Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required 1. for L Gee (Pty) for the year ended 31 December 2021 draft the actual statement of comprehencive income according to the absorption costing

required

1. for L Gee (Pty) for the year ended 31 December 2021 draft the actual statement of comprehencive income according to the absorption costing system, clearly indicating whether overheads were over/under absorped. clearly seperate the over/under absorption between the volume and expenditure variences.

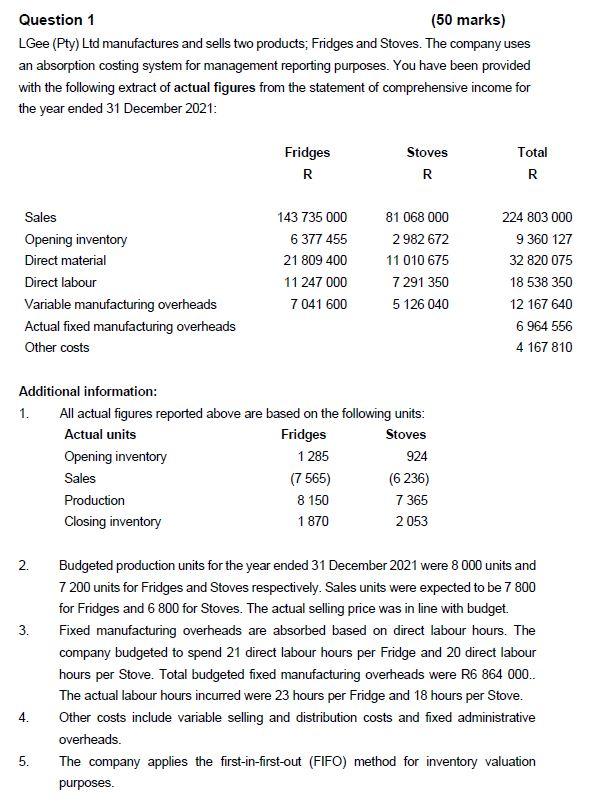

Question 1 (50 marks) LGee (Pty) Ltd manufactures and sells two products; Fridges and Stoves. The company uses an absorption costing system for management reporting purposes. You have been provided with the following extract of actual figures from the statement of comprehensive income for the year ended 31 December 2021: Fridges R Stoves R Total R Sales Opening inventory Direct material Direct labour Variable manufacturing overheads Actual fixed manufacturing overheads Other costs 143 735 000 6 377 455 21 809 400 11 247 000 7 041 600 81 068 000 2 982 672 11 010 675 7 291 350 5 126 040 224 803 000 9 360 127 32 820 075 18 538 350 12 167 640 6 964 556 4 167 810 Additional information: 1. All actual figures reported above are based on the following units: Actual units Fridges Stoves Opening inventory 1 285 924 Sales (7 565) (6 236) Production 8 150 7 365 Closing inventory 1 870 2053 2. 3. Budgeted production units for the year ended 31 December 2021 were 8 000 units and 7 200 units for Fridges and Stoves respectively. Sales units were expected to be 7 800 for Fridges and 6 800 for Stoves. The actual selling price was in line with budget. Fixed manufacturing overheads are absorbed based on direct labour hours. The company budgeted to spend 21 direct labour hours per Fridge and 20 direct labour hours per Stove. Total budgeted fixed manufacturing overheads were R6 864 000.. The actual labour hours incurred were 23 hours per Fridge and 18 hours per Stove. Other costs include variable selling and distribution costs and fixed administrative overheads. The company applies the first-in-first-out (FIFO) method for inventory valuation purposes. 4. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started