Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required 2 From a tax perspective, would you advise Jack and Diane to Rent or Own the property? Provide detailed reasoning to your advice. Required

Required 2

From a tax perspective, would you advise Jack and Diane to Rent or Own the property? Provide detailed reasoning to your advice.

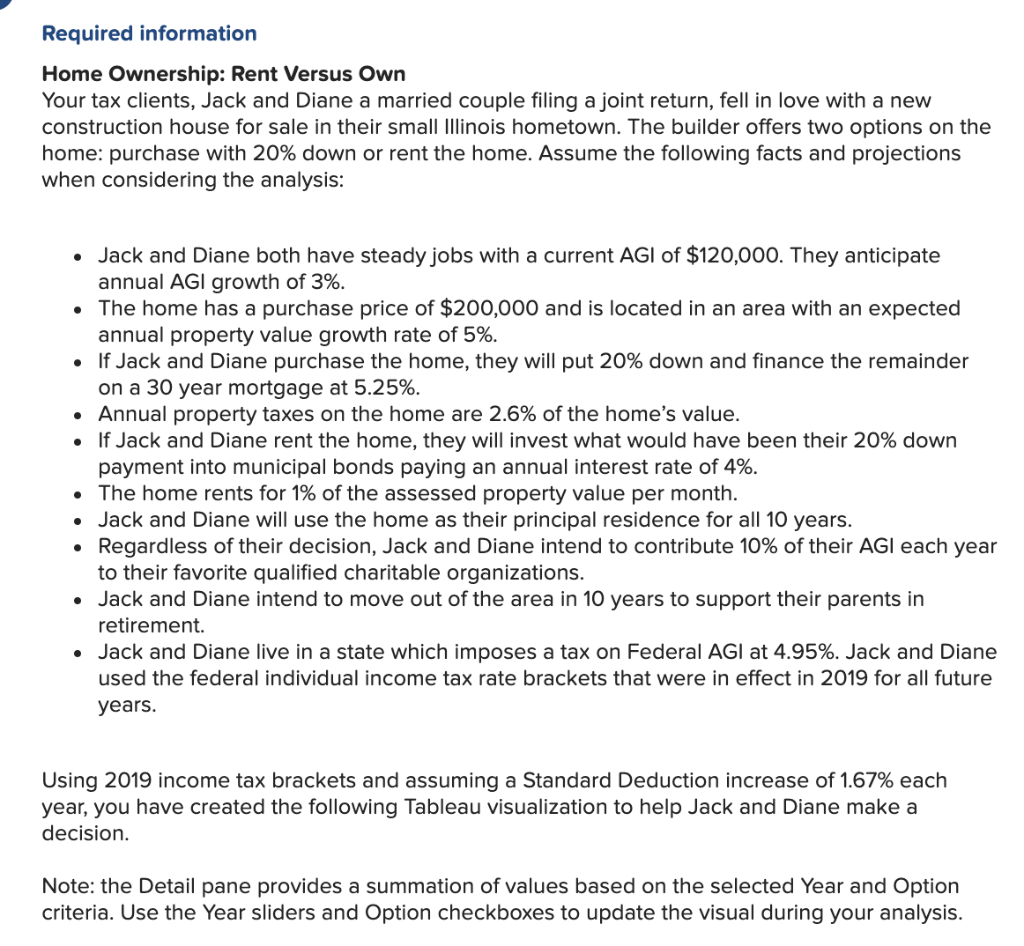

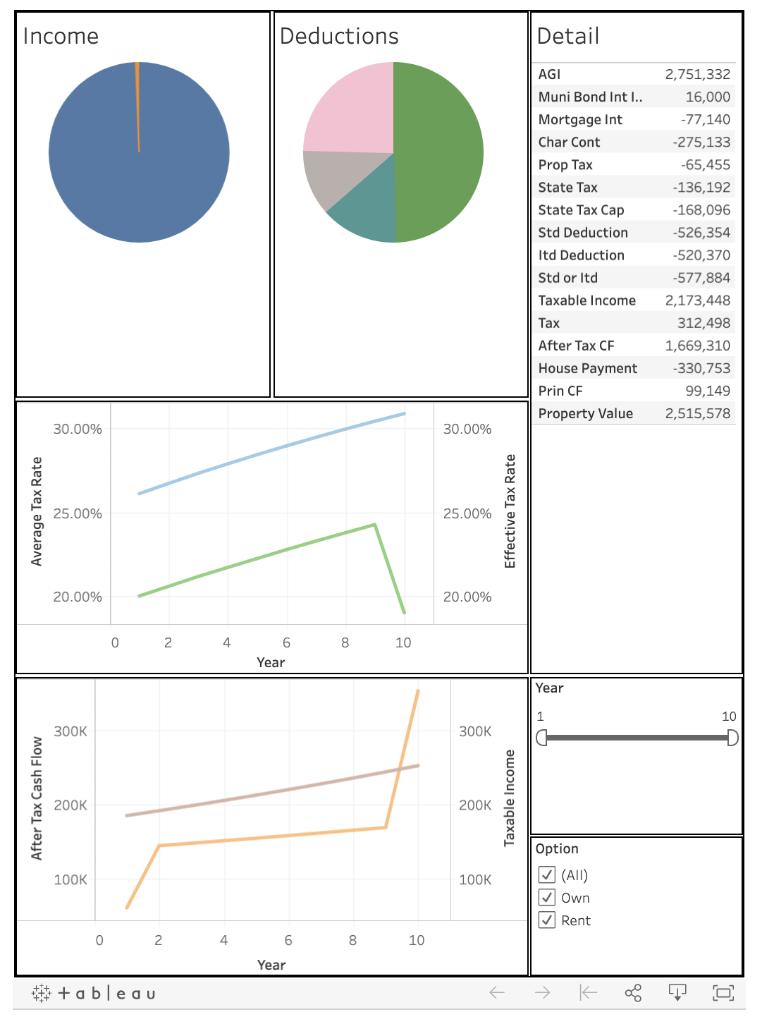

Required information Home Ownership: Rent Versus Own Your tax clients, Jack and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: . Jack and Diane both have steady jobs with a current AGI of $120,000. They anticipate annual AGI growth of 3%. The home has a purchase price of $200,000 and is located in an area with an expected annual property value growth rate of 5%. If Jack and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25%. Annual property taxes on the home are 2.6% of the home's value. If Jack and Diane rent the home, they will invest what would have been their 20% down payment into municipal bonds paying an annual interest rate of 4%. The home rents for 1% of the assessed property value per month. Jack and Diane will use the home as their principal residence for all 10 years. Regardless of their decision, Jack and Diane intend to contribute 10% of their AGI each year to their favorite qualified charitable organizations. Jack and Diane intend to move out of the area in 10 years to support their parents in retirement. Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming a Standard Deduction increase of 1.67% each year, you have created the following Tableau visualization to help Jack and Diane make a decision. Note: the Detail pane provides a summation of values based on the selected Year and Option criteria. Use the Year sliders and Option checkboxes to update the visual during your analysis. Income Deductions Detail AGI Muni Bond Int I.. Mortgage Int Char Cont Prop Tax State Tax State Tax Cap Std Deduction Itd Deduction Std or Itd Taxable income Tax After Tax CF House Payment Prin CF Property Value 2,751,332 16,000 -77,140 -275,133 -65,455 -136,192 -168,096 -526,354 -520,370 -577,884 2,173,448 312,498 1,669,310 -330,753 99,149 2,515,578 30.00% 30.00% Average Tax Rate 25.00% 25.00% Effective Tax Rate 20.00% 20.00% 0 2 4 6 8 10 Year Year 10 300K 300K 1 C After Tax Cash Flow 200K 200K Taxable income 100K 100K Option 7 (All) Own Rent 0 2 4 6 8 10 Year # +ableau K Required: 1. What is the effective tax rate in Year 4 if Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7? 