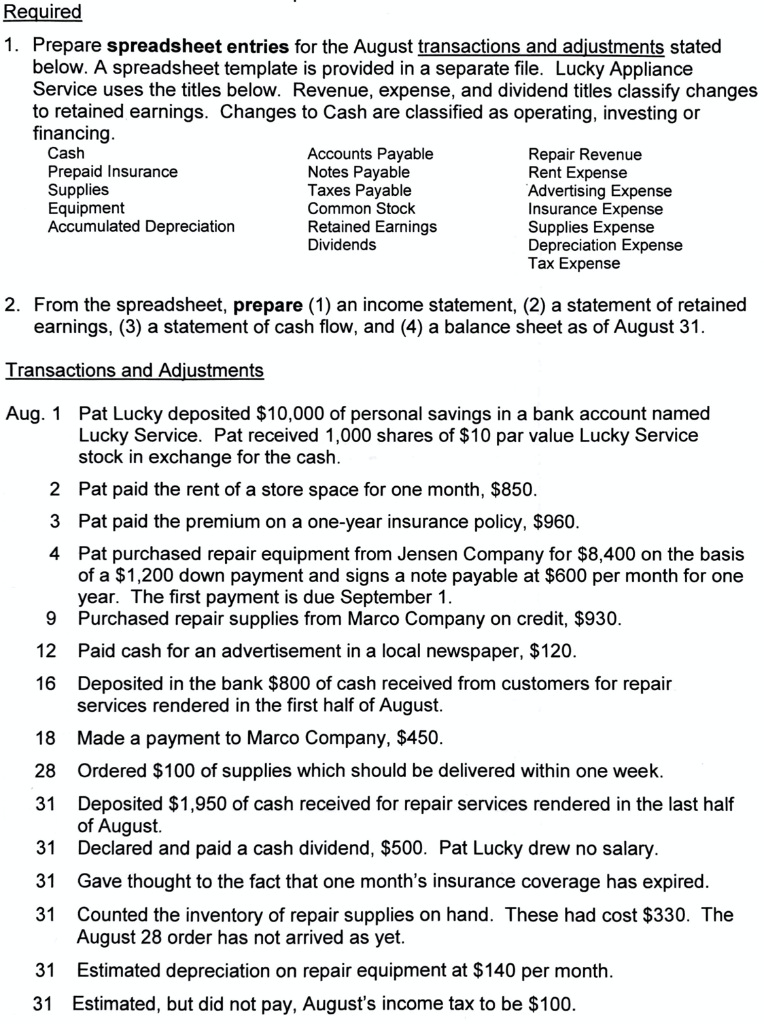

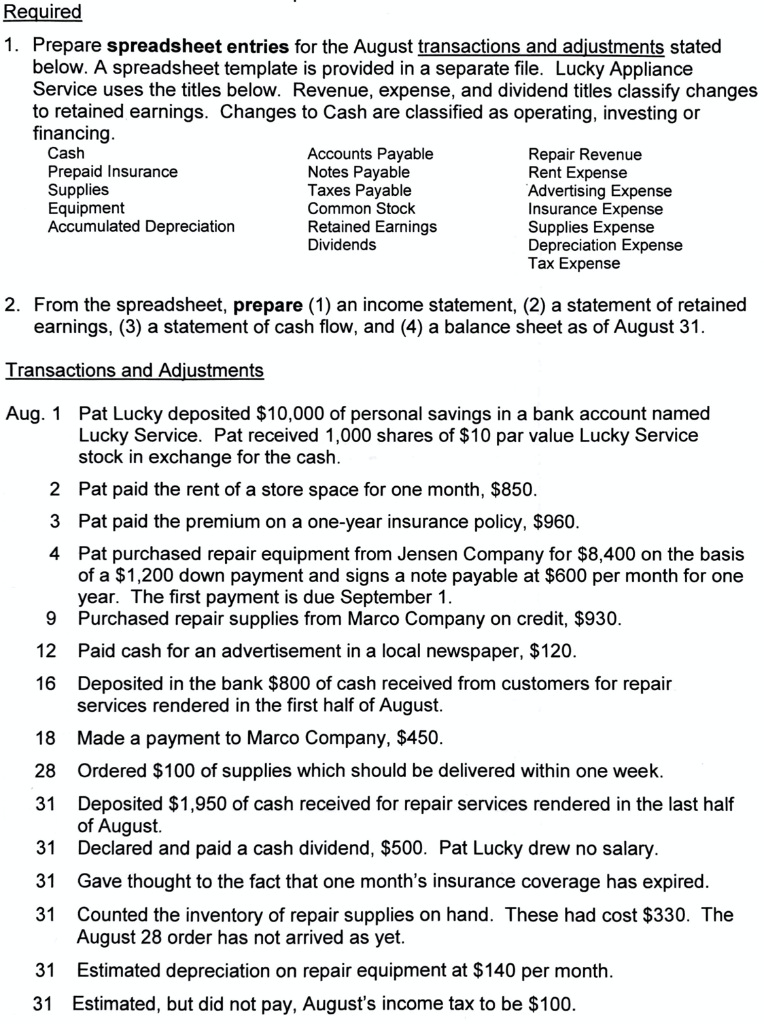

Required 1. Prepare spreadsheet entries for the August transactions and adjustments stated below. A spreadsheet template is provided in a separate file. Lucky Appliance Service uses the titles below. Revenue, expense, and dividend titles classify changes to retained earnings. Changes to Cash are classified as operating, investing or financing Cash Accounts Payable Repair Revenue Prepaid Insurance Notes Payable Rent Expense Supplies Taxes Payable Advertising Expense Equipment Common Stock Insurance Expense Accumulated Depreciation Retained Earnings Supplies Expense Dividends Depreciation Expense Tax Expense 2. From the spreadsheet, prepare (1) an income statement, (2) a statement of retained earnings, (3) a statement of cash flow, and (4) a balance sheet as of August 31. Transactions and Adjustments and sigptember nipany on Aug. 1 Pat Lucky deposited $10,000 of personal savings in a bank account named Lucky Service. Pat received 1,000 shares of $10 par value Lucky Service stock in exchange for the cash. 2 Pat paid the rent of a store space for one month, $850. 3 Pat paid the premium on a one-year insurance policy, $960. 4 Pat purchased repair equipment from Jensen Company for $8,400 on the basis of a $1,200 down payment and signs a note payable at $600 per month for one year. The first payment is due September 1. 9 Purchased repair supplies from Marco Company on credit, $930. 12 Paid cash for an advertisement in a local newspaper, $120. 16 Deposited in the bank $800 of cash received from customers for repair services rendered in the first half of August. 18 Made a payment to Marco Company, $450. 28 Ordered $100 of supplies which should be delivered within one week. 31 Deposited $1,950 of cash received for repair services rendered in the last half of August. 31 Declared and paid a cash dividend, $500. Pat Lucky drew no salary. 31 Gave thought to the fact that one month's insurance coverage has expired. 31 Counted the inventory of repair supplies on hand. These had cost $330. The August 28 order has not arrived as yet. 31 Estimated depreciation on repair equipment at $140 per month. 31 Estimated, but did not pay, August's income tax to be $100