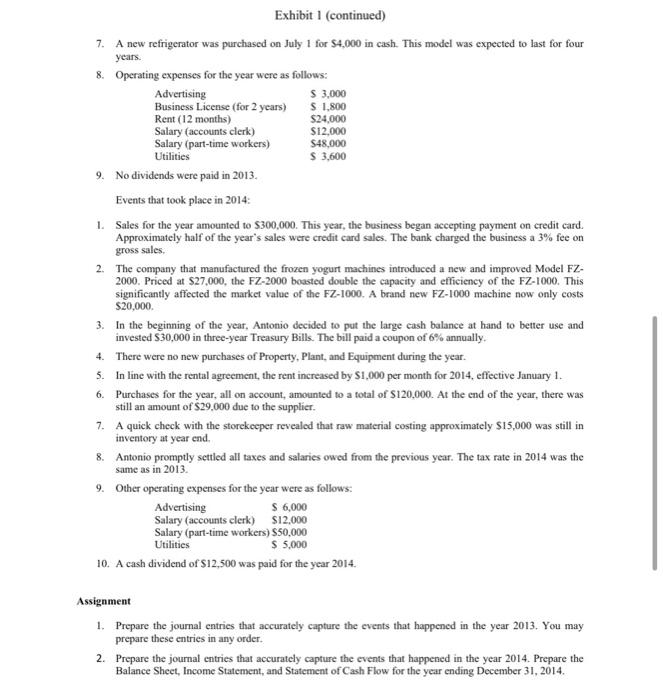

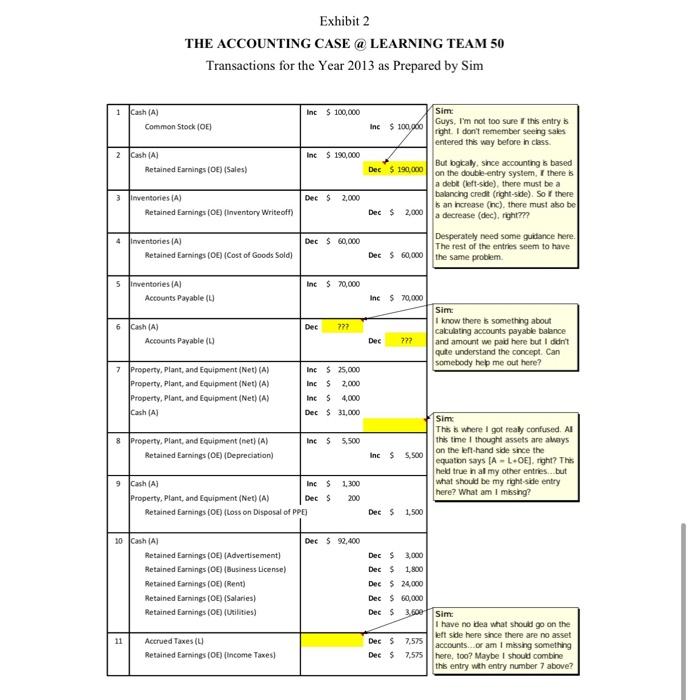

Required 1. Review the work that Sim prepared (Exhibit 1) to address the first assignment question in the case. Help Michelle and Caroline identify the mistakes and make the necessary corrections to Sim's work (Exhibit 2). 2. Help the learning team complete the second assignment question so that they are well prepared for the next day's class discussion. Exhibit 1 THE ACCOUNTING CASE ( LEARNING TEAM 50 The Case Assigned to Learning Team 50 JENNY'S FROYO, INC. Late one November night in 2011, Antonio left the majestic Goldman Sachs Tower in downtown New York for the last time. Wildly successful as an investment banker, he had decided he wanted more time for himself and his family, so he quit. In the previous three months, he had been toying with the idea of starting his own business. The turning point came one fateful day as Antonio was having coffee with Branon, his old friend and MBA learning teammate at the Darden School of Business. Branon, a high-flying consultant with McKinsey and Company, was getting tired of the grueling schedule and travelling required of consultants. What started as Branon's tongue-in-cheek suggestion that they sell frozen yogurt eventually developed into a serious conversation. The inspiration was drawn from the memory of another learning teammate, Jennifer, who made excellent frozen yogurt and brought it to learning team meetings from time to time. It always served as a timely pick-me-up when the going got tough. That thought led Antonio to pick up the phone and call Jennifer on the spot. As it happened, Jennifer had married a billionaire and was bored at home with little to do. When Jennifer offered to share her frozen yogurt recipe and even invest in the start-up, it all came together. It had been two years since the business commenced on January 1, 2013, and business was booming. It was time to prepare the financial statements for the year ending December 31,2014. Branon, CFO of Jenny's Froyo, Inc., was waiting impatiently for the financial statements from their highly unreliable accounts clerk. All attempts to contact him had failed, so Branon decided that he would construct the Balance Sheet, Income Statement, and Statement of Cash Flow himself for the year ending December 31, 2014, in preparation for his meeting with Antonio the next day. As a starting point, Branon retrieved the balance sheet and income statement for the year ending December 31, 2013 (Exhibit A). He could only vaguely remember the events that had taken place during the last two years but jotted them down as follows: Events that took place in 2013: 1. Jennifer invested $60,000 in the business. Antonio and Branon invested $20,000 each. 2. Cash sales during the year amounted to $190,000. 3. The raw materials (milk, cream, yogurt, etc.) were purchased entirely on account from a trusted supplier. 4. During the year, approximately $2,000 worth of milk went bad due to poor refrigeration and had to be written off. 5. The $25,000 machine (Model FZ-1000) required to make the yogurt was purchased with cash on January 1. It was estimated that the FZ-1000 should last the business five years, and that the cost should be allocated equally over that period. 6. The original refrigerator the business used was purchased for $2,000 cash on January 1. By July 1, however, Antonio realized that it was insufficient to keep the milk properly cooled, so he sold it for $1,300 cash. The fridge had a book value of $1,500 at the point of sale. Exhibit 1 (continued) 7. A new refrigerator was purchased on July 1 for $4,000 in cash. This model was expected to last for four years. 8. Operating expenses for the year were as follows: AdvertisingBusinessLicense(for2years)Rent(12months)Salary(accountsclerk)Salary(part-timeworkers)Utilities$3,000$1,800$24,000$12,000$48,000$3,600 9. No dividends were paid in 2013. Events that took place in 2014: 1. Sales for the year amounted to $300,000. This year, the business began accepting payment on credit card. Approximately half of the year's sales were credit card sales. The bank charged the business a 3% fee on gross sales, 2. The company that manufactured the frozen yogurt machines introduced a new and improved Model FZ2000 . Priced at $27,000, the FZ-2000 boasted double the capacity and efficiency of the FZ-1000. This significantly affected the market value of the FZ-1000. A brand new FZ-1000 machine now only costs $20,000. 