Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Make the elimination entries for 2017. 2. Make the elimination entries for 2019. Chapter 5, Bonds Payable Problem - 11 points The Parent

Required:

1. Make the elimination entries for 2017.

2. Make the elimination entries for 2019.

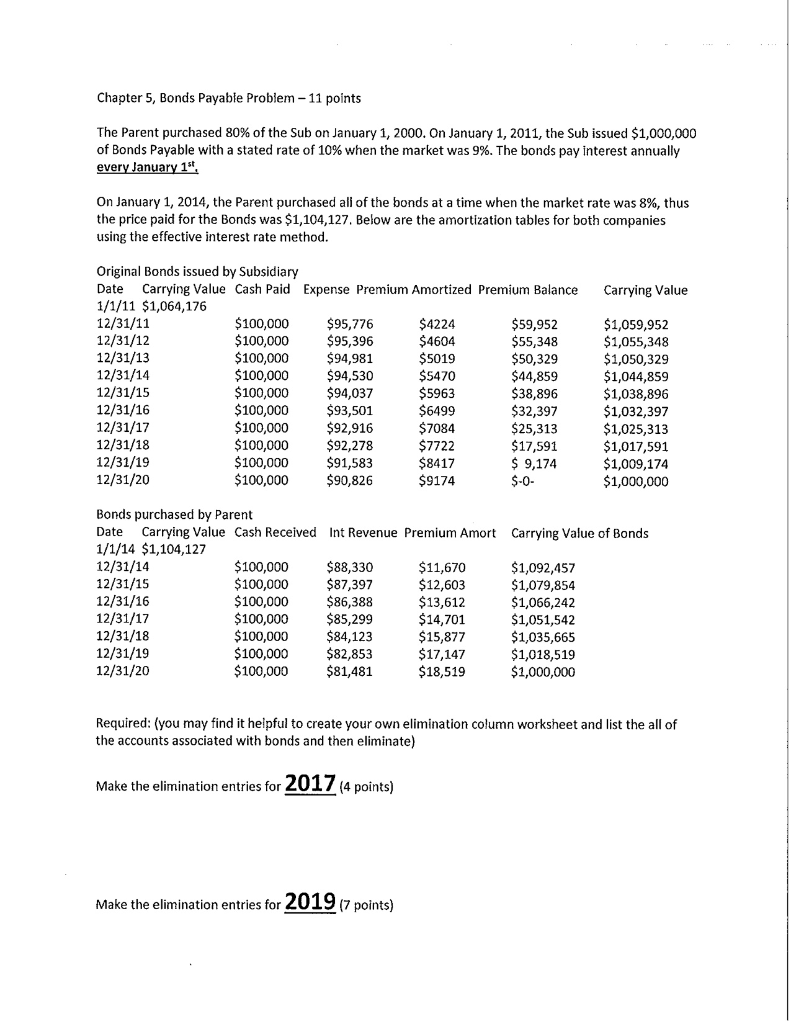

Chapter 5, Bonds Payable Problem - 11 points The Parent purchased 80% of the Sub on January 1, 2000. On January 1, 2011, the Sub issued $1,000,000 of Bonds Payable with a stated rate of 10% when the market was 9%. The bonds pay interest annually every January 15, On January 1, 2014, the Parent purchased all of the bonds at a time when the market rate was 8%, thus the price paid for the Bonds was $1,104,127. Below are the amortization tables for both companies using the effective interest rate method. Carrying Value Original Bonds issued by Subsidiary Date Carrying Value Cash Paid Expense Premium Amortized Premium Balance 1/1/11 $1,064,176 12/31/11 $100,000 $95,776 $4224 $59,952 12/31/12 $100,000 $95,396 $4604 $55,348 12/31/13 $100,000 $94,981 $5019 $50,329 12/31/14 $100,000 $94,530 $5470 $44,859 12/31/15 $100,000 $94,037 $5963 $38,896 12/31/16 $100,000 $93,501 $6499 $32,397 12/31/17 $100,000 $92,916 $7084 $25,313 12/31/18 $100,000 $92,278 $7722 $17,591 12/31/19 $100,000 $91,583 $8417 $ 9,174 12/31/20 $100,000 $90,826 $9174 $-0- $1,059,952 $1,055,348 $1,050,329 $1,044,859 $1,038,896 $1,032,397 $1,025,313 $1,017,591 $1,009,174 $1,000,000 Bonds purchased by Parent Date Carrying Value Cash Received Int Revenue Premium Amort Carrying Value of Bonds 1/1/14 $1,104,127 12/31/14 $100,000 $88,330 $11,670 $1,092,457 12/31/15 $100,000 $87,397 $12,603 $1,079,854 12/31/16 $100,000 $86,388 $13,612 $1,066,242 12/31/17 $100,000 $85,299 $14,701 $1,051,542 12/31/18 $100,000 $84,123 $15,877 $1,035,665 12/31/19 $100,000 $82,853 $17,147 $1,018,519 12/31/20 $100,000 $81,481 $18,519 $1,000,000 Required: (you may find it helpful to create your own elimination column worksheet and list the all of the accounts associated with bonds and then eliminate) Make the elimination entries for 2017 (4 points) Make the elimination entries for 2019 17 points) Chapter 5, Bonds Payable Problem - 11 points The Parent purchased 80% of the Sub on January 1, 2000. On January 1, 2011, the Sub issued $1,000,000 of Bonds Payable with a stated rate of 10% when the market was 9%. The bonds pay interest annually every January 15, On January 1, 2014, the Parent purchased all of the bonds at a time when the market rate was 8%, thus the price paid for the Bonds was $1,104,127. Below are the amortization tables for both companies using the effective interest rate method. Carrying Value Original Bonds issued by Subsidiary Date Carrying Value Cash Paid Expense Premium Amortized Premium Balance 1/1/11 $1,064,176 12/31/11 $100,000 $95,776 $4224 $59,952 12/31/12 $100,000 $95,396 $4604 $55,348 12/31/13 $100,000 $94,981 $5019 $50,329 12/31/14 $100,000 $94,530 $5470 $44,859 12/31/15 $100,000 $94,037 $5963 $38,896 12/31/16 $100,000 $93,501 $6499 $32,397 12/31/17 $100,000 $92,916 $7084 $25,313 12/31/18 $100,000 $92,278 $7722 $17,591 12/31/19 $100,000 $91,583 $8417 $ 9,174 12/31/20 $100,000 $90,826 $9174 $-0- $1,059,952 $1,055,348 $1,050,329 $1,044,859 $1,038,896 $1,032,397 $1,025,313 $1,017,591 $1,009,174 $1,000,000 Bonds purchased by Parent Date Carrying Value Cash Received Int Revenue Premium Amort Carrying Value of Bonds 1/1/14 $1,104,127 12/31/14 $100,000 $88,330 $11,670 $1,092,457 12/31/15 $100,000 $87,397 $12,603 $1,079,854 12/31/16 $100,000 $86,388 $13,612 $1,066,242 12/31/17 $100,000 $85,299 $14,701 $1,051,542 12/31/18 $100,000 $84,123 $15,877 $1,035,665 12/31/19 $100,000 $82,853 $17,147 $1,018,519 12/31/20 $100,000 $81,481 $18,519 $1,000,000 Required: (you may find it helpful to create your own elimination column worksheet and list the all of the accounts associated with bonds and then eliminate) Make the elimination entries for 2017 (4 points) Make the elimination entries for 2019 17 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started