Answered step by step

Verified Expert Solution

Question

1 Approved Answer

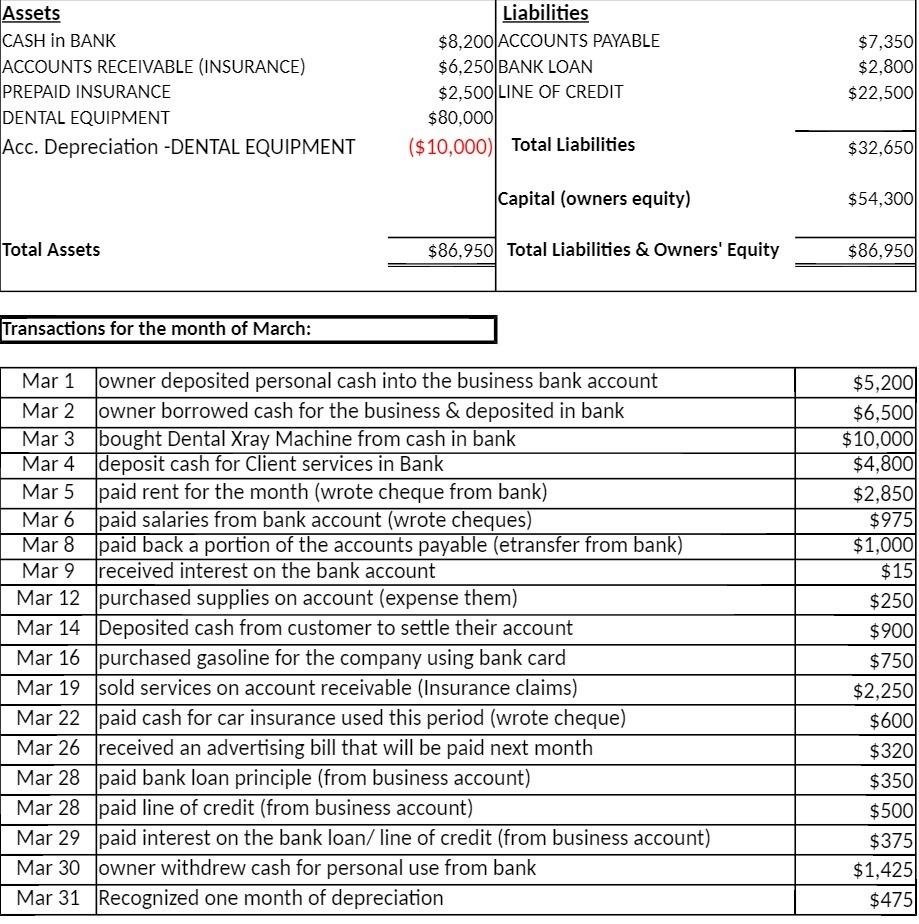

Required: 1) How would you journal this as well as add to general ledger? Assets CASH in BANK ACCOUNTS RECEIVABLE (INSURANCE) PREPAID INSURANCE DENTAL EQUIPMENT

Required:

1) How would you journal this as well as add to general ledger?

Assets CASH in BANK ACCOUNTS RECEIVABLE (INSURANCE) PREPAID INSURANCE DENTAL EQUIPMENT Acc. Depreciation -DENTAL EQUIPMENT Total Assets Transactions for the month of March: Mar 1 Mar 3 Mar 4 Mar 5 Mar 6 Mar 8 Mar 9 Mar 12 Mar 14 Mar 16 Mar 19 Liabilities $8,200 ACCOUNTS PAYABLE $6,250 BANK LOAN $2,500 LINE OF CREDIT $80,000 ($10,000) Total Liabilities Capital (owners equity) $86,950 Total Liabilities & Owners' Equity owner deposited personal cash into the business bank account owner borrowed cash for the business & deposited in bank bought Dental Xray Machine from cash in bank deposit cash for Client services in Bank paid rent for the month (wrote cheque from bank) paid salaries from bank account (wrote cheques) paid back a portion of the accounts payable (etransfer from bank) received interest on the bank account purchased supplies on account (expense them) Deposited cash from customer to settle their account purchased gasoline for the company using bank card sold services on account receivable (Insurance claims) paid cash for car insurance used this period (wrote cheque) received an advertising bill that will be paid next month Mar 22 Mar 26 Mar 28 Mar 28 Mar 29 Mar 30 Mar 31 Recognized one month of depreciation paid bank loan principle (from business account) paid line of credit (from business account) paid interest on the bank loan/ line of credit (from business account) owner withdrew cash for personal use from bank $7,350 $2,800 $22,500 $32,650 $54,300 $86,950 $5,200 $6,500 $10,000 $4,800 $2,850 $975 $1.000 $15 $250 $900 $750 $2,250 $600 $320 $350 $500 $375 $1,425 $475

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started