Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1) The provided information to compute the Sharpe ratio before and after October, 1987 (assume the risk-free rate is 0.25%). 2) Can we use

Required:

1) The provided information to compute the Sharpe ratio before and after October, 1987 (assume the risk-free rate is 0.25%).

2) Can we use central limit theory to approximate the sampling distributions of these Sharpe ratios?

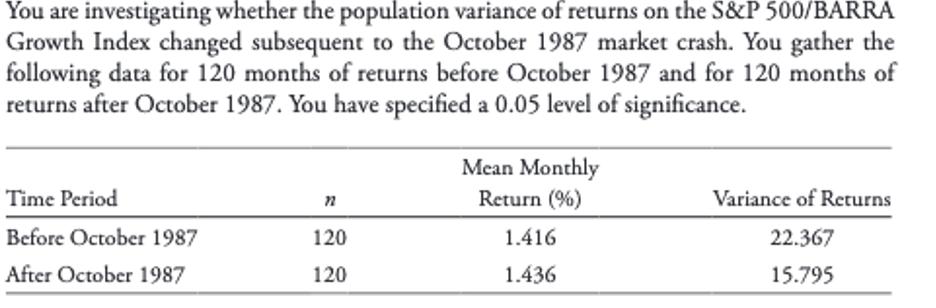

You are investigating whether the population variance of returns on the S&P 500/BARRA Growth Index changed subsequent to the October 1987 market crash. You gather the following data for 120 months of returns before October 1987 and for 120 months of returns after October 1987. You have specified a 0.05 level of significance. Time Period Before October 1987 After October 1987 120 120 Mean Monthly Return (%) 1.416 1.436 Variance of Returns 22.367 15.795

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1To compute the Sharpe ratio we need to use the formula Sharpe ratio Mean return Riskfree rate Stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started