Required:

2. Compose an executive summary addressing the reporting issues in Zodiaks 2020 income statement and balance sheet to conform to generally accepted accounting principles.

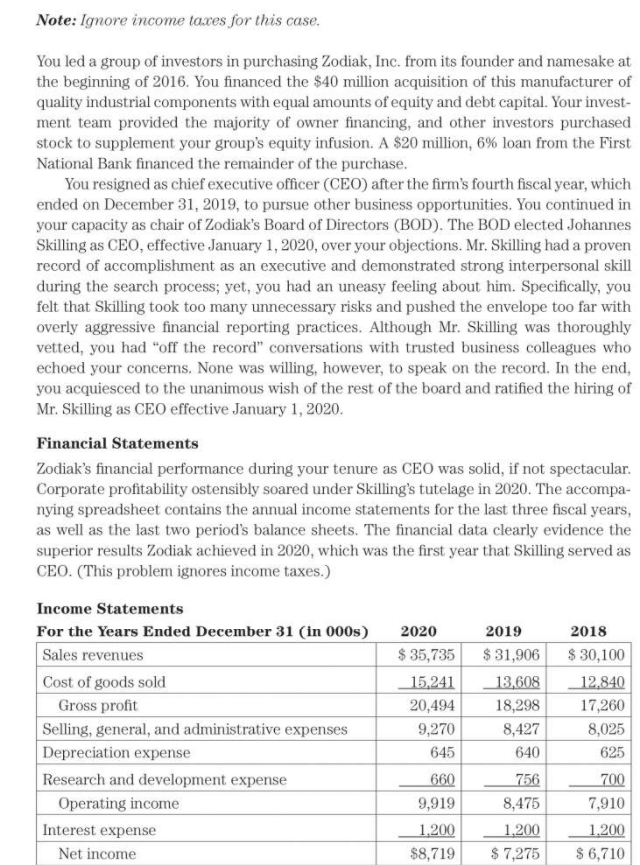

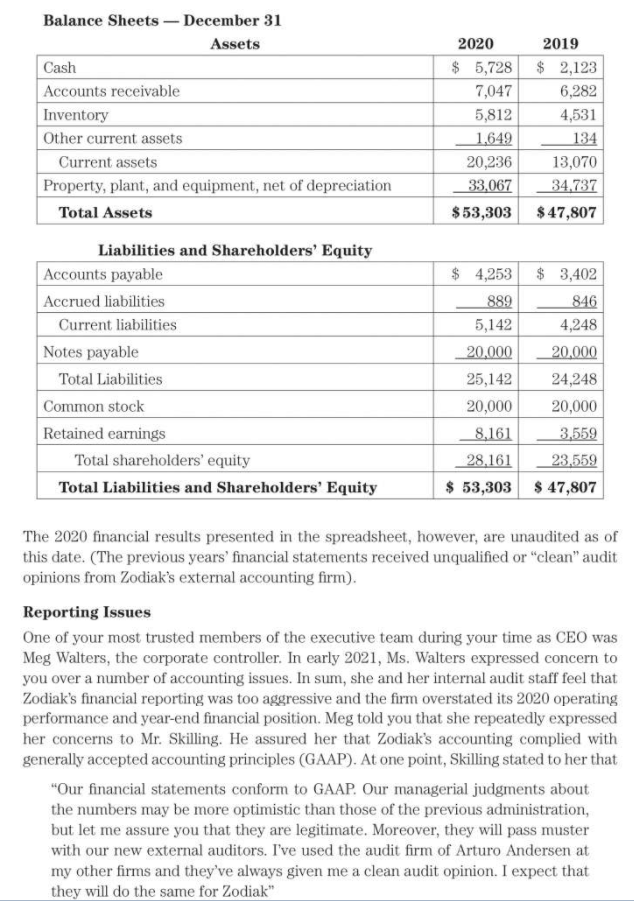

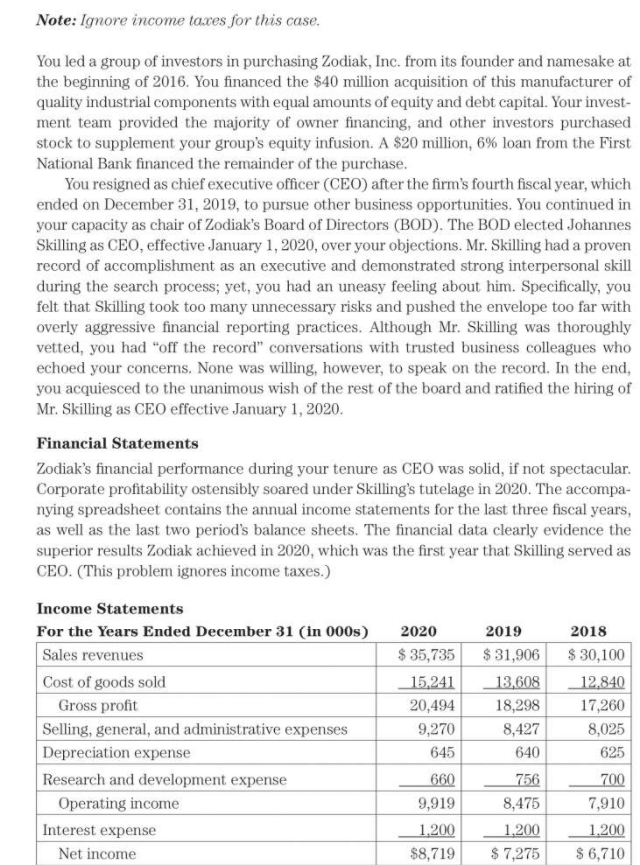

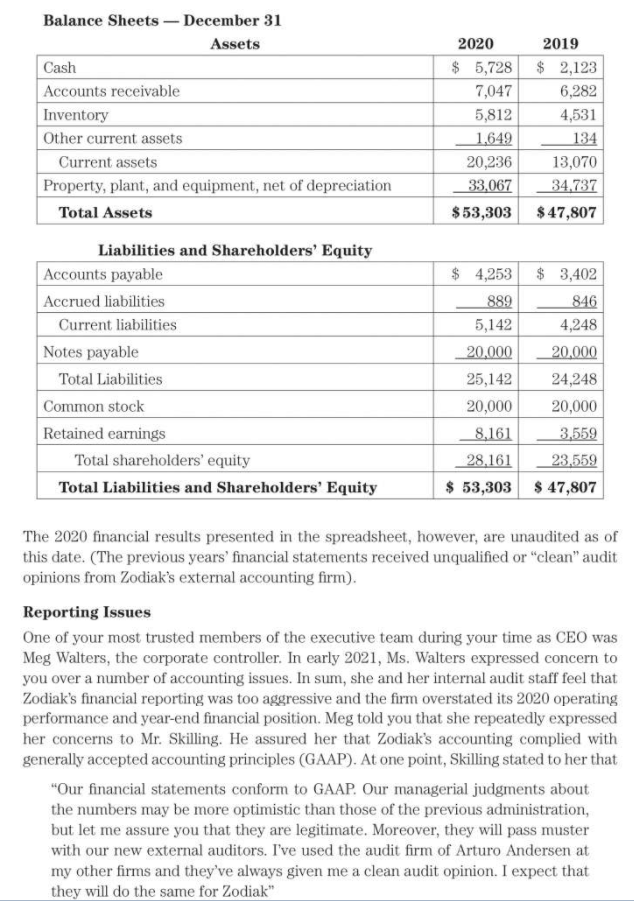

Note: Ignore income taxes for this case. You led a group of investors in purchasing Zodiak, Inc. from its founder and namesake at the beginning of 2016. You financed the $40 million acquisition of this manufacturer of quality industrial components with equal amounts of equity and debt capital. Your invest- ment team provided the majority of owner financing, and other investors purchased stock to supplement your group's equity infusion. A $20 million, 6% loan from the First National Bank financed the remainder of the purchase. You resigned as chief executive officer (CEO) after the firm's fourth fiscal year, which ended on December 31, 2019, to pursue other business opportunities. You continued in your capacity as chair of Zodiak's Board of Directors (BOD). The BOD elected Johannes Skilling as CEO, effective January 1, 2020, over your objections. Mr. Skilling had a proven record of accomplishment as an executive and demonstrated strong interpersonal skill during the search process; yet, you had an uneasy feeling about him. Specifically, you felt that Skilling took too many unnecessary risks and pushed the envelope too far with overly aggressive financial reporting practices. Although Mr. Skilling was thoroughly vetted, you had "off the record conversations with trusted business colleagues who echoed your concerns. None was willing, however, to speak on the record. In the end, you acquiesced to the unanimous wish of the rest of the board and ratified the hiring of Mr. Skilling as CEO effective January 1, 2020. Financial Statements Zodiak's financial performance during your tenure as CEO was solid, if not spectacular. Corporate profitability ostensibly soared under Skilling's tutelage in 2020. The accompa- nying spreadsheet contains the annual income statements for the last three fiscal years, as well as the last two period's balance sheets. The financial data clearly evidence the superior results Zodiak achieved in 2020, which was the first year that Skilling served as CEO. (This problem ignores income taxes.) Income Statements For the Years Ended December 31 (in 000s) Sales revenues Cost of goods sold Gross profit Selling, general, and administrative expenses Depreciation expense Research and development expense Operating income Interest expense Net income 2020 $ 35,735 15,241 20,494 9,270 645 660 9,919 1,200 $8,719 2019 $ 31,906 13,608 18,298 8,427 640 2018 $ 30,100 12.840 17,260 8,025 625 756 8,475 1.200 $ 7,275 700 7,910 1.200 $ 6,710 Balance Sheets - December 31 Assets Cash Accounts receivable Inventory Other current assets Current assets Property, plant, and equipment, net of depreciation Total Assets 2020 2019 $ 5,728 $ 2,123 7,047 6,282 5,812 4,531 1,649 134 20,236 13,070 33,067 34.737 $53,303 $ 47,807 Liabilities and Shareholders' Equity Accounts payable Accrued liabilities