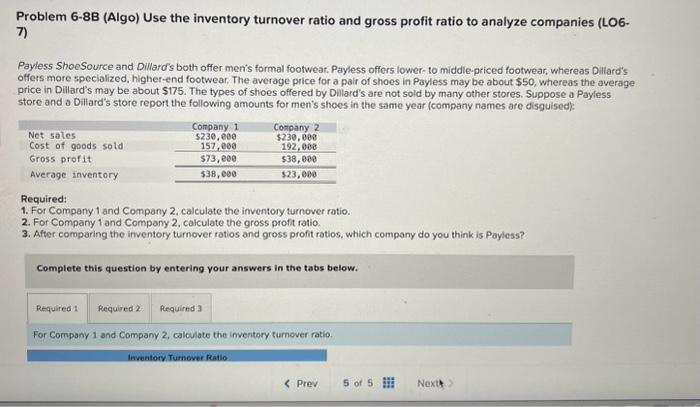

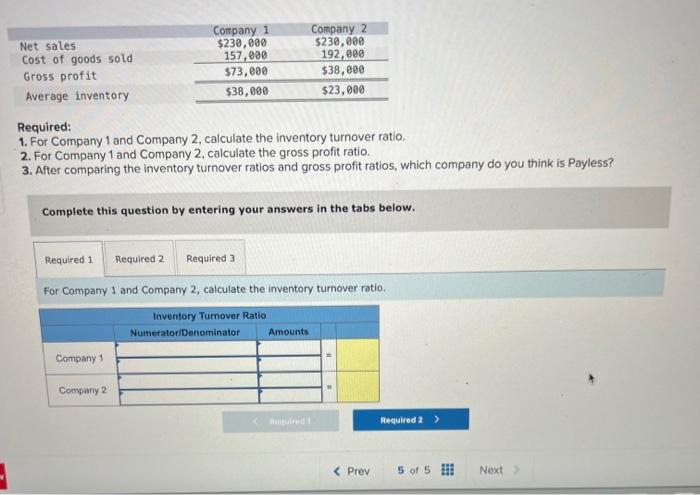

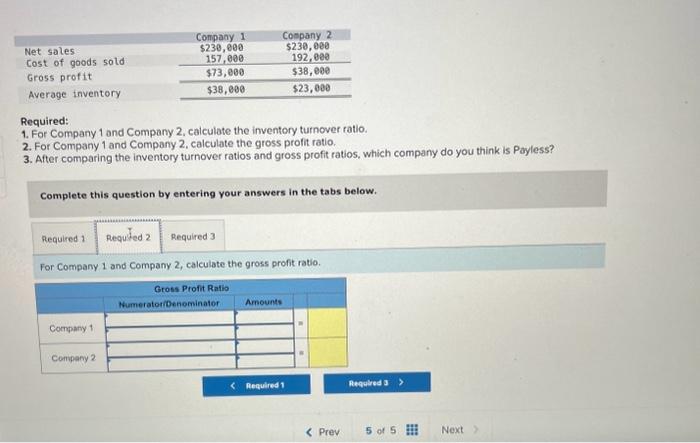

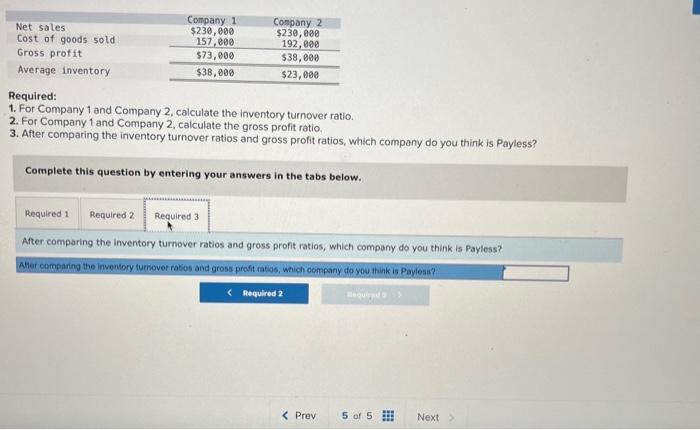

Required: 1. For Company 1 and Company 2, calculate the inventory turnover ratio. 2. For Company 1 and Company 2 , calculate the gross profit ratio. 3. After comparing the inventory turnover ratios and gross profit ratios, which company do you think is Payless? Complete this question by entering your answers in the tabs below. For Company 1 and Company 2, calculate the inventory turnover ratio. Required: 1. For Company 1 and Company 2, calculate the inventory turnover ratio. 2. For Company 1 and Company 2, calculate the gross profit ratio. 3. After comparing the inventory turnover ratios and gross profit ratios, which company do you think is Payless? Complete this question by entering your answers in the tabs below. For Company 1 and Company 2, calculate the gross profit ratio. Required: 1. For Company 1 and Company 2, calculate the inventory turnover ratio. 2. For Company 1 and Company 2, calculate the gross profit ratio. 3. After comparing the inventory turnover ratios and gross profit ratios, which company do you think is Payless? Complete this question by entering your answers in the tabs below. After comparing the inventory turnover ratios and gross profit ratios, which company do you think is Payless? Problem 6-8B (Algo) Use the inventory turnover ratio and gross profit ratio to analyze companies (LO6. 7) Payless ShoeSource and Dillard's both offer men's formal footwear. Payless offers lower- to middle-priced footwear, whereas Dillard's offers more specialized, higher-end footwear, The average price for a pair of shoes in Payless may be about $50, whereas the average price in Dillard's may be about \$175. The types of shoes offered by Dillard's are not sold by many other stores. Suppose a Payless store and o Dillard's store report the following amounts for men's shoes in the same year (company names are disguised): Required: 1. For Company 1 and Company 2, calculate the inventory turnover ratio. 2. For Company 1 and Company 2, calculate the gross profit ratio. 3. After comparing the inventory turnover ratios and gross profit ratios, which company do you think is Payless? Complete this question by entering your answers in the tabs below. For Company 1 and Company 2, calculate the inventory turnever ratio