Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Journalize all of the transactions for the partnership. 2. Prepare the partners' equity section of the balance sheet as of January 2, 2017.

Required: 1. Journalize all of the transactions for the partnership. 2. Prepare the partners' equity section of the balance sheet as of January 2, 2017.

Show all Working!.

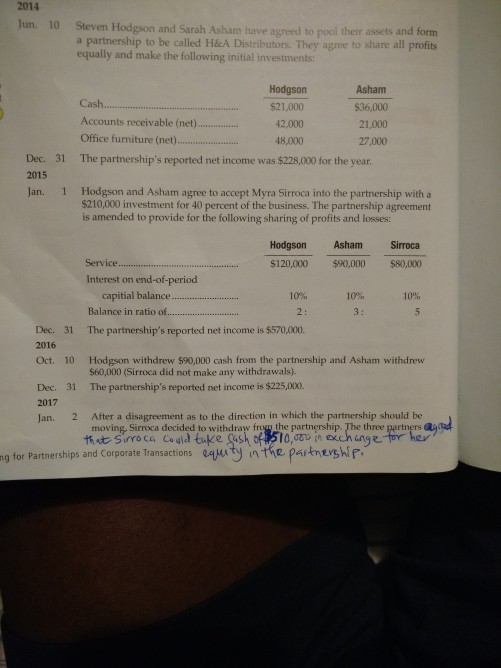

2014 Jun. 10 Steven Hodgson and Sarah Asharn have agreed to pool their assets and form a partnership to be called H&cA Distributors. They agree to share all profits equally and make the following initial investments: Cash Accounts receivable (net Office furniture (net). Hodgson 521,000 42,000 48,000 Asham $36,000 21,000 27,000 Dec. 31 The partnership's reported net income was $228,000 for the year 2015 Jan. 1 Hodgson and Asham agree to accept Myra Sirroca into the partnership with a $210,000 investment for 40 percent of the business. The partnership agreement is amended to provide for the following sharing of profits and losses: Hodgson Asham Sirroca 120,000 $90,000 $80,000 Service Interest on end-of-period 10% 2: The partnership's reported net income is $570,000. capitial balance Balance in ratio o. 10% 10% 3: Dec. 2016 31 Oct. 10Hodgson withdrew $90,000 cash from the partnership and Asham withdrew 560,000 (Sirroca did not make any withdrawals). The partnership's reported net income is $225,000. Dec. 31 2017 Jan. 2 After a disagreement as to the direction in which the partnership should be moving. Sirroca decided to withdraw frogm the partnrship. The three partn tot Sirro ca co ala take (shof0,000 in exchange ng for Partnerships and Corporate TransactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started