3. What is the State Tax Deduction for Year 5 if Jack and Diane own? 4. How much Mortgage Interest is paid by Jack and Diane over the 10 year period? Required information Home Ownership: Rent Versus Own Your tax clients, Jack and Diane a married couple filing a joint return, fell in love with a new construction house for sale in their small Illinois hometown. The builder offers two options on the home: purchase with 20% down or rent the home. Assume the following facts and projections when considering the analysis: . Jack and Diane both have steady jobs with a current AGI of $120,000. They anticipate annual AGI growth of 3%. The home has a purchase price of $200,000 and is located in an area with an expected annual property value growth rate of 5%. If Jack and Diane purchase the home, they will put 20% down and finance the remainder on a 30 year mortgage at 5.25%. Annual property taxes on the home are 2.6% of the home's value. If Jack and Diane rent the home, they will invest what would have been their 20% down payment into municipal bonds paying an annual interest rate of 4%. The home rents for 1% of the assessed property value per month. Jack and Diane will use the home as their principal residence for all 10 years. Regardless of their decision, Jack and Diane intend to contribute 10% of their AGI each year to their favorite qualified charitable organizations. Jack and Diane intend to move out of the area in 10 years to support their parents in retirement. Jack and Diane live in a state which imposes a tax on Federal AGI at 4.95%. Jack and Diane used the federal individual income tax rate brackets that were in effect in 2019 for all future years. Using 2019 income tax brackets and assuming a Standard Deduction increase of 1.67% each year, you have created the following Tableau visualization to help Jack and Diane make a decision. Note: the Detail pane provides a summation of values based on the selected Year and Option criteria. Use the Year sliders and Option checkboxes to update the visual during your analysis. Income Deductions Detail AGI Muni Bond Int I.. Mortgage Int Char Cont Prop Tax State Tax State Tax Cap Std Deduction Itd Deduction Std or Itd Taxable income Tax After Tax CF House Payment Prin CF Property Value 2,751,332 16,000 -77,140 -275,133 -65,455 -136,192 -168,096 -526,354 -520,370 -577,884 2,173,448 312,498 1,669,310 -330,753 99,149 2,515,578 30.00% 30.00% Average Tax Rate 25.00% 25.00% Effective Tax Rate 20.00% 20.00% 0 2 4 6 8 10 Year Year 10 300K 300K 1 C After Tax Cash Flow 200K 200K Taxable income 100K 100K Option 7 (All) Own Rent 0 2 4 6 8 10 Year # +ableau K Required: 1. What is the effective tax rate in Year 4 if Jack and Diane rent; own? 2. What is the projected property tax on the home in Year 7? 3. What is the State Tax Deduction for Year 5 if Jack and Diane own? 4. How much Mortgage Interest is paid by Jack and Diane over the 10 year periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started