Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Prepare the necessary elimination and consolidation journal entries with respect to A's group financial statements for the year ended 31 December 20x4, using

Required:

1. Prepare the necessary elimination and consolidation journal entries with respect to A's group financial statements for the year ended 31 December 20x4, using the simultaneous method of consolidation.

2. On 1 January 20x5, C acquired 90% of D's share capital. Calculate the total non-controlling interest percentage, both direct and indirect, in D Ltd.

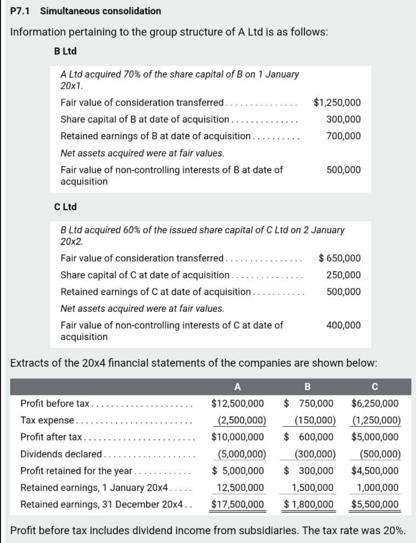

P7.1 Simultaneous consolidation Information pertaining to the group structure of A Ltd is as follows: B Ltd A Ltd acquired 70% of the share capital of B on 1 January 20x1. Fair value of consideration transferred Share capital of B at date of acquisition.. Retained earnings of 8 at date of acquisition. Net assets acquired were at fair values. Fair value of non-controlling interests of B at date of acquisition Retained earnings of C at date of acquisition. Net assets acquired were at fair values. C Ltd B Ltd acquired 60% of the issued share capital of C Ltd on 2 January 20x2. Fair value of consideration transferred. Share capital of C at date of acquisition Fair value of non-controlling interests of C at date of acquisition $1,250,000 300,000 700,000 Profit before tax.. Tax expense.. Profit after tax.. 500,000 (5,000,000) $ 5,000,000 $ 650,000 250,000 500,000 Extracts of the 20x4 financial statements of the companies are shown below: B $750,000 400,000 $12,500,000 (2,500,000) (150,000) $10,000,000 $ 600,000 Dividends declared. Profit retained for the year. Retained earnings, 1 January 20x4 12,500,000 1,500,000 Retained earnings, 31 December 20x4.. $17,500,000 $1,800,000 Profit before tax includes dividend income from subsidiaries. The tax rate was 20%. (300,000) $ 300,000 $6,250,000 (1,250,000) $5,000,000 (500,000) $4,500,000 1,000,000 $5,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 13 If there is excess of proportionate share in net assets of subsidiary company intrinsic of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started