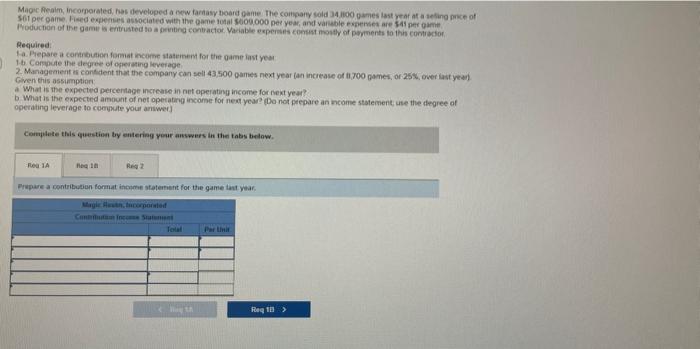

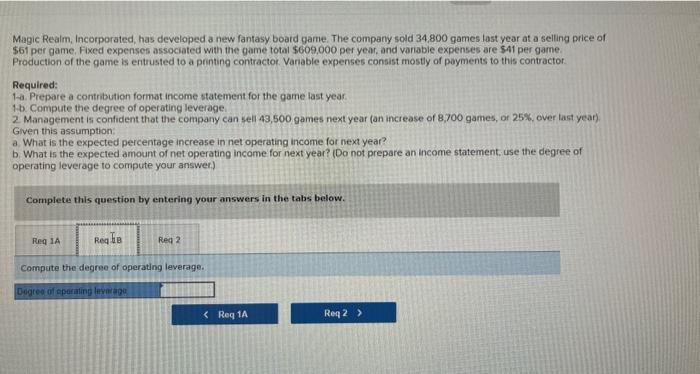

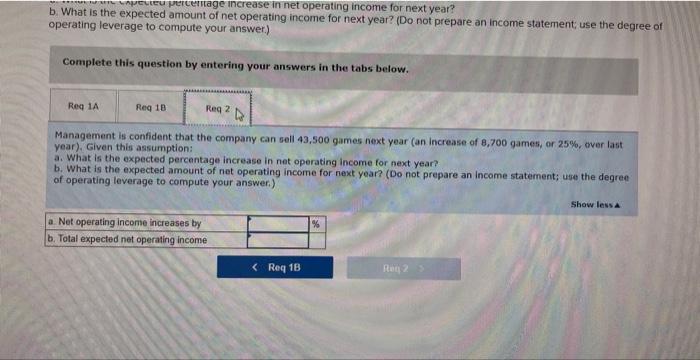

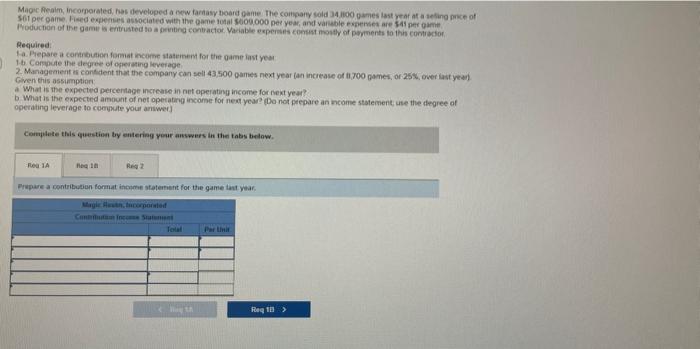

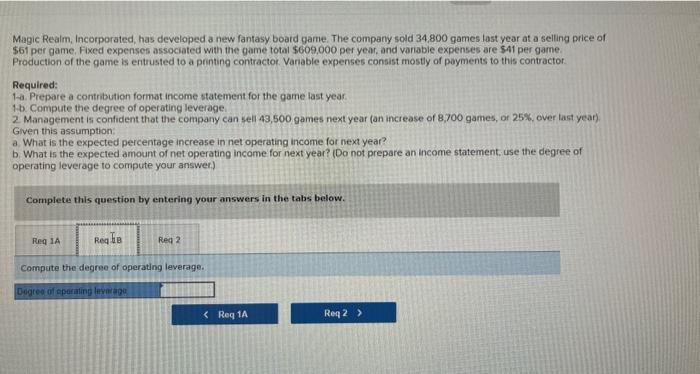

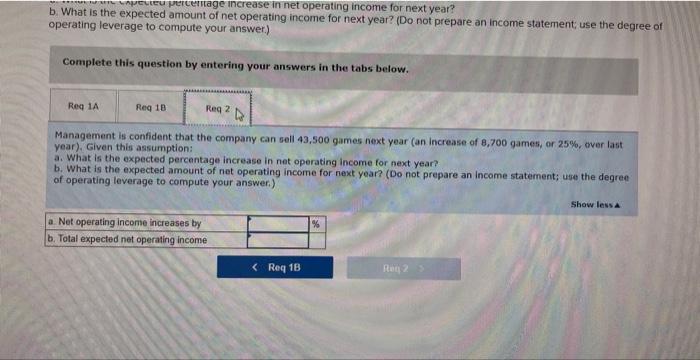

Required: 1. Prepare a conthbution format income satereme for the 0 amen last yed 1. Compute ithe degree of ofierating ieverage 2. Management es contedent that the company can seli 43,500 games next year (an increase of ti,700 games, or.254, over avit yeat Given this assimption: a. What is the expected percertage increase in net operativy incoine for next year? b. What is the expected amount of net opetating income for neat yeare (bo not prepare an ncome statement, use the thegree of operating leverage to coensute your aniwer] Complete this qquetien ty enteriag year answers in the tabs below. Prepare a contributien format incosme statement for the game tast year. Magic Realm, Incorporated, has developed a new fantasy board game. The company sold 34,800 games last year at a selling price of $61 per game. Fixed expenses associated with the game total $609,000 per year, and variabie expenses are $41 per game Production of the game is entrusted to a printing contractor. Varable expenses consist mostly of poyments to this contractor. Required: Ta. Prepare a contribution format income statement for the game last year. 1.b. Compute the degree of operating leverage: 2 Management is confident that the company can sell 43,500 games next year (an increase of 8,700 games, or 25\%, over last year) Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare an income statement, use the degree of operating leverage to compute your answer.) Complete this question by entering your answers in the tabs below. Compute the degree of operating leverage. b. What is the expected amorutage increase in net operating income for next year? operating leverage to compute your answer) operating leverage to compute your answer.) Complete this question by entering your answers in the tabs below. Management is confident that the company can sell 43,500 games next year (an increase of 8,700 games, or 25\%, over last year). Given this assumption: a. What is the expected percentage increase in net operating income for next year? b. What is the expected amount of net operating income for next year? (Do not prepare an income statement; use the degree of operating leverage to compute your answer.)