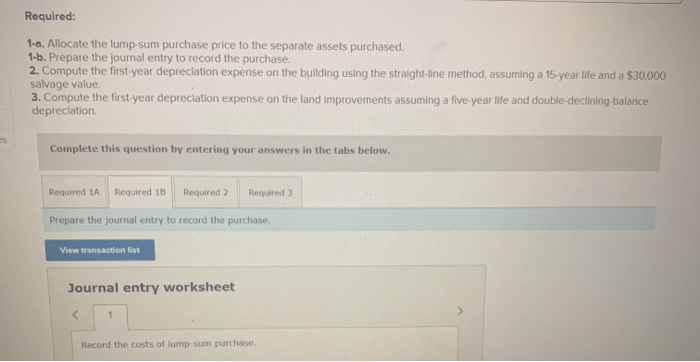

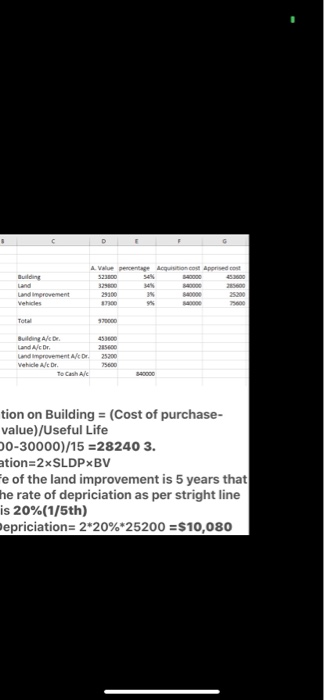

Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation es Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet 1 > Record the costs of lump-sum purchase. D G Building Land improvement Vehicles A Value percentage Acquisition cost apprised cost 523100 SAN 000 32900 23100 340000 Total 370000 Building Alcor Land A/c Dr and improvement A/c Dr Vehicle A/c Dr. To Cash Ale 25300 75000 tion on Building = (Cost of purchase- value)/Useful Life 00-30000)/15 =28240 3. ation=2xSLDPxBV e of the land improvement is 5 years that he rate of depriciation as per stright line is 20%(1/5th) epriciation=2*20%*25200 = $10,080 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining balance depreciation es Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Prepare the journal entry to record the purchase. View transaction list Journal entry worksheet 1 > Record the costs of lump-sum purchase. D G Building Land improvement Vehicles A Value percentage Acquisition cost apprised cost 523100 SAN 000 32900 23100 340000 Total 370000 Building Alcor Land A/c Dr and improvement A/c Dr Vehicle A/c Dr. To Cash Ale 25300 75000 tion on Building = (Cost of purchase- value)/Useful Life 00-30000)/15 =28240 3. ation=2xSLDPxBV e of the land improvement is 5 years that he rate of depriciation as per stright line is 20%(1/5th) epriciation=2*20%*25200 = $10,080