Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Record adjusting entries for the following information. a. The records show that the equipment was estimated to have a total estimated useful life

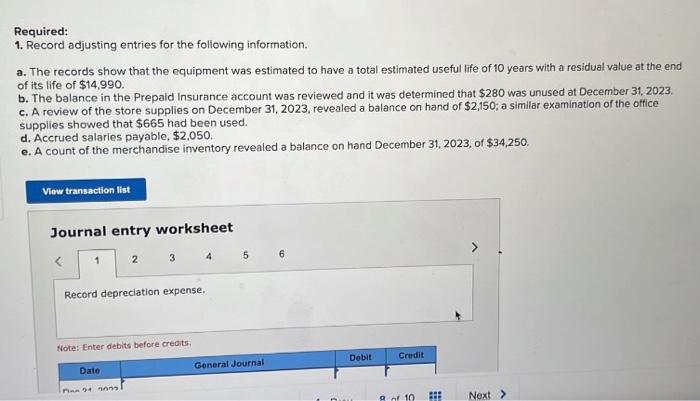

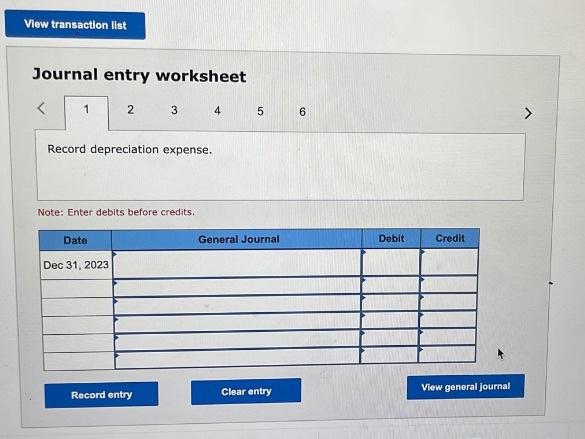

Required:

1. Record adjusting entries for the following information.

a. The records show that the equipment was estimated to have a total estimated useful life of 10 years with a residual value at the end 0.5 points skpped of its life of $14,990.

- The balance in the Prepaid Insurance account was reviewed and it was determined that $280 was unused at December 31, 2023.

- A review of the store supplies on December 31, 2023, revealed a balance on hand of $2,150; a similar examination of the office supplies showed that $665 had been used.

- Accrued salaries payable, $2,050.

- A count of the merchandise inventory revealed a balance on hand December 31, 2023, of $34,250.

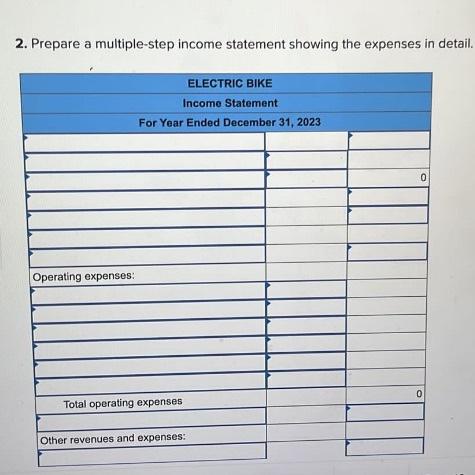

2. Prepare a multiple-step income statement showing the expenses in detail.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started