Current liabilities Notes payable Total Liabilities Common stock Retained earnings Total shareholders' equity Total Liabilities and Shareholders' Equity $ 4,253 $ 3,402 889 846 5,142 4,248 20.000 20.000 25,142 24,248 20,000 20,000 8.161 3,559 28,161 23,559 $ 53,303 $ 47,807 The 2020 financial results presented in the spreadsheet, however, are unaudited as of this date. The previous years' financial statements received unqualified or clean" audit opinions from Zodiak's external accounting firm). Reporting Issues One of your most trusted members of the executive team during your time as CEO was Meg Walters, the corporate controller. In early 2021, Ms. Walters expressed concern to you over a number of accounting issues. In sum, she and her internal audit staff feel that Zodiak's financial reporting was too aggressive and the firm overstated its 2020 operating performance and year-end financial position. Meg told you that she repeatedly expressed her concerns to Mr. Skilling. He assured her that Zodiak's accounting complied with generally accepted accounting principles (GAAP). At one point, Skilling stated to her that "Our financial statements conform to GAAP. Our managerial judgments about the numbers may be more optimistic than those of the previous administration, but let me assure you that they are legitimate. Moreover, they will pass muster with our new external auditors. I've used the audit firm of Arturo Andersen at my other firms and they've always given me a clean audit opinion. I expect that they will do the same for Zodiak" Two areas particularly concerned Ms. Walters: The company booked revenues of $2 million when it shipped product to some of its regular customers at end of 2020. Zodiak reported these sales even though the customers had not ordered the goods. Skilling stated that the sales would "help" the 2020 numbers. In addition, Zodiak's sales force told the Introduction to Accounting and Finance recipients that they could return the goods in 2021 if they didn't want them. The firm made no provision for any returns of these sales. Ms. Walters firmly believed that the customers would return the $2 million of goods in 2021. She knows that Zodiak could sell the goods to other customers when the customers return them. Meg further notes that Zodiak's cost of goods sold have traditionally been 42.65% of sales revenues. Zodiak added the $1 million cost of corporate reorganization to the balance of its property, plant, and equipment account. Mr. Skilling opined that the restructuring would benefit the firm for at least the next ten years. "And besides," he said, We recognized 10% of that restructuring cost as a depreciation expense in 2020." Meg believed that the total cost of reorganizing the company should be recorded as a 2020 expense because it was a necessary cost of doing business in that year. You are very concerned about the issues that Ms. Walters presented to you. You would like to bring them to the full Board's attention. In order to do so, you charge Ms. Walters with two tasks: Required: 1. Recast Zodiak's 2020 income statement and balance sheet to conform to generally accepted accounting principles. 