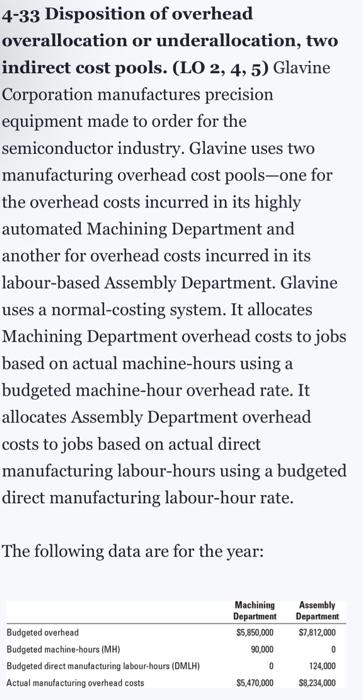

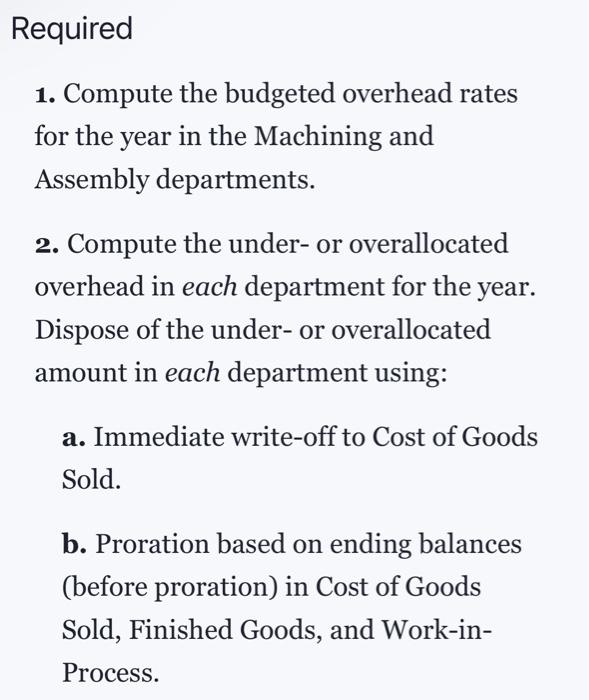

Required 1. Compute the budgeted overhead rates for the year in the Machining and Assembly departments. 2. Compute the under- or overallocated overhead in each department for the year. Dispose of the under- or overallocated amount in each department using: a. Immediate write-off to Cost of Goods Sold. b. Proration based on ending balances (before proration) in Cost of Goods Sold, Finished Goods, and Work-inProcess. c. Proration based on the allocated overhead amount (before proration) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-inProcess. 3. Which disposition method do you prefer in requirement 2? Explain. Check Figure: 2. Machining department: Overallocation, \$510,000; Assembly department: Underallocation, $170,000 Check Figure: 2. Machining department: Overallocation, \$510,000; Assembly department: Underallocation, $170,000 4-33 Disposition of overhead overallocation or underallocation, two indirect cost pools. ( LO2,4,5) Glavine Corporation manufactures precision equipment made to order for the semiconductor industry. Glavine uses two manufacturing overhead cost pools-one for the overhead costs incurred in its highly automated Machining Department and another for overhead costs incurred in its labour-based Assembly Department. Glavine uses a normal-costing system. It allocates Machining Department overhead costs to jobs based on actual machine-hours using a budgeted machine-hour overhead rate. It allocates Assembly Department overhead costs to jobs based on actual direct manufacturing labour-hours using a budgeted direct manufacturing labour-hour rate. The following data are for the year: Required 1. Compute the budgeted overhead rates for the year in the Machining and Assembly departments. 2. Compute the under- or overallocated overhead in each department for the year. Dispose of the under- or overallocated amount in each department using: a. Immediate write-off to Cost of Goods Sold. b. Proration based on ending balances (before proration) in Cost of Goods Sold, Finished Goods, and Work-inProcess. c. Proration based on the allocated overhead amount (before proration) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-inProcess. 3. Which disposition method do you prefer in requirement 2? Explain. Check Figure: 2. Machining department: Overallocation, \$510,000; Assembly department: Underallocation, $170,000 Check Figure: 2. Machining department: Overallocation, \$510,000; Assembly department: Underallocation, $170,000 4-33 Disposition of overhead overallocation or underallocation, two indirect cost pools. ( LO2,4,5) Glavine Corporation manufactures precision equipment made to order for the semiconductor industry. Glavine uses two manufacturing overhead cost pools-one for the overhead costs incurred in its highly automated Machining Department and another for overhead costs incurred in its labour-based Assembly Department. Glavine uses a normal-costing system. It allocates Machining Department overhead costs to jobs based on actual machine-hours using a budgeted machine-hour overhead rate. It allocates Assembly Department overhead costs to jobs based on actual direct manufacturing labour-hours using a budgeted direct manufacturing labour-hour rate. The following data are for the year