Question

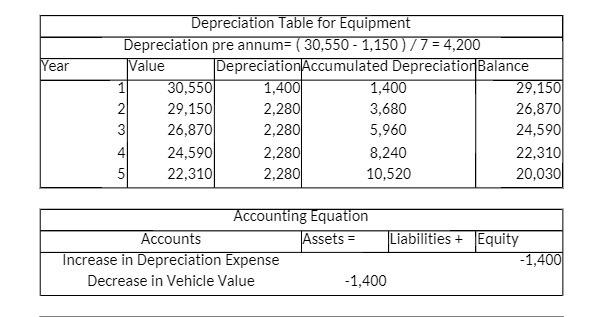

Why is the depreciation expense listed as 2280 rather than the 4200 from the equation, and why is 1400 listed as a negative? Year Depreciation

Why is the depreciation expense listed as 2280 rather than the 4200 from the equation, and why is 1400 listed as a negative?

Year Depreciation Table for Equipment Depreciation pre annum= (30,550-1,150)/7 = 4,200 Value 1 2 N 3 4 5 30,550 29,150 26,870 24,590 22,310 Depreciation Accumulated Depreciation Balance 1,400 2,280 2,280 2,280 2,280 Accounting Equation Assets = Accounts Increase in Depreciation Expense Decrease in Vehicle Value 1,400 3,680 5,960 8,240 10,520 -1,400 29,150 26,870 24,590 22,310 20,030 Liabilities+ Equity -1,400

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Using Financial Accounting Information The Alternative to Debits and Credits

Authors: Gary A. Porter, Curtis L. Norton

8th edition

1111534918, 978-1111534912

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App