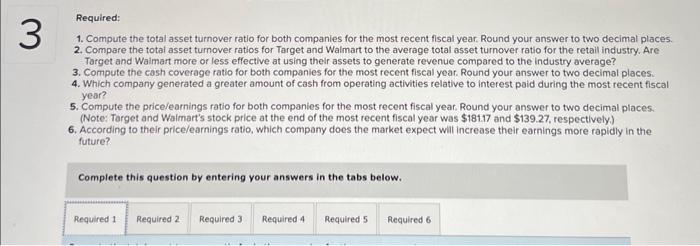

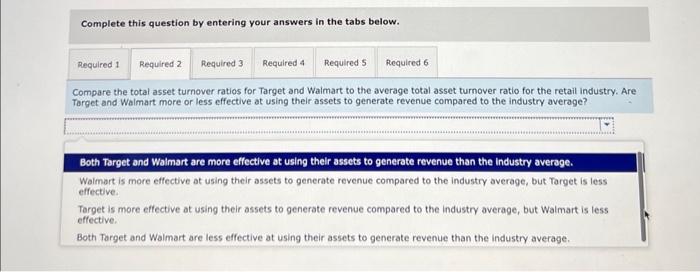

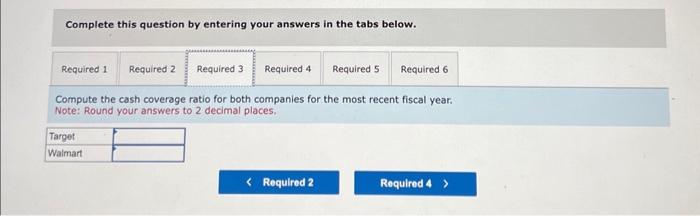

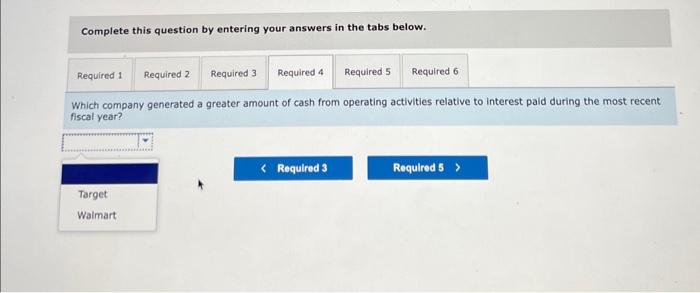

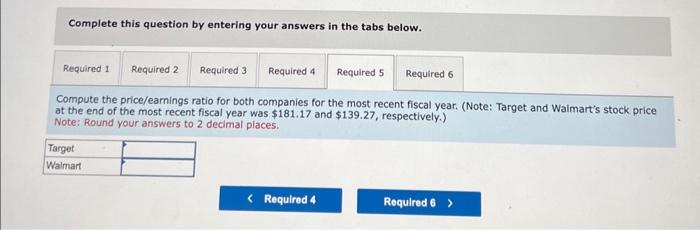

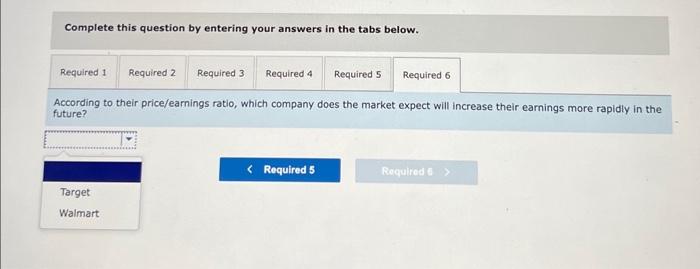

Required: 1. Compute the total asset turnover ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. 2. Compare the total asset tumover ratios for Target and Walmart to the average total asset turnover ratio for the retail industry. Are Torget and Waimart more or less effective at using their assets to generate revenue compared to the industry average? 3. Compute the cash coverage ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. 4. Which company generated a greater amount of cash from operating activities relative to interest paid during the most recent fiscal year? 5. Compute the price/earnings ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. (Noter Target and Waimart's stock price at the end of the most recent fiscal year was $181.17 and $139.27, respectively.) 6. According to their price/earnings ratio, which company does the market expect will increase their earnings more rapidly in the future? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compare the total asset tumover ratios for Target and Waimart to the average total asset turnover ratio for the retail industry. A Target and Waimart more or less effective at using their assets to generate revenue compared to the industry average? Complete this question by entering your answers in the tabs below. Compute the cash coverage ratio for both companies for the most recent fiscal year. Note: Round your answers to 2 decimal places; Complete this question by entering your answers in the tabs below. Which company generated a greater amount of cash from operating activities relative to interest paid during the most recent fiscal year? Complete this question by entering your answers in the tabs below. Compute the price/eamings ratio for both companies for the most recent fiscal year. (Note: Target and Waimart's stock price at the end of the most recent fiscal year was $181,17 and $139.27, respectively.) Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. According to their price/earnings ratio, which company does the market expect will increase their earnings more rapidly in the future? Required: 1. Compute the total asset turnover ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. 2. Compare the total asset tumover ratios for Target and Walmart to the average total asset turnover ratio for the retail industry. Are Torget and Waimart more or less effective at using their assets to generate revenue compared to the industry average? 3. Compute the cash coverage ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. 4. Which company generated a greater amount of cash from operating activities relative to interest paid during the most recent fiscal year? 5. Compute the price/earnings ratio for both companies for the most recent fiscal year. Round your answer to two decimal places. (Noter Target and Waimart's stock price at the end of the most recent fiscal year was $181.17 and $139.27, respectively.) 6. According to their price/earnings ratio, which company does the market expect will increase their earnings more rapidly in the future? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Compare the total asset tumover ratios for Target and Waimart to the average total asset turnover ratio for the retail industry. A Target and Waimart more or less effective at using their assets to generate revenue compared to the industry average? Complete this question by entering your answers in the tabs below. Compute the cash coverage ratio for both companies for the most recent fiscal year. Note: Round your answers to 2 decimal places; Complete this question by entering your answers in the tabs below. Which company generated a greater amount of cash from operating activities relative to interest paid during the most recent fiscal year? Complete this question by entering your answers in the tabs below. Compute the price/eamings ratio for both companies for the most recent fiscal year. (Note: Target and Waimart's stock price at the end of the most recent fiscal year was $181,17 and $139.27, respectively.) Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. According to their price/earnings ratio, which company does the market expect will increase their earnings more rapidly in the future