Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1- prepare a cash collection schedule from customers 2- prepare a schedule of cash payments for materials 3- prepare the cash budget 1. The

Required: 1- prepare a cash collection schedule from customers 2- prepare a schedule of cash payments for materials 3- prepare the cash budget

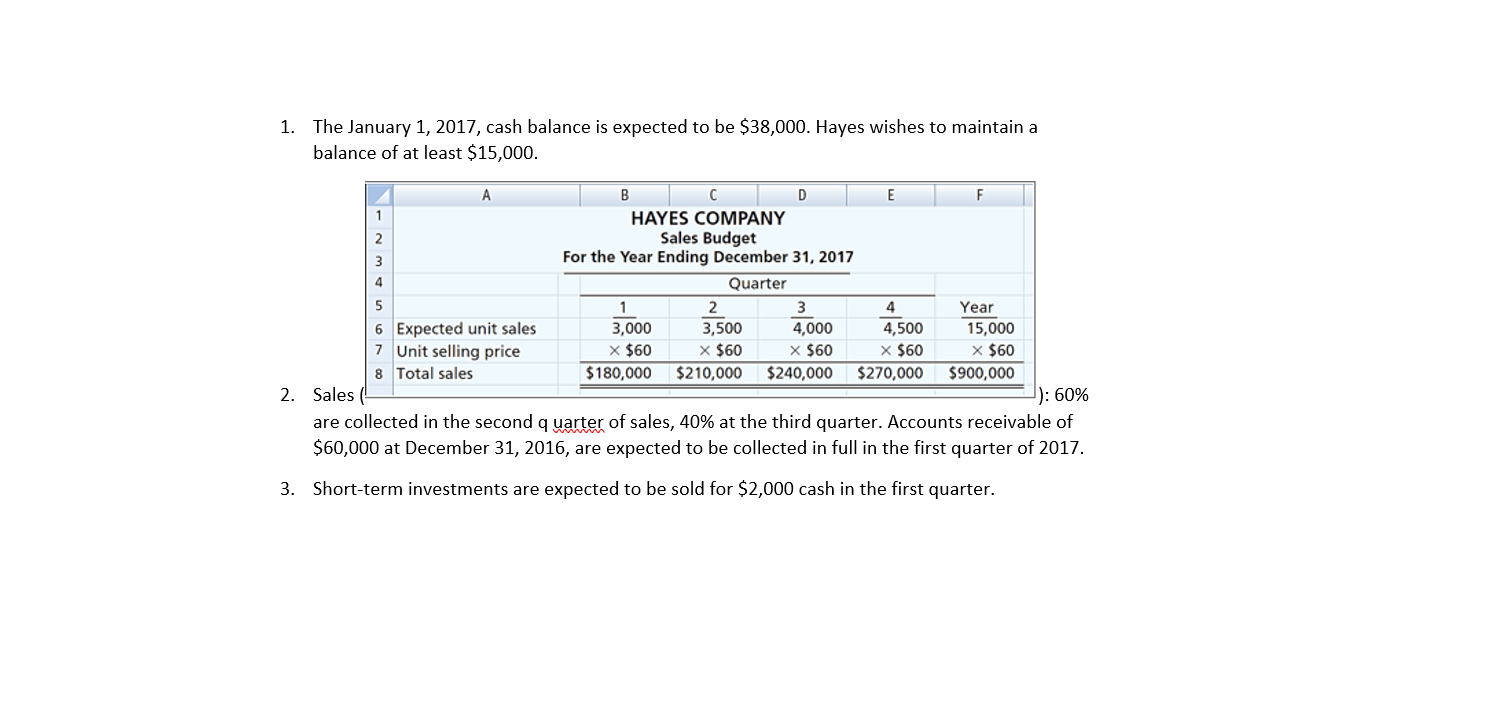

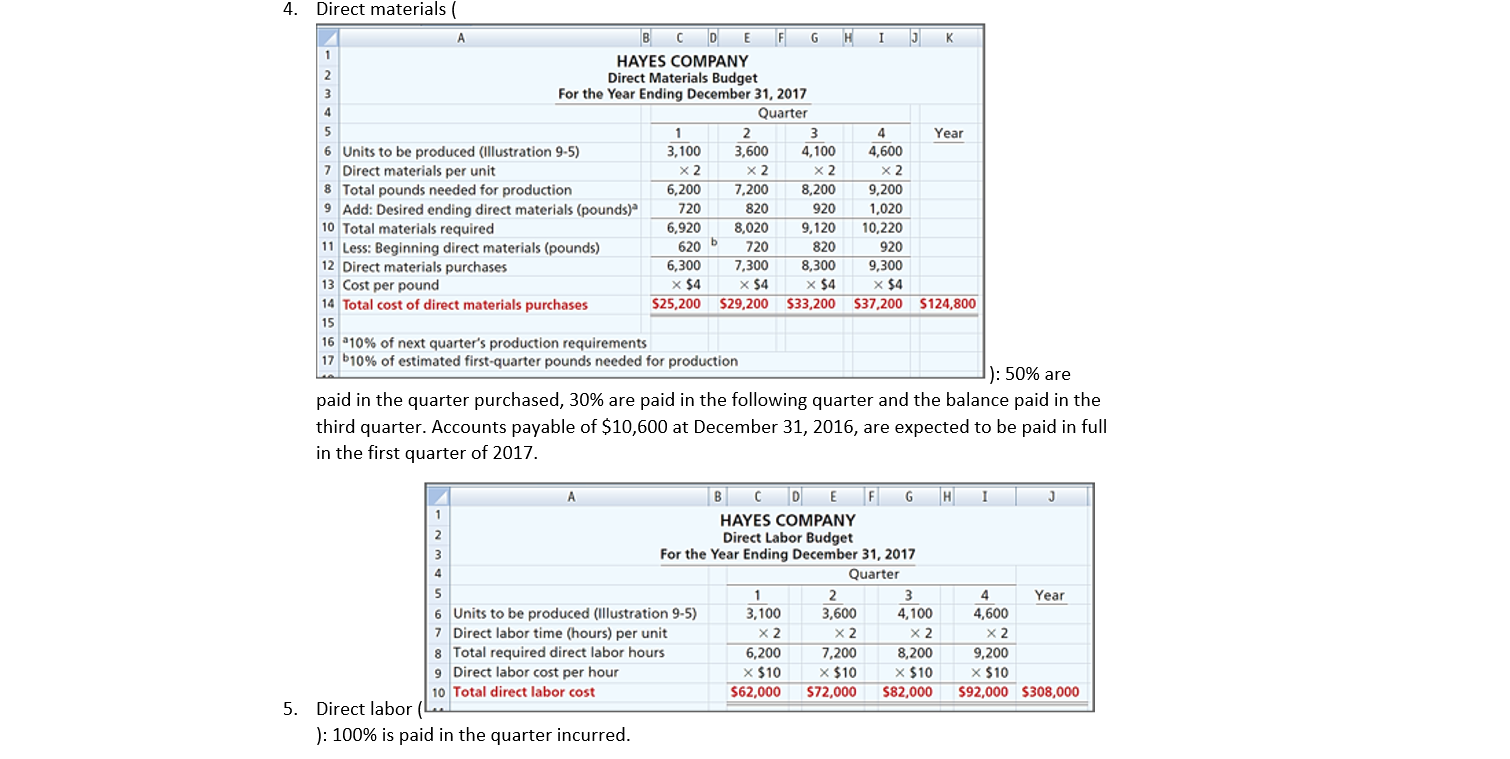

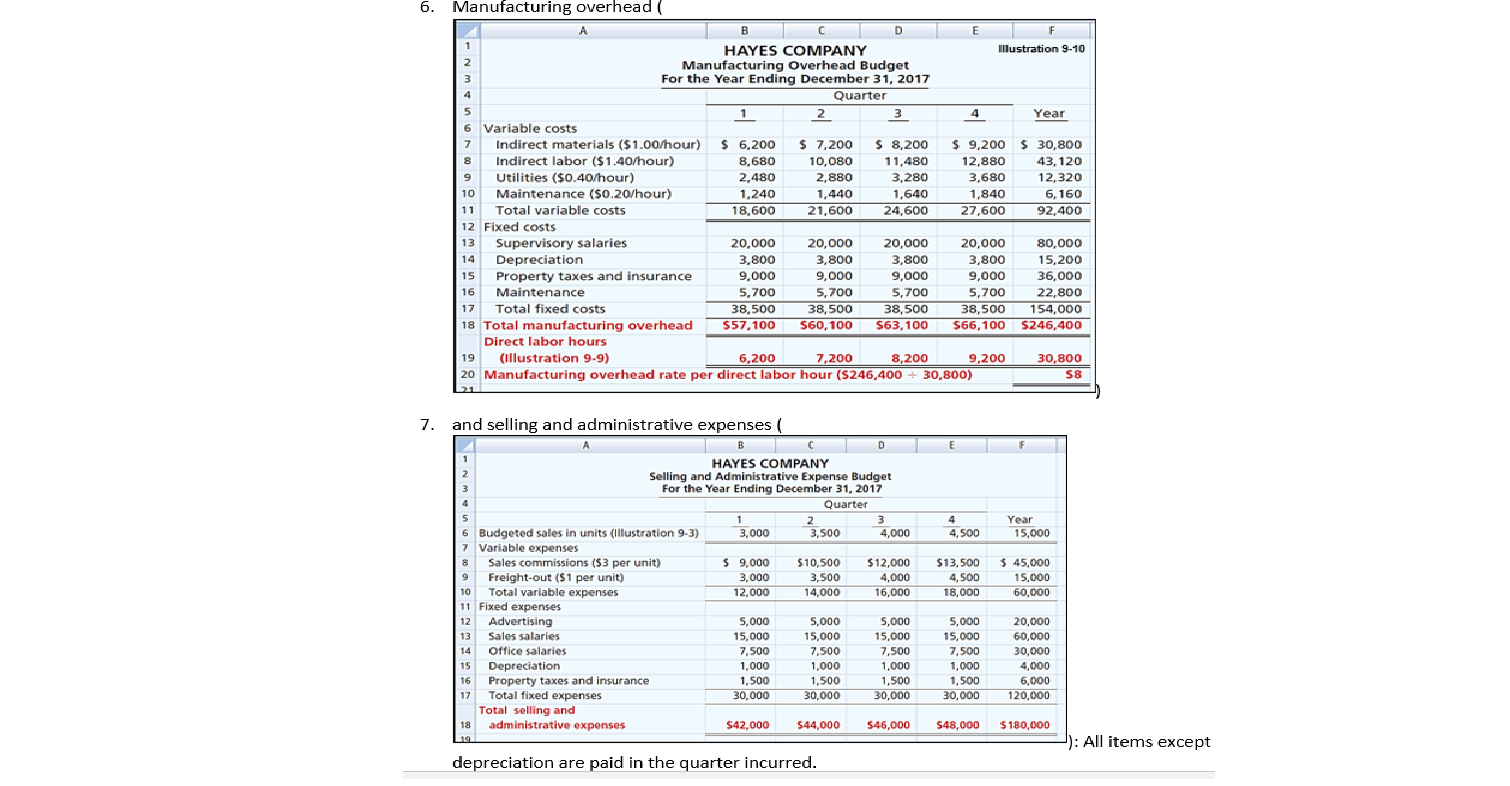

1. The January 1, 2017, cash balance is expected to be $38,000. Hayes wishes to maintain a balance of at least $15,000. DE F HAYES COMPANY Sales Budget For the Year Ending December 31, 2017 Quarter Year 6 Expected unit sales 3,000 3,500 4,000 4,500 15,000 Unit selling price x $60 x $60 x $60 x $60 X $60 8 Total sales $180,000 $210,000 $240,000 $270,000 $900,000 2. Sales ): 60% are collected in the second quarter of sales, 40% at the third quarter. Accounts receivable of $60,000 at December 31, 2016, are expected to be collected in full in the first quarter of 2017. 3. Short-term investments are expected to be sold for $2,000 cash in the first quarter. 