' commission rate remains unchanged at 15%. b. The agents' commission rate is increased to 20%. c. The company employs its own sales force. Use income before income taxes in your operating leverage computation. 5. Based on the data in (1) through (4) above, make a recommendation as to whether the company should continue to use sales agents (at a 20% commission rate) or employ its own sales force. Give reasons for your answer. (CMA, adapted) Pittman Company Budgeted Income Statement For the Year Ended December 31 Sales $ 16,000,000 Manufacturing expenses: Variable $7,200,000 Fixed overhead 2,340,000 9,540,000 Gross margin 6,460,000 Selling and administrative expenses: Commissions to agents 2,400,000 Fixed marketing expenses 120.000 Fixed administrative expenses 1,800,000 4,320,000 Net operating income 2,140,000 Fixed interest expenses 540,000 Income before income taxes Income taxes (30%) Net income 1,600,000 480.000 $ 1,120,000 Salaries: Sales manager $ 100,000 Salespersons 600,000 Travel and entertainment 400,000 Advertising 1,300,000 Total $2,400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the requirements we will use the provided budgeted income statement and the additional information about expenses when the company employs its own sales force Lets start with the first requ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started