Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIRED 1) Discuss the reasons and implications of the changes in the ratios over the last three years 2) Suggest ways by which the Return

REQUIRED

1) Discuss the reasons and implications of the changes in the ratios over the last three years 2) Suggest ways by which the Return on Capital Employed could be improved

PLEASE THE ANSWER TO BE BASED ON THE ABOVE SUBJECT AND I NEED ALSO CALCULATION IF IS POSSIBLE...PLEASE NOT ANY COPY PASTE

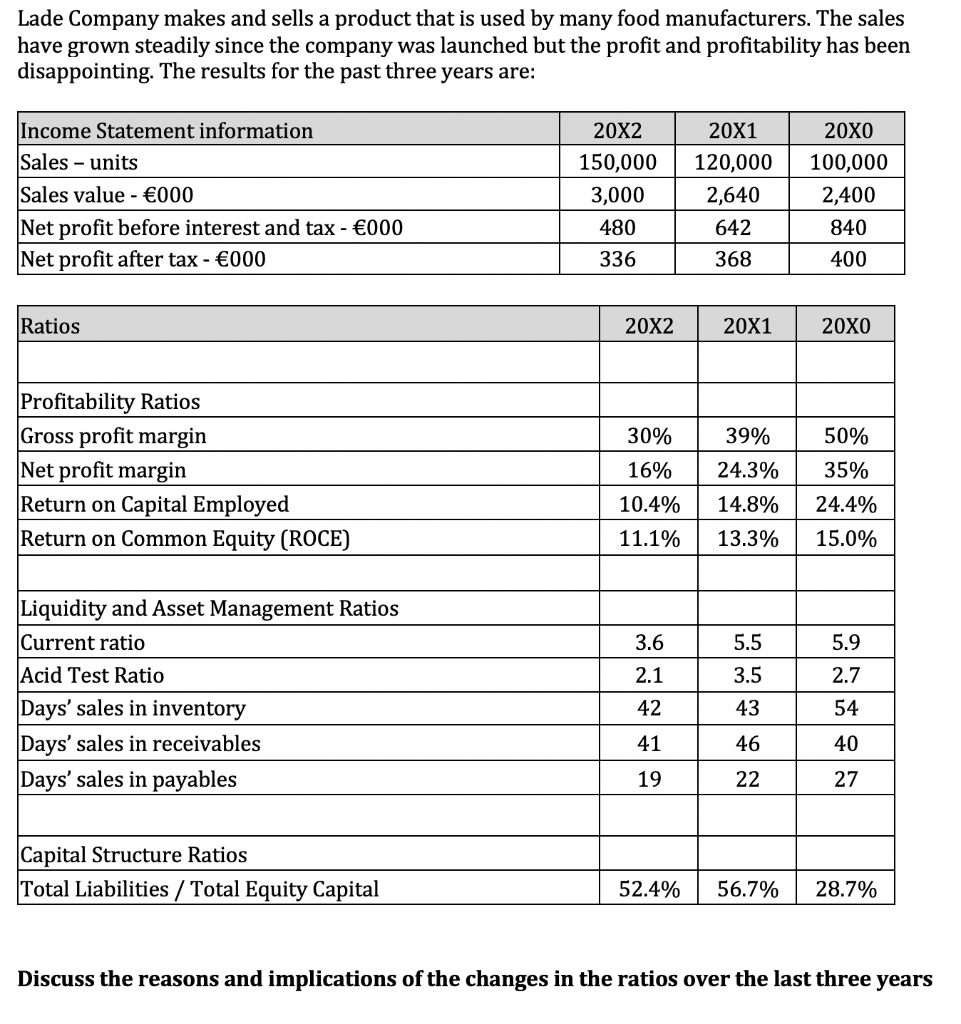

Lade Company makes and sells a product that is used by many food manufacturers. The sales have grown steadily since the company was launched but the profit and profitability has been disappointing. The results for the past three years are: Income Statement information Sales - units Sales value - 000 Net profit before interest and tax - 000 Net profit after tax - 000 20X2 150,000 3,000 480 336 20X1 120,000 2,640 642 368 20X0 100,000 2,400 840 400 Ratios 20X2 20X1 20XO 39% 50% Profitability Ratios Gross profit margin Net profit margin Return on Capital Employed Return on Common Equity (ROCE) 30% 16% 35% 10.4% 24.3% 14.8% 13.3% 24.4% 11.1% 15.0% 5.5 5.9 3.5 2.7 Liquidity and Asset Management Ratios Current ratio Acid Test Ratio Days' sales in inventory Days' sales in receivables Days' sales in payables 33RH-9 43 54 46 40 22 27 Capital Structure Ratios Total Liabilities / Total Equity Capital 52.4% 56.7% 28.7% Discuss the reasons and implications of the changes in the ratios over the last three years Lade Company makes and sells a product that is used by many food manufacturers. The sales have grown steadily since the company was launched but the profit and profitability has been disappointing. The results for the past three years are: Income Statement information Sales - units Sales value - 000 Net profit before interest and tax - 000 Net profit after tax - 000 20X2 150,000 3,000 480 336 20X1 120,000 2,640 642 368 20X0 100,000 2,400 840 400 Ratios 20X2 20X1 20XO 39% 50% Profitability Ratios Gross profit margin Net profit margin Return on Capital Employed Return on Common Equity (ROCE) 30% 16% 35% 10.4% 24.3% 14.8% 13.3% 24.4% 11.1% 15.0% 5.5 5.9 3.5 2.7 Liquidity and Asset Management Ratios Current ratio Acid Test Ratio Days' sales in inventory Days' sales in receivables Days' sales in payables 33RH-9 43 54 46 40 22 27 Capital Structure Ratios Total Liabilities / Total Equity Capital 52.4% 56.7% 28.7% Discuss the reasons and implications of the changes in the ratios over the last three yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started