4. Direct materials ( H I J K B C D E F G HAYES COMPANY Direct Materials Budget For the Year Ending December 31, 2017 Quarter Year 3,600 4,100 X2 x2 6 Units to be produced (Illustration 9-5) 7 Direct materials per unit 8 Total pounds needed for production 9 Add: Desired ending direct materials (pounds) 10 Total materials required 11 Less: Beginning direct materials (pounds) 12 Direct materials purchases 13 Cost per pound 14 Total cost of direct materials purchases 3,100 X2 6,200 720 6,920 620 6,300 X $4 $25,200 7,200 820 8,020 720 7,300 x 54 $29,200 8,200 920 9,120 820 4,600 X2 9,200 1,020 10,220 920 9,300 X $4 $37,200 8,300 X $4 $33,200 $124,800 16 -10% of next quarter's production requirements 17 10% of estimated first-quarter pounds needed for production 1): 50% are paid in the quarter purchased, 30% are paid in the following quarter and the balance paid in the third quarter. Accounts payable of $10,600 at December 31, 2016, are expected to be paid in full in the first quarter of 2017. H I J B C D E F G HAYES COMPANY Direct Labor Budget For the Year Ending December 31, 2017 Quarter Year 6 Units to be produced (Illustration 9-5) 7 Direct labor time (hours) per unit 8 Total required direct labor hours 9 Direct labor cost per hour 10 Total direct labor cost 5. Direct labor (... ): 100% is paid in the quarter incurred. 