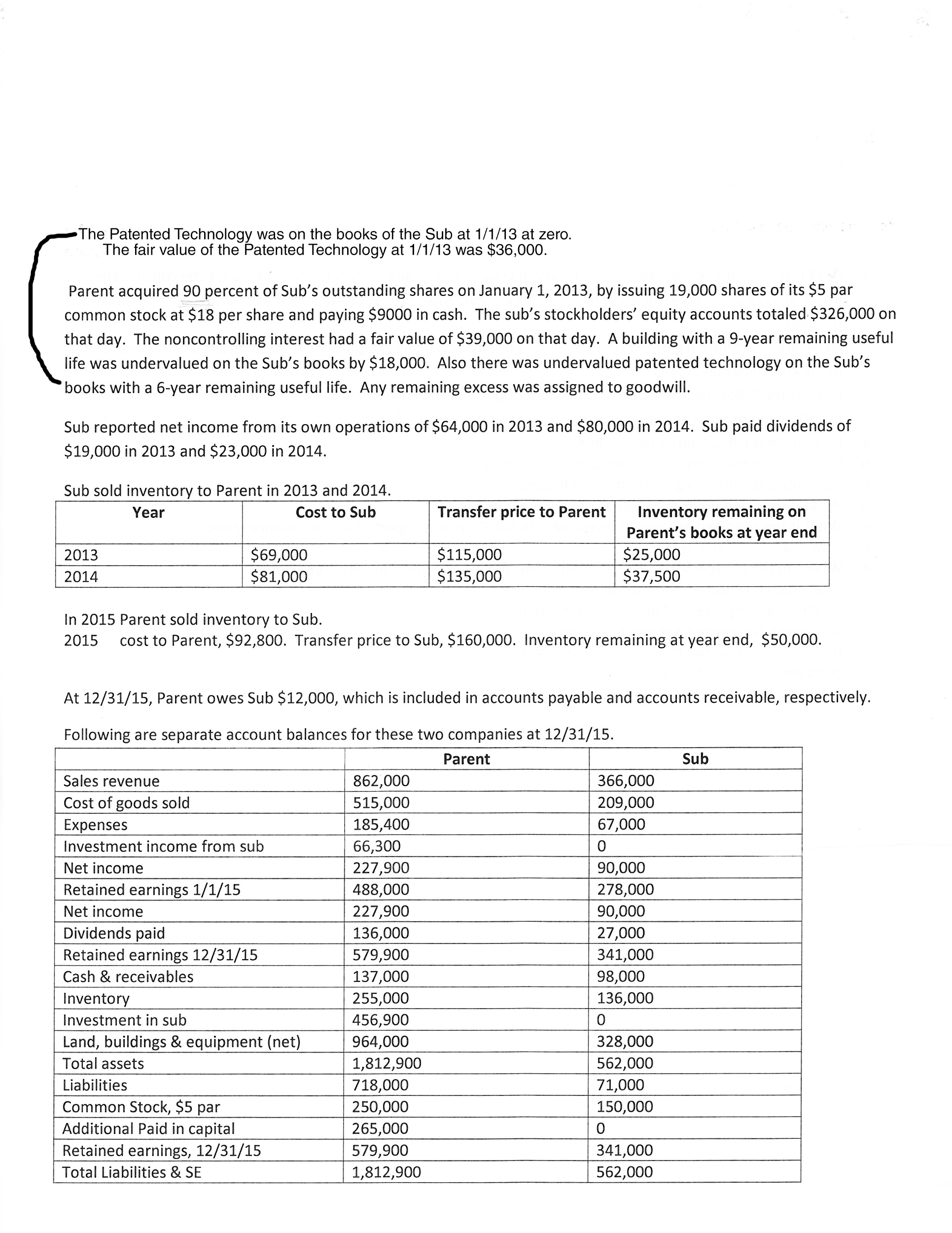

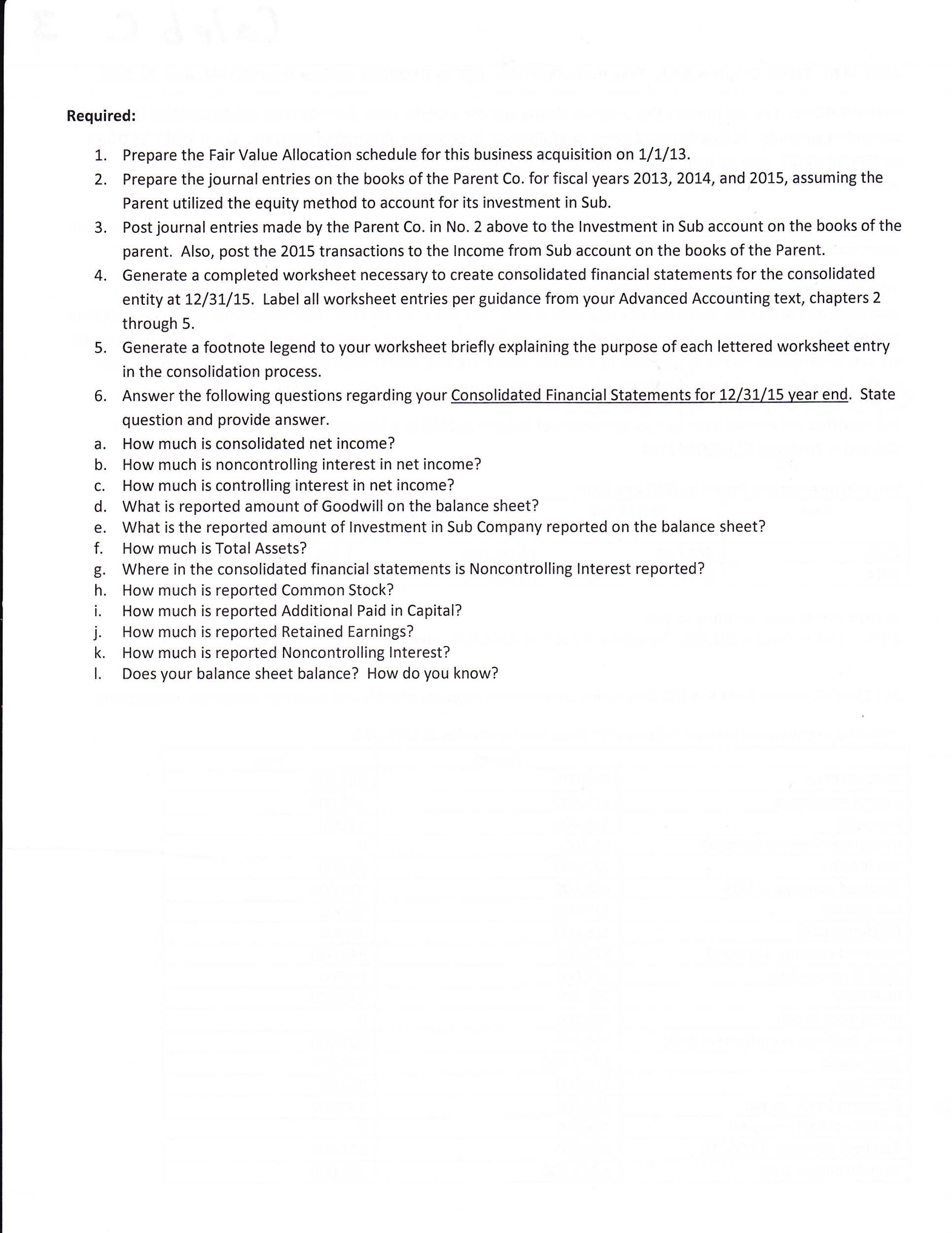

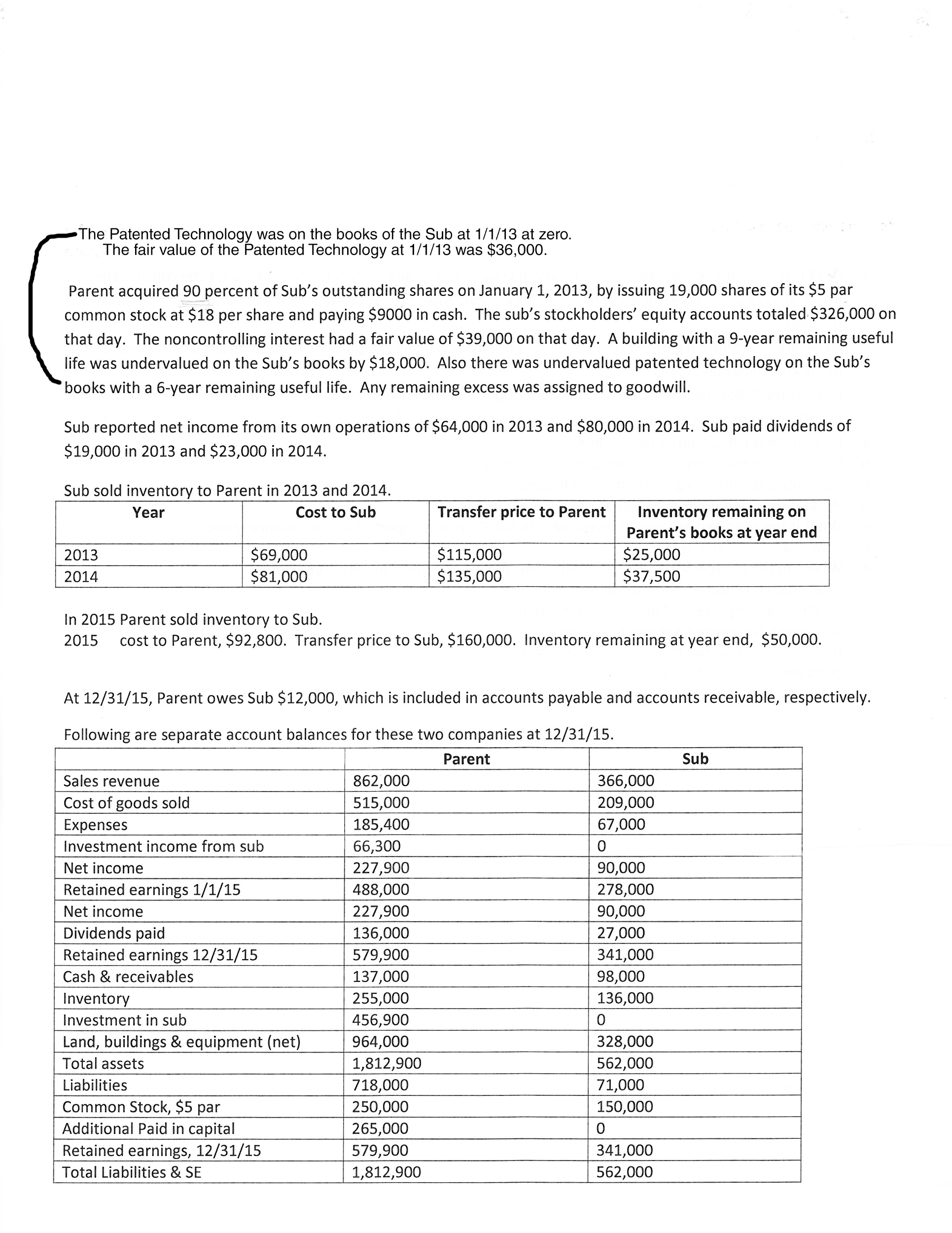

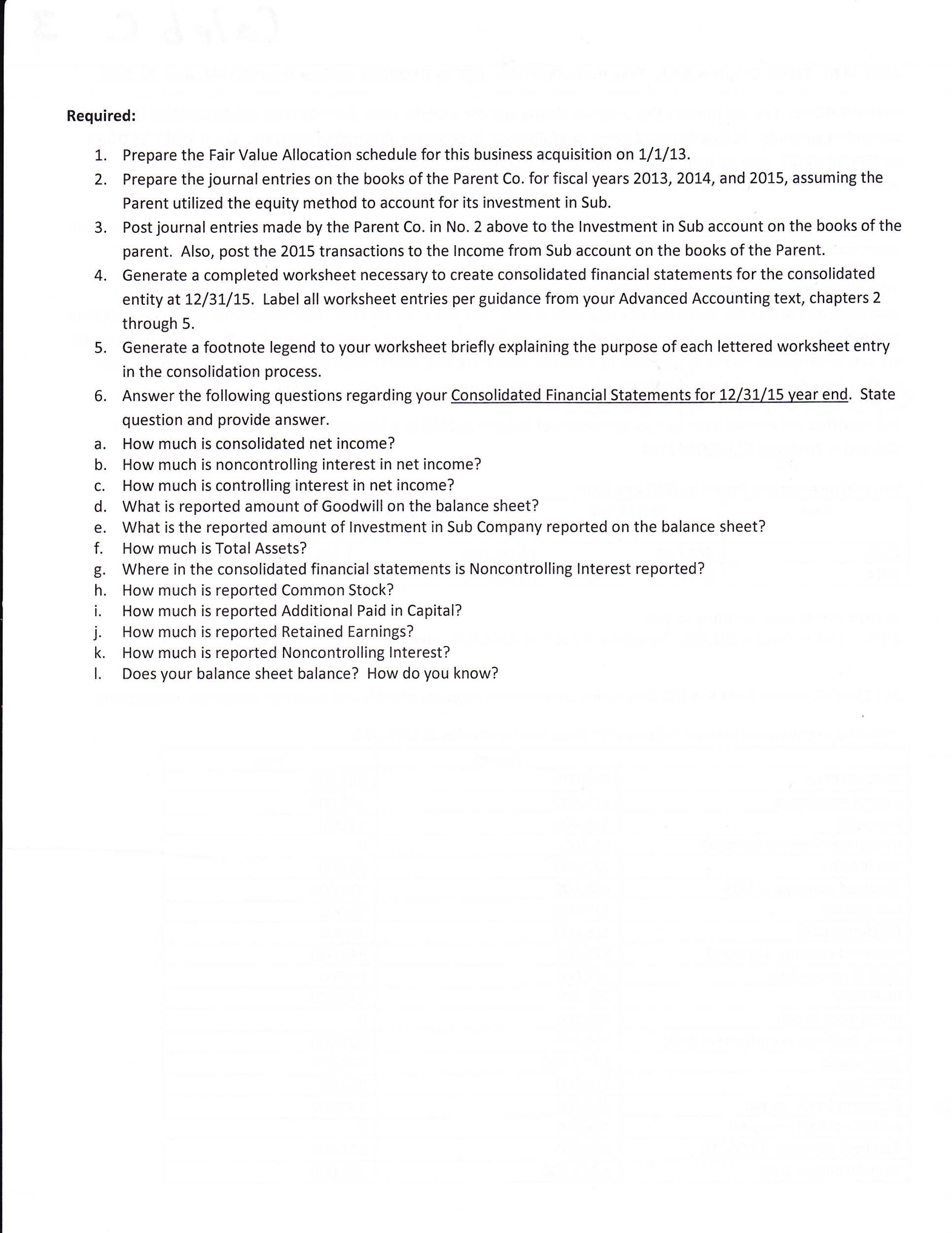

Required: 1. Prepare the Fair Value Allocation schedule for this business acquisition on 1/1/13. 2. Prepare the journal entries on the books of the Parent Co. for fiscal years 2013, 2014, and 2015, assuming the Parent utilized the equity method to account for its investment in Sub. 3. Post journal entries made by the Parent Co. in No. 2 above to the Investment in Sub account on the books of the parent. Also, post the 2015 transactions to the Income from Sub account on the books of the Parent. 4. Generate a completed worksheet necessary to create consolidated financial statements for the consolidated entity at 12/31/15. Label all worksheet entries per guidance from your Advanced Accounting text, chapters 2 through 5. 