Question

Required 1. For the years 20X2 and 20X1, conduct the DuPont Analysis and calculate the Return of Equity (ROE) for Megasales Company. (Please show the

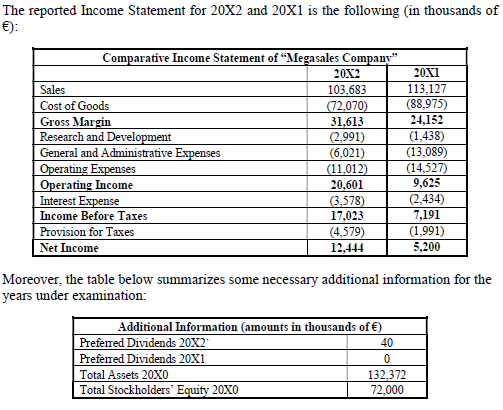

Required 1. For the years 20X2 and 20X1, conduct the DuPont Analysis and calculate the Return of Equity (ROE) for Megasales Company. (Please show the analytical computations for all components of the DuPont Analysis for the two respective years). 2. For the years 20X2 and 20X1, compute the Return of Equity (ROE) for Megasales Company. Analyze and interpret your results for the two years under examination. 3. Describe how each of the three components of the DuPont Analysis, affects the change in the Return of Equity (ROE) from 20X1 to 20X2. How does the level of debt affect the level of ROE? (Explain briefly. Max 300 words) 4. What are the possible limitations of the ROE analysis as far as profitability is concerned? (Explain briefly. Max 300 words

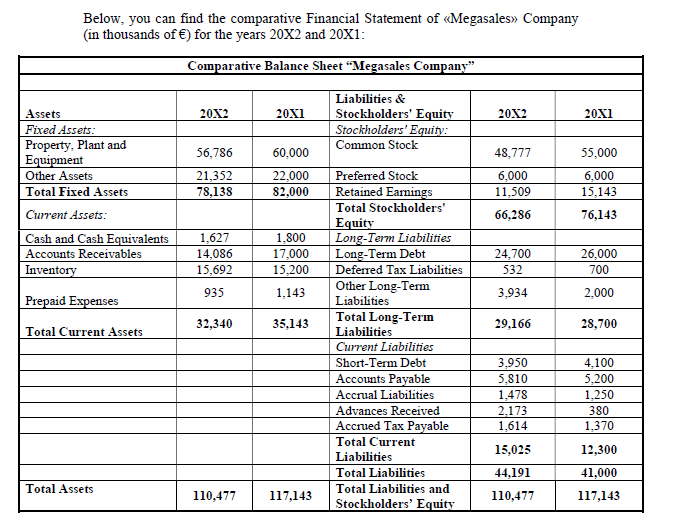

Below, you can find the comparative Financial Statement of Megasales Company (in thousands of ) for the years 20X2 and 20X1: Comparative Balance Sheet Megasales Company" 20X2 20X1 20X2 20X1 Liabilities & Stockholders' Equity Stockholders' Equity: Common Stock Assets Fixed Assets: Property, Plant and Equipment Other Assets Total Fixed Assets 60,000 48,777 56,786 21,352 78,138 22.000 82,000 6.000 11,509 55,000 6,000 15.143 66,286 76,143 Current Assets: Cash and Cash Equivalents Accounts Receivables Inventory / 1,627 14,086 15,692 935 1,800 17,000 15,200 1,143 24.700 532 3,934 26,000 700 2,000 Prepaid Expenses 32,340 35,143 29,166 28,700 Total Current Assets Preferred Stock Retained Earnings Total Stockholders' Equity Long-Term Liabilities Long-Term Debt Deferred Tax Liabilities Other Long-Term Liabilities Total Long-Terin Liabilities Current Liabilities Short-Term Debt Accounts Payable Accrual Liabilities Advances Received Accrued Tax Payable Total Current Liabilities Total Liabilities Total Liabilities and Stockholders' Equity 3.950 5.810 1.478 2.173 1.614 4.100 5,200 1,250 380 1.370 15,025 44,191 110,477 12,300 41,000 117,143 Total Assets 110,477 117,143 The reported Income Statement for 20X2 and 20X1 is the following in thousands of ): Comparative Income Statement of "Megasales Company 20X2 Sales 103,683 Cost of Goods (72.070) Gross Margin 31,613 Research and Development (2.991) General and Administrative Expenses (6.021) Operating Expenses (11.012) Operating Income 20.601 Interest Expense (3.578) Income Before Taxes 17,023 Provision for Taxes (4,579) Net Income 12.444 2011 113.127 (88.975) 24,152 (1,438) (13,089) (14,527) 9,625 (2,434) 7,191 (1,991) 5,200 Moreover, the table below summarizes some necessary additional information for the years under examination: Additional Information amounts in thousands of ) Preferred Dividends 20X2 40 Preferred Dividends 20X1 Total Assets 20X0 132.372 Total Stockholders' Equity 20X0 72.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started