Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference

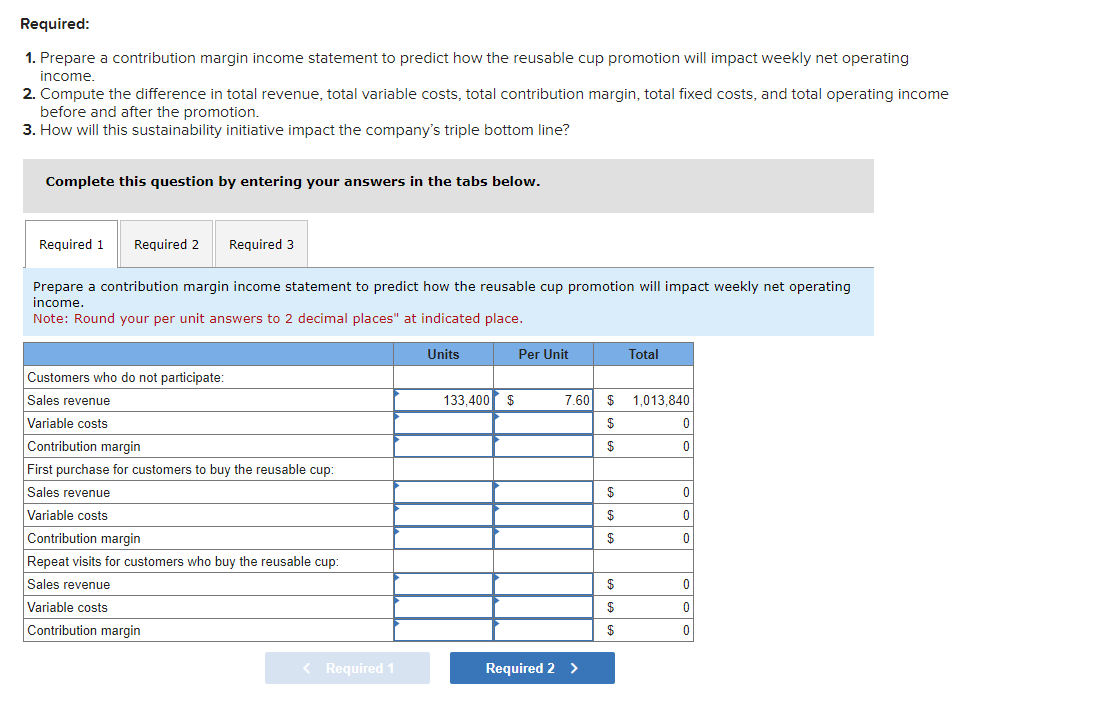

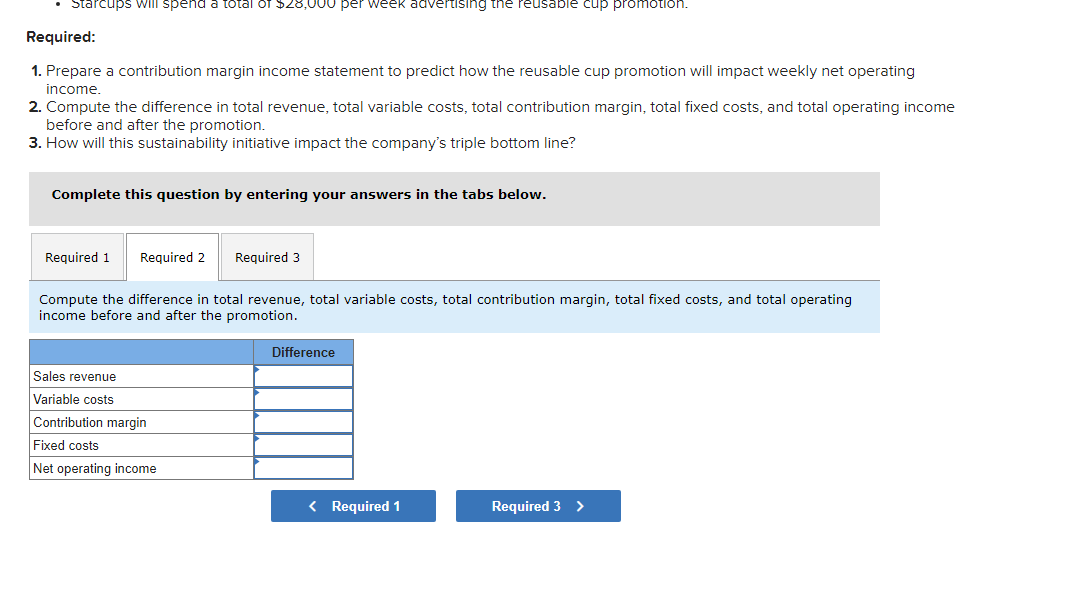

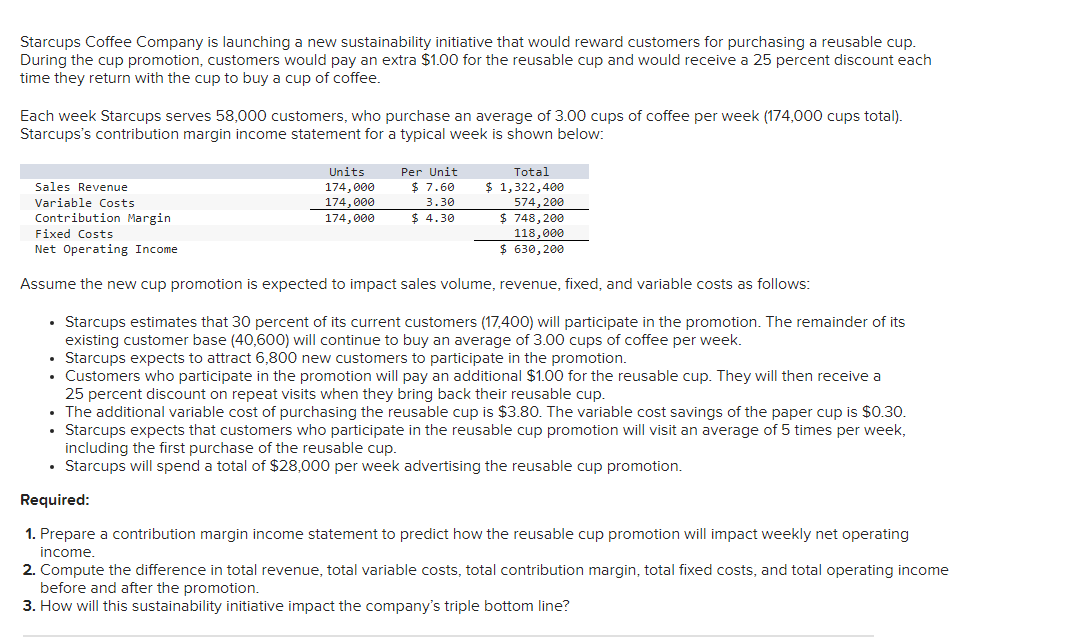

Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line? Complete this question by entering your answers in the tabs below. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating incon before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line? Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. Note: Round your per unit answers to 2 decimal places" at indicated place. Starcups Coffee Company is launching a new sustainability initiative that would reward customers for purchasing a reusable cup. During the cup promotion, customers would pay an extra $1.00 for the reusable cup and would receive a 25 percent discount each time they return with the cup to buy a cup of coffee. Each week Starcups serves 58,000 customers, who purchase an average of 3.00 cups of coffee per week (174,000 cups total). Starcups's contribution margin income statement for a typical week is shown below: Assume the new cup promotion is expected to impact sales volume, revenue, fixed, and variable costs as follows: - Starcups estimates that 30 percent of its current customers (17,400) will participate in the promotion. The remainder of its existing customer base (40,600) will continue to buy an average of 3.00 cups of coffee per week. - Starcups expects to attract 6,800 new customers to participate in the promotion. - Customers who participate in the promotion will pay an additional $1.00 for the reusable cup. They will then receive a 25 percent discount on repeat visits when they bring back their reusable cup. - The additional variable cost of purchasing the reusable cup is $3.80. The variable cost savings of the paper cup is $0.30. - Starcups expects that customers who participate in the reusable cup promotion will visit an average of 5 times per week, including the first purchase of the reusable cup. - Starcups will spend a total of $28,000 per week advertising the reusable cup promotion. Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line

Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line? Complete this question by entering your answers in the tabs below. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating incon before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line? Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. Note: Round your per unit answers to 2 decimal places" at indicated place. Starcups Coffee Company is launching a new sustainability initiative that would reward customers for purchasing a reusable cup. During the cup promotion, customers would pay an extra $1.00 for the reusable cup and would receive a 25 percent discount each time they return with the cup to buy a cup of coffee. Each week Starcups serves 58,000 customers, who purchase an average of 3.00 cups of coffee per week (174,000 cups total). Starcups's contribution margin income statement for a typical week is shown below: Assume the new cup promotion is expected to impact sales volume, revenue, fixed, and variable costs as follows: - Starcups estimates that 30 percent of its current customers (17,400) will participate in the promotion. The remainder of its existing customer base (40,600) will continue to buy an average of 3.00 cups of coffee per week. - Starcups expects to attract 6,800 new customers to participate in the promotion. - Customers who participate in the promotion will pay an additional $1.00 for the reusable cup. They will then receive a 25 percent discount on repeat visits when they bring back their reusable cup. - The additional variable cost of purchasing the reusable cup is $3.80. The variable cost savings of the paper cup is $0.30. - Starcups expects that customers who participate in the reusable cup promotion will visit an average of 5 times per week, including the first purchase of the reusable cup. - Starcups will spend a total of $28,000 per week advertising the reusable cup promotion. Required: 1. Prepare a contribution margin income statement to predict how the reusable cup promotion will impact weekly net operating income. 2. Compute the difference in total revenue, total variable costs, total contribution margin, total fixed costs, and total operating income before and after the promotion. 3. How will this sustainability initiative impact the company's triple bottom line Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started