3. In the beginning of the year, Antonio decided to put the large cash balance at hand to better use and invested $30,000 in three-year Treasury Bills. The bill paid a coupon of 6% annually. 4. There were no new purchases of Property, Plant, and Equipment during the year. 5. In line with the rental agreement, the rent increased by $1,000 per month for 2014, effective January 1 . 6. Purchases for the year, all on account, amounted to a total of $120,000. At the end of the year, there was still an amount of $29,000 due to the supplier. 7. A quick check with the storekeeper revealed that raw material costing approximately $15,000 was still in inventory at year end. 8. Antonio promptly settled all taxes and salaries owed from the previous year. The tax rate in 2014 was the same as in 2013. 9. Other operating expenses for the year were as follows: AdvertisingSalary(accountsclerk)Salary(part-timeworkers)Utilities$6,000$12,000$50,000$5,000 10. A cash dividend of $12,500 was paid for the year 2014. Assignment 1. Prepare the journal entries that accurately capture the events that happened in the year 2013. You may prepare these entries in any order. 2. Prepare the journal entries that accurately capture the events that happened in the year 2014. Prepare the Balance Sheet, Income Statement, and Statement of Cash Flow for the year ending December 31, 2014. Exhibit 1 (continued) Exhibit A JENNY'S FROYO, INC. Balance Sheet and Income Statement THE ACCOUNTING CASE @ LEARNING TEAM 50 Transactions for the Year 2013 as Prepared by Sim 6 Sim: Guys, Im not too sure If this entry is right. I dont remember seeing saks: entered this way before in class. But bgicaly, since accounting is based on the doubie-entry system, I there is a debt (left-sibe), there must be a balancing credit (right-side). So f there is an harease (inc). there must ako be a decrease (dec), righimp? Desperately need some guitance here. The rest of the entries sem to have the same problem. Required 1. Review the work that Sim prepared (Exhibit 1) to address the first assignment question in the case. Help Michelle and Caroline identify the mistakes and make the necessary corrections to Sim's work (Exhibit 2). 2. Help the learning team complete the second assignment question so that they are well prepared for the next day's class discussion. Exhibit 1 THE ACCOUNTING CASE ( LEARNING TEAM 50 The Case Assigned to Learning Team 50 JENNY'S FROYO, INC. Late one November night in 2011, Antonio left the majestic Goldman Sachs Tower in downtown New York for the last time. Wildly successful as an investment banker, he had decided he wanted more time for himself and his family, so he quit. In the previous three months, he had been toying with the idea of starting his own business. The turning point came one fateful day as Antonio was having coffee with Branon, his old friend and MBA learning teammate at the Darden School of Business. Branon, a high-flying consultant with McKinsey and Company, was getting tired of the grueling schedule and travelling required of consultants. What started as Branon's tongue-in-cheek suggestion that they sell frozen yogurt eventually developed into a serious conversation. The inspiration was drawn from the memory of another learning teammate, Jennifer, who made excellent frozen yogurt and brought it to learning team meetings from time to time. It always served as a timely pick-me-up when the going got tough. That thought led Antonio to pick up the phone and call Jennifer on the spot. As it happened, Jennifer had married a billionaire and was bored at home with little to do. When Jennifer offered to share her frozen yogurt recipe and even invest in the start-up, it all came together. It had been two years since the business commenced on January 1, 2013, and business was booming. It was time to prepare the financial statements for the year ending December 31,2014. Branon, CFO of Jenny's Froyo, Inc., was waiting impatiently for the financial statements from their highly unreliable accounts clerk. All attempts to contact him had failed, so Branon decided that he would construct the Balance Sheet, Income Statement, and Statement of Cash Flow himself for the year ending December 31, 2014, in preparation for his meeting with Antonio the next day. As a starting point, Branon retrieved the balance sheet and income statement for the year ending December 31, 2013 (Exhibit A). He could only vaguely remember the events that had taken place during the last two years but jotted them down as follows: Events that took place in 2013: 1. Jennifer invested $60,000 in the business. Antonio and Branon invested $20,000 each. 2. Cash sales during the year amounted to $190,000. 