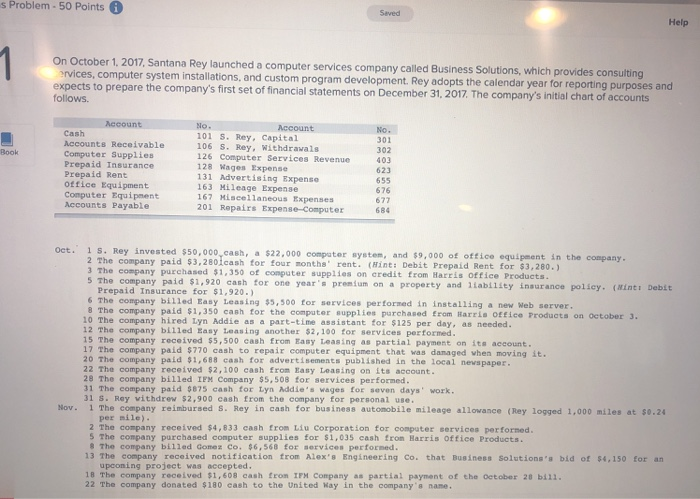

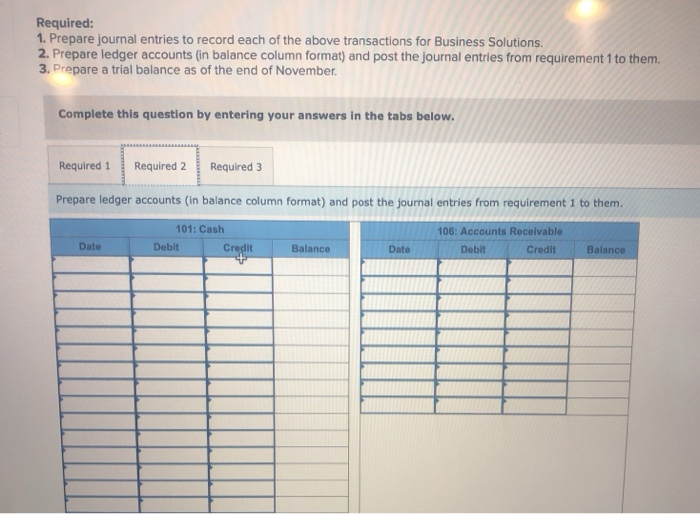

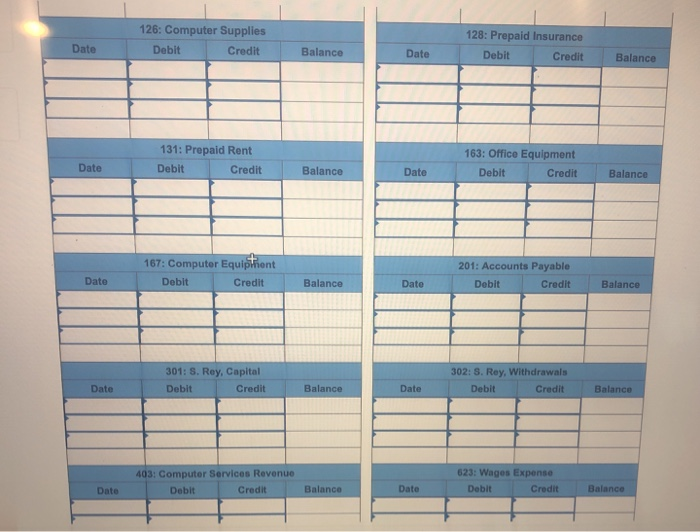

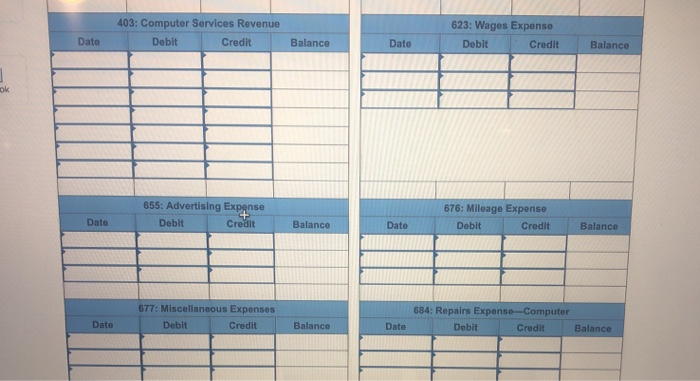

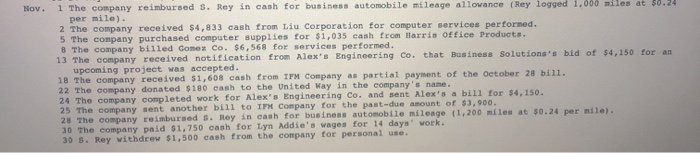

Required: 1. Prepare journal entries to record each of the above transactions for Business Solutions. 2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. 3. Prepare a trial balance as of the end of November. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. 101: Cash 106: Accounts Receivable Date Debit Credit Balance Date Debit Credit Balance 126: Computer Supplies 128: Prepaid Insurance Date Debit Credit Balance Date Debit Credit Balance 131: Prepaid Rent 163: Office Equipment Date Debit Credit Balance Date Debit Credit Balance 167: Computer Equipient 201: Accounts Payable Date Debit Credit Balance Date Debit Credit Balance 301: S. Rey, Capital 302: S. Rey, Withdrawals Credit Balance Date Debit Balance Date Debit Credit 403: Computer Services Revenue 623: Wages Expense Balance Date Debit Credit Balance Credit Date Debit 403: Computer Services Revenue 623: Wages Expense Date Debit Credit Balance Date Debit Credit Balance ok 655: Advertising Expense 676: Mileage Expense Credit Date Debit Balance Date Debit Credit Balance 677: Miscellaneous Expenses 684: Repairs Expense-Computer Date Debit Credit Balance Date Debit Balance Credit 1 The company reimbursed S. Rey in cash for business automobile mileage allowance (Rey logged 1,000 miles at 50.24 per mile). 2 The company received $4,833 cash from Liu Corporation for computer services perforned. 5 The conpany purchased computer supplies for $1,035 cash from Harris Office Products. 8 The company billed Gomez Co. $6,568 for services performed. 13 The company received notification from Alex's Engineering Co. upcoming project was accepted. 18 The company received $1,608 cash from IFM Conpany as partial payment of the October 28 bill. 22 The company donated $180 cash to the United Way in the company's name. 24 The company completed work for Alex's Engineering Co. and sent Alex's a bill for $4,150. 25 The company sent another bill to IFM Company for the past-due amount of $3,900. 28 The company reimbursed s. Rey in cash for business automobile mileage (1,200 miles at $0.24 per mile). 30 The company paid $1,750 cash for Lyn Addie's wages for 14 daye work. 30 S. Rey withdre $1,500 cash from the company for personal use. Nov. that Business Solutions's bid of $4,150 for an