Answered step by step

Verified Expert Solution

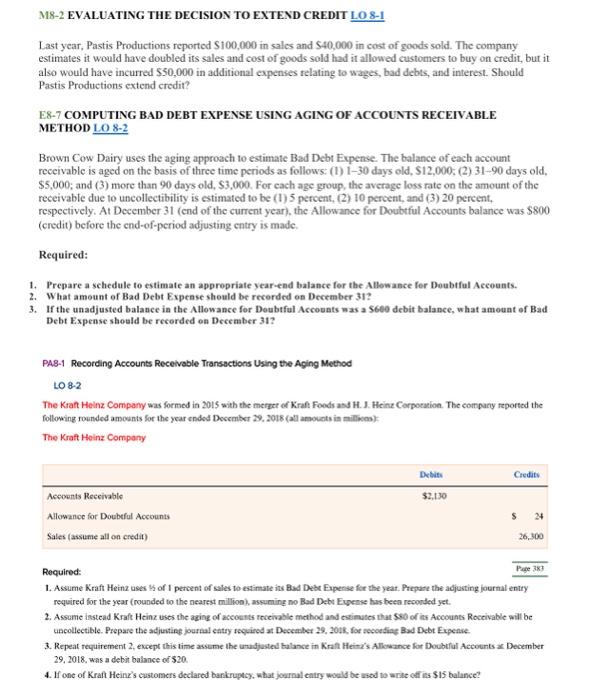

Question

1 Approved Answer

Required 1: Prepare a schedule to estimate an appropriate vear-end balance for the Allowance for Doubtful Accounts. What amount of Bad Debt Expense should be

Required 1:

- Prepare a schedule to estimate an appropriate vear-end balance for the Allowance for Doubtful Accounts.

- What amount of Bad Debt Expense should be recorded on December 31?

- If the unadjusted balance in the Allowance for Doubtful Accounts was a $600 debit balance, what amount of Bad Debt Expense should be recorded on December 31?

Required 2:

- Assume Kraft Heinz uses of 1 percent of sales to estimate its Bad Debt Expense for the year. Prepare the adjusting journal entry required for the year (rounded to the nearest million), assuming no Bad Debt Expense has been recorded yet.

- Assume instead Kraft Heinz uses the aging of accounts receivable method and estimates that $80 of its Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at December 29, 2018, for recording Bad Debt Expense.

- Repeat requirement 2, except this time assume the unadjusted balance in Kraft Heinz's Allowance for Doubtful Accounts at December 29, 2018, was a debit balance of $20.

- If one of Kraft Heinz's customers declared bankruptcy, what journal entry would be used to write off its $15 balance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started