3. The raw materials (milk, cream, yogurt, etc.) were purchased entirely on account from a trusted supplier. 4. During the year, approximately $2,000 worth of milk went bad due to poor refrigeration and had to be written off. 5. The $25,000 machine (Model FZ-1000) required to make the yogurt was purchased with cash on January 1. It was estimated that the FZ-1000 should last the business five years, and that the cost should be allocated equally over that period. 6. The original refrigerator the business used was purchased for $2,000 cash on January 1. By July 1, however, Antonio realized that it was insufficient to keep the milk properly cooled, so he sold it for $1,300 cash. The fridge had a book value of $1,500 at the point of sale. Exhibit 1 (continued) 7. A new refrigerator was purchased on July 1 for $4,000 in cash. This model was expected to last for four years. 8. Operating expenses for the year were as follows: AdvertisingBusinessLicense(for2years)Rent(12months)Salary(accountsclerk)Salary(part-timeworkers)Utilities$3,000$1,800$24,000$12,000$48,000$3,600 9. No dividends were paid in 2013. Events that took place in 2014: 1. Sales for the year amounted to $300,000. This year, the business began accepting payment on credit card. Approximately half of the year's sales were credit card sales. The bank charged the business a 3% fee on gross sales, 2. The company that manufactured the frozen yogurt machines introduced a new and improved Model FZ2000 . Priced at $27,000, the FZ-2000 boasted double the capacity and efficiency of the FZ-1000. This significantly affected the market value of the FZ-1000. A brand new FZ-1000 machine now only costs $20,000. 3. In the beginning of the year, Antonio decided to put the large cash balance at hand to better use and invested $30,000 in three-year Treasury Bills. The bill paid a coupon of 6% annually. 4. There were no new purchases of Property, Plant, and Equipment during the year. 5. In line with the rental agreement, the rent increased by $1,000 per month for 2014, effective January 1 . 6. Purchases for the year, all on account, amounted to a total of $120,000. At the end of the year, there was still an amount of $29,000 due to the supplier. 7. A quick check with the storekeeper revealed that raw material costing approximately $15,000 was still in inventory at year end. 8. Antonio promptly settled all taxes and salaries owed from the previous year. The tax rate in 2014 was the same as in 2013. 9. Other operating expenses for the year were as follows: AdvertisingSalary(accountsclerk)Salary(part-timeworkers)Utilities$6,000$12,000$50,000$5,000 10. A cash dividend of $12,500 was paid for the year 2014. Assignment 1. Prepare the journal entries that accurately capture the events that happened in the year 2013. You may prepare these entries in any order. 2. Prepare the journal entries that accurately capture the events that happened in the year 2014. Prepare the Balance Sheet, Income Statement, and Statement of Cash Flow for the year ending December 31, 2014. Exhibit 1 (continued) Exhibit A JENNY'S FROYO, INC. Balance Sheet and Income Statement THE ACCOUNTING CASE @ LEARNING TEAM 50 Transactions for the Year 2013 as Prepared by Sim 6 Sim: Guys, Im not too sure If this entry is right. I dont remember seeing saks: entered this way before in class. But bgicaly, since accounting is based on the doubie-entry system, I there is a debt (left-sibe), there must be a balancing credit (right-side). So f there is an harease (inc). there must ako be a decrease (dec), righimp? Desperately need some guitance here. The rest of the entries sem to have the same