Question

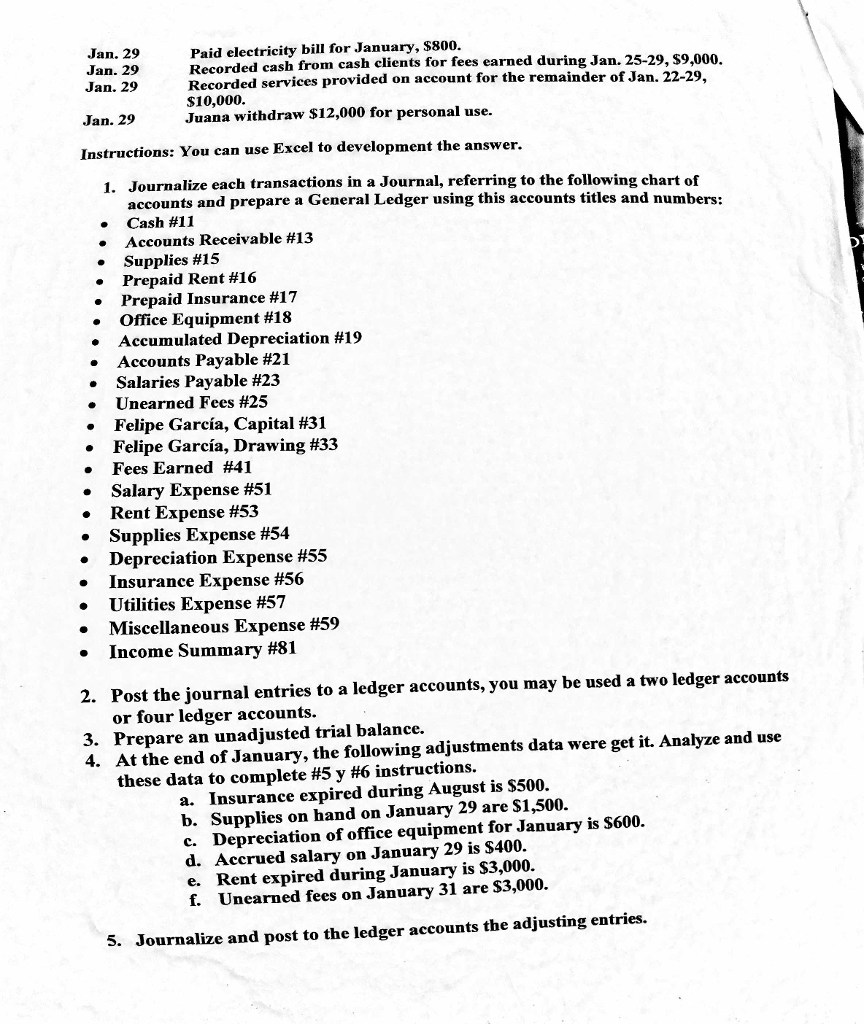

Required: 2: Post the journal entries to a ledger accounts. 3: Prepare an unadjusted Trial Balance 4: At the end of January, the following adjustments

Required:

2: Post the journal entries to a ledger accounts.

3: Prepare an unadjusted Trial Balance

4: At the end of January, the following adjustments data. Use these data to complete #5 and #6

a. Insurance expired during January is $500.

b. Supplies on hand on Janyary 29 are $1,500.

c. Depreciation of office equipment for January is $3000.

d. Accrued salary on Janyary 29 is $400.

e. Rent expired during January is $3000.

f. Unearned fees on January 31 are $3,000.

5. Journalize and post to the ledger accounts the adjusting entries.

6. Prepare an adjusted trial balance.

7. Prepare an income statement, a statement of owners equity and a balance sheet.

8. Journalize and post to the ledger accounts the closing entries.

9. Prepare a post closing trial balance.

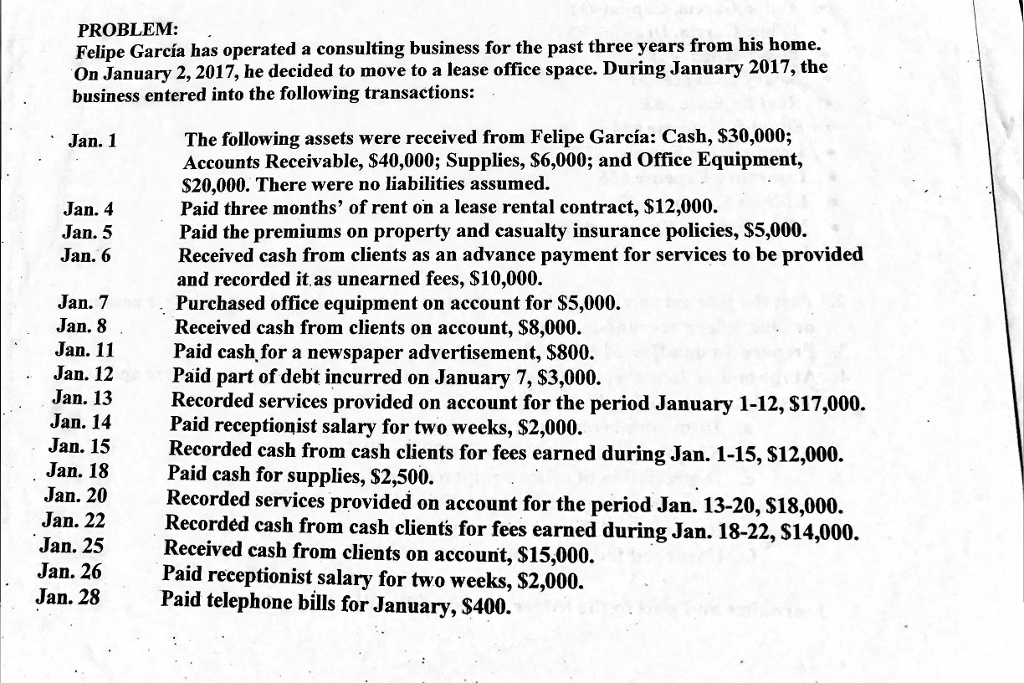

PROBLEM: Felipe Garcia has operated a consulting business for the past three years from his home. On January 2, 2017, he decided to move to a lease office space. During January 2017, the business entered into the following transactions: The following assets were received from Felipe Garcia: Cash, $30,000; Jan. 1 Accounts Receivable, $40,000; Supplies, S6,000; and Office Equipment, $20,000. There were no liabilities assumed. Paid three months' of rent on a lease rental contract, $12,000. Jan. 4 Paid the premiums on property and casualty insurance policies, $5,000. Jan. 5 Received cash from clients as an advance payment for services to be provided Jan. 6 and recorded i as unearned fees, $10,000. Jan. 7 Purchased office equipment on account for $5,000. Jan. 8 Received cash from clients on account, $8,000. Jan. 11 Paid cash for a newspaper advertisement, $800. Jan. 12 Paid part of debt incurred on January 7, $3,000. Jan. 13 Recorded services provided on account for the period January 1-12, $17,000. Jan. 14 Paid receptionist salary for two weeks, $2,000. Jan. 15 Recorded cash from cash clients for fees earned during Jan. 1-15, $12,000. Jan. 18 Paid cash for supplies $2,500. Jan. 20 Recorded services provided on account for the period Jan. 13-20, $18,000. Jan. 22 Recorded cash from cash clients for fees earned during Jan. 18-22, $14,000. Jan. 25 Received cash from clients on account, $15,000. Paid receptionist salary for two weeks, $2,000. Jan. 26 Jan. 28 Paid telephone bills for January, $400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started