3,100 X2 6,200 X $10 $62,000 3,600 X2 7,200 X $10 $72,000 4,100 X2 8,200 x $10 $82,000 4,600 X2 9,200 X $10 $92,000 $308,000 OU AWN 6. Manufacturing overhead B C D E F HAYES COMPANY Illustration 9-10 Manufacturing Overhead Budget For the Year Ending December 31, 2017 Quarter 2 3 Year Variable costs Indirect materials ($1.00/hour) $ 6,200 $ 7,200 $ 8,200 $ 9,200 $30,800 Indirect labor ($ 1.40/hour) 8.680 10,080 11,480 12,880 43,120 Utilities ($0.40/hour) 2.480 2,880 3,280 3,680 12,320 Maintenance (50.20/hour) 1,240 1,440 1,640 1,840 6,160 Total variable costs 18,600 21,600 24,600 27,600 92,400 12 Fixed costs 13 Supervisory salaries 20,000 20,000 20,000 20,000 80,000 Depreciation 3.800 3,800 3,800 3,800 15,200 Property taxes and insurance 9,000 9,000 9,000 9,000 36,000 Maintenance 5,700 5,700 5,700 5,700 22,800 Total fixed costs 38,500 38,500 38,500 38,500 154,000 18 Total manufacturing overhead $57.100 $60,100 $63,100 $66, 100 $246,400 Direct labor hours 19 (illustration 9-9) 6,200 7,200 8,200 9,200 30,800 20 Manufacturing overhead rate per direct labor hour (S246,400 + 30,800) 15 7. and selling and administrative expenses WN - HAYES COMPANY Selling and Administrative