2. Compose an executive summary addressing the issues in your calculations and comment on the firm's 2020 financial performance and its financial position as of December 31, 2020. Note: Ignore income taxes for this case. You led a group of investors in purchasing Zodiak, Inc. from its founder and namesake at the beginning of 2016. You financed the $40 million acquisition of this manufacturer of quality industrial components with equal amounts of equity and debt capital. Your invest- ment team provided the majority of owner financing, and other investors purchased stock to supplement your group's equity infusion. A $20 million, 6% loan from the First National Bank financed the remainder of the purchase. You resigned as chief executive officer (CEO) after the firm's fourth fiscal year, which ended on December 31, 2019, to pursue other business opportunities. You continued in your capacity as chair of Zodiak's Board of Directors (BOD). The BOD elected Johannes Skilling as CEO, effective January 1, 2020, over your objections. Mr. Skilling had a proven record of accomplishment as an executive and demonstrated strong interpersonal skill during the search process; yet, you had an uneasy feeling about him. Specifically, you felt that Skilling took too many unnecessary risks and pushed the envelope too far with overly aggressive financial reporting practices. Although Mr. Skilling was thoroughly vetted, you had "off the record conversations with trusted business colleagues who echoed your concerns. None was willing, however, to speak on the record. In the end, you acquiesced to the unanimous wish of the rest of the board and ratified the hiring of Mr. Skilling as CEO effective January 1, 2020. Financial Statements Zodiak's financial performance during your tenure as CEO was solid, if not spectacular. Corporate profitability ostensibly soared under Skilling's tutelage in 2020. The accompa- nying spreadsheet contains the annual income statements for the last three fiscal years, as well as the last two period's balance sheets. The financial data clearly evidence the superior results Zodiak achieved in 2020, which was the first year that Skilling served as CEO. (This problem ignores income taxes.) Income Statements For the Years Ended December 31 (in 000s) Sales revenues Cost of goods sold Gross profit Selling, general, and administrative expenses Depreciation expense Research and development expense Operating income Interest expense Net income 2020 $ 35,735 15,241 20,494 9,270 645 660 9,919 1,200 $8,719 2019 $ 31,906 13,608 18,298 8,427 640 2018 $ 30,100 12.840 17,260 8,025 625 756 8,475 1.200 $ 7,275 700 7,910 1.200 $ 6,710 Balance Sheets - December 31 Assets Cash Accounts receivable Inventory Other current assets Current assets Property, plant, and equipment, net of depreciation Total Assets 2020 2019 $ 5,728 $ 2,123 7,047 6,282 5,812 4,531 1,649 134 20,236 13,070 33,067 34.737 $53,303 $ 47,807 Liabilities and Shareholders' Equity Accounts payable Accrued liabilities Current liabilities Notes payable Total Liabilities Common stock Retained earnings Total shareholders' equity Total Liabilities and Shareholders' Equity $ 4,253 $ 3,402 889 