5. Generate a footnote legend to your worksheet briefly explaining the purpose of each lettered worksheet entry in the consolidation process. 6. Answer the following questions regarding your Consolidated Financial Statements for 12/31/15 year end. State question and provide answer. a. How much is consolidated net income? b. How much is non-controlling interest in net income? C. How much is controlling interest in net income? d. What is reported amount of Goodwill on the balance sheet? e. What is the reported amount of Investment in Sub Company reported on the balance sheet? f. How much is Total Assets? g. Where in the consolidated financial statements is Non-controlling Interest reported? h. How much is reported Common Stock? j. How much is reported Additional Paid in Capital? j. How much is reported Retained Earnings? k. How much is reported Non-controlling Interest? I. Does your balance sheet balance? How do you know? Required: 1. Prepare the Fair Value Allocation schedule for this business acquisition on 1/1/13. 2. Prepare the journal entries on the books of the Parent Co. for fiscal years 2013, 2014, and 2015, assuming the Parent utilized the equity method to account for its investment in Sub. 3. Post journal entries made by the Parent Co. in No. 2 above to the Investment in Sub account on the books of the parent. Also, post the 2015 transactions to the Income from Sub account on the books of the Parent. 4. Generate a completed worksheet necessary to create consolidated financial statements for the consolidated entity at 12/31/15. Label all worksheet entries per guidance from your Advanced Accounting text, chapters 2 through 5. 5. Generate a footnote legend to your worksheet briefly explaining the purpose of each lettered worksheet entry in the consolidation process. 6. Answer the following questions regarding your Consolidated Financial Statements for 12/31/15 year end. State question and provide answer. a. How much is consolidated net income? b. How much is non-controlling interest in net income? C. How much is controlling interest in net income? d. What is reported amount of Goodwill on the balance sheet? e. What is the reported amount of Investment in Sub Company reported on the balance sheet? f. How much is Total Assets? g. Where in the consolidated financial statements is Non-controlling Interest reported? h. How much is reported Common Stock? j. How much is reported Additional Paid in Capital? j. How much is reported Retained Earnings? k. How much is reported Non-controlling Interest? I. Does your balance sheet balance? How do you know