Expense Budget For the Year Ending December 31, 2017 Quarter 3,000 2 - 3,500 4,000 4.500 Year 15,000 $ 9,000 3,000 12,000 $10,500 3,500 14,000 $12,000 4,000 16,000 $13,500 4,500 18,000 $ 45,000 15,000 60,000 Budgeted sales in units (Illustration 9-3) 7 Variable expenses Sales commissions (53 per unit) Freight-out ($1 per unit) 10 Total variable expenses 11 Fixed expenses 12 Advertising 13 Sales salaries Office salaries Depreciation Property taxes and insurance 17 Total fixed expenses Total selling and 18 administrative expenses 5,000 15,000 7,500 1,000 1,500 30,000 5,000 15,000 7,500 1,000 1,500 30,000 5,000 15,000 7,500 1,000 1,500 30,000 5,000 15,000 7,500 1,000 1,500 30,000 20,000 60,000 30,000 4,000 6,000 120,000 $42,000 $44,000 $46,000 $48,000 $180,000 D): All items except depreciation are paid in the quarter incurred. 8. Management plans to purchase a truck in the second quarter for $10,000 cash. 9. Hayes makes equal quarterly payments of its estimated annual income taxes. 10. Loans are repaid in the earliest quarter in which there is sufficient cash (that is, when the cash on hand exceeds the $15,000 minimum required balance)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started