846 5,142 4,248 20.000 20.000 25,142 24,248 20,000 20,000 8.161 3,559 28,161 23,559 $ 53,303 $ 47,807 The 2020 financial results presented in the spreadsheet, however, are unaudited as of this date. The previous years' financial statements received unqualified or clean" audit opinions from Zodiak's external accounting firm). Reporting Issues One of your most trusted members of the executive team during your time as CEO was Meg Walters, the corporate controller. In early 2021, Ms. Walters expressed concern to you over a number of accounting issues. In sum, she and her internal audit staff feel that Zodiak's financial reporting was too aggressive and the firm overstated its 2020 operating performance and year-end financial position. Meg told you that she repeatedly expressed her concerns to Mr. Skilling. He assured her that Zodiak's accounting complied with generally accepted accounting principles (GAAP). At one point, Skilling stated to her that "Our financial statements conform to GAAP. Our managerial judgments about the numbers may be more optimistic than those of the previous administration, but let me assure you that they are legitimate. Moreover, they will pass muster with our new external auditors. I've used the audit firm of Arturo Andersen at my other firms and they've always given me a clean audit opinion. I expect that they will do the same for Zodiak" Two areas particularly concerned Ms. Walters: The company booked revenues of $2 million when it shipped product to some of its regular customers at end of 2020. Zodiak reported these sales even though the customers had not ordered the goods. Skilling stated that the sales would "help" the 2020 numbers. In addition, Zodiak's sales force told the Introduction to Accounting and Finance recipients that they could return the goods in 2021 if they didn't want them. The firm made no provision for any returns of these sales. Ms. Walters firmly believed that the customers would return the $2 million of goods in 2021. She knows that Zodiak could sell the goods to other customers when the customers return them. Meg further notes that Zodiak's cost of goods sold have traditionally been 42.65% of sales revenues. Zodiak added the $1 million cost of corporate reorganization to the balance of its property, plant, and equipment account. Mr. Skilling opined that the restructuring would benefit the firm for at least the next ten years. "And besides," he said, We recognized 10% of that restructuring cost as a depreciation expense in 2020." Meg believed that the total cost of reorganizing the company should be recorded as a 2020 expense because it was a necessary cost of doing business in that year. You are very concerned about the issues that Ms. Walters presented to you. You would like to bring them to the full Board's attention. In order to do so, you charge Ms. Walters with two tasks: Required: 1. Recast Zodiak's 2020 income statement and balance sheet to conform to generally accepted accounting principles. 2. Compose an executive summary addressing the issues in your calculations and comment on the firm's 2020 financial performance and its financial